This version of the form is not currently in use and is provided for reference only. Download this version of

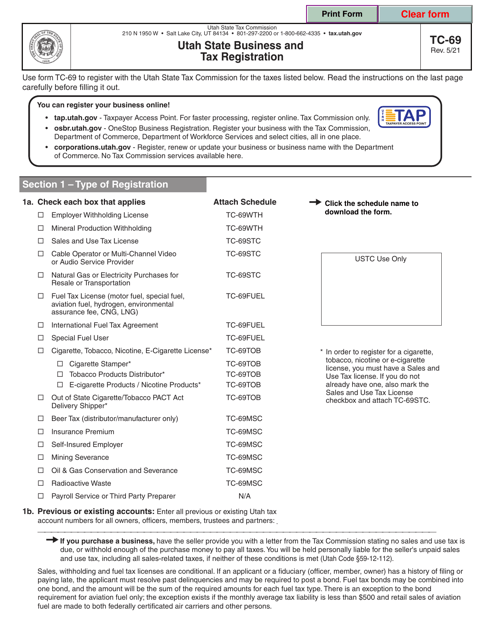

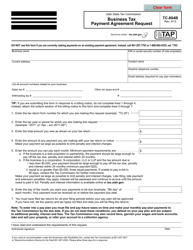

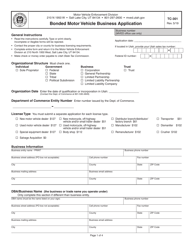

Form TC-69

for the current year.

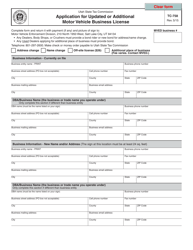

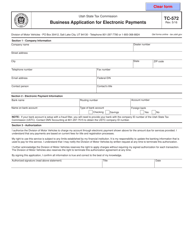

Form TC-69 Utah State Business and Tax Registration - Utah

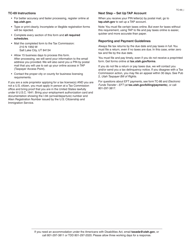

What Is Form TC-69?

