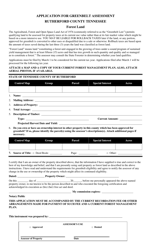

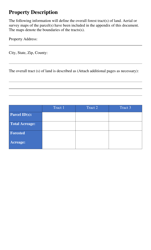

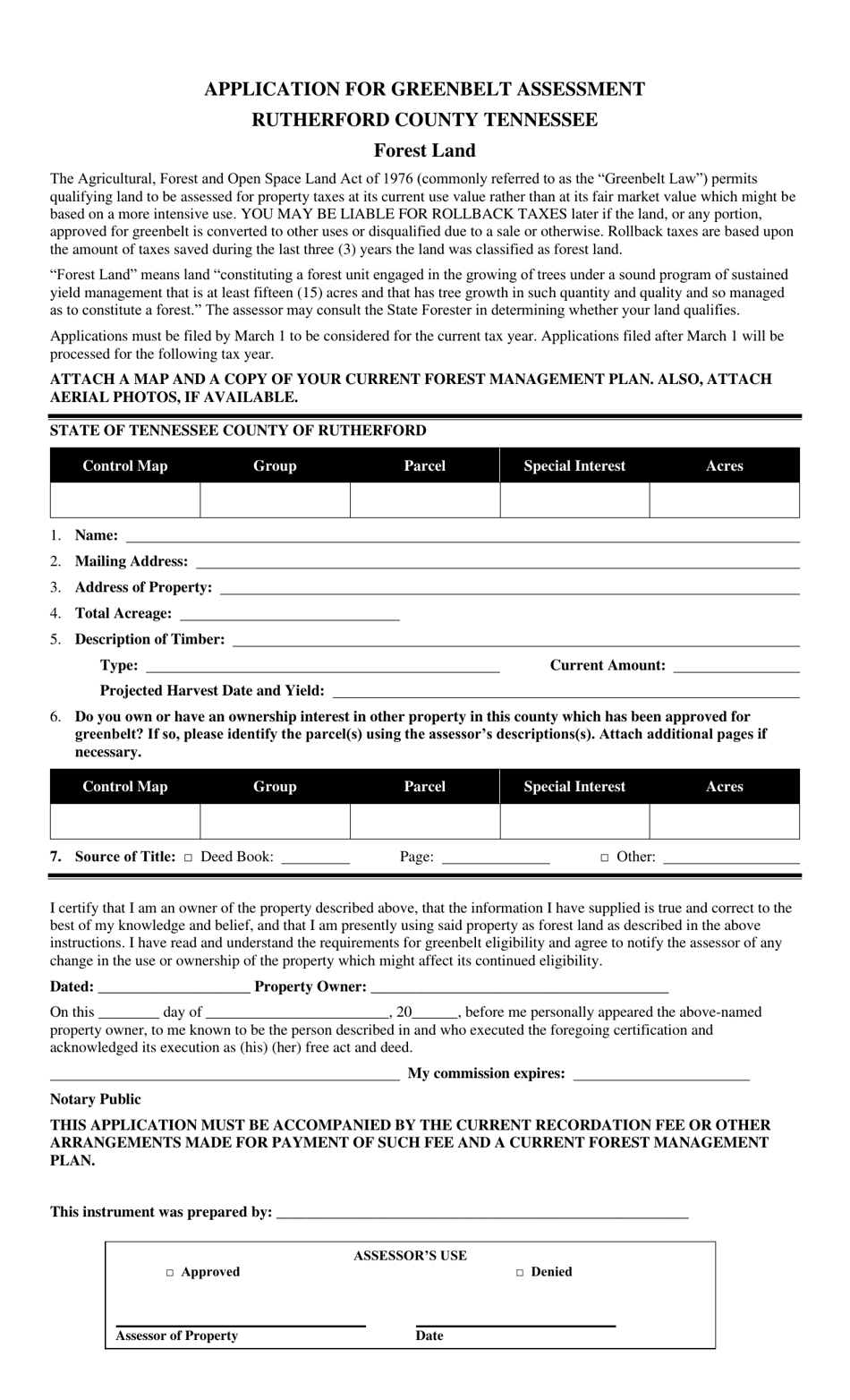

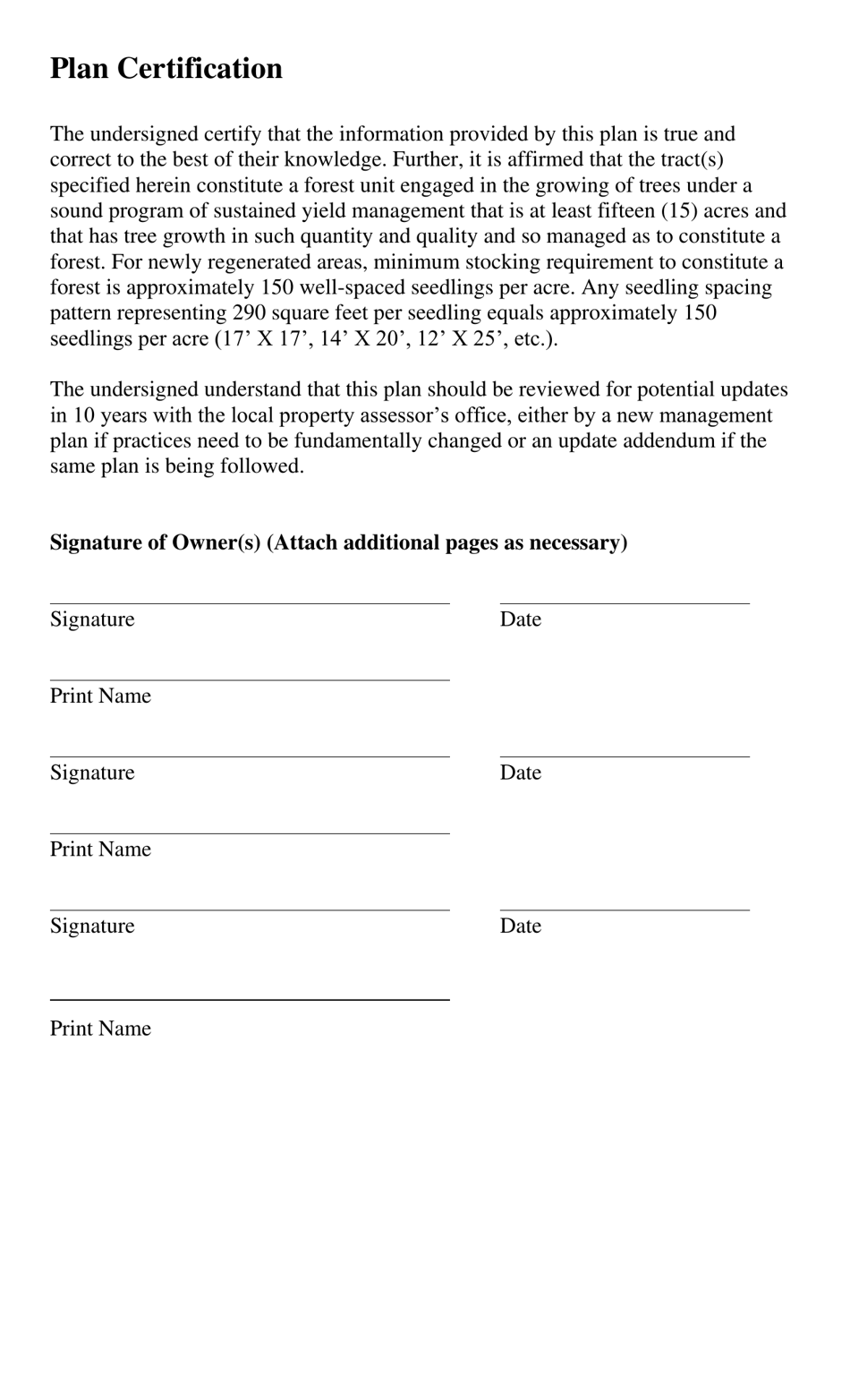

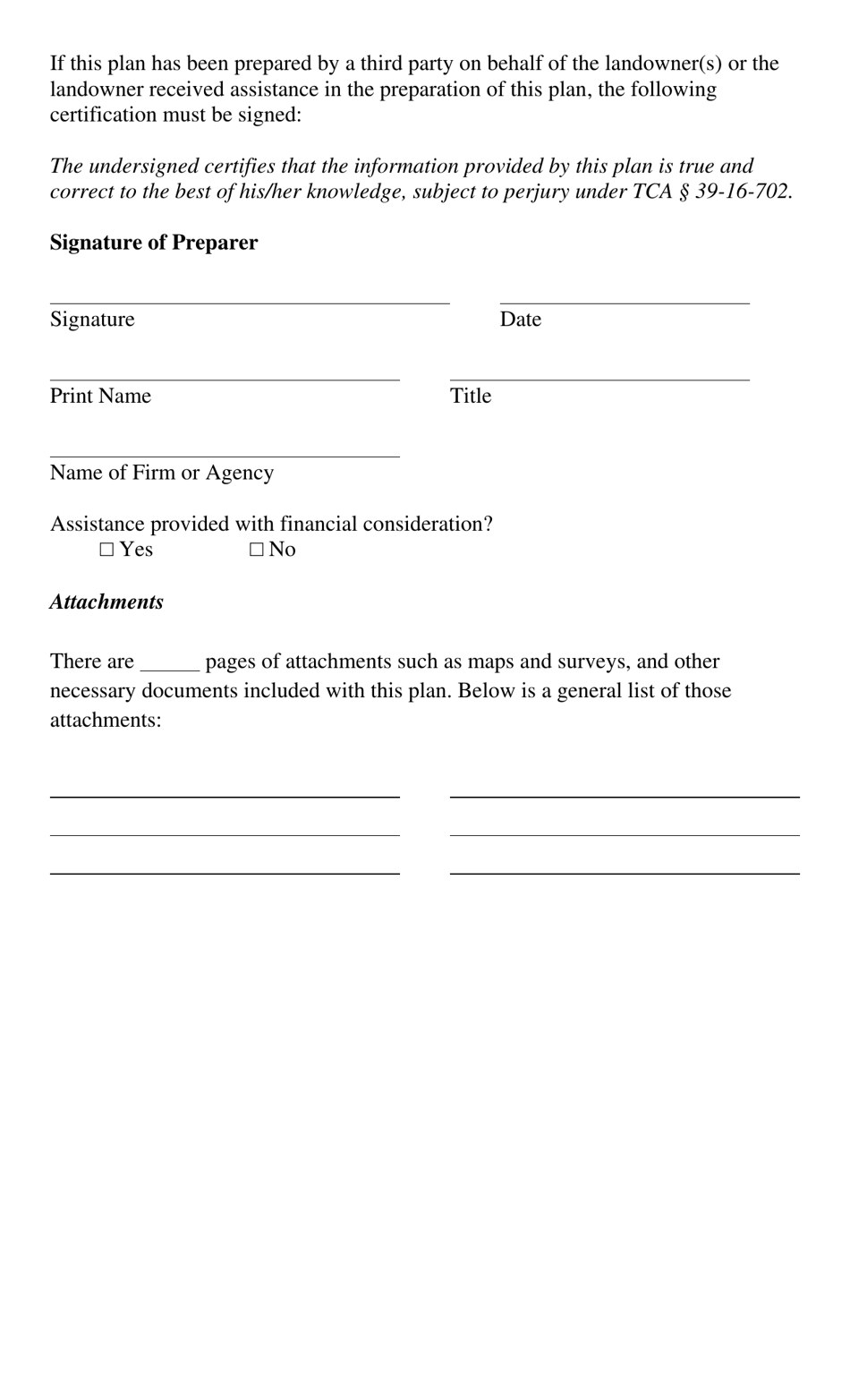

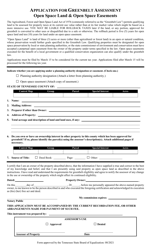

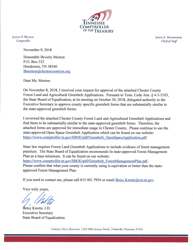

Application for Greenbelt Assessment - Rutherford County, Tennessee

Application for Greenbelt Assessment is a legal document that was released by the Tennessee Comptroller of the Treasury - a government authority operating within Tennessee. The form may be used strictly within Rutherford County.

