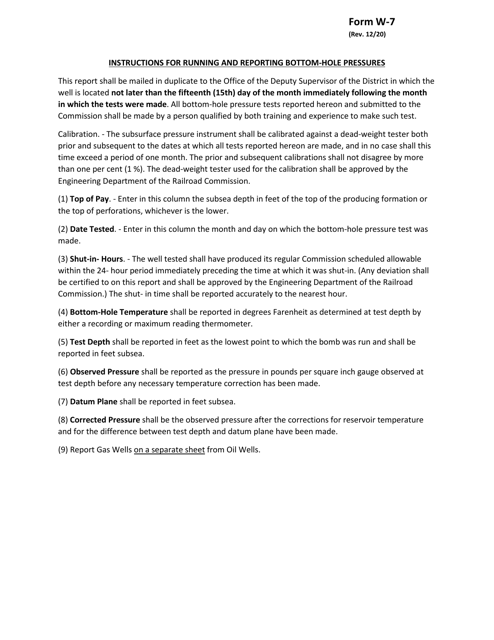

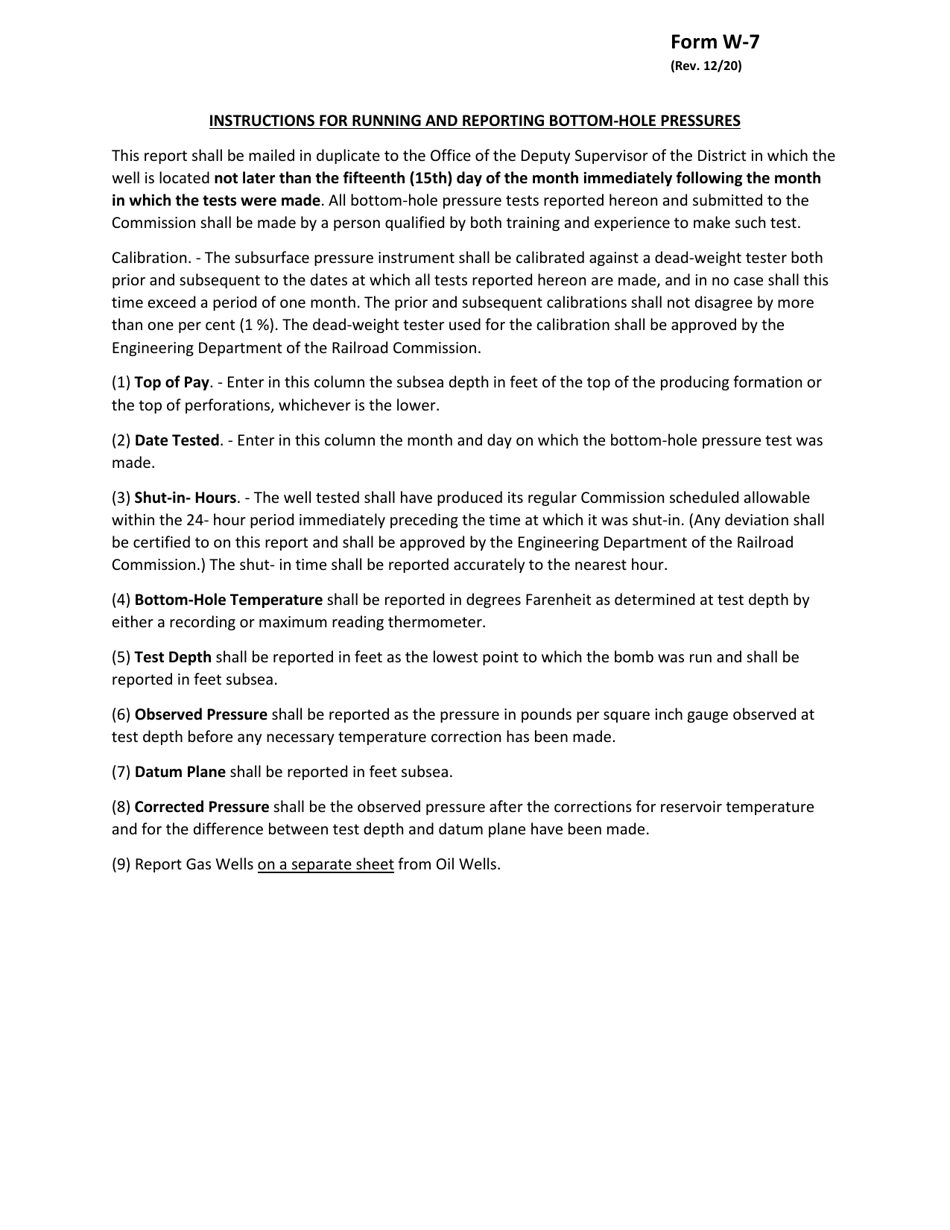

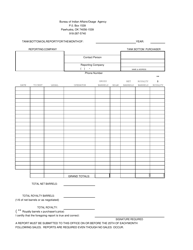

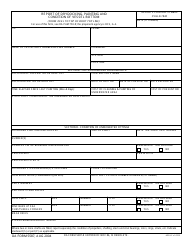

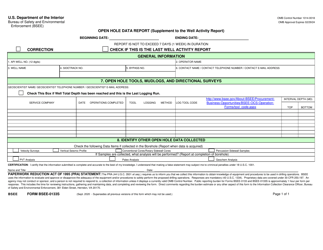

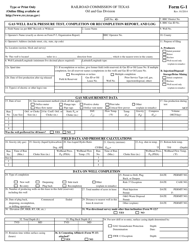

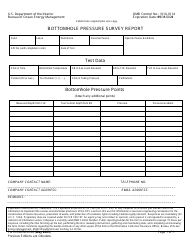

Instructions for Form W-7 Bottom-Hole Pressure Report - Texas

This document contains official instructions for Form W-7 , Bottom-Hole Pressure Report - a form released and collected by the Railroad Commission of Texas. An up-to-date fillable Form W-7 is available for download through this link.

FAQ

Q: What is Form W-7?

A: Form W-7 is a tax form used to apply for an Individual Taxpayer Identification Number (ITIN).

Q: What is a Bottom-Hole Pressure Report?

A: A Bottom-Hole Pressure Report is a document that records the pressure measurements at the bottom of an oil or gas well.

Q: Who needs to file a Bottom-Hole Pressure Report in Texas?

A: Operators of oil or gas wells in Texas are required to file a Bottom-Hole Pressure Report with the appropriate regulatory agency.

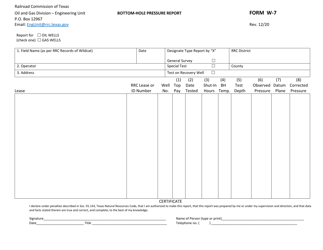

Q: What information is required on a Bottom-Hole Pressure Report?

A: A Bottom-Hole Pressure Report typically includes information about the well, such as its location, operator, and the date and time of the pressure measurements.

Q: When is the deadline for filing a Bottom-Hole Pressure Report in Texas?

A: The deadline for filing a Bottom-Hole Pressure Report in Texas may vary depending on the specific regulations of the regulatory agency.

Q: What are the consequences of not filing a Bottom-Hole Pressure Report?

A: Failure to file a Bottom-Hole Pressure Report in Texas may result in penalties or other enforcement actions by the regulatory agency.

Q: Can I e-file Form W-7?

A: No, Form W-7 cannot be e-filed. It must be mailed to the IRS along with the required documentation.

Q: Can I request an extension for filing a Bottom-Hole Pressure Report?

A: The availability of extensions for filing a Bottom-Hole Pressure Report may depend on the specific regulations of the regulatory agency.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Railroad Commission of Texas.