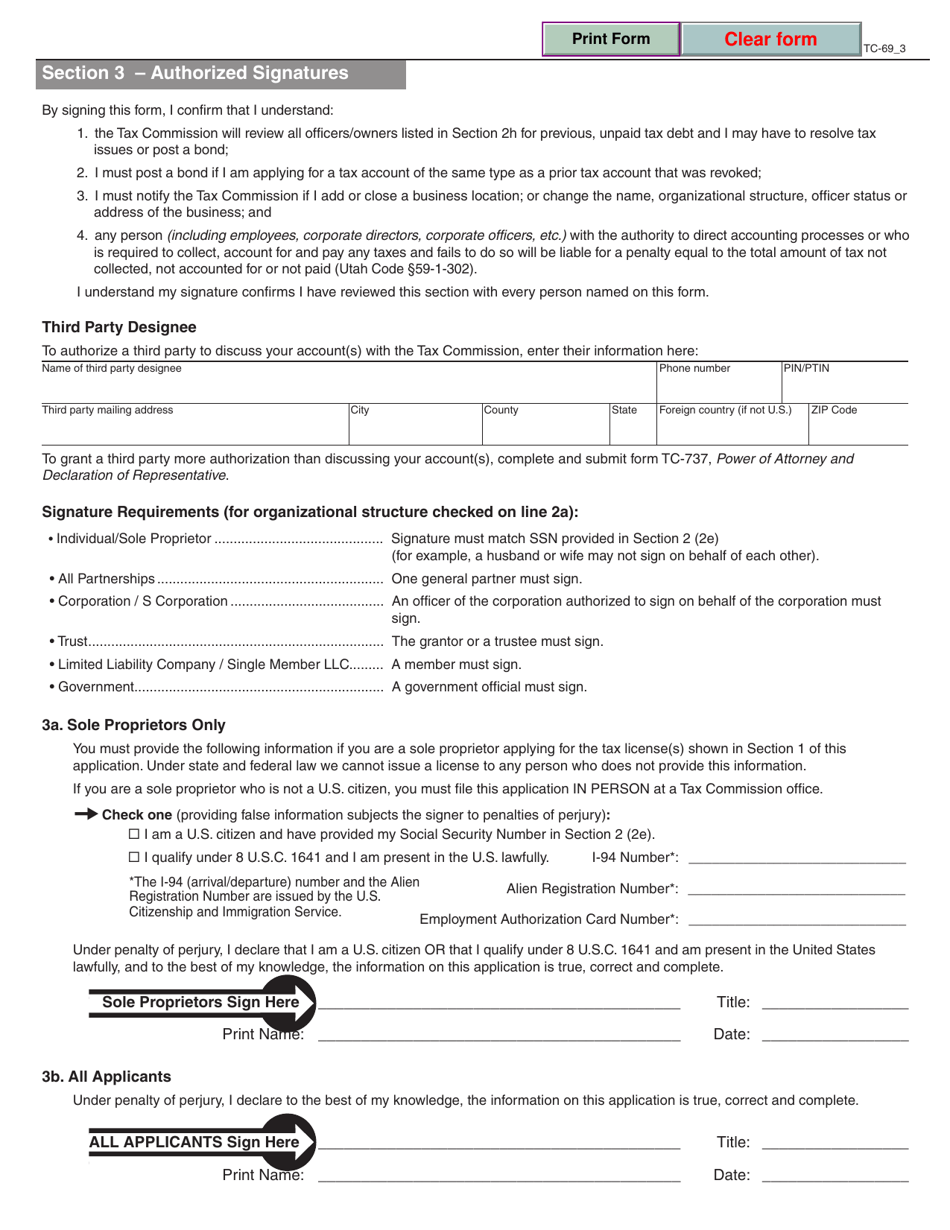

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

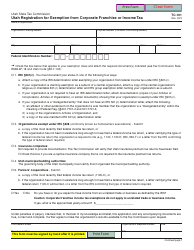

Q: What is Form TC-69?

A: Form TC-69 is the Utah State Business and Tax Registration form.

Q: What is the purpose of Form TC-69?

A: The purpose of Form TC-69 is to register a business in the state of Utah for tax purposes.

Q: Who needs to file Form TC-69?

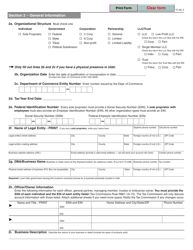

A: Any individual or business entity that operates or intends to operate a business in Utah and meets the state's tax requirements needs to file Form TC-69.

