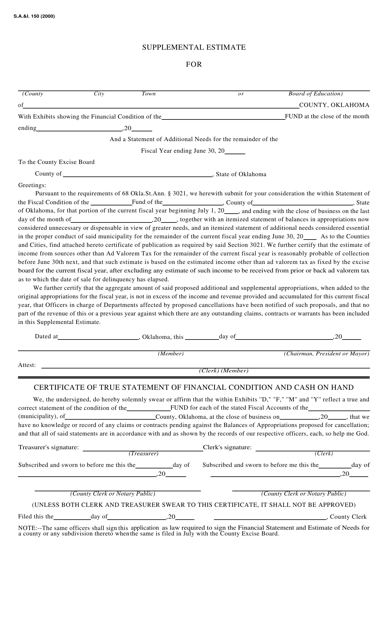

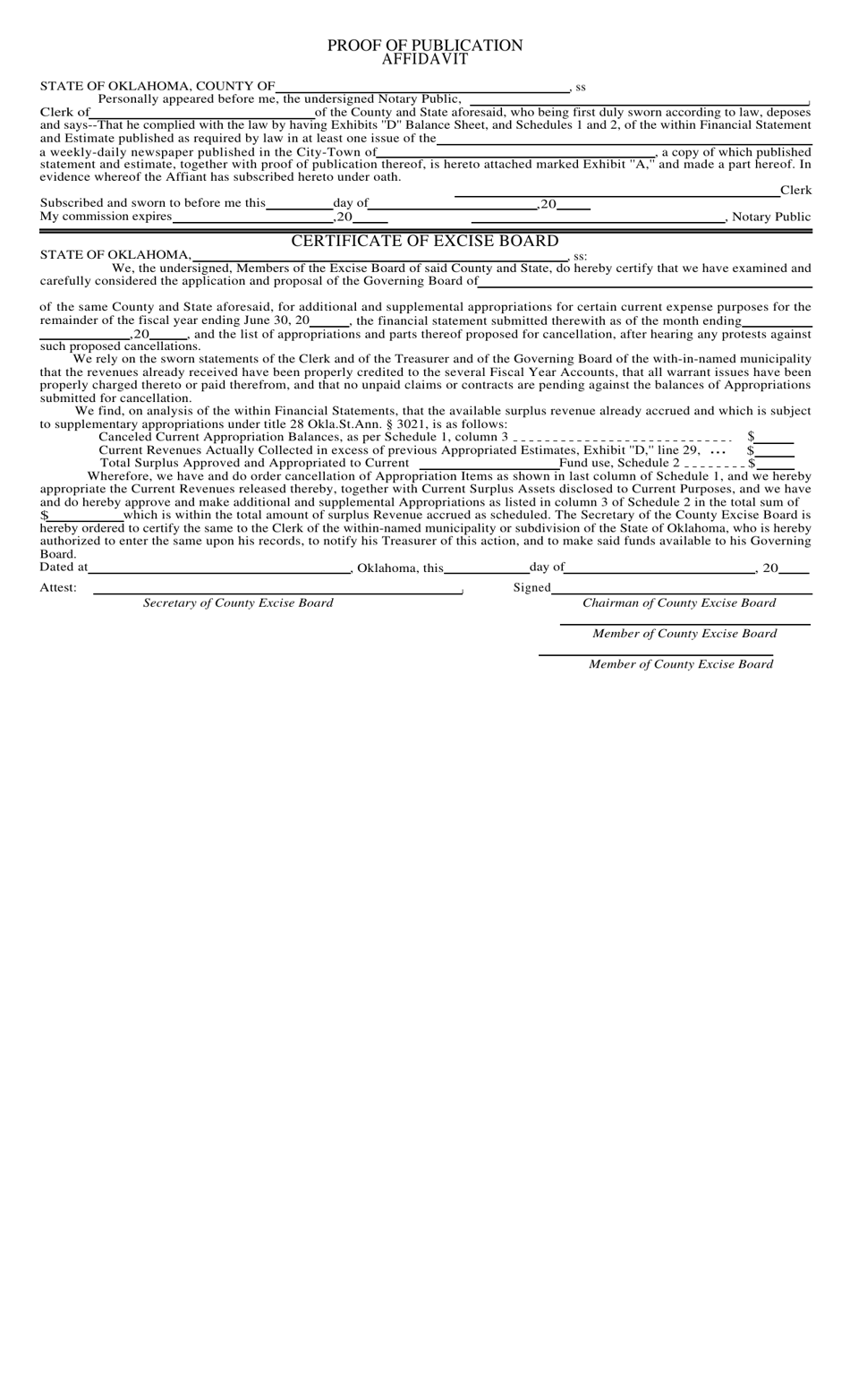

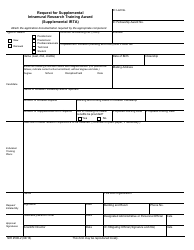

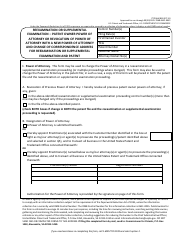

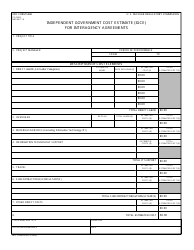

Form S.A.& I.150 Supplemental Estimate - Oklahoma

What Is Form S.A.& I.150?

This is a legal form that was released by the Oklahoma State Auditor and Inspector - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S.A.& I.150?

