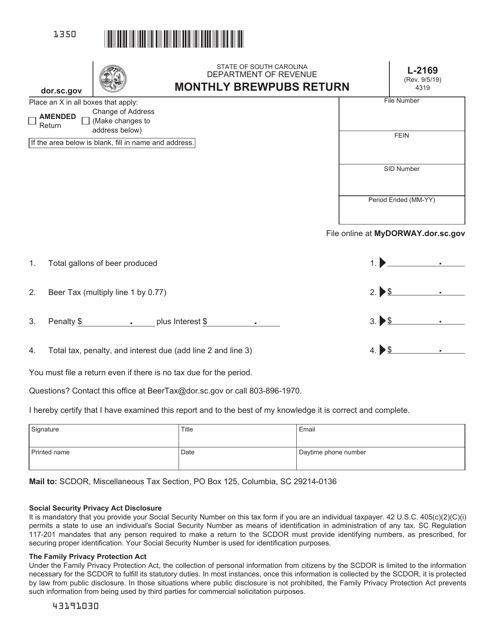

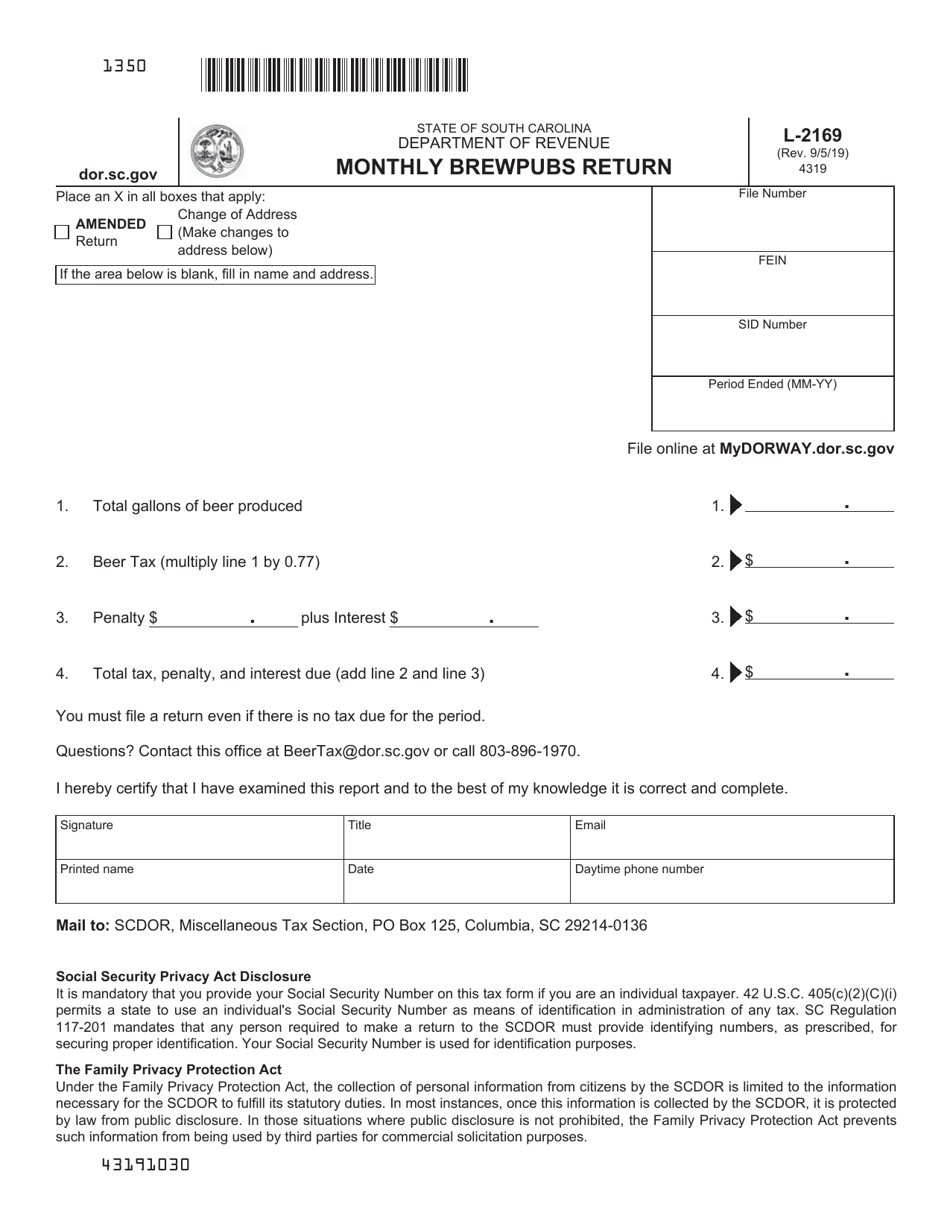

Form L-2169 Monthly Brewpubs Return - South Carolina

What Is Form L-2169?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form L-2169?

A: Form L-2169 is the Monthly Brewpubs Return for South Carolina.

Q: Who needs to file Form L-2169?

A: Brewpubs in South Carolina must file Form L-2169.

Q: What is the purpose of Form L-2169?

A: Form L-2169 is used to report and remit the monthly beer production and sales tax for brewpubs in South Carolina.

Q: When is Form L-2169 due?

A: Form L-2169 is due on the 20th day of the month following the reporting period.

Q: Is there a penalty for late filing of Form L-2169?

A: Yes, there is a penalty for late filing of Form L-2169. The penalty amount is based on the amount of tax due.

Q: What other documents may be required to accompany Form L-2169?

A: Other supporting documentation, such as sales and production records, may be required to accompany Form L-2169.

Q: Are there any exemptions or deductions available on Form L-2169?

A: Yes, there may be exemptions and deductions available for certain brewpubs. Please refer to the instructions for Form L-2169 for more information.

Form Details:

- Released on September 5, 2019;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form L-2169 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.