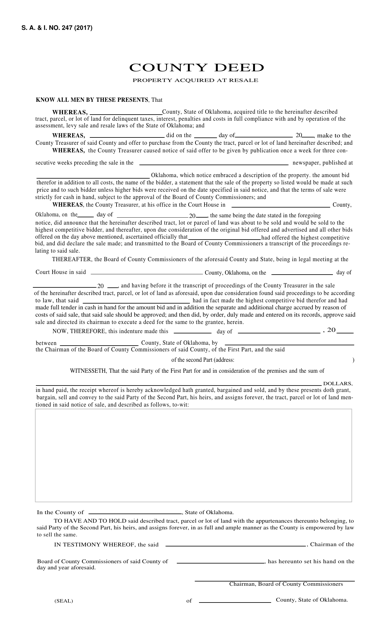

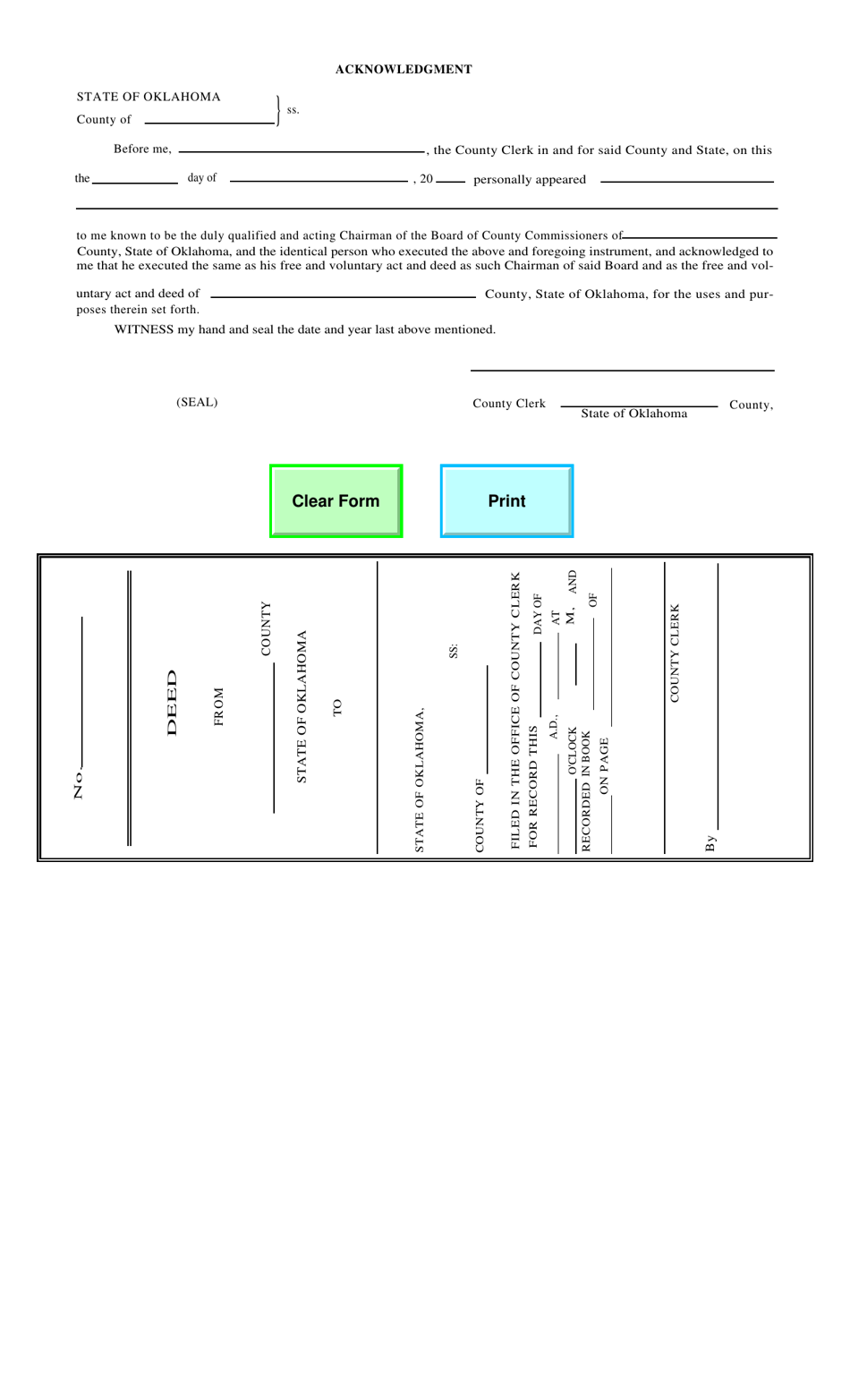

Form S.A.& I.247 County Deed - Oklahoma

What Is Form S.A.& I.247?

This is a legal form that was released by the Oklahoma State Auditor and Inspector - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S.A.& I.247?

A: Form S.A.& I.247 is a County Deed in Oklahoma.

Q: What is the purpose of Form S.A.& I.247?

A: Form S.A.& I.247 is used for transferring ownership of real property in Oklahoma.

Q: Do I need a lawyer to fill out Form S.A.& I.247?

