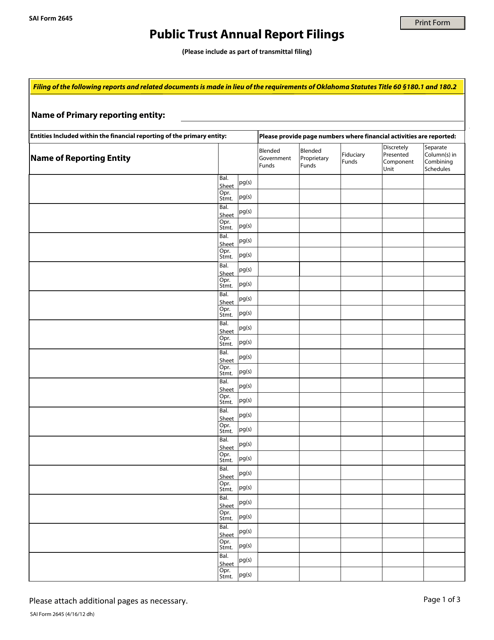

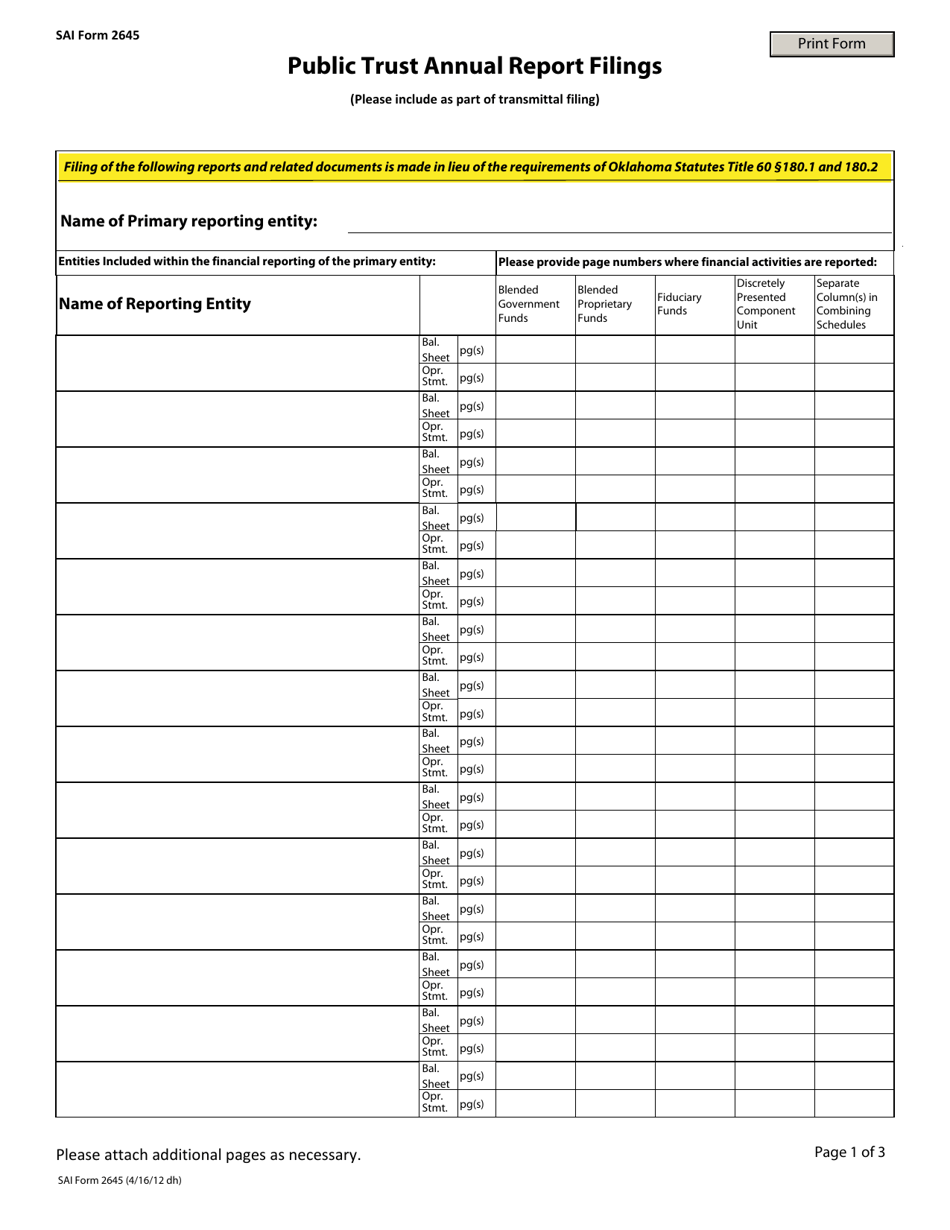

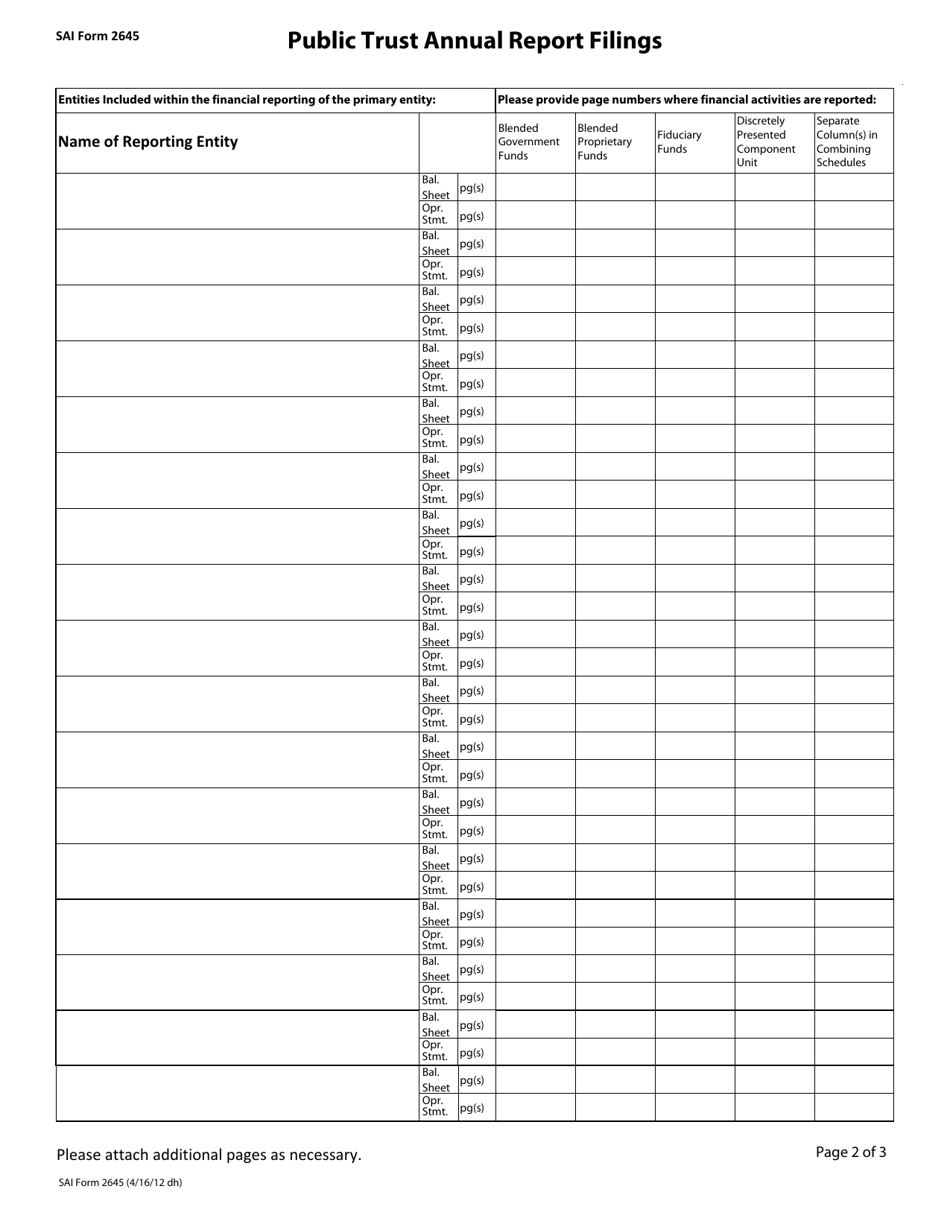

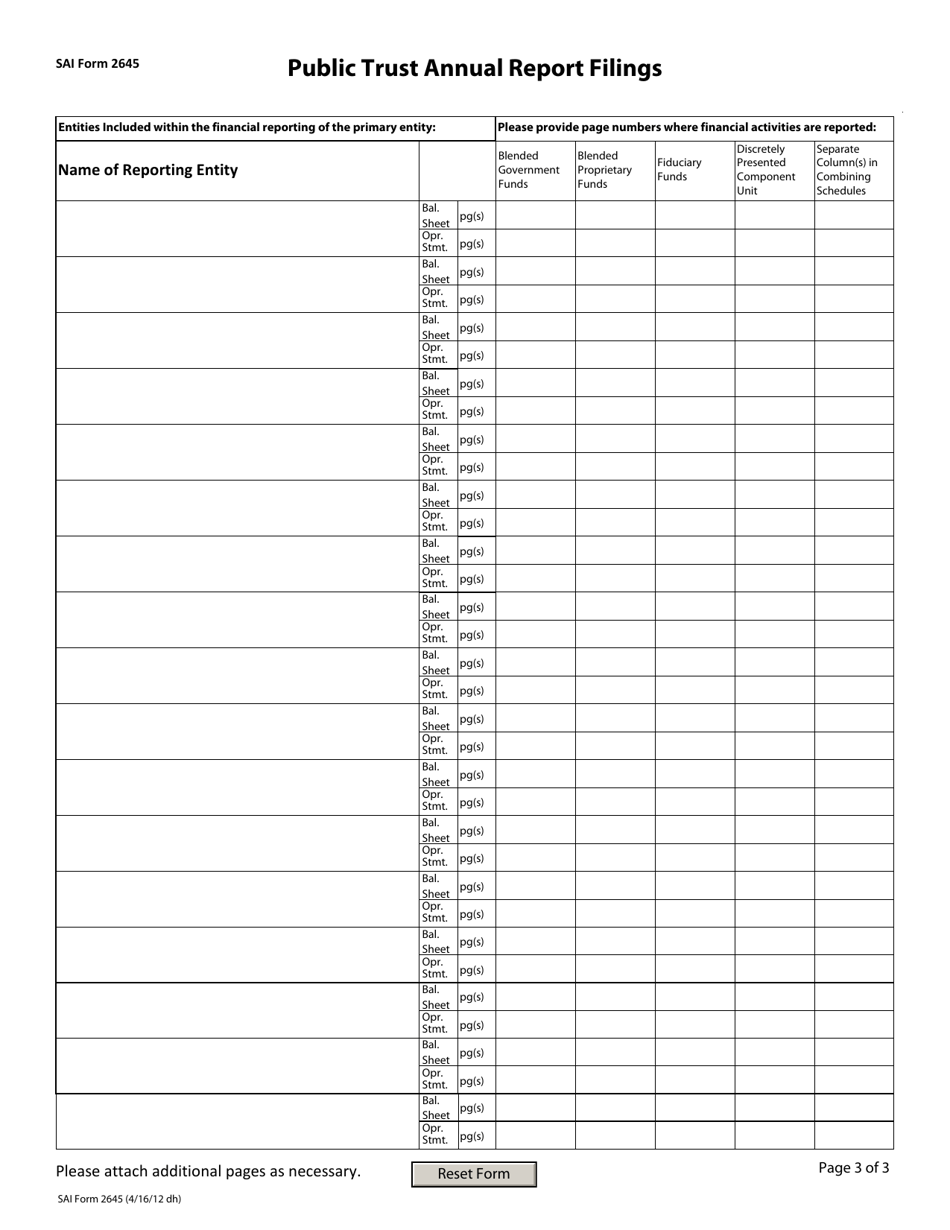

OSAI Form 2645 Public Trust Annual Report Filings - Oklahoma

What Is OSAI Form 2645?

This is a legal form that was released by the Oklahoma State Auditor and Inspector - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2645?

A: Form 2645 is the Public TrustAnnual Report Filing form in Oklahoma.

Q: Who needs to file Form 2645?

A: Public Trusts in Oklahoma need to file Form 2645.

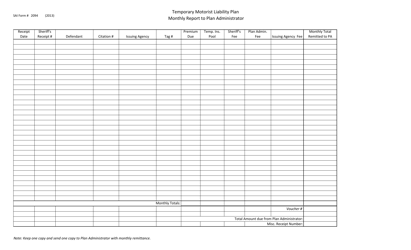

Q: What information is required on Form 2645?

A: Form 2645 requires information such as the trust's name, address, financial statements, and details about its activities.

Q: When is Form 2645 due?

A: Form 2645 is due on or before the 30th day of the fifth month after the close of the trust's fiscal year.

Q: Is there a fee for filing Form 2645?

A: Yes, there is a fee for filing Form 2645. The fee varies depending on the assets held by the trust.

Q: What happens if I don't file Form 2645?

A: Failure to file Form 2645 may result in penalties and potential legal consequences.

Q: Can I get an extension for filing Form 2645?

A: No, extensions for filing Form 2645 are generally not granted.

Q: Are there any exemptions from filing Form 2645?

A: Yes, certain types of trusts may be exempt from filing Form 2645. You should consult the Oklahoma Secretary of State for specific exemptions.

Form Details:

- Released on April 16, 2012;

- The latest edition provided by the Oklahoma State Auditor and Inspector;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OSAI Form 2645 by clicking the link below or browse more documents and templates provided by the Oklahoma State Auditor and Inspector.