FAQ

Q: What is the Greenbelt Assessment?

A: The Greenbelt Assessment is a program in Rutherford County, Tennessee that provides a property tax benefit for agricultural, forest, and open space land.

Q: Who is eligible for the Greenbelt Assessment?

A: Any landowner in Rutherford County with at least 15 acres of qualifying land used for agricultural, forest, or open space purposes may be eligible for the Greenbelt Assessment.

Q: How does the Greenbelt Assessment benefit landowners?

A: The Greenbelt Assessment reduces the property taxes for qualifying land, which can help to lower the overall tax burden for landowners.

Q: What types of land qualify for the Greenbelt Assessment?

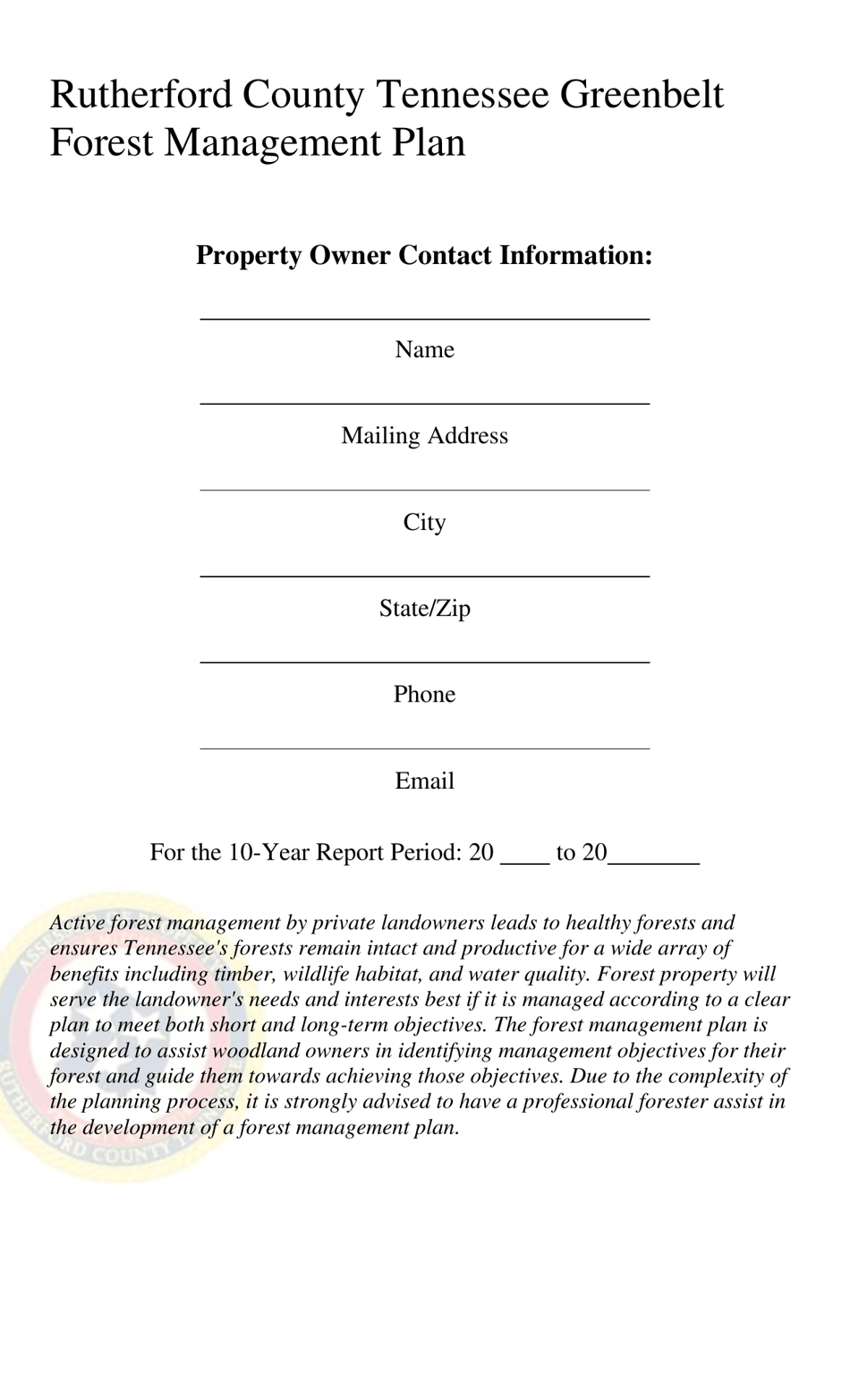

A: Land used for agricultural production, timber production, or as open space for public enjoyment may qualify for the Greenbelt Assessment.

Q: How can I apply for the Greenbelt Assessment?

