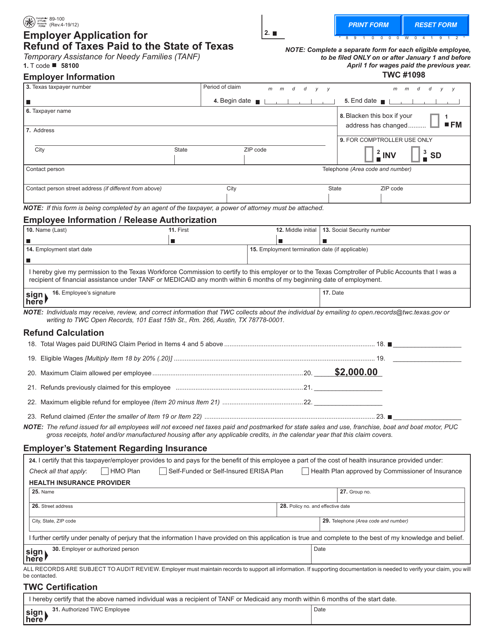

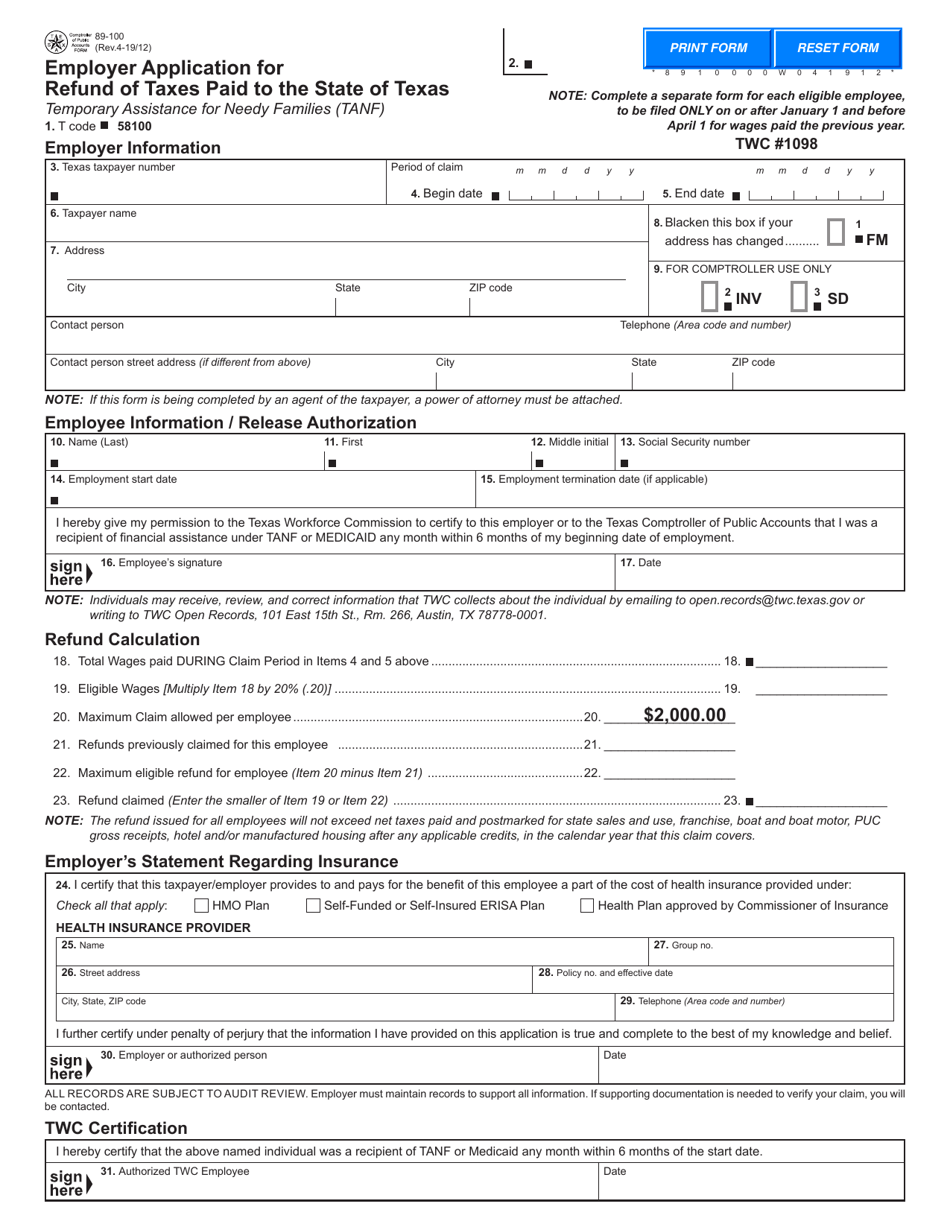

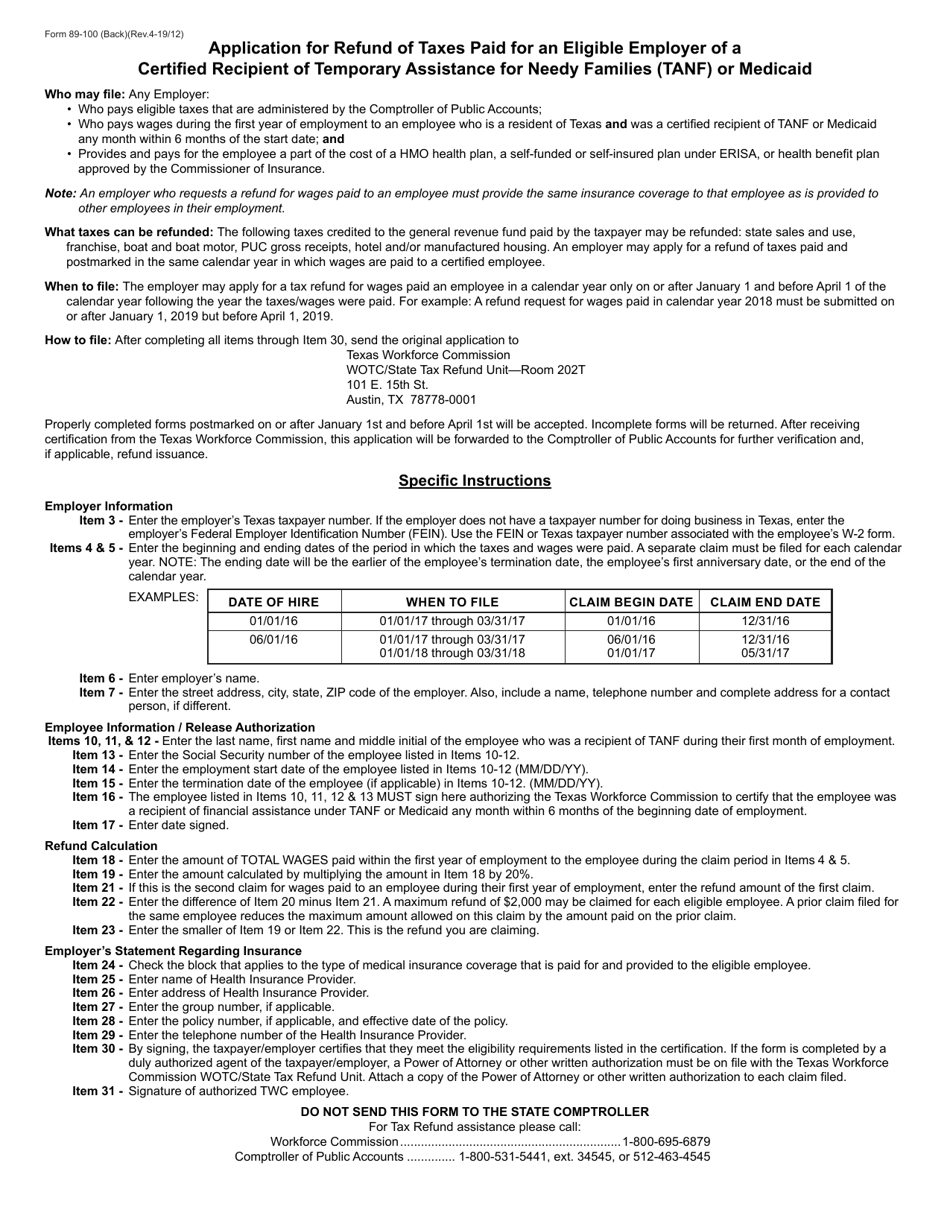

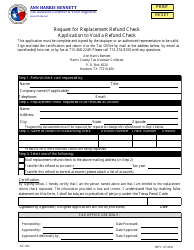

Form 89-100 Application for Refund of Taxes Paid for an Eligible Employer of a Certified Recipient of Temporary Assistance for Needy Families (TANF) or Medicaid - Texas

What Is Form 89-100?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 89-100?

A: Form 89-100 is an application for refund of taxes paid for an eligible employer of a certified recipient of Temporary Assistance for Needy Families (TANF) or Medicaid in Texas.

Q: Who can use Form 89-100?

A: Employers in Texas who have paid taxes on behalf of a certified recipient of TANF or Medicaid can use Form 89-100.

Q: What is the purpose of Form 89-100?

A: The purpose of Form 89-100 is to apply for a refund of taxes paid by an employer for a certified recipient of TANF or Medicaid.

Q: What information is required on Form 89-100?

A: Form 89-100 requires information about the employer, the certified recipient of TANF or Medicaid, and details about the taxes paid.

Q: Is there a deadline for submitting Form 89-100?

A: Yes, Form 89-100 should be submitted within the prescribed deadline specified by the Texas Workforce Commission.

Q: How long does it take to process Form 89-100?

A: The processing time for Form 89-100 varies and is determined by the Texas Workforce Commission.

Q: Is there a fee for submitting Form 89-100?

A: There is no fee for submitting Form 89-100.

Form Details:

- Released on April 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 89-100 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.