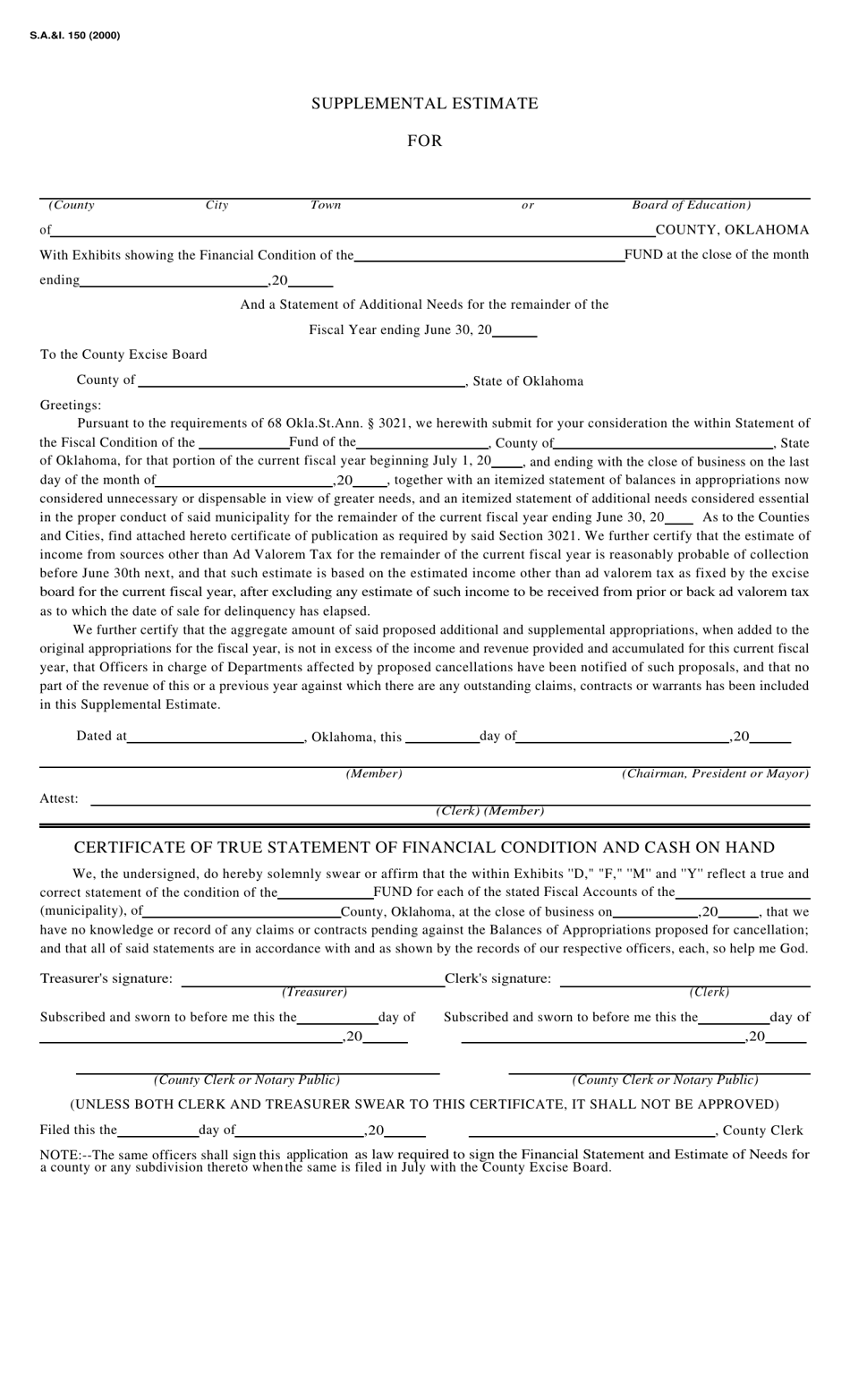

A: Form S.A.& I.150 is a Supplemental Estimate form in Oklahoma.

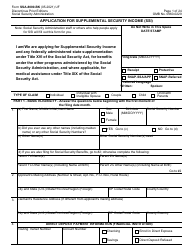

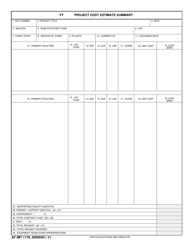

Q: What is the purpose of Form S.A.& I.150?

