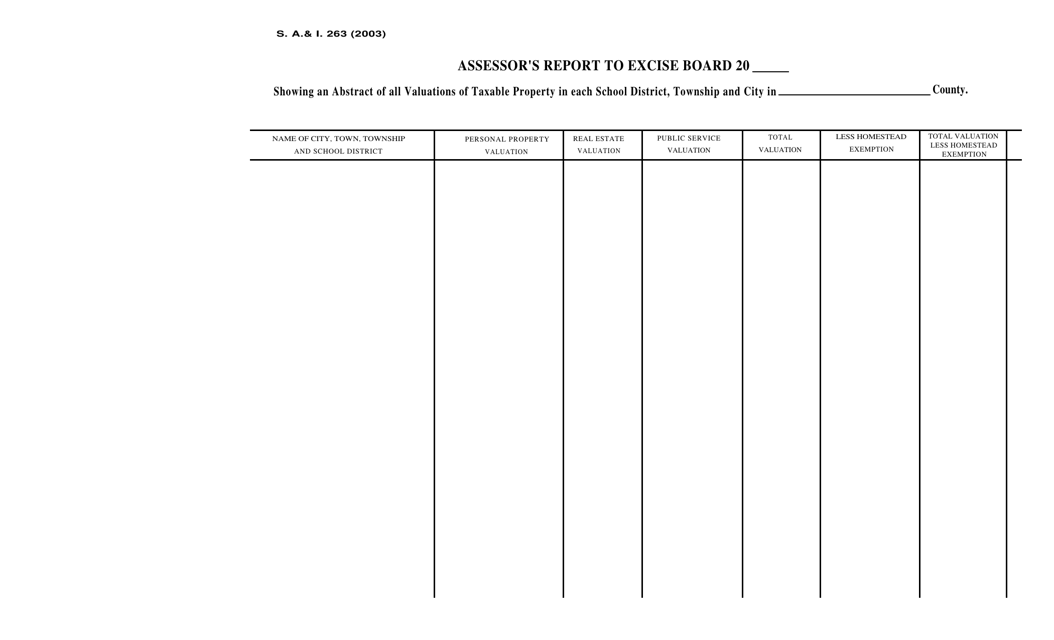

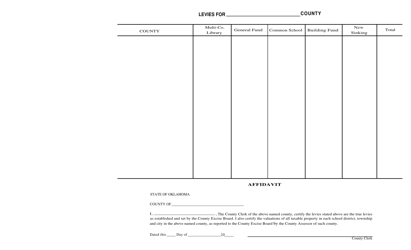

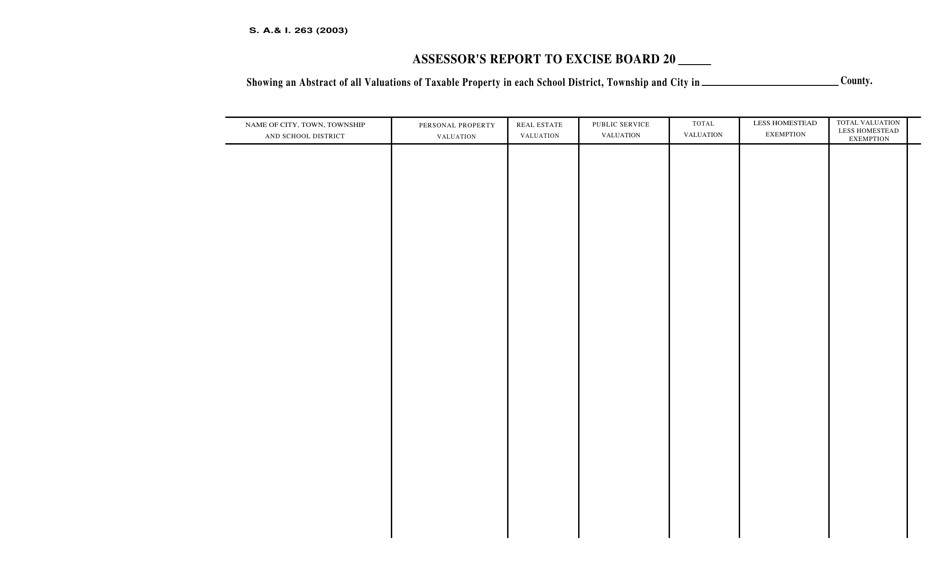

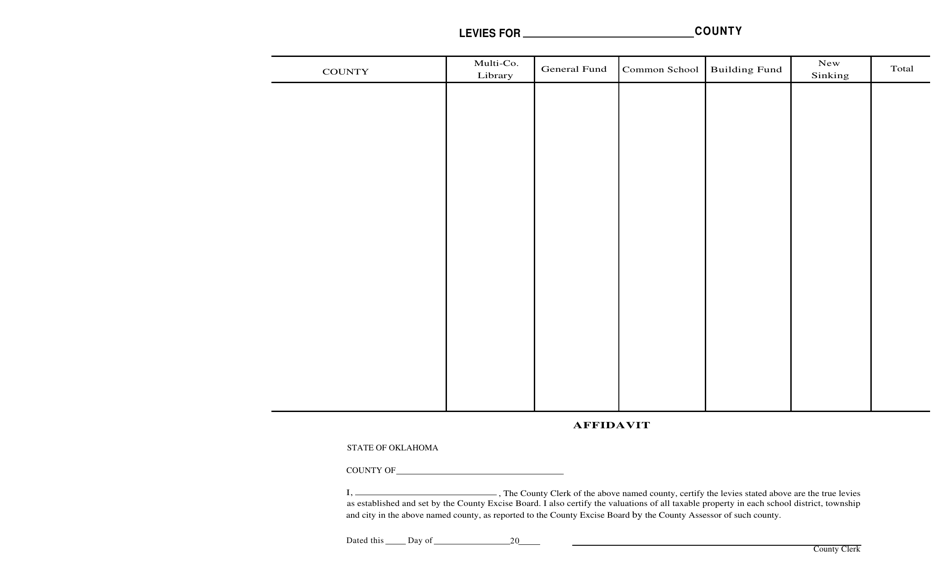

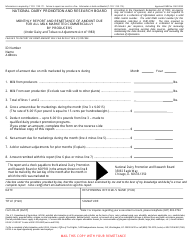

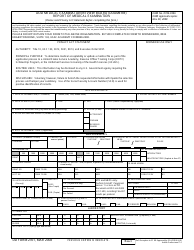

Form S.A.& I.263 Assessor's Report to Excise Board - Oklahoma

What Is Form S.A.& I.263?

This is a legal form that was released by the Oklahoma State Auditor and Inspector - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S.A.& I.263?

A: Form S.A.& I.263 is an Assessor's Report to the Excise Board in Oklahoma.

Q: Who submits Form S.A.& I.263?

A: Assessors submit Form S.A.& I.263 to the Excise Board in Oklahoma.

Q: What is the purpose of Form S.A.& I.263?

A: The purpose of Form S.A.& I.263 is to provide a report to the Excise Board regarding assessments.

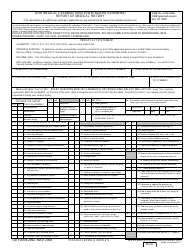

Q: What information is included in Form S.A.& I.263?

A: Form S.A.& I.263 includes information about property assessments and other relevant details.

Q: When should Form S.A.& I.263 be submitted?

A: Form S.A.& I.263 should be submitted by assessors to the Excise Board within the specified timeframes.

Q: Are there any specific guidelines for completing Form S.A.& I.263?

A: Yes, there are specific guidelines for completing Form S.A.& I.263. Assessors should refer to the instructions provided with the form.

Q: What happens after submitting Form S.A.& I.263?

A: After submitting Form S.A.& I.263, the Excise Board will review the report and take necessary actions based on the information provided.

Q: Are there any fees associated with submitting Form S.A.& I.263?

A: There may be fees associated with submitting Form S.A.& I.263. Assessors should check with the Excise Board for more information.

Q: Is Form S.A.& I.263 confidential?

A: The confidentiality of Form S.A.& I.263 may vary. Assessors should review the applicable laws and regulations regarding confidentiality.

Form Details:

- Released on January 1, 2003;

- The latest edition provided by the Oklahoma State Auditor and Inspector;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form S.A.& I.263 by clicking the link below or browse more documents and templates provided by the Oklahoma State Auditor and Inspector.