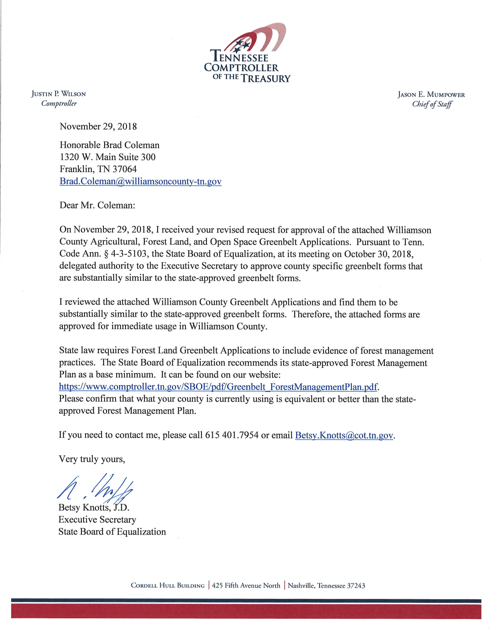

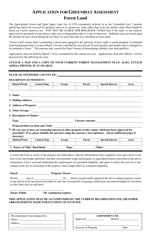

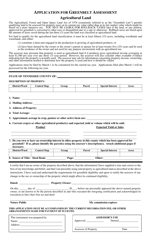

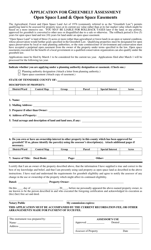

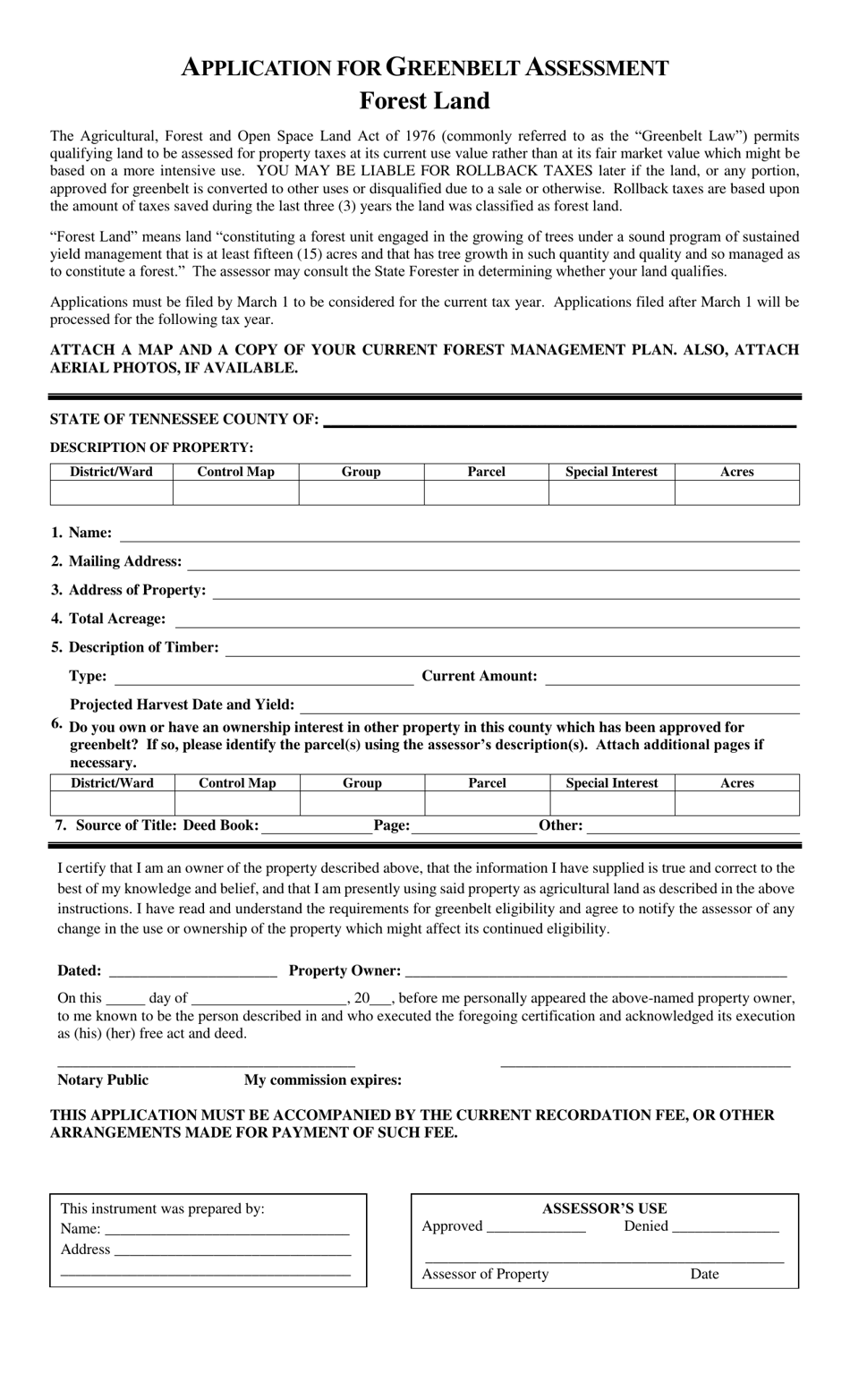

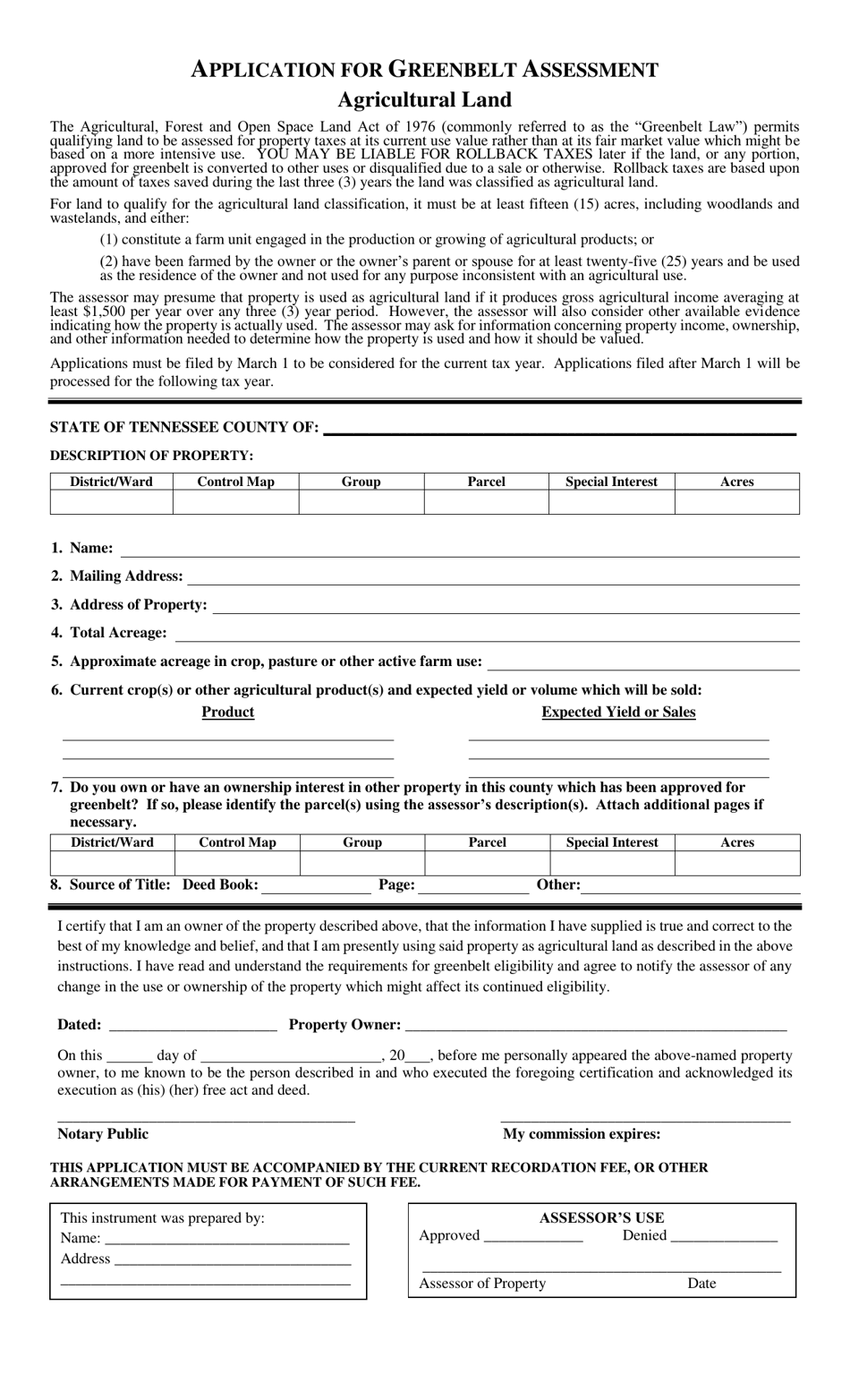

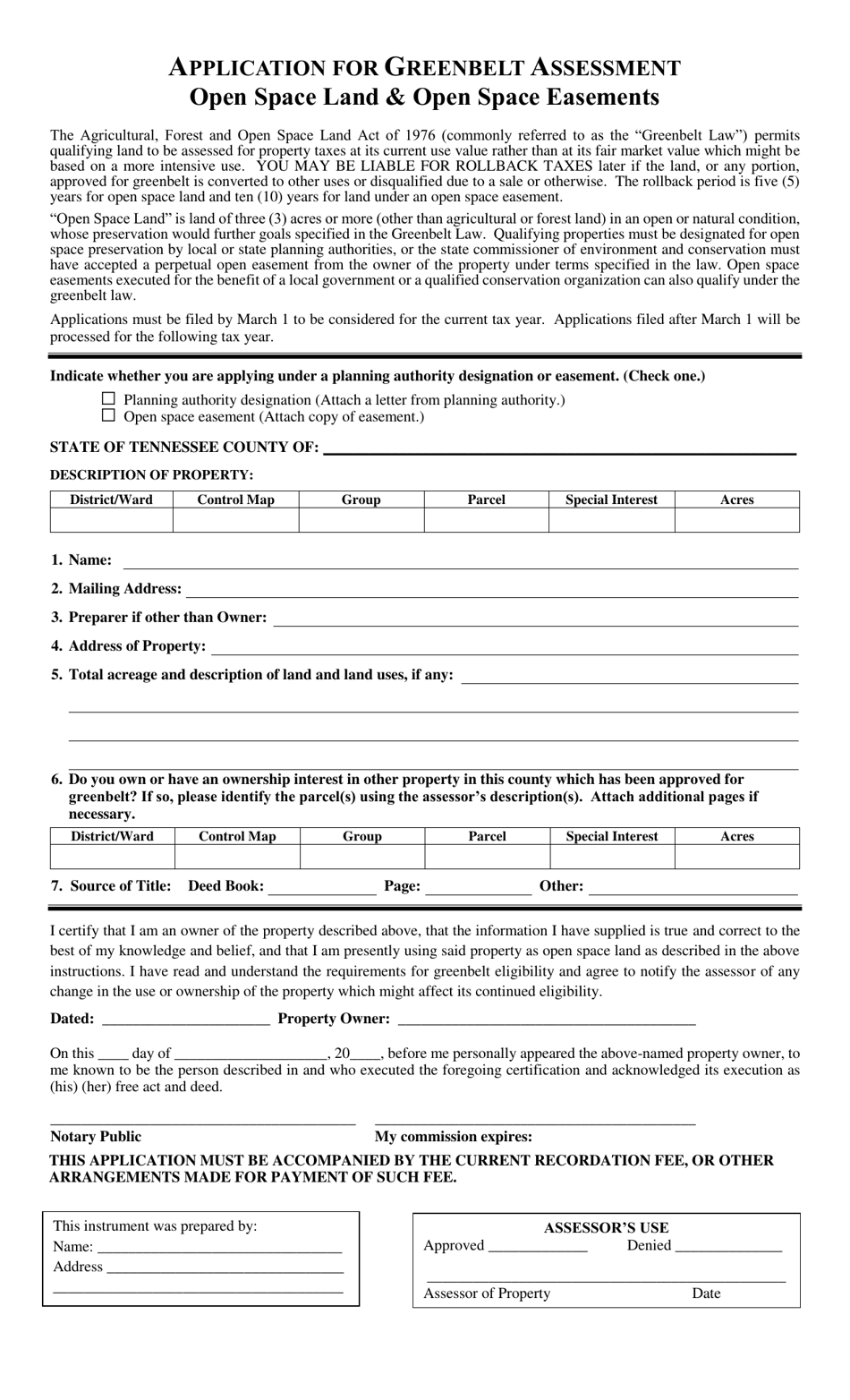

Application for Greenbelt Assessment - Williamson County, Tennessee

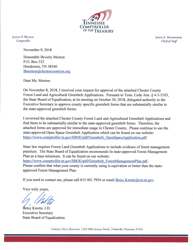

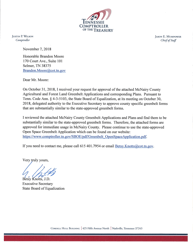

Application for Greenbelt Assessment is a legal document that was released by the Tennessee Comptroller of the Treasury - a government authority operating within Tennessee. The form may be used strictly within Williamson County.

FAQ

Q: What is the application for?

A: The application is for Greenbelt Assessment in Williamson County, Tennessee.

Q: What is Greenbelt Assessment?

A: Greenbelt Assessment is a program that allows agricultural and forest land to be assessed for property taxes at its current use value, rather than its potential development value.

Q: Who can apply for Greenbelt Assessment?

A: Owners of agricultural or forest land in Williamson County, Tennessee can apply for Greenbelt Assessment.

Q: What are the benefits of Greenbelt Assessment?

A: The benefits of Greenbelt Assessment include reduced property taxes for agricultural and forest land, and the preservation of open space and rural character in the county.

Q: How can I apply for Greenbelt Assessment?

A: You can apply for Greenbelt Assessment by submitting the application form and required documents to the Williamson County Trustee's Office.

Q: What documents are required for the application?

A: The documents required for the application include proof of ownership, a copy of the current tax bill, and a land use plan.

Q: Is there an application fee?

A: Yes, there is an application fee for Greenbelt Assessment in Williamson County, Tennessee.

Q: How often do I need to renew Greenbelt Assessment?

A: Greenbelt Assessment needs to be renewed every six years in Williamson County, Tennessee.

Form Details:

- Released on November 29, 2018;

- The latest edition currently provided by the Tennessee Comptroller of the Treasury;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Tennessee Comptroller of the Treasury.