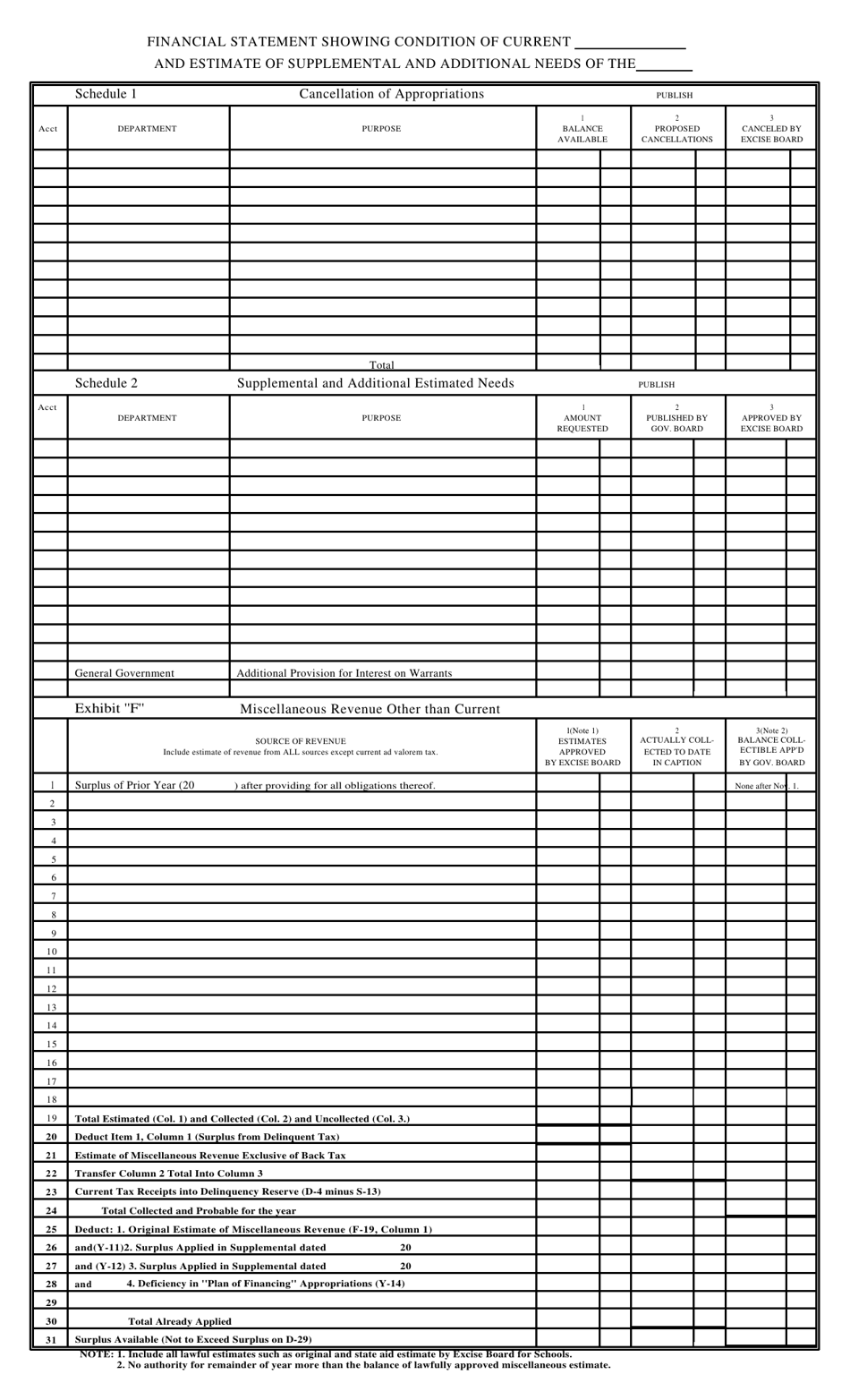

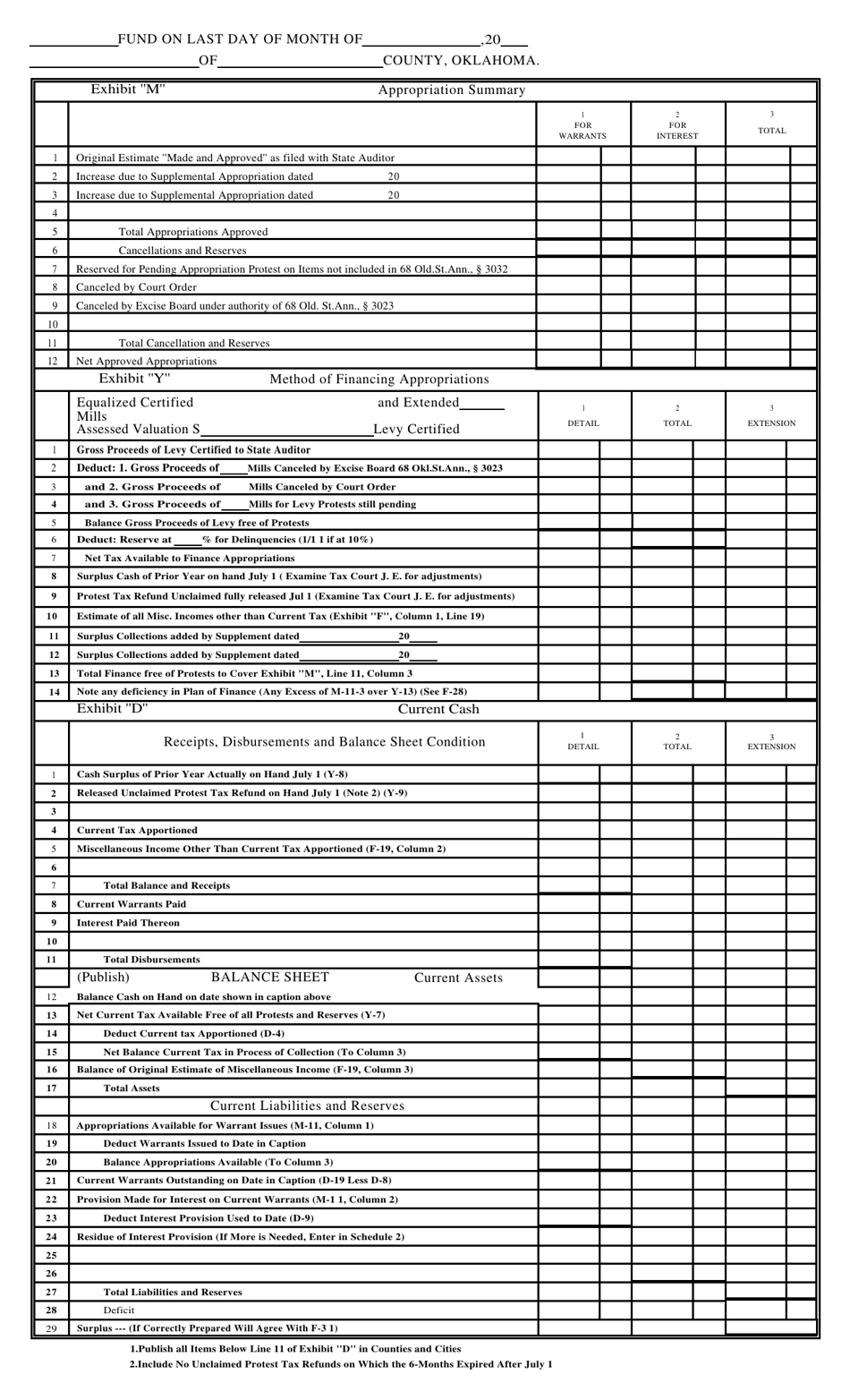

A: The purpose of Form S.A.& I.150 is to provide a supplemental estimate for property assessment in Oklahoma.

Q: Who needs to file Form S.A.& I.150?

A: Property owners in Oklahoma who wish to submit a supplemental estimate for their property assessment need to file Form S.A.& I.150.

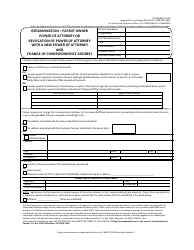

Q: Is there a deadline for filing Form S.A.& I.150?

A: Yes, the deadline for filing Form S.A.& I.150 is generally March 15th of the year for which the supplemental estimate is being requested.

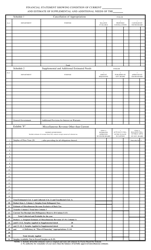

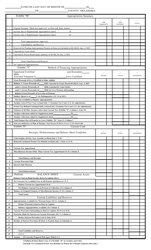