A: It is not required to have a lawyer to fill out Form S.A.& I.247, but you may consult with one for legal advice.

Q: How much does it cost to file Form S.A.& I.247?

A: The filing fees for Form S.A.& I.247 vary by county in Oklahoma. You can contact your local county clerk's office for the specific fee.

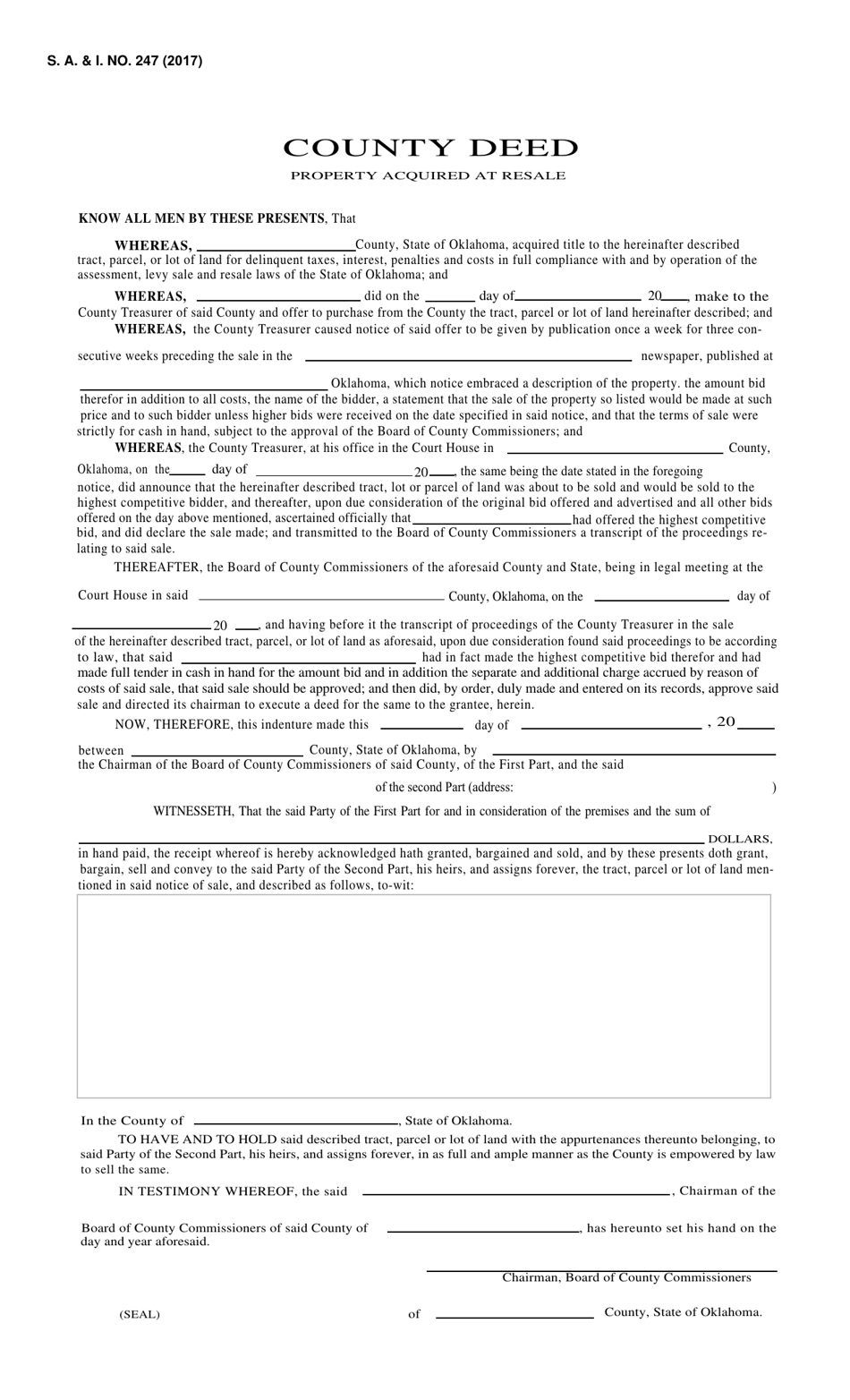

Q: What information do I need to provide on Form S.A.& I.247?

A: You will need to provide the names of the grantor and grantee, a legal description of the property, and the consideration for the transfer.

Q: Can Form S.A.& I.247 be used for both residential and commercial properties?

A: Yes, Form S.A.& I.247 can be used for both residential and commercial properties.

Q: Are there any exemptions or special requirements for filling out Form S.A.& I.247?

A: Certain transfers may be exempt from certain taxes or have special requirements. It is advisable to consult with a professional for specific exemptions or requirements.

Q: How long does it take to process Form S.A.& I.247?

A: The processing time for Form S.A.& I.247 varies by county in Oklahoma. Contact your local county clerk's office for an estimate.

Q: What happens after filing Form S.A.& I.247?

A: After filing Form S.A.& I.247, the county clerk will record the deed and provide you with a copy for your records.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Oklahoma State Auditor and Inspector;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form S.A.& I.247 by clicking the link below or browse more documents and templates provided by the Oklahoma State Auditor and Inspector.