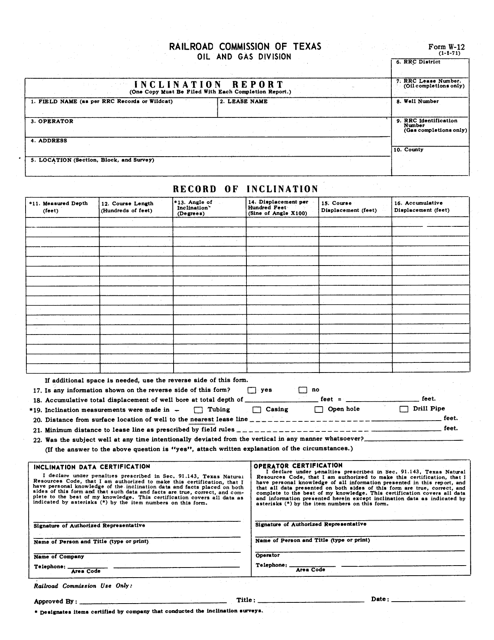

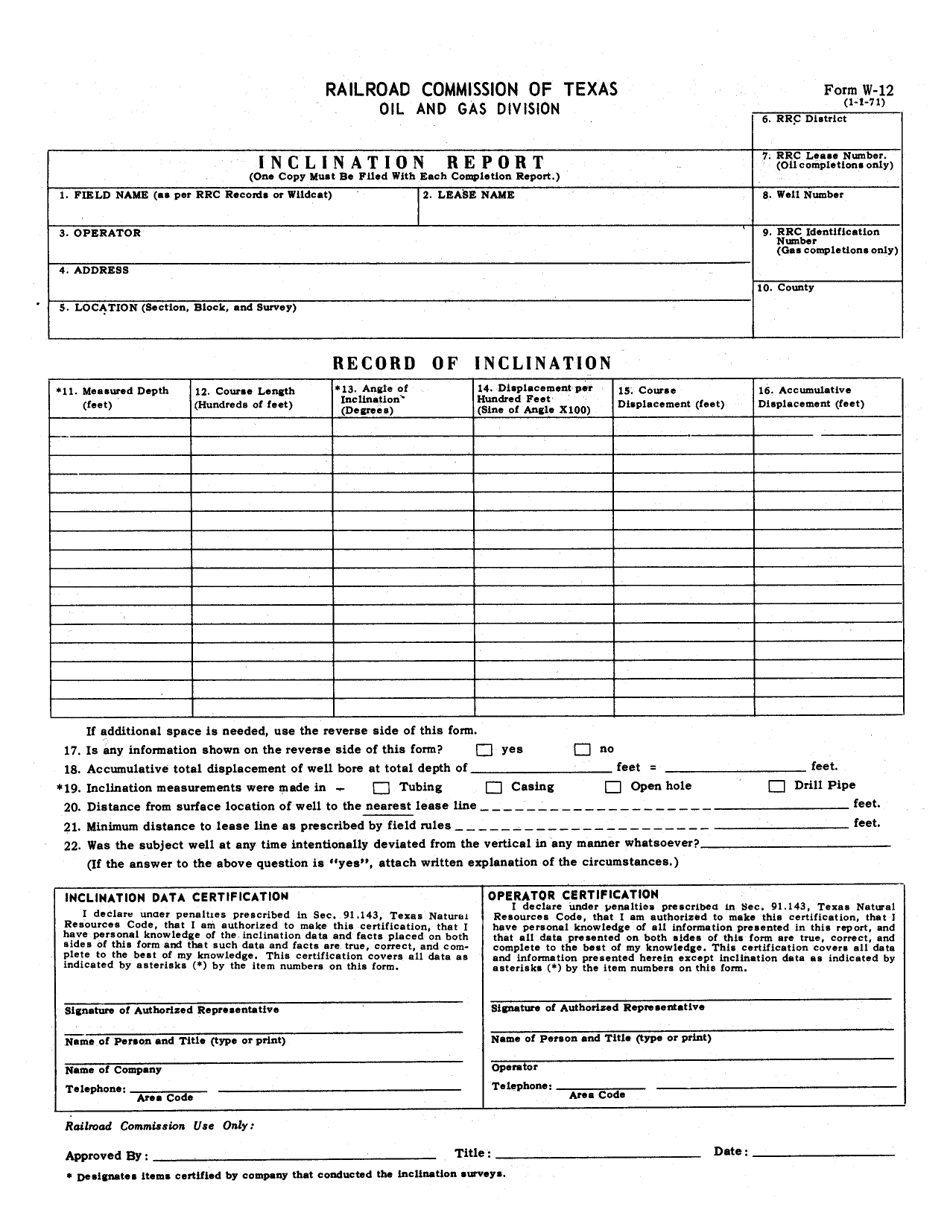

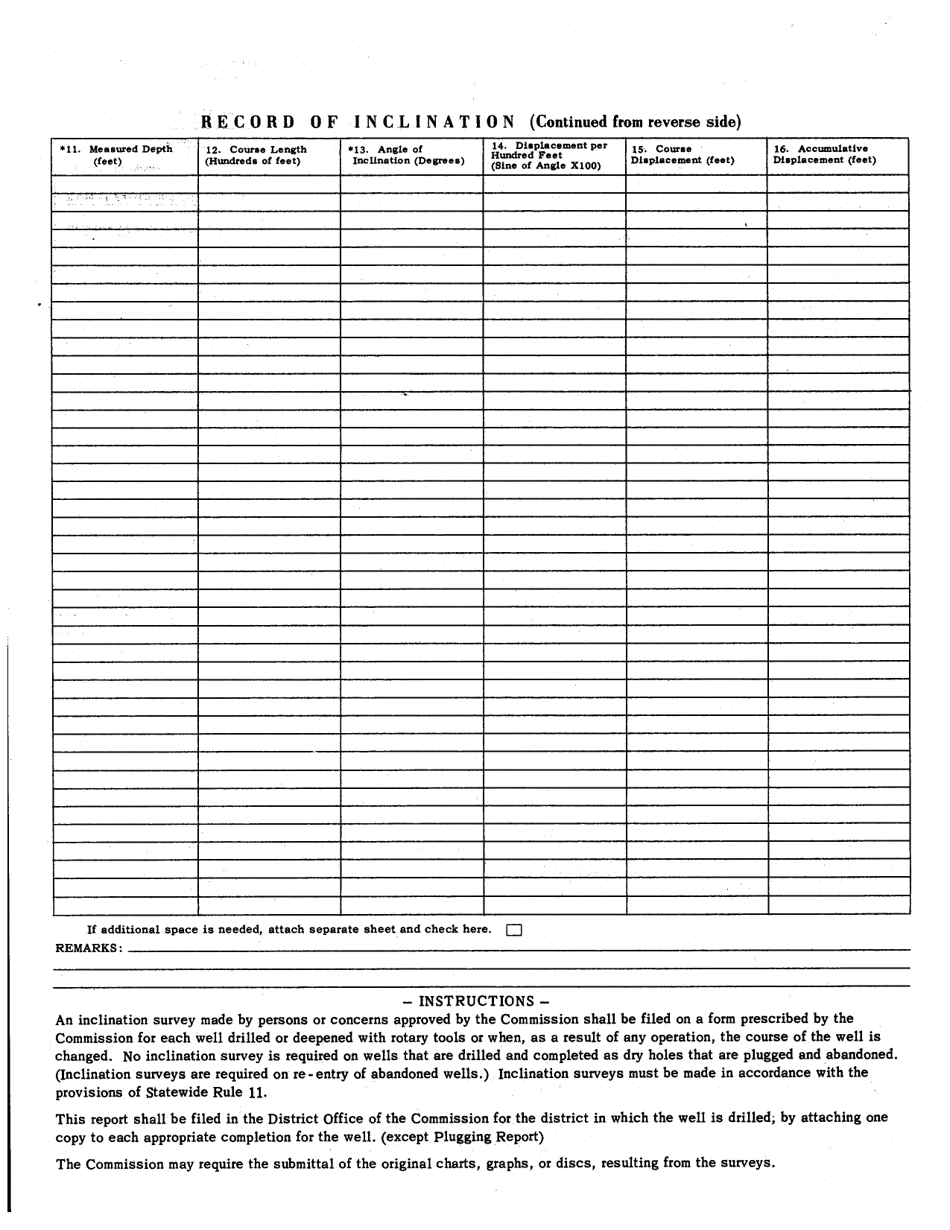

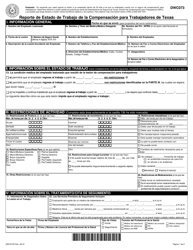

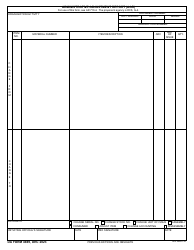

Form W-12 Inclination Report - Texas

What Is Form W-12?

This is a legal form that was released by the Railroad Commission of Texas - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form W-12 Inclination Report?

A: Form W-12 Inclination Report is a tax form used to report income and expenses related to oil and gas production in Texas.

Q: Who needs to file Form W-12 Inclination Report?

A: Operators of oil and gas wells in Texas need to file Form W-12 Inclination Report.

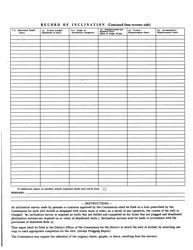

Q: What information is required on Form W-12 Inclination Report?

A: Form W-12 Inclination Report requires operators to report the production volumes, well head prices, and expenses associated with oil and gas production.

Q: When is Form W-12 Inclination Report due?

A: Form W-12 Inclination Report is due on the 25th day of the month following the end of the reporting period.

Q: Are there any penalties for late filing of Form W-12 Inclination Report?

A: Yes, there are penalties for late filing of Form W-12 Inclination Report. The penalty amount depends on the number of days the report is filed late.

Form Details:

- Released on January 1, 1971;

- The latest edition provided by the Railroad Commission of Texas;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form W-12 by clicking the link below or browse more documents and templates provided by the Railroad Commission of Texas.