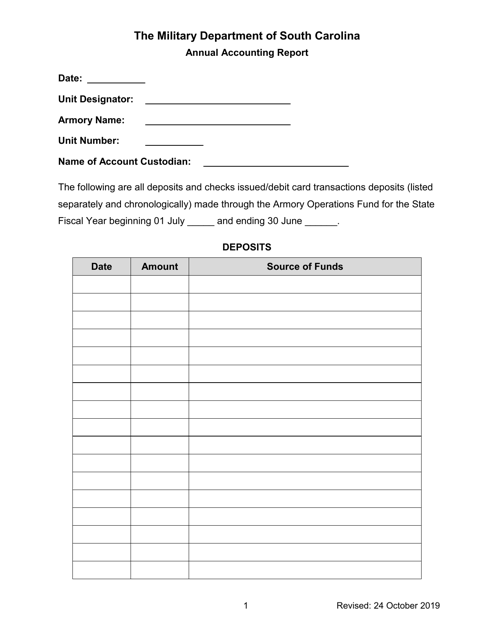

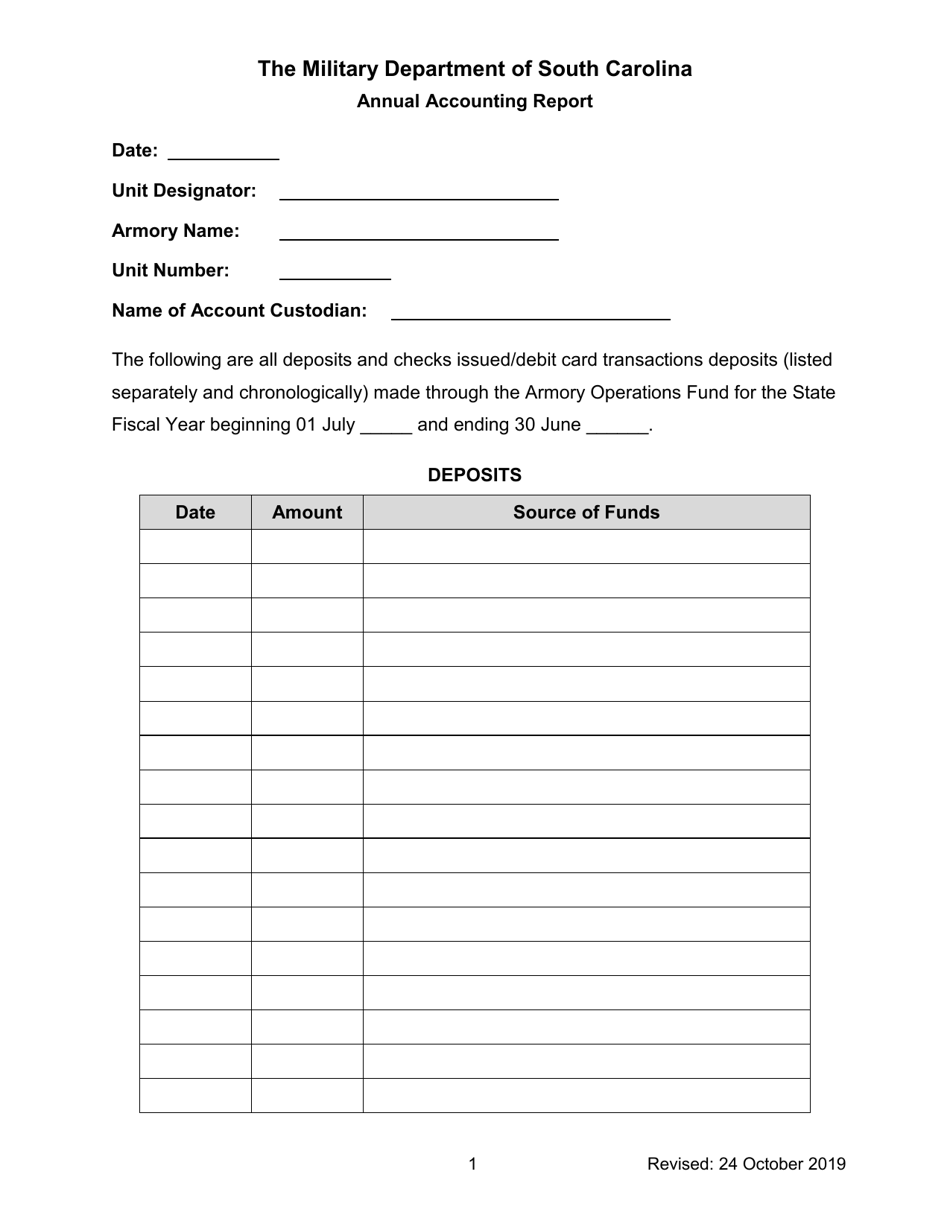

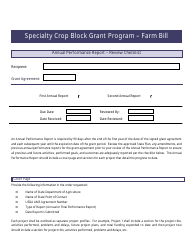

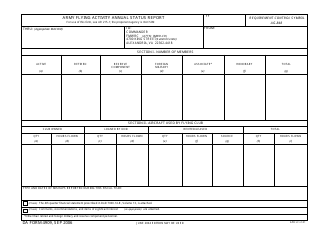

Annual Accounting Report - South Carolina

Annual Accounting Report is a legal document that was released by the South Carolina Military Department - a government authority operating within South Carolina.

FAQ

Q: What is the Annual Accounting Report in South Carolina?

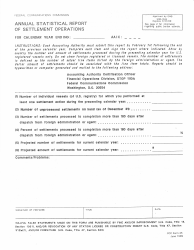

A: The Annual Accounting Report is a financial report submitted by businesses in South Carolina to the state's Department of Revenue.

Q: Who is required to file the Annual Accounting Report in South Carolina?

A: Most businesses that are registered with the South Carolina Department of Revenue are required to file the Annual Accounting Report.

Q: When is the deadline to file the Annual Accounting Report in South Carolina?

A: The deadline to file the Annual Accounting Report in South Carolina is typically the 15th day of the fourth month after the end of the business's fiscal year.

