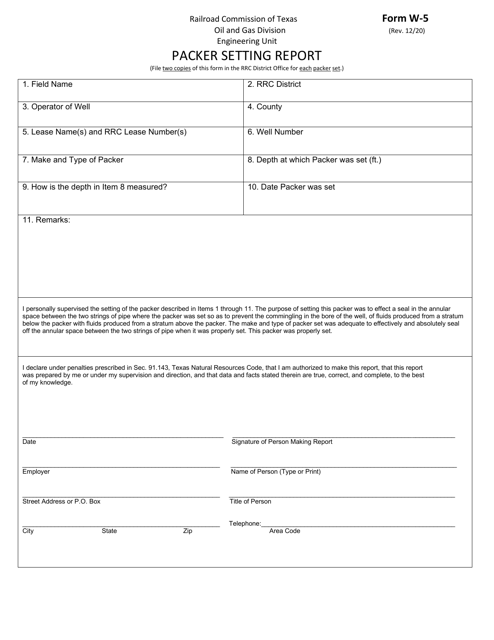

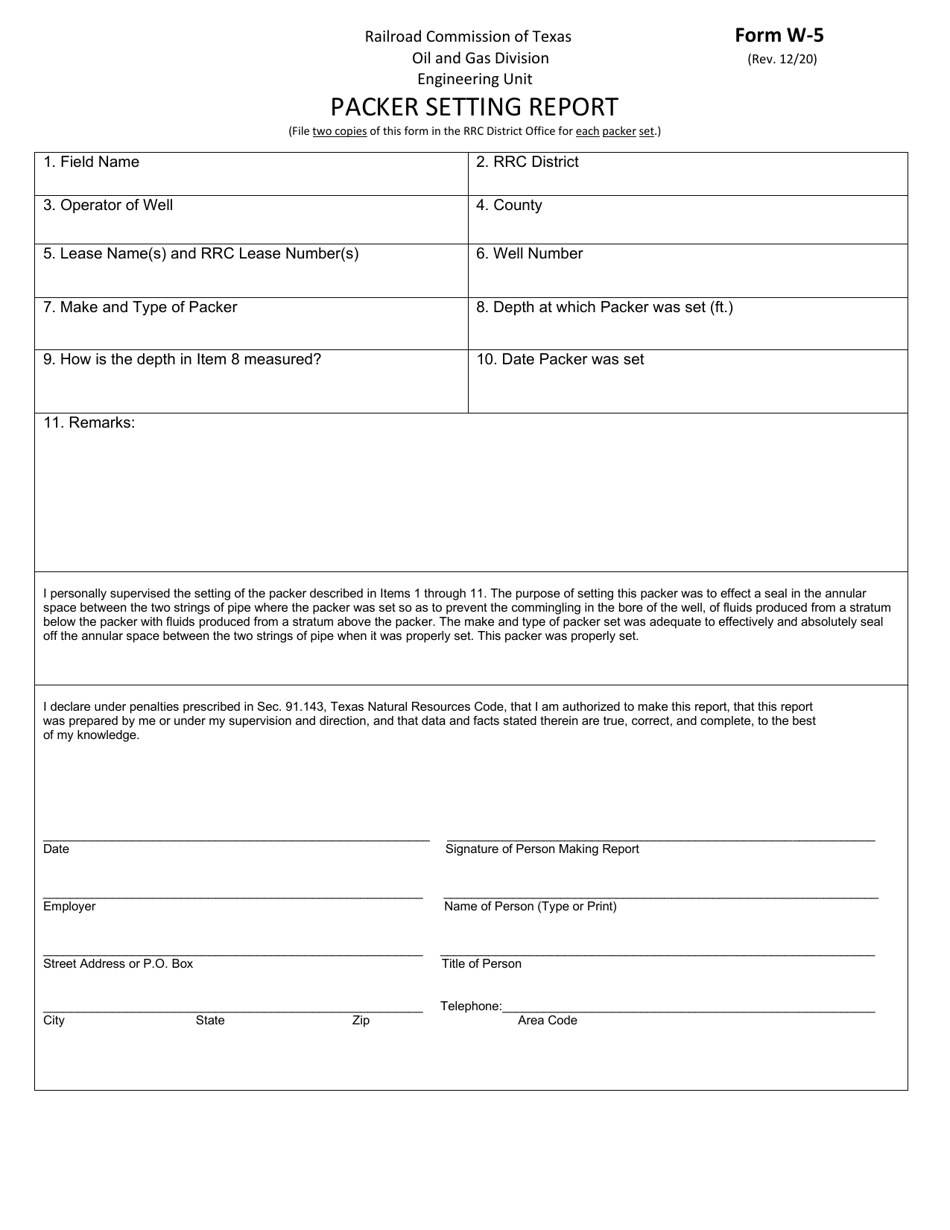

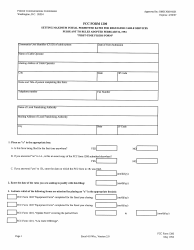

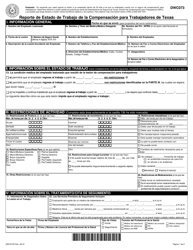

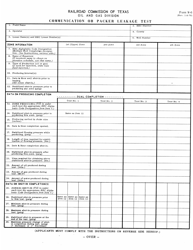

Form W-5 Packer Setting Report - Texas

What Is Form W-5?

This is a legal form that was released by the Railroad Commission of Texas - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form W-5?

A: Form W-5 is a document that allows employees to request advance payments of the earned income credit (EIC) from their employer.

Q: What is the purpose of Form W-5?

A: The purpose of Form W-5 is to request advance payments of the earned income credit.

Q: Who can submit Form W-5?

A: Employees who expect to qualify for the earned income credit for the current tax year can submit Form W-5.

Q: What is the Earned Income Credit (EIC)?

A: The Earned Income Credit (EIC) is a tax credit for low-income individuals and families.

Q: Do I need to submit Form W-5 every year?

A: Yes, you need to submit Form W-5 each year if you want to receive advance payments of the earned income credit.

Q: Can I change or stop my advance payments?

A: Yes, you can change or stop your advance payments by submitting a new Form W-5 to your employer.

Q: Is Form W-5 specific to Texas?

A: No, Form W-5 is not specific to Texas. It is used nationwide in the United States.

Q: Is Form W-5 related to state taxes?

A: No, Form W-5 is not related to state taxes. It is solely for requesting advance payments of the earned income credit.

Q: How does Form W-5 affect my tax return?

A: Form W-5 does not directly affect your tax return. It is used to receive advance payments of the earned income credit, which can help increase your income during the year.

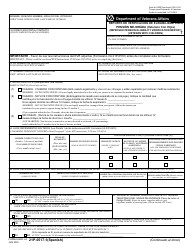

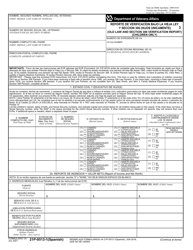

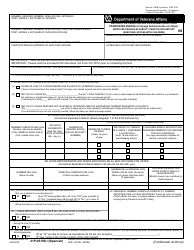

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Railroad Commission of Texas;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form W-5 by clicking the link below or browse more documents and templates provided by the Railroad Commission of Texas.