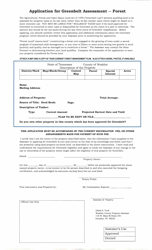

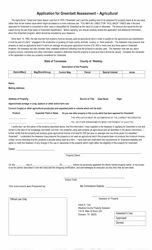

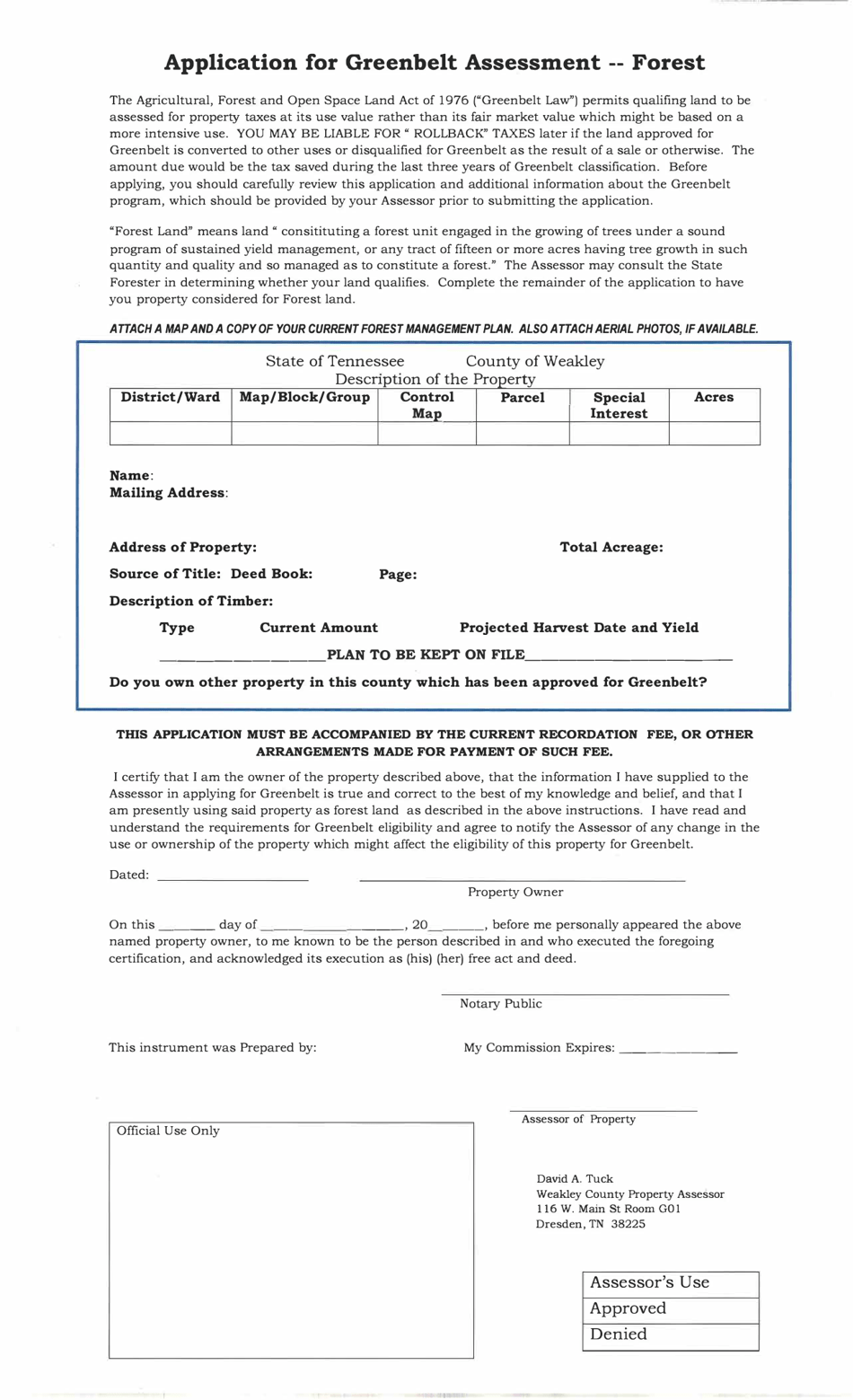

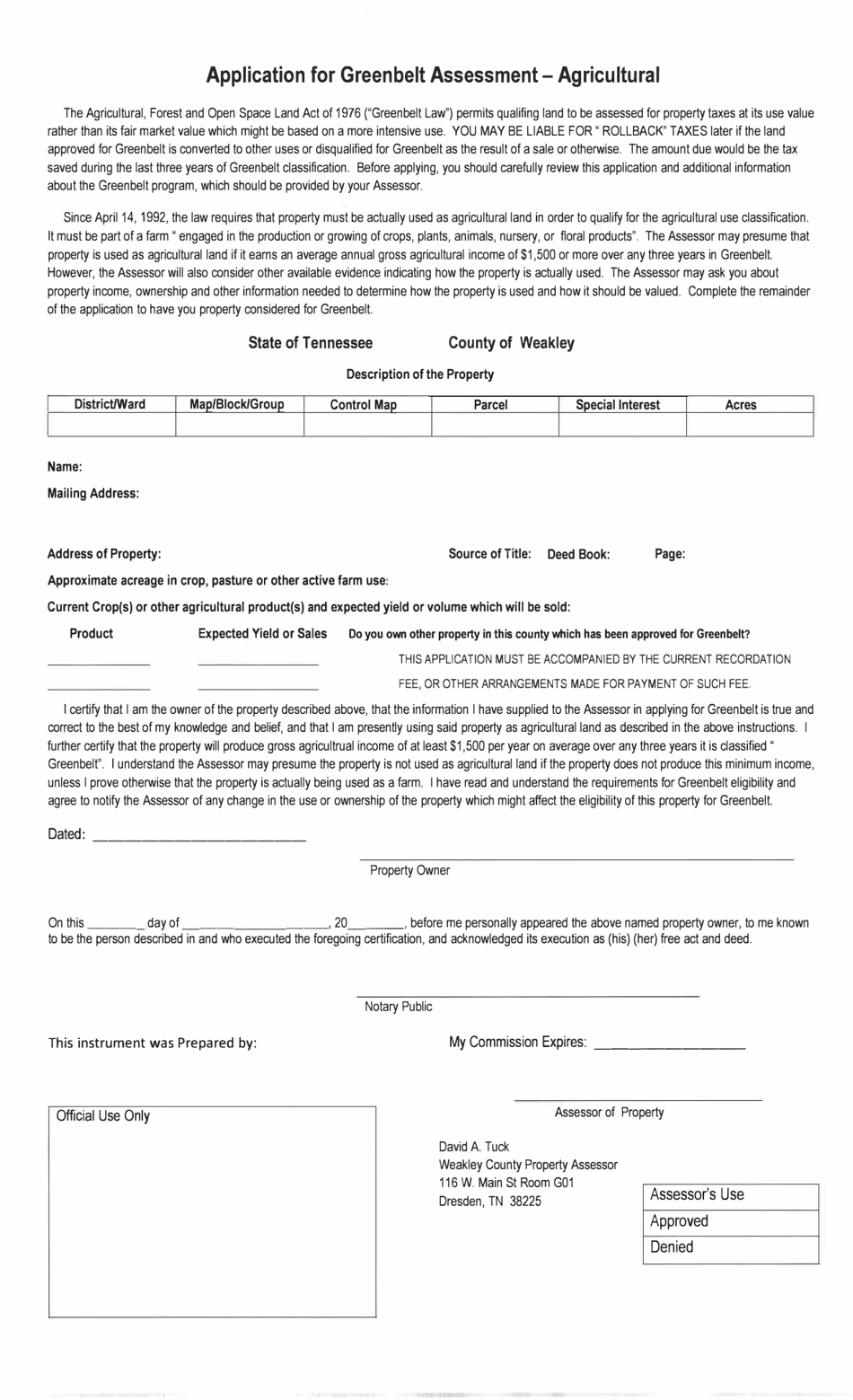

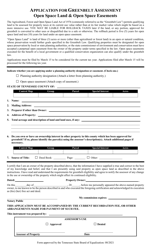

Application for Greenbelt Assessment - Weakley County, Tennessee

Application for Greenbelt Assessment is a legal document that was released by the Tennessee Comptroller of the Treasury - a government authority operating within Tennessee. The form may be used strictly within Weakley County.

FAQ

Q: What is the Greenbelt Assessment?

A: The Greenbelt Assessment is a program in Weakley County, Tennessee that offers property tax relief for agricultural land.

Q: Who is eligible for the Greenbelt Assessment?

A: Property owners who use their land for agricultural purposes are eligible for the Greenbelt Assessment.

Q: What are the benefits of the Greenbelt Assessment?

A: The Greenbelt Assessment allows eligible property owners to receive a reduced assessment value for their agricultural land, resulting in lower property taxes.

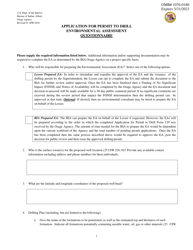

Q: How can I apply for the Greenbelt Assessment?

A: To apply for the Greenbelt Assessment, you need to complete an application form and submit it to the Weakley County Assessor's Office.