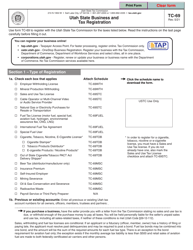

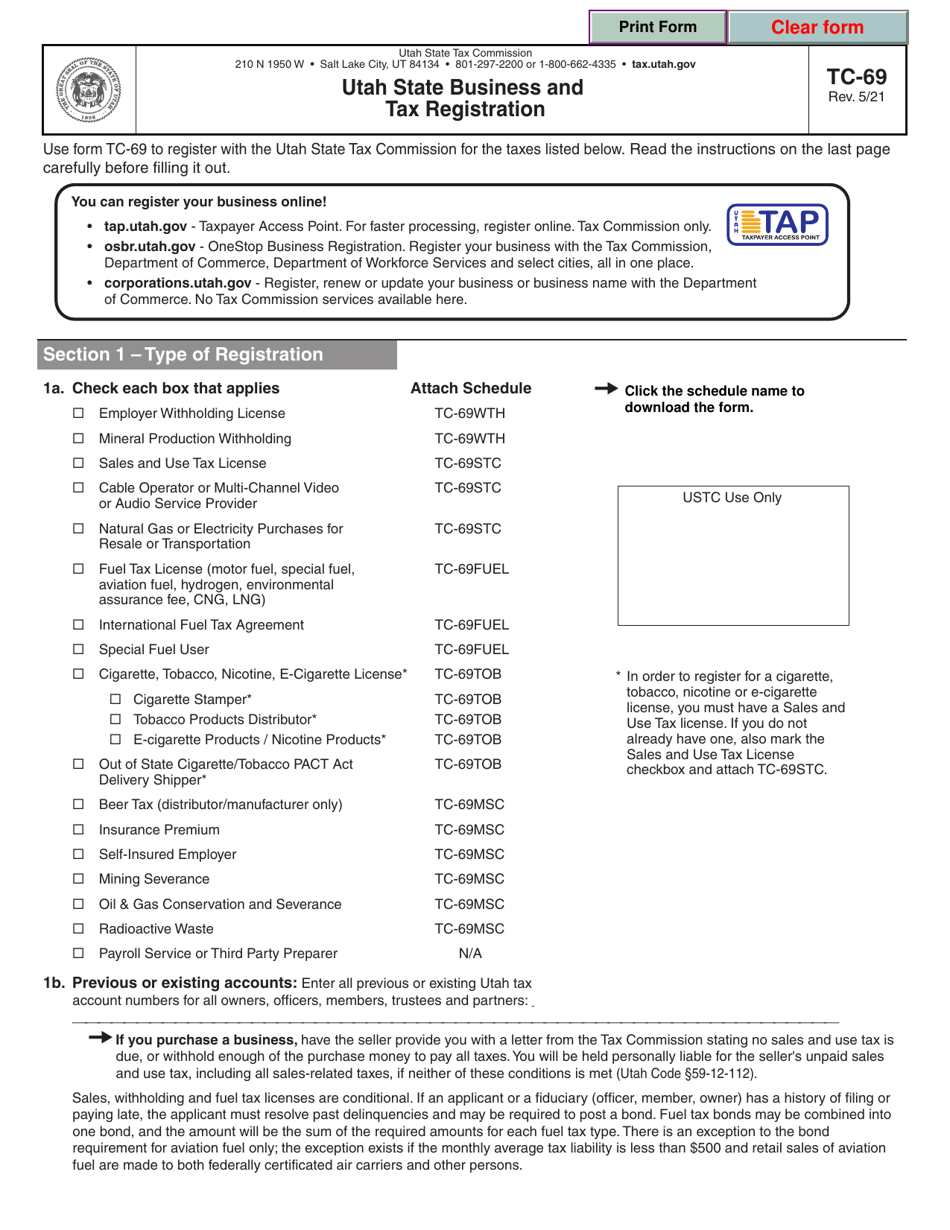

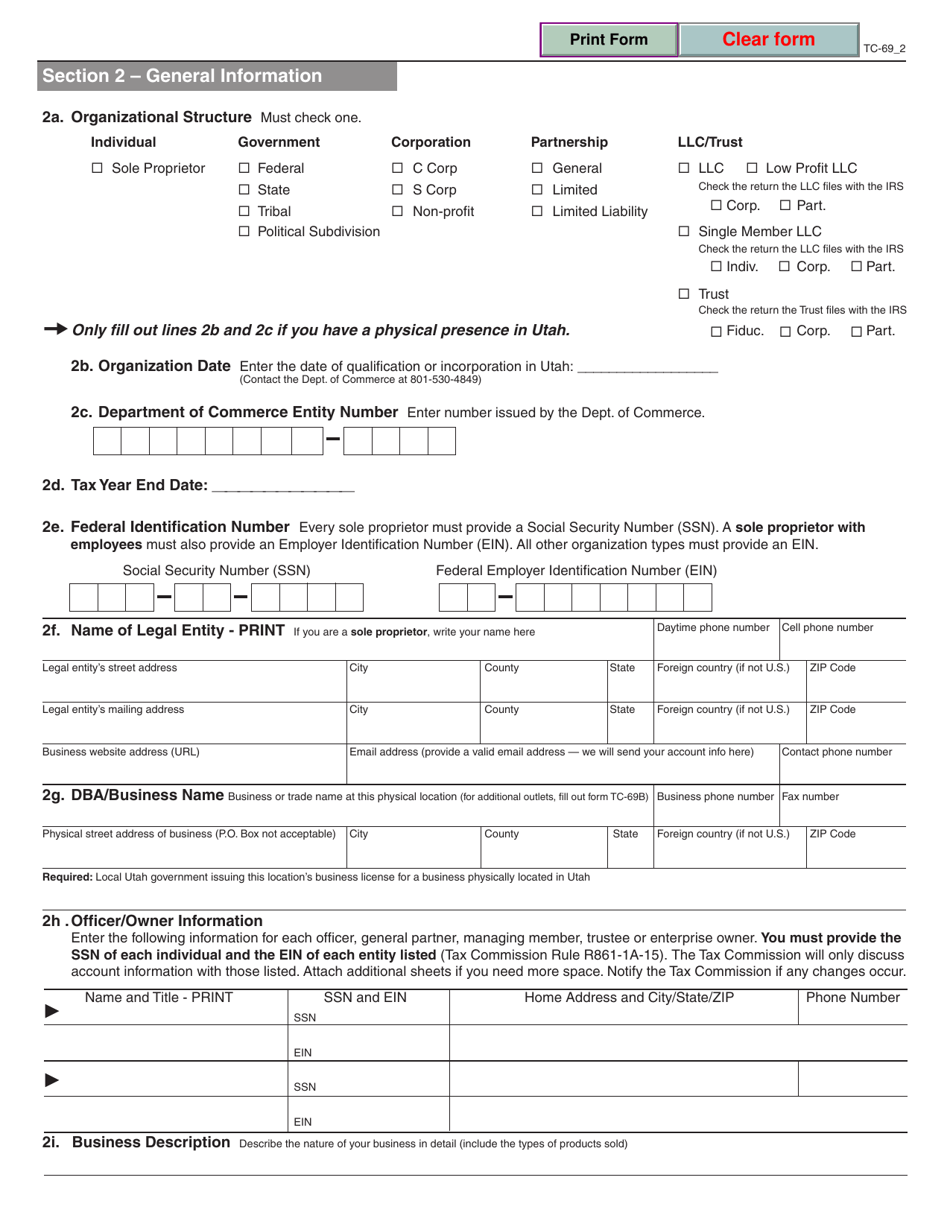

Q: What information is required on Form TC-69?

A: Form TC-69 requires information such as business name, address, federal tax ID, nature of business, and other related details.

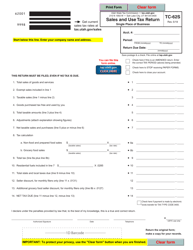

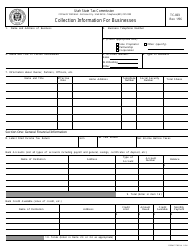

Q: Is there a fee for filing Form TC-69?

A: No, there is no fee for filing Form TC-69.

Q: When should Form TC-69 be filed?

A: Form TC-69 should be filed before starting or within 60 days of starting a business in Utah.

Q: What happens after filing Form TC-69?

A: After filing Form TC-69, you will receive a Utah State Business and Tax Registration Certificate, which allows you to legally conduct business in the state.

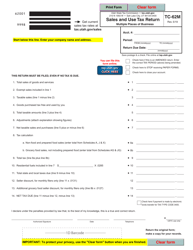

Q: Are there any ongoing reporting requirements after filing Form TC-69?

A: Yes, businesses registered with the Utah State Tax Commission are required to file regular tax returns and meet other reporting obligations as per state laws.

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-69 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.