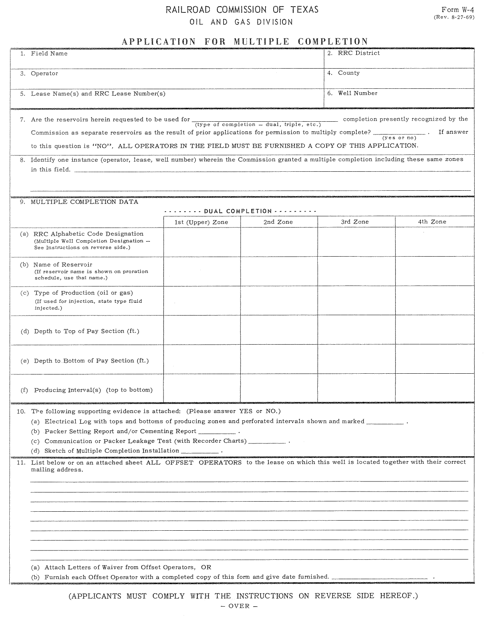

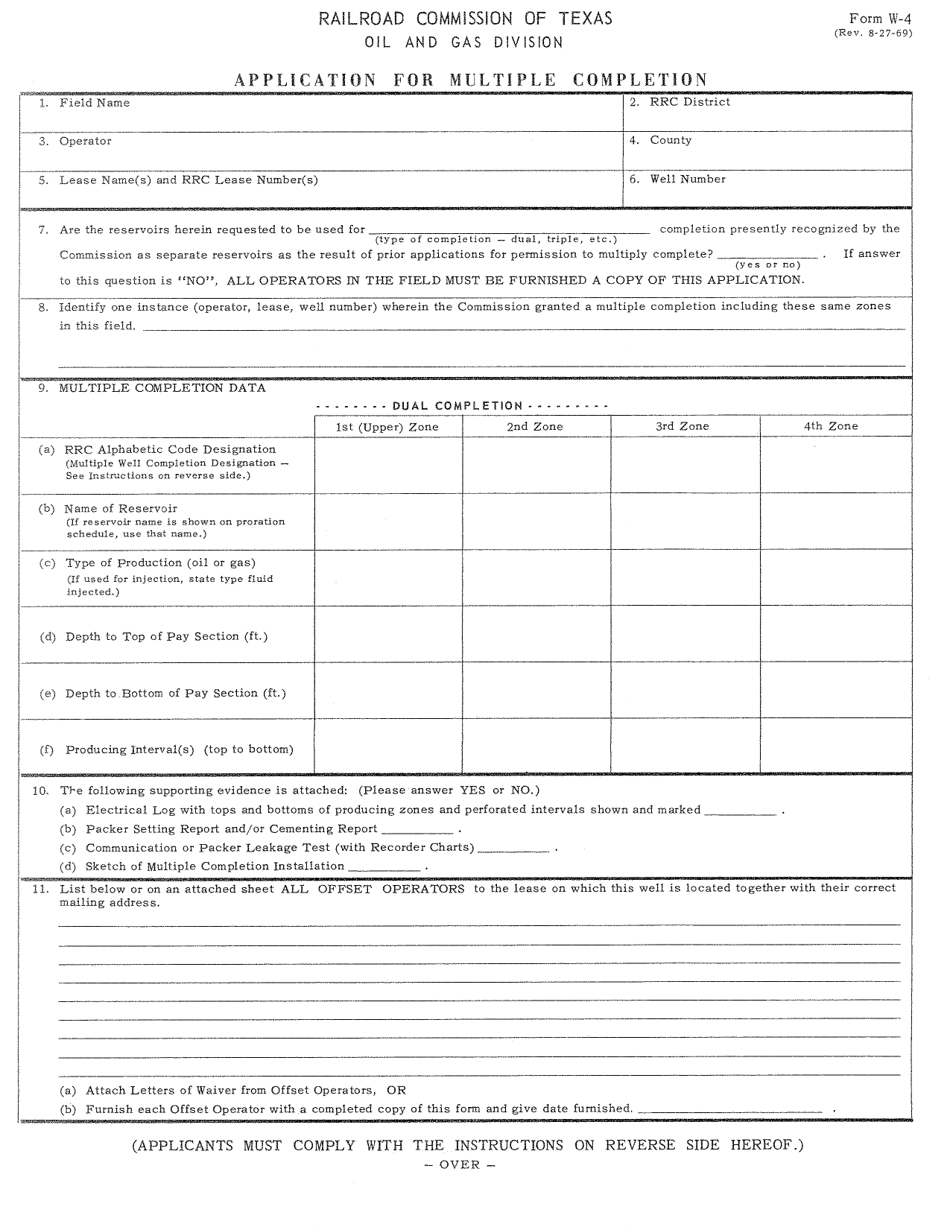

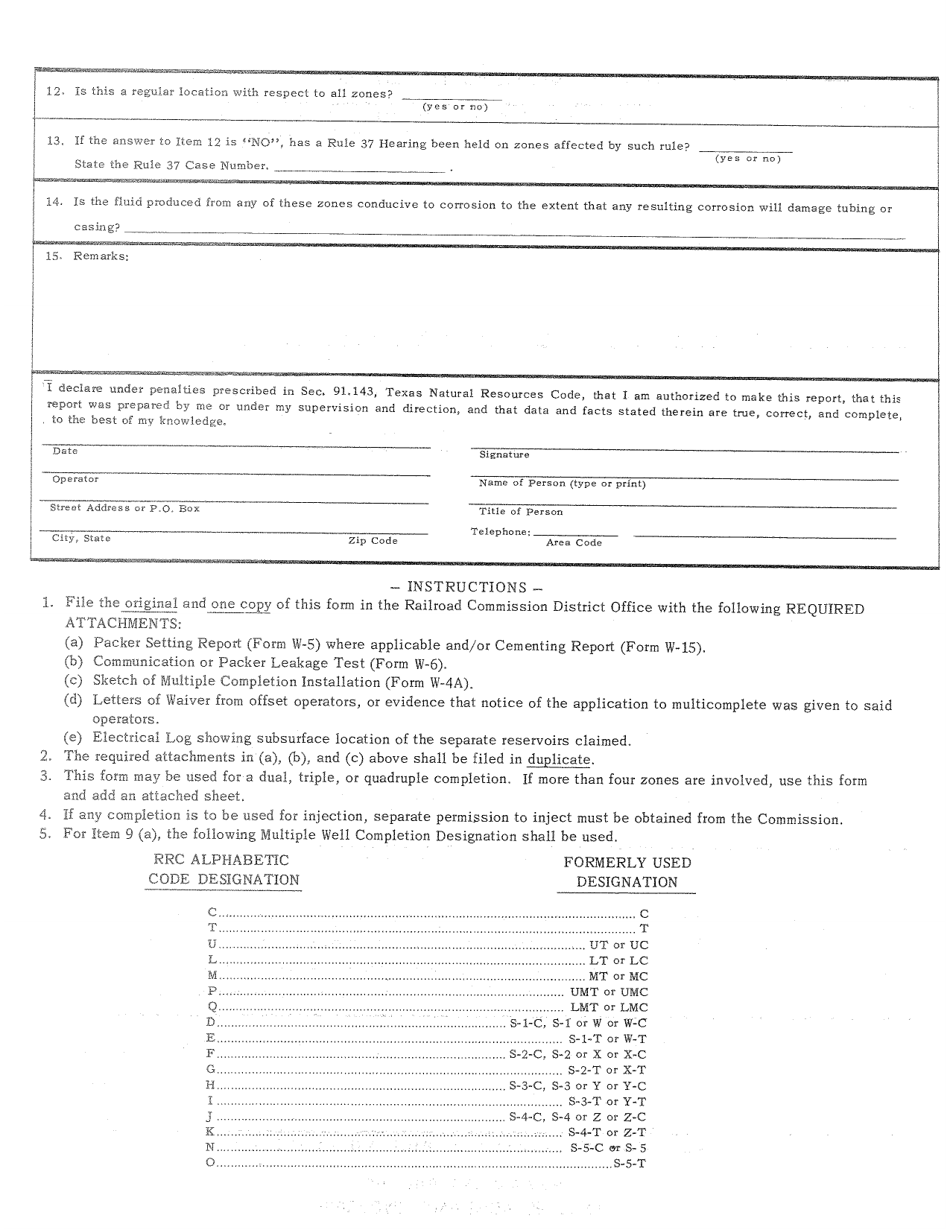

Form W-4 Application for Multiple Completion - Texas

What Is Form W-4?

This is a legal form that was released by the Railroad Commission of Texas - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form W-4?

A: Form W-4 is an IRS document used to determine how much federal income tax should be withheld from an employee's paycheck.

Q: Who needs to complete a Form W-4?

A: Every new employee must complete a Form W-4, as well as anyone who wants to change their withholding allowances.

Q: What is the purpose of Form W-4?

A: The purpose of Form W-4 is to provide your employer with the necessary information to withhold the correct amount of federal income tax from your paycheck.

Q: Is Form W-4 specific to Texas?

A: No, Form W-4 is a federal form and applies to all states, including Texas.

Q: Can I submit an incomplete Form W-4?

A: No, you must complete all required sections of the Form W-4, including your personal information, marital status, and withholding allowances.

Q: Can I change my Form W-4 during the tax year?

A: Yes, you can update your Form W-4 at any time during the tax year if your personal or financial situation changes.

Q: What happens if I don't submit a Form W-4?

A: If you don't submit a Form W-4, your employer will withhold federal income tax based on the default Single status and no allowances.

Q: Are there any penalties for incorrectly completing Form W-4?

A: There can be penalties for submitting an intentionally false or fraudulent Form W-4, but accidentally making a mistake is generally not penalized.

Q: Can I use Form W-4 for state income tax withholding?

A: No, Form W-4 is only used for federal income tax withholding. State income tax withholding is typically done using a separate state-specific form.

Form Details:

- Released on August 27, 1969;

- The latest edition provided by the Railroad Commission of Texas;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form W-4 by clicking the link below or browse more documents and templates provided by the Railroad Commission of Texas.