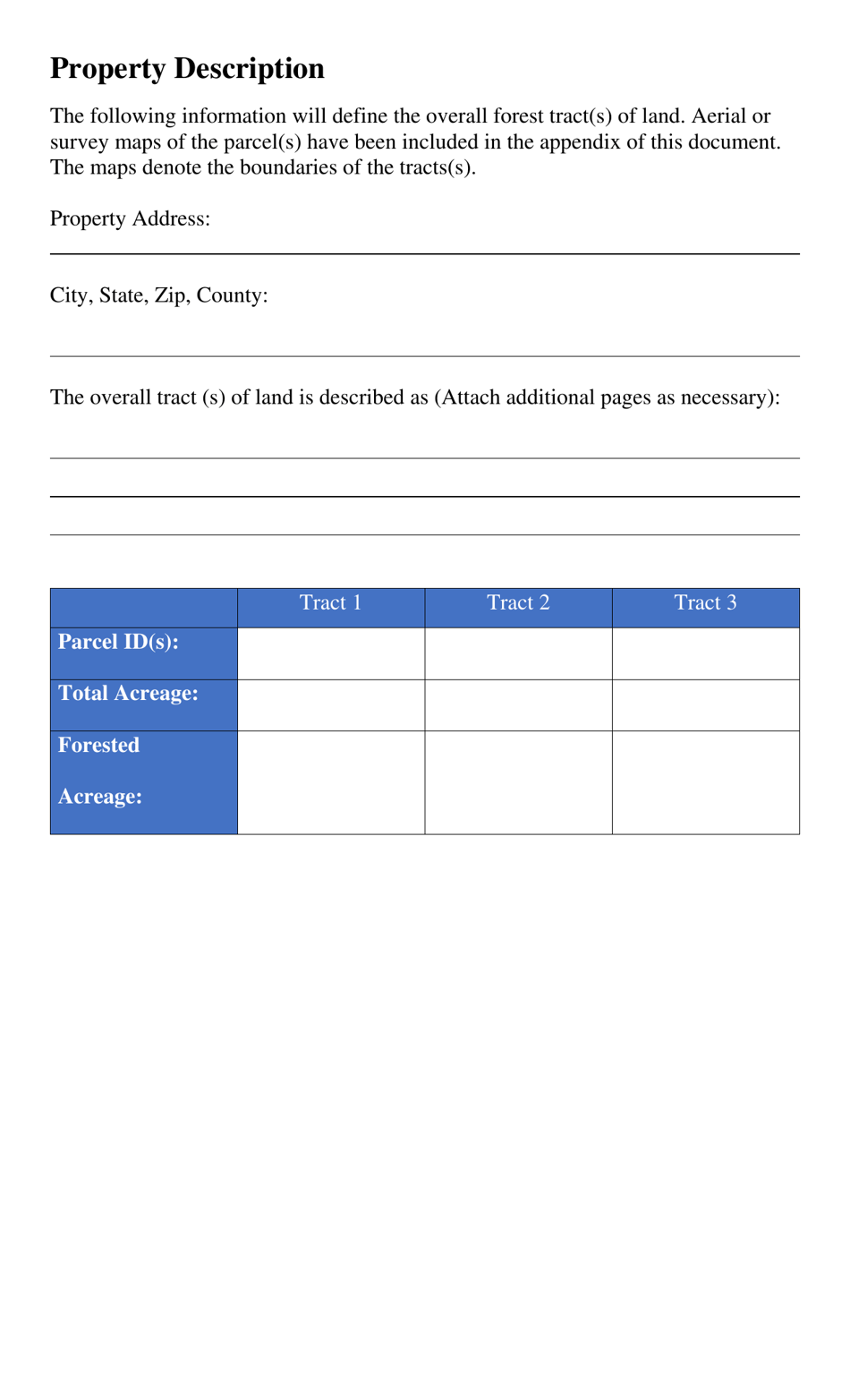