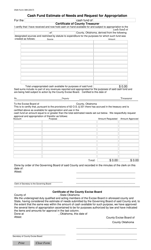

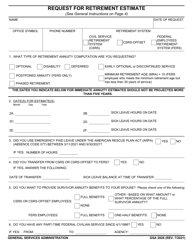

Q: What information is required on Form S.A.& I.150?

A: Form S.A.& I.150 requires information such as the property owner's name, address, property description, current assessment, reason for the supplemental estimate, and supporting documentation.

Q: Can I submit multiple supplemental estimates?

A: Yes, you can submit multiple supplemental estimates for different properties or different reasons for assessment adjustments.

Q: What happens after I file Form S.A.& I.150?

A: After you file Form S.A.& I.150, the county assessor's office will review your request and may schedule an assessment hearing if necessary. You will be notified of any changes to your property assessment.

Q: Are there any fees for filing Form S.A.& I.150?

A: There are no fees for filing Form S.A.& I.150 in Oklahoma.

Q: What if I disagree with the county assessor's decision?

A: If you disagree with the county assessor's decision regarding your supplemental estimate, you may appeal the decision to the County Board of Equalization or the Oklahoma Tax Commission.

Form Details:

- Released on January 1, 2000;

- The latest edition provided by the Oklahoma State Auditor and Inspector;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form S.A.& I.150 by clicking the link below or browse more documents and templates provided by the Oklahoma State Auditor and Inspector.