This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

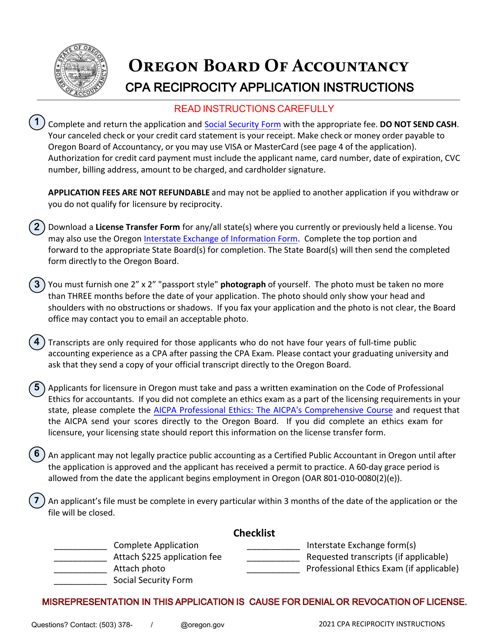

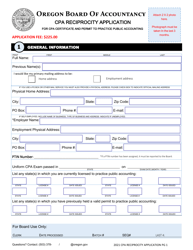

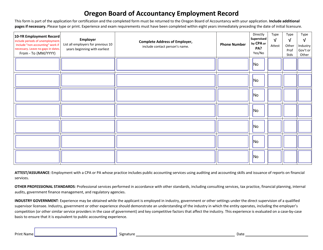

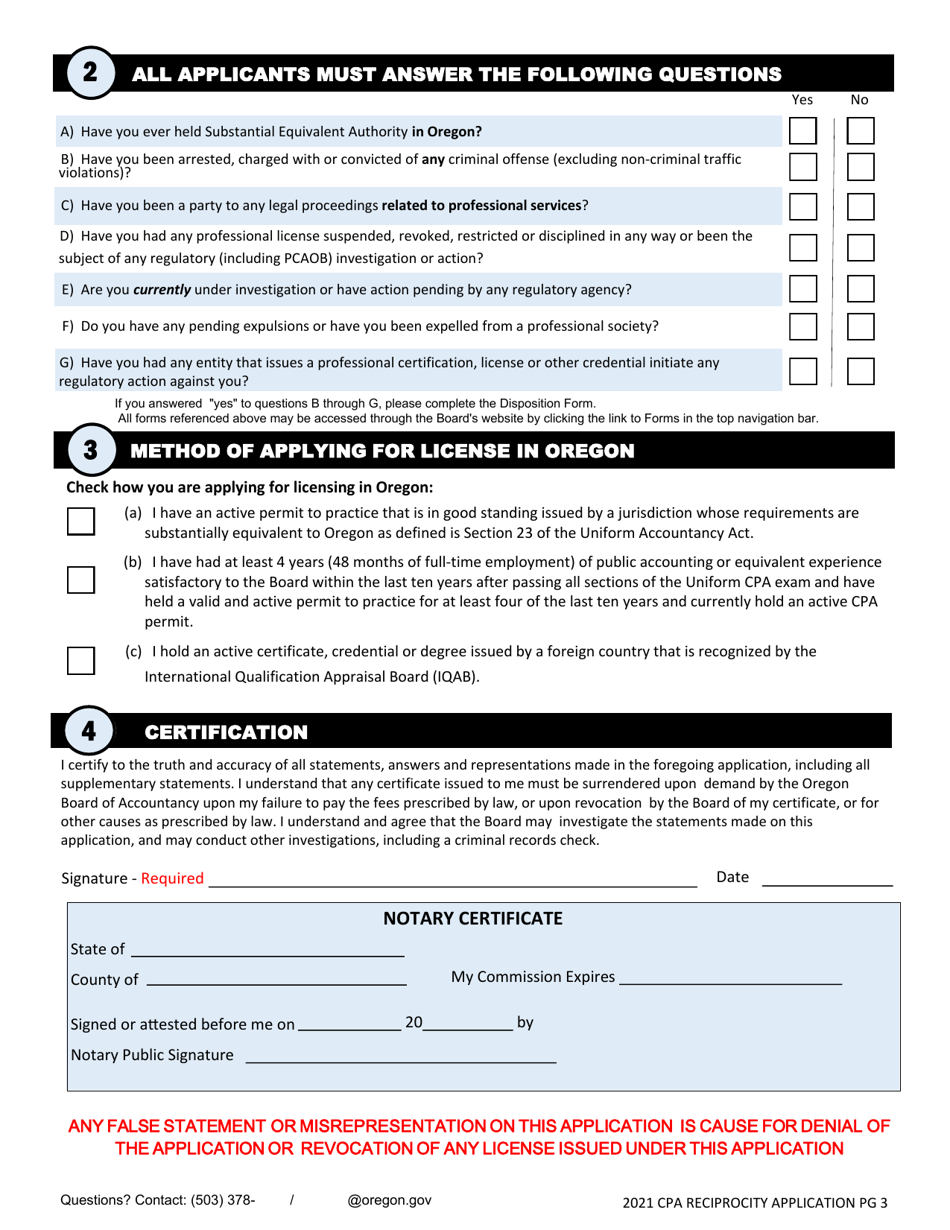

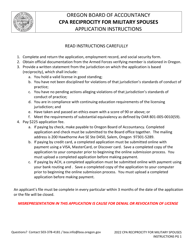

CPA Reciprocity Application for CPA Certificate and Permit to Practice Public Accounting - Oregon

CPA Reciprocity Application for CPA Certificate and Permit to Practice Public Accounting is a legal document that was released by the Oregon Board of Accountancy - a government authority operating within Oregon.

FAQ

Q: What is the CPA reciprocity application for CPA certificate and permit to practice public accounting?