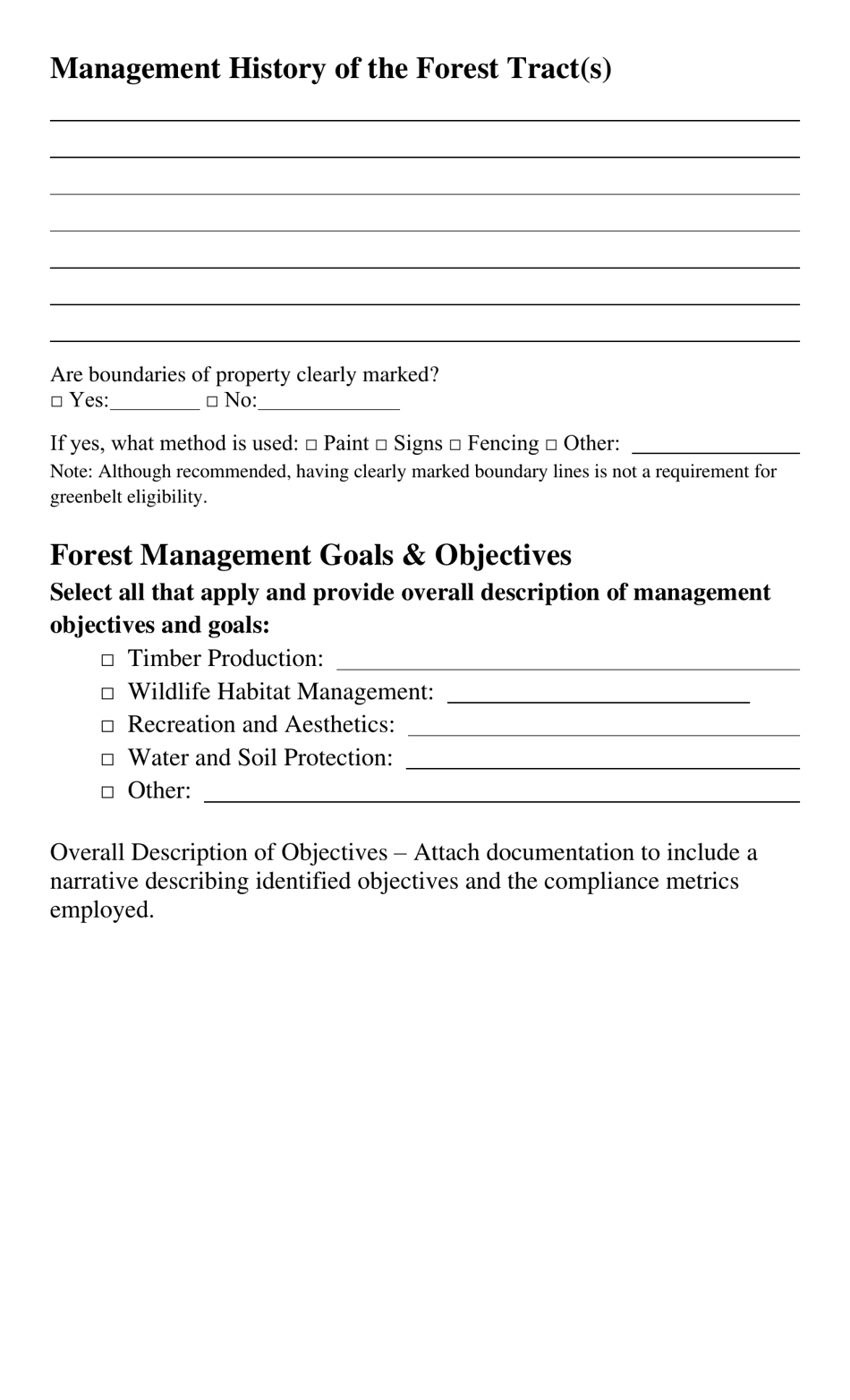