Q: When should I apply for the Greenbelt Assessment?

A: It is recommended to apply for the Greenbelt Assessment between January 1st and March 1st of each year.

Q: Are there any requirements to maintain the Greenbelt Assessment status?

A: Yes, property owners must continue to use their land for agricultural purposes to maintain the Greenbelt Assessment status.

Q: What happens if I no longer qualify for the Greenbelt Assessment?

A: If you no longer qualify for the Greenbelt Assessment, you may be required to pay additional property taxes for the reassessed value of your land.

Q: Can the Greenbelt Assessment be transferred to a new owner?

A: Yes, the Greenbelt Assessment can be transferred to a new owner when the property is sold.

Q: Is there a fee for applying for the Greenbelt Assessment?

A: There may be a small fee for processing the application, which varies by county.

Form Details:

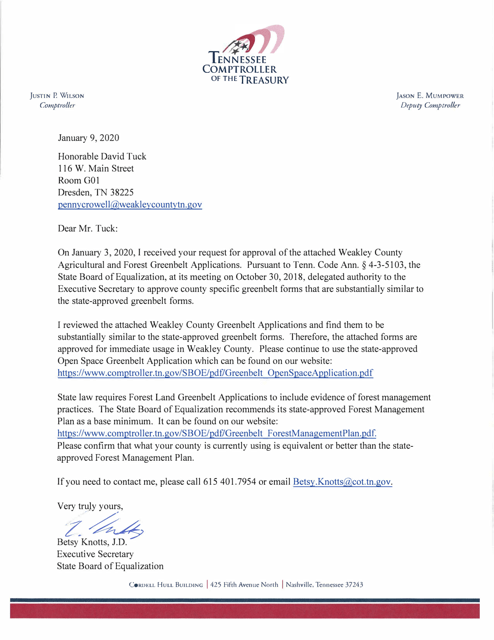

- Released on January 9, 2020;

- The latest edition currently provided by the Tennessee Comptroller of the Treasury;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Tennessee Comptroller of the Treasury.