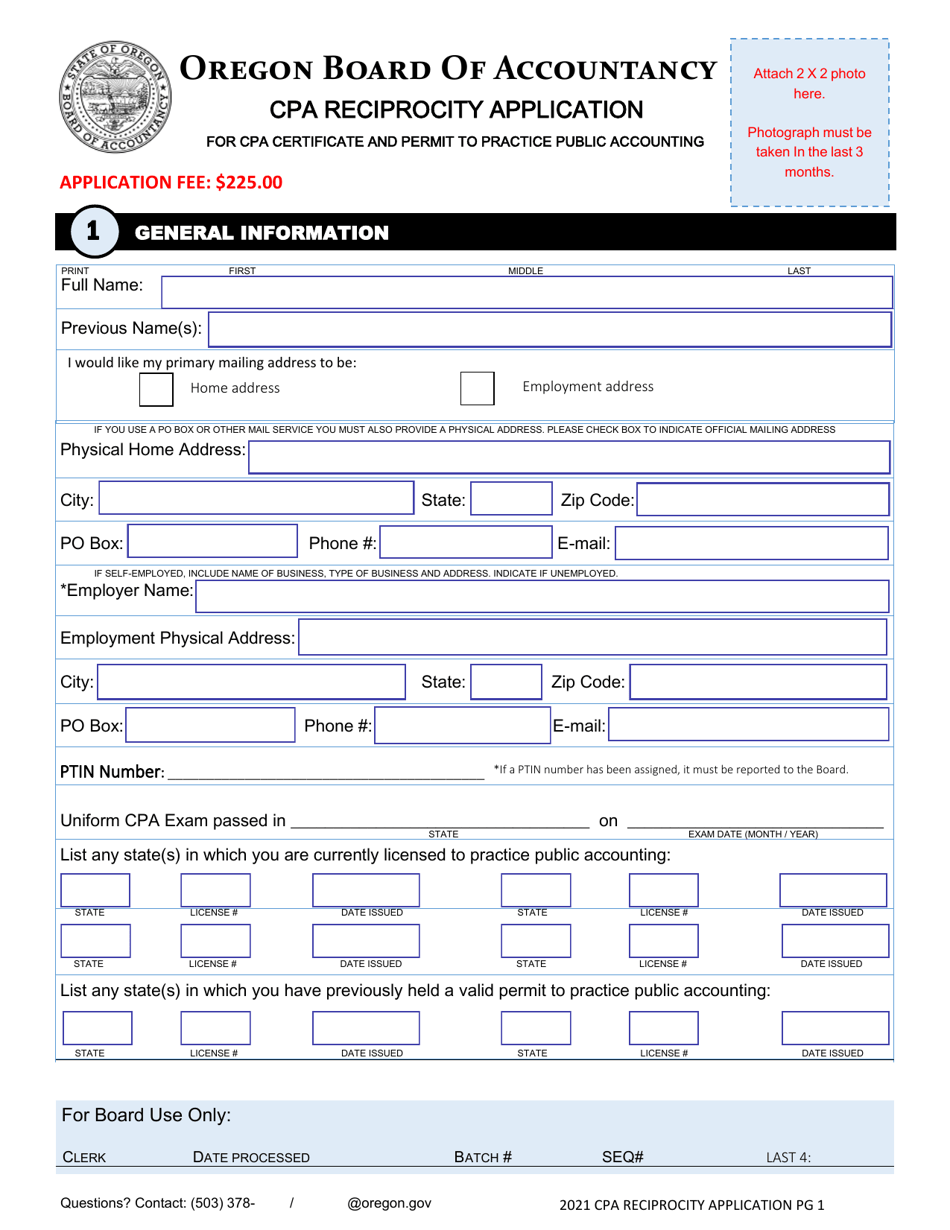

A: It is an application process in Oregon for licensed CPAs from other states to obtain a CPA certificate and permit to practice public accounting in Oregon.

Q: Who is eligible to apply for CPA reciprocity in Oregon?

A: Licensed CPAs from other states who meet the eligibility requirements set by the Oregon Board of Accountancy.

Q: What are the eligibility requirements for CPA reciprocity in Oregon?

A: Eligibility requirements include holding an active CPA license from another state, passing the Uniform CPA Exam, meeting the education requirements, and having relevant experience.

Q: What exams do I need to pass for CPA reciprocity in Oregon?

A: You need to pass the Uniform CPA Exam.

Q: What are the education requirements for CPA reciprocity in Oregon?

A: You need to have a bachelor's degree or higher from an accredited college or university, with specific accounting and business coursework.

Q: Can I apply for CPA reciprocity in Oregon if I don't have a bachelor's degree?

A: No, a bachelor's degree is required to apply for CPA reciprocity in Oregon.

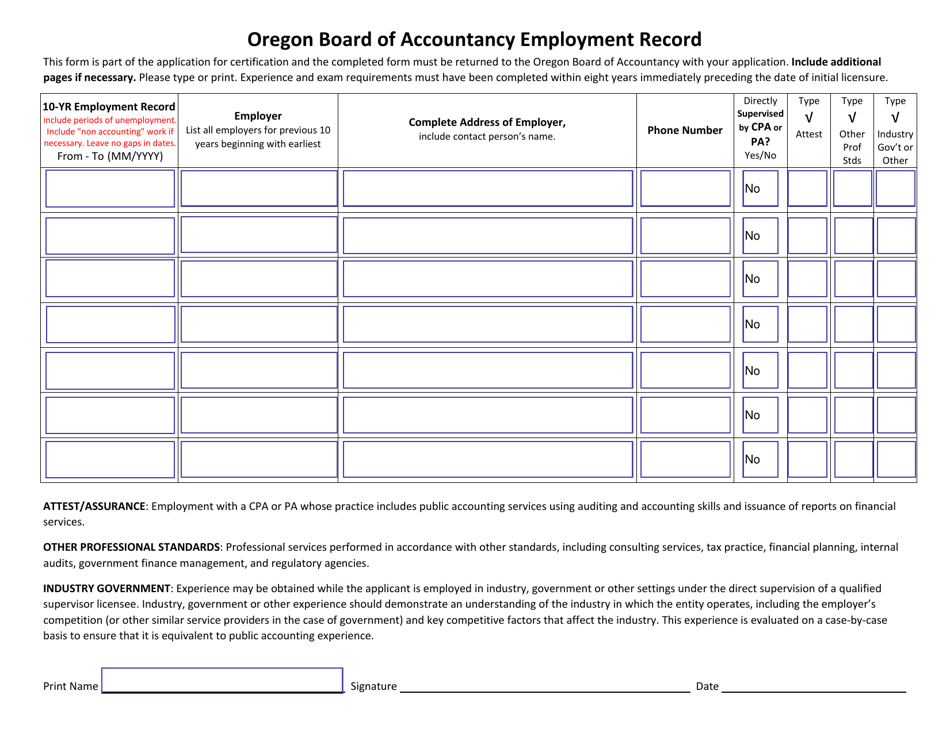

Q: Do I need to have work experience for CPA reciprocity in Oregon?