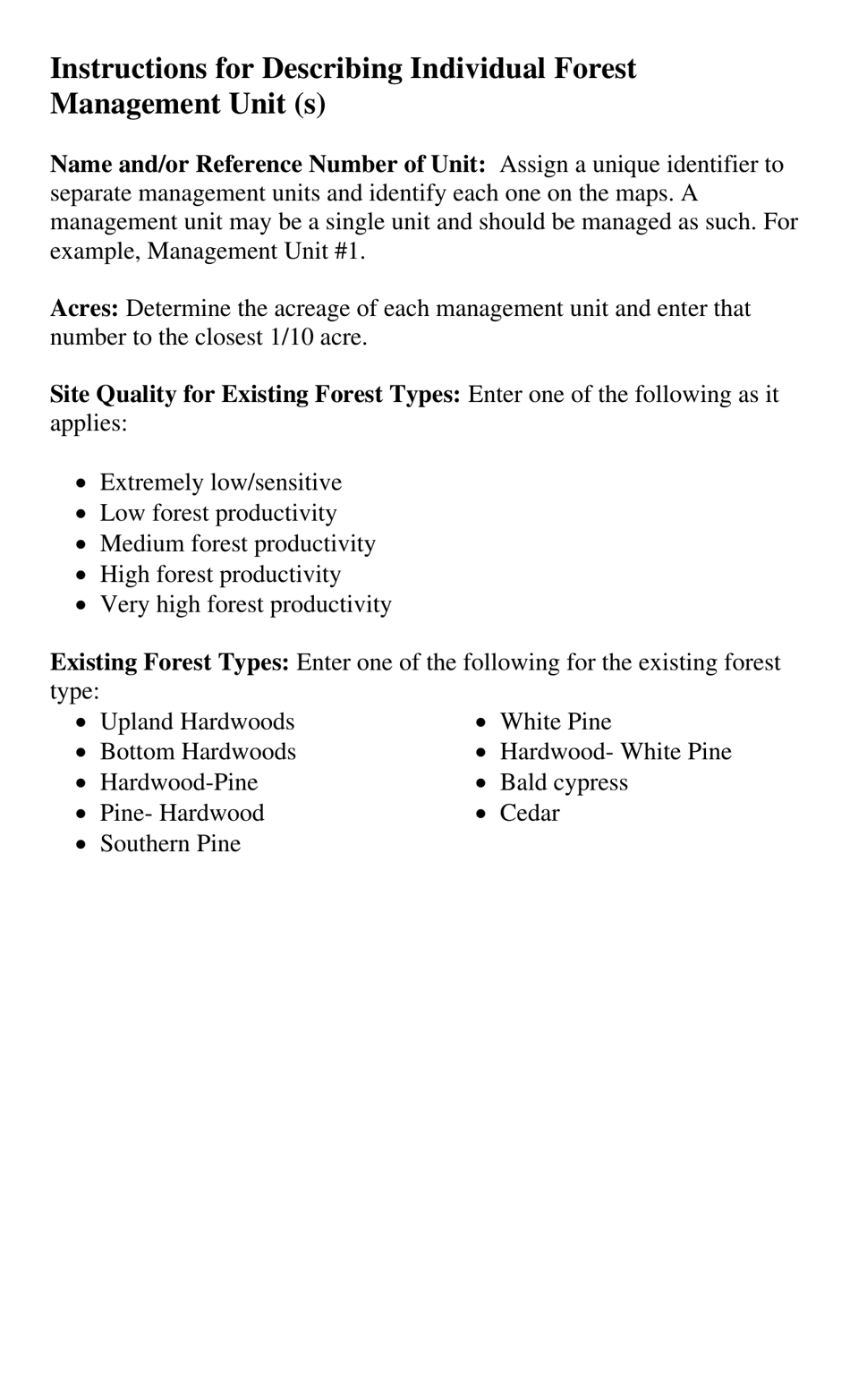

