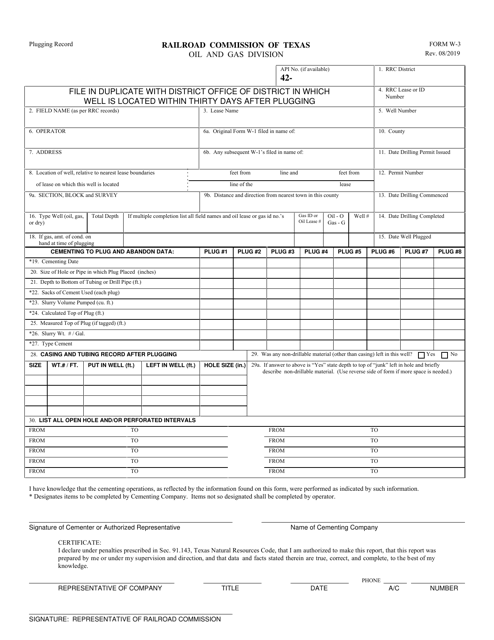

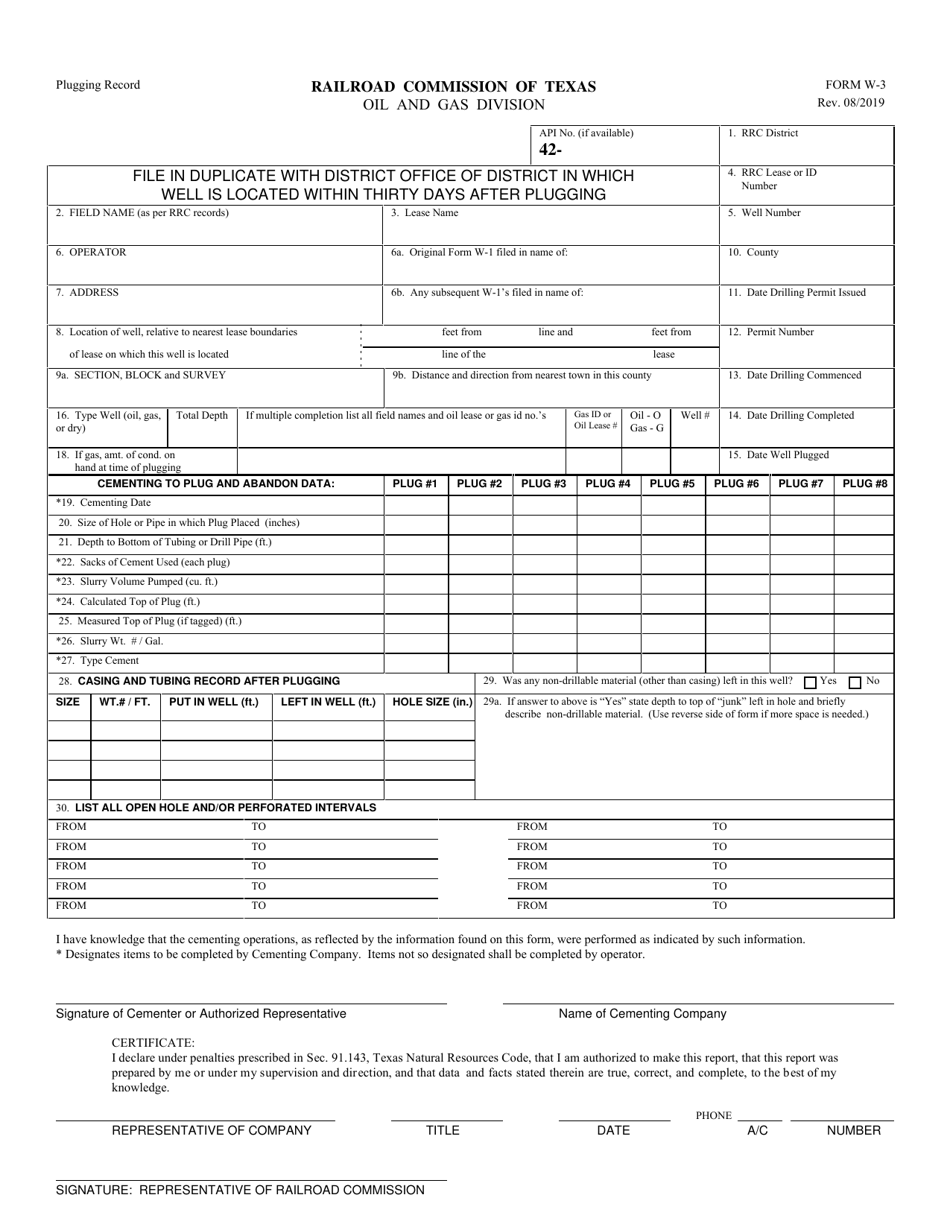

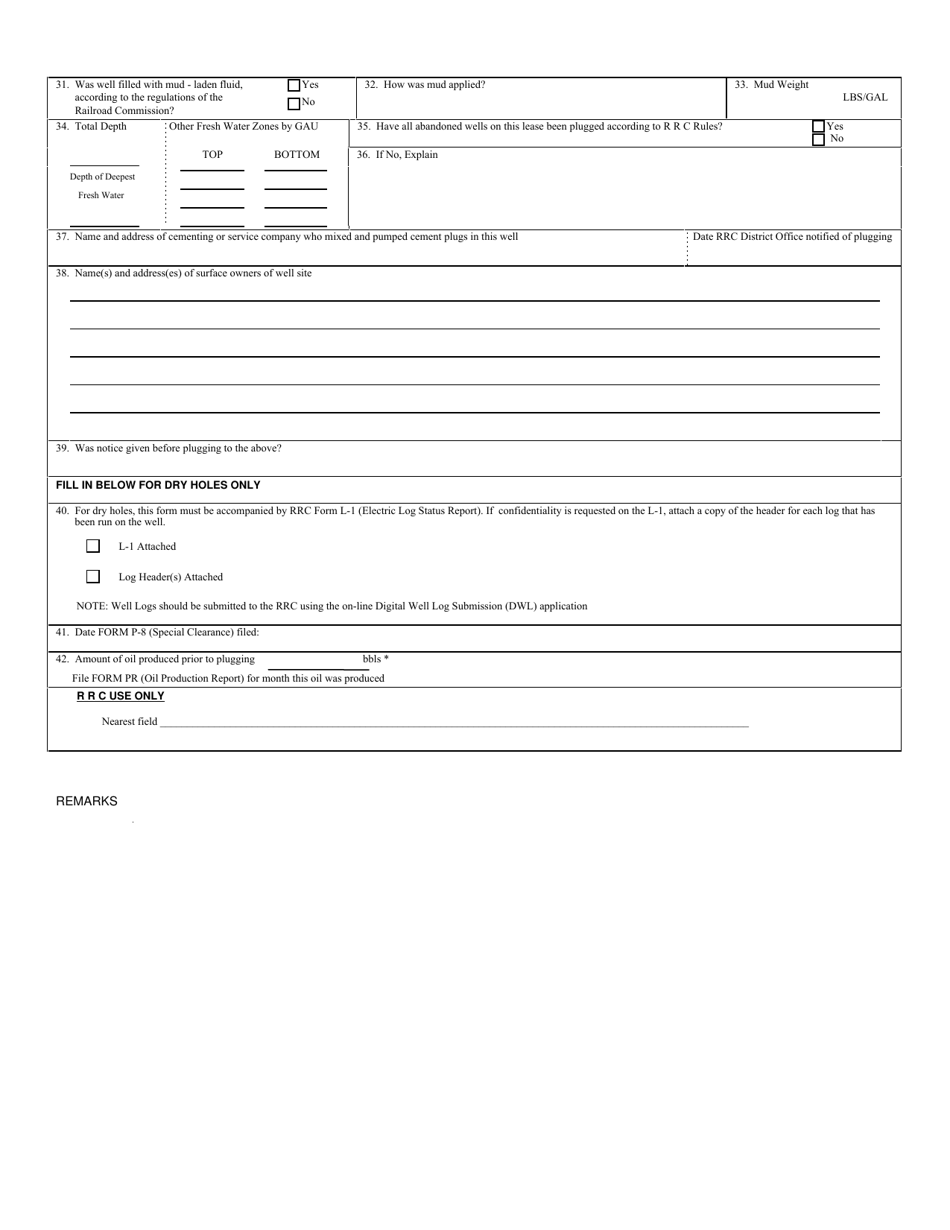

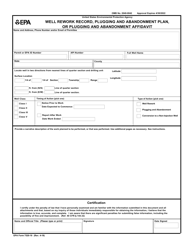

Form W-3 Plugging Record - Texas

What Is Form W-3?

This is a legal form that was released by the Railroad Commission of Texas - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form W-3?

A: Form W-3 is a transmittal form used to summarize and report wage and tax information for employees.

Q: What is the purpose of Form W-3?

A: The purpose of Form W-3 is to transmit Form W-2, Wage and Tax Statement, to the Social Security Administration (SSA).

Q: Who needs to file Form W-3?

A: Employers who are required to file Form W-2 must also file Form W-3.

Q: What information is reported on Form W-3?

A: Form W-3 reports the total wages, tips, and other compensation, as well as the total withholding and Medicare wages, for all employees.

Q: Is Form W-3 different for Texas?

A: No, Form W-3 is a federal form and is the same for all states, including Texas.

Q: When is Form W-3 due?

A: Form W-3 is due on or before the last day of January following the end of the calendar year.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Railroad Commission of Texas;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W-3 by clicking the link below or browse more documents and templates provided by the Railroad Commission of Texas.