A: Yes, you need to have relevant work experience in public accounting, governmental accounting, or related areas.

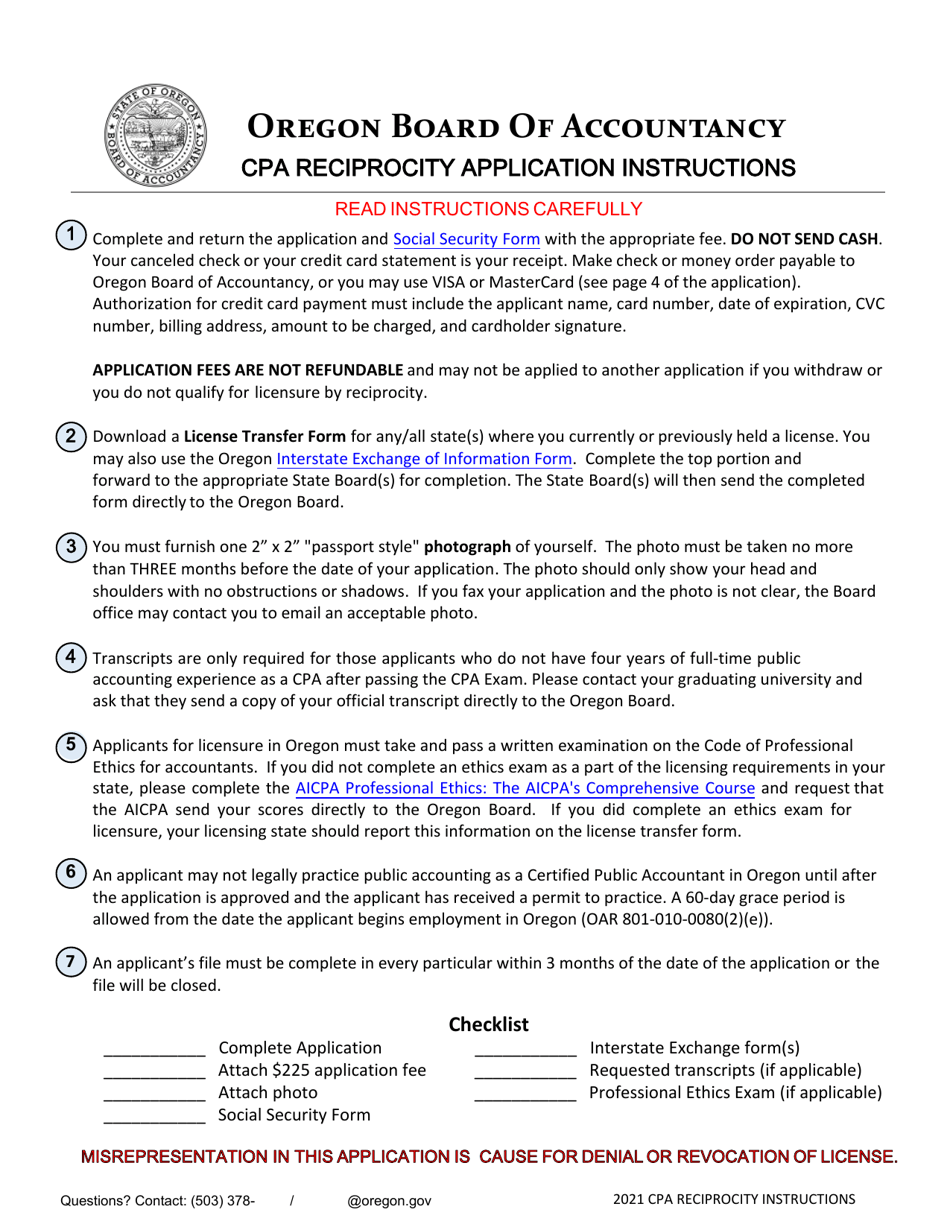

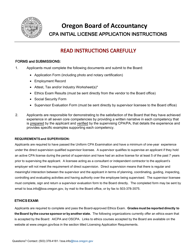

Q: How do I apply for CPA reciprocity in Oregon?

