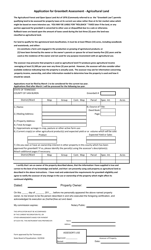

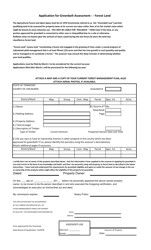

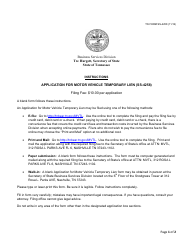

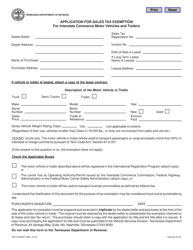

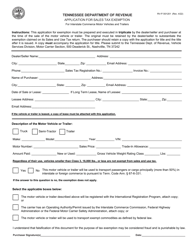

Application for Greenbelt Assessment - Van Buren County, Tennessee

Application for Greenbelt Assessment is a legal document that was released by the Tennessee Comptroller of the Treasury - a government authority operating within Tennessee. The form may be used strictly within Van Buren County.

FAQ

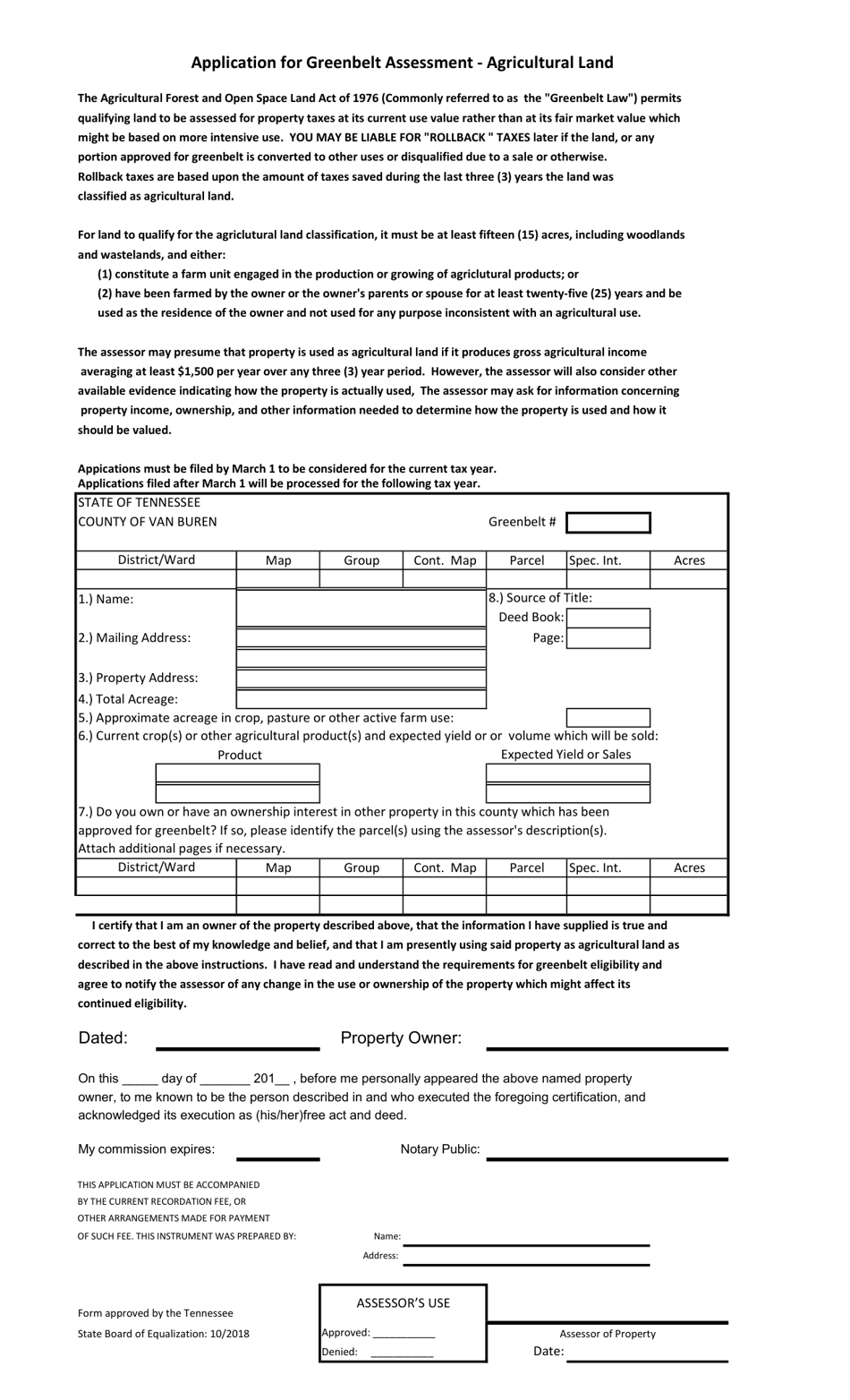

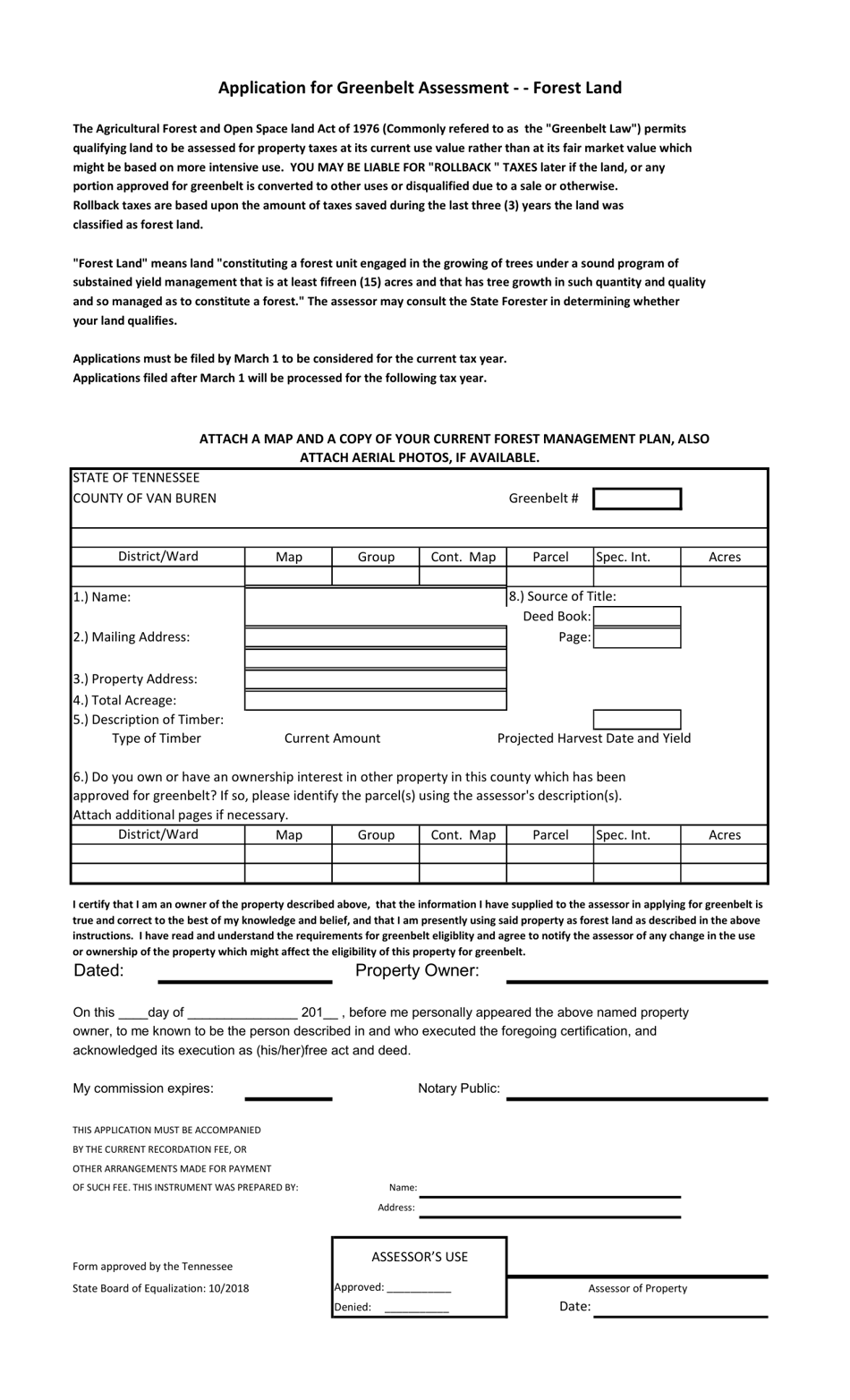

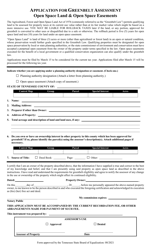

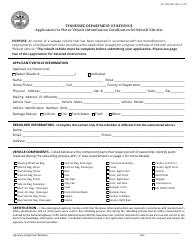

Q: What is a Greenbelt Assessment?

A: A Greenbelt Assessment is a program that provides property tax breaks for agricultural or forest land.

Q: Who is eligible for the Greenbelt Assessment in Van Buren County, Tennessee?

A: Property owners who use their land for qualifying agricultural or forestry purposes may be eligible.

Q: What are the benefits of the Greenbelt Assessment?

A: The Greenbelt Assessment program offers reduced property tax rates for qualifying land, making it more affordable for agricultural and forestry operations.

Q: How can I apply for the Greenbelt Assessment in Van Buren County, Tennessee?

A: To apply, you need to complete an application form and submit it to the Van Buren County Assessor's Office.

Q: Are there any requirements to maintain the Greenbelt Assessment status?

A: Yes, you must continue using the land for agricultural or forestry purposes and comply with any applicable land management plans.

Q: What happens if I no longer meet the eligibility requirements for the Greenbelt Assessment?

A: If you no longer qualify, you may be subject to additional property taxes and penalties for the years in which you received the Greenbelt Assessment benefits.

Q: Can I appeal the denial of my Greenbelt Assessment application?

A: Yes, if your application is denied, you have the right to appeal the decision to the Van Buren County Board of Equalization.

Form Details:

- Released on November 7, 2018;

- The latest edition currently provided by the Tennessee Comptroller of the Treasury;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Tennessee Comptroller of the Treasury.