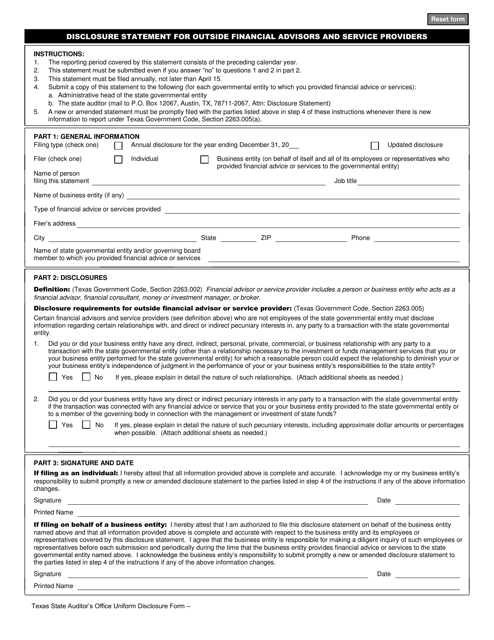

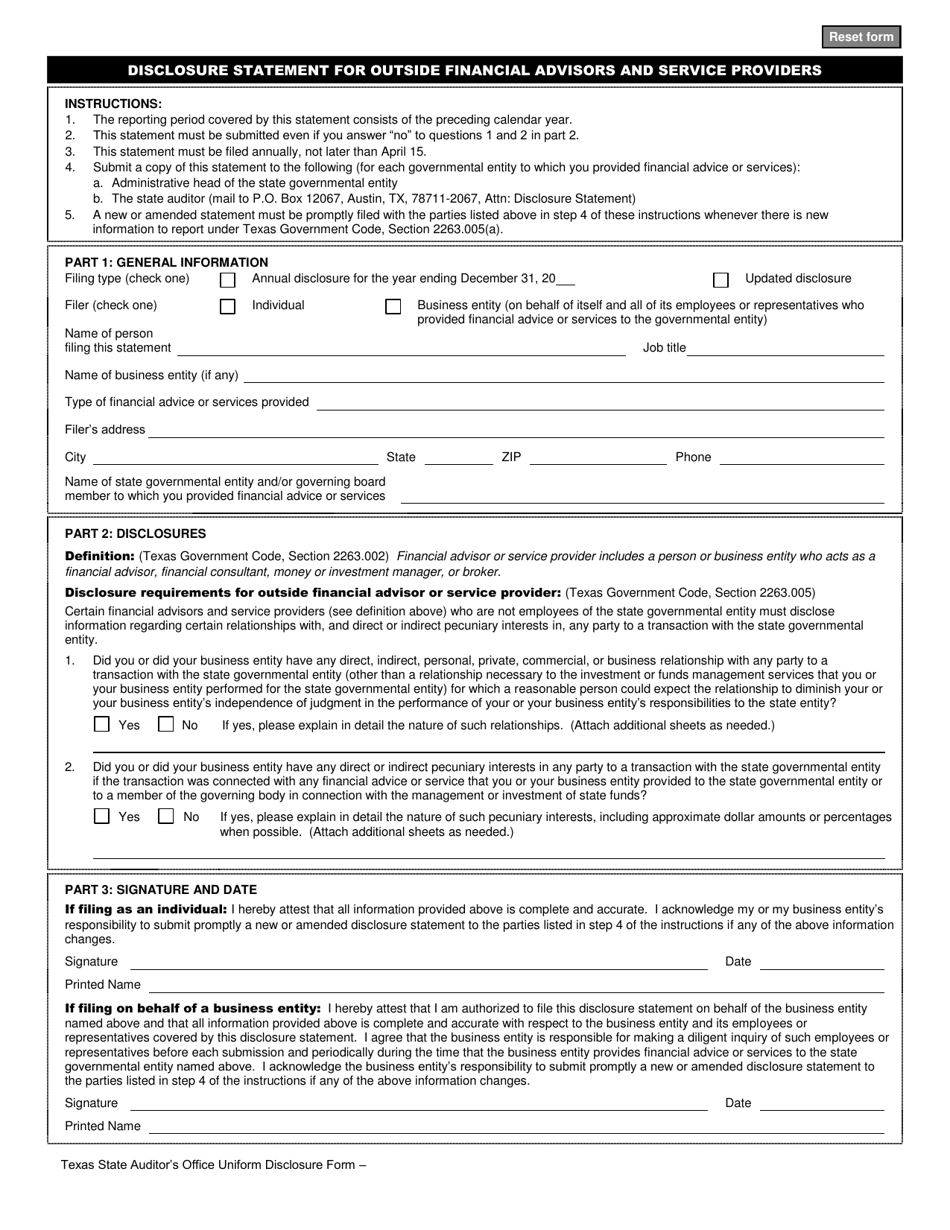

Disclosure Statement for Outside Financial Advisors and Service Providers - Texas

Disclosure Statement for Outside Financial Advisors and Service Providers is a legal document that was released by the Texas State Auditor's Office - a government authority operating within Texas.

FAQ

Q: What is a disclosure statement?

A: A disclosure statement is a document that provides information about the relationship between a financial advisor or service provider and their clients.

Q: Who is required to provide a disclosure statement?

A: Financial advisors and service providers in Texas are required to provide a disclosure statement to their clients.

Q: What information is typically included in a disclosure statement?

A: A disclosure statement typically includes information such as the advisor's qualifications, experience, fees, conflicts of interest, and any disciplinary history.

Q: Why is a disclosure statement important?

A: A disclosure statement is important because it helps clients make informed decisions about whether to engage the services of a particular advisor or service provider.

Q: How can I obtain a disclosure statement?

A: You can obtain a disclosure statement from your financial advisor or service provider by requesting it in writing.

Q: Are financial advisors and service providers required to update their disclosure statements?

A: Yes, financial advisors and service providers are required to update their disclosure statements if there are any material changes to the information provided.

Form Details:

- Released on January 1, 2011;

- The latest edition currently provided by the Texas State Auditor's Office;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Texas State Auditor's Office.