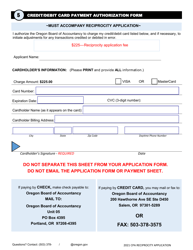

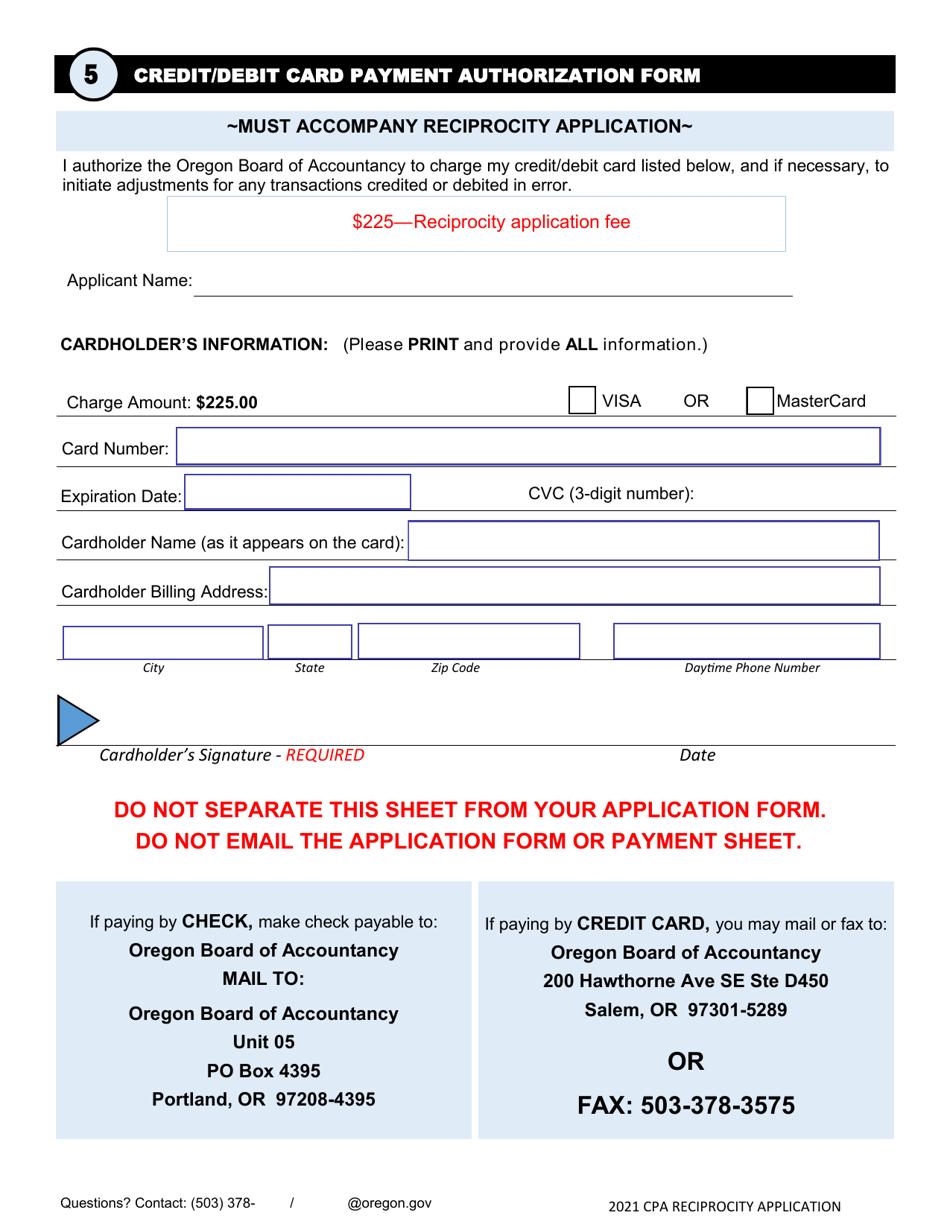

A: You need to submit the CPA Reciprocity Application along with the required documents and fees to the Oregon Board of Accountancy.

Q: What documents do I need to submit with the CPA reciprocity application in Oregon?

A: You need to submit official transcripts, verification of CPA license, a Certificate of Moral Character, and other supporting documents.

Q: How much is the application fee for CPA reciprocity in Oregon?

A: The application fee for CPA reciprocity in Oregon is $300.

Form Details:

- Released on January 1, 2021;

- The latest edition currently provided by the Oregon Board of Accountancy;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oregon Board of Accountancy.