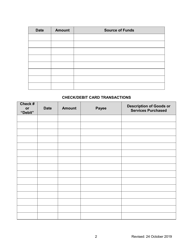

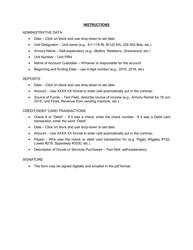

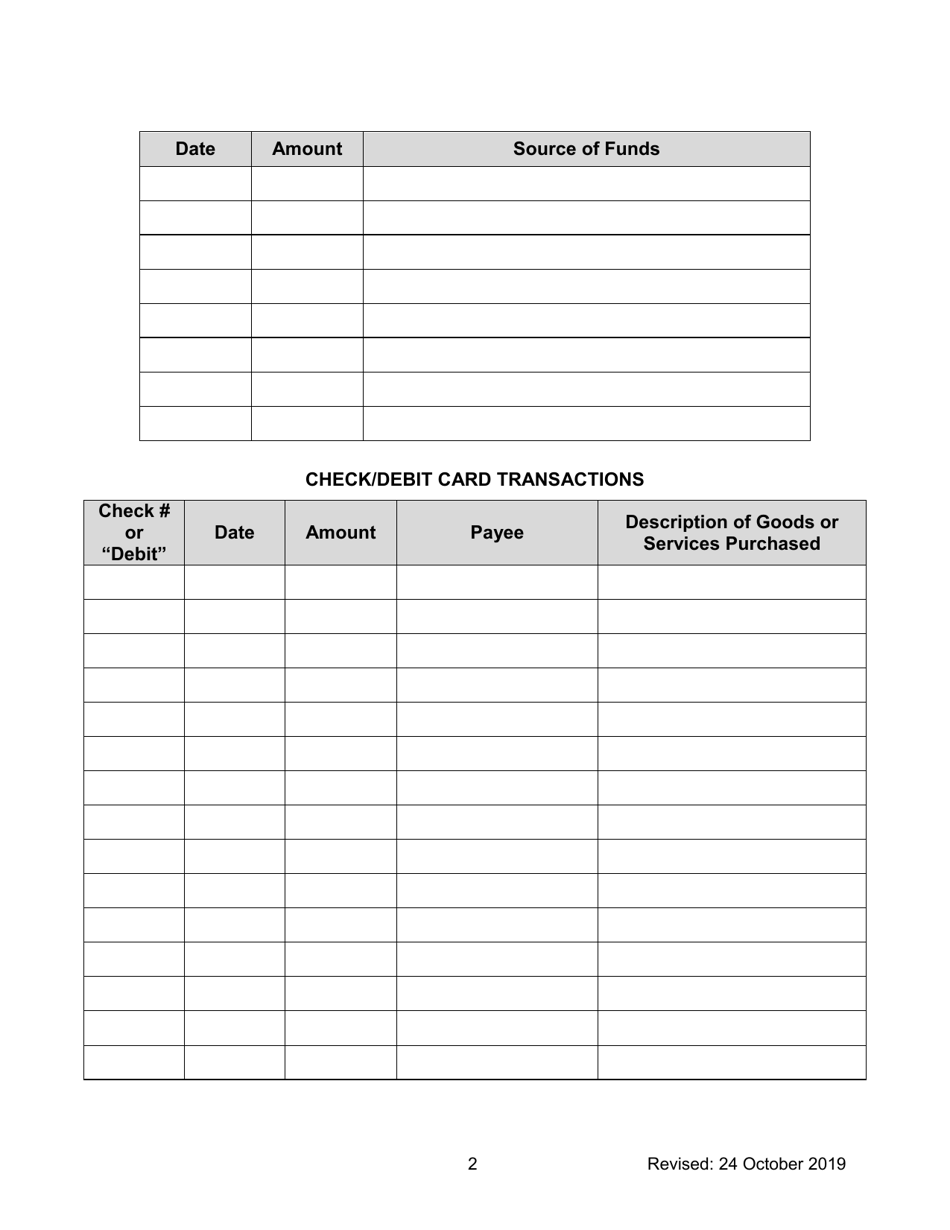

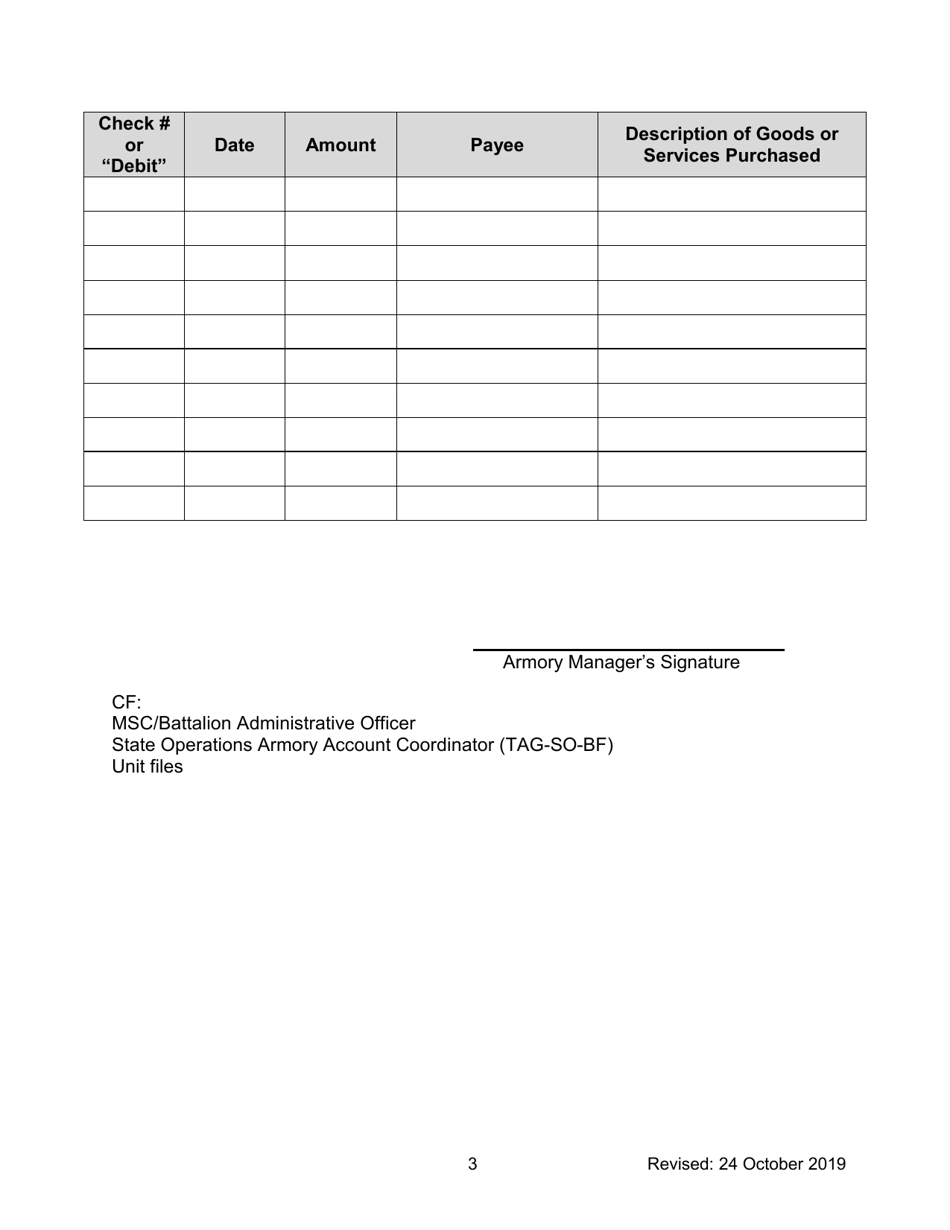

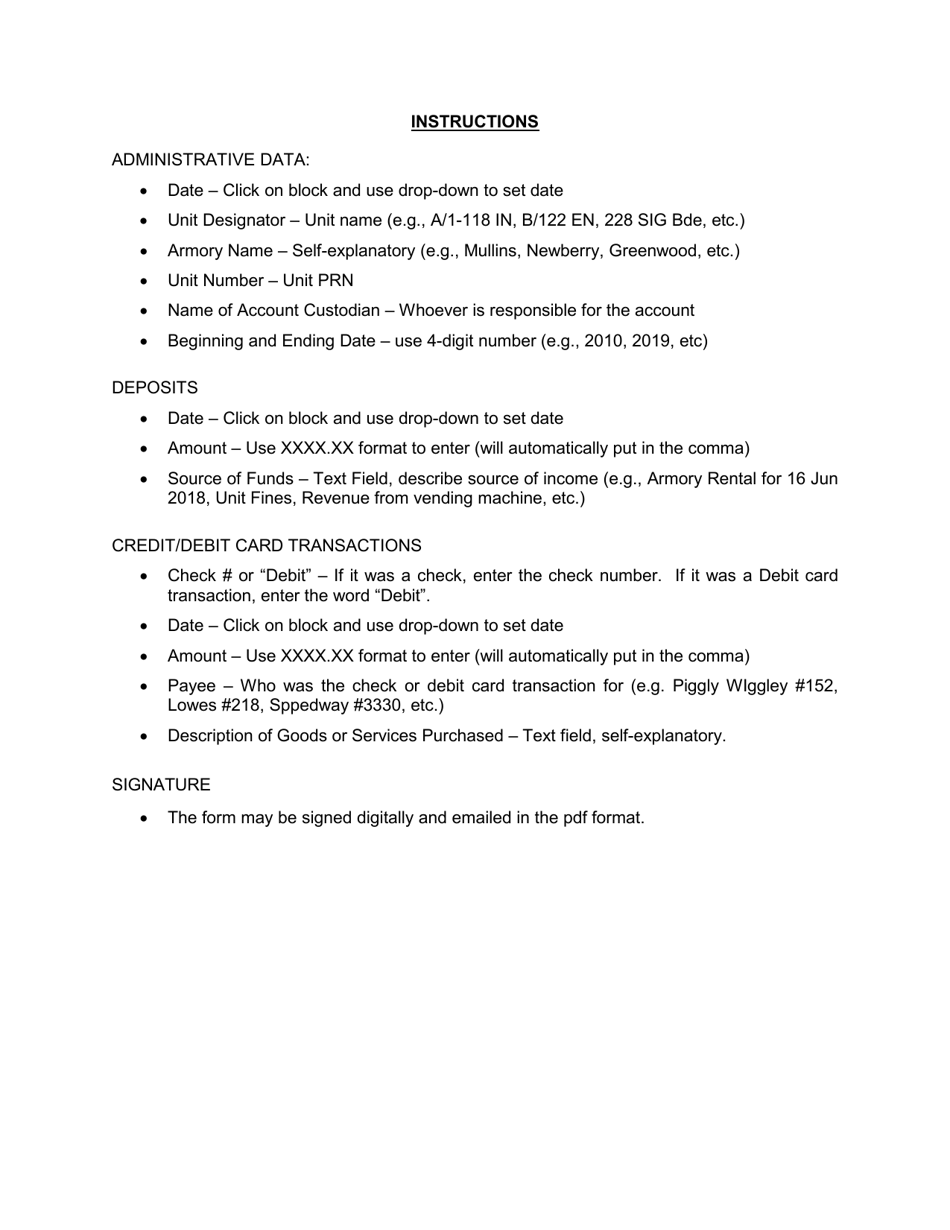

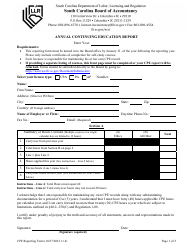

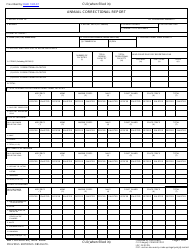

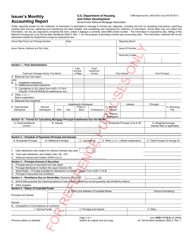

Q: What information is included in the Annual Accounting Report in South Carolina?

A: The Annual Accounting Report includes information about a business's income, expenses, assets, and liabilities.

Q: Is there a penalty for late filing of the Annual Accounting Report in South Carolina?

A: Yes, there is a penalty for late filing of the Annual Accounting Report in South Carolina. The penalty amount varies depending on the length of the delay.

Form Details:

- Released on October 24, 2019;

- The latest edition currently provided by the South Carolina Military Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the South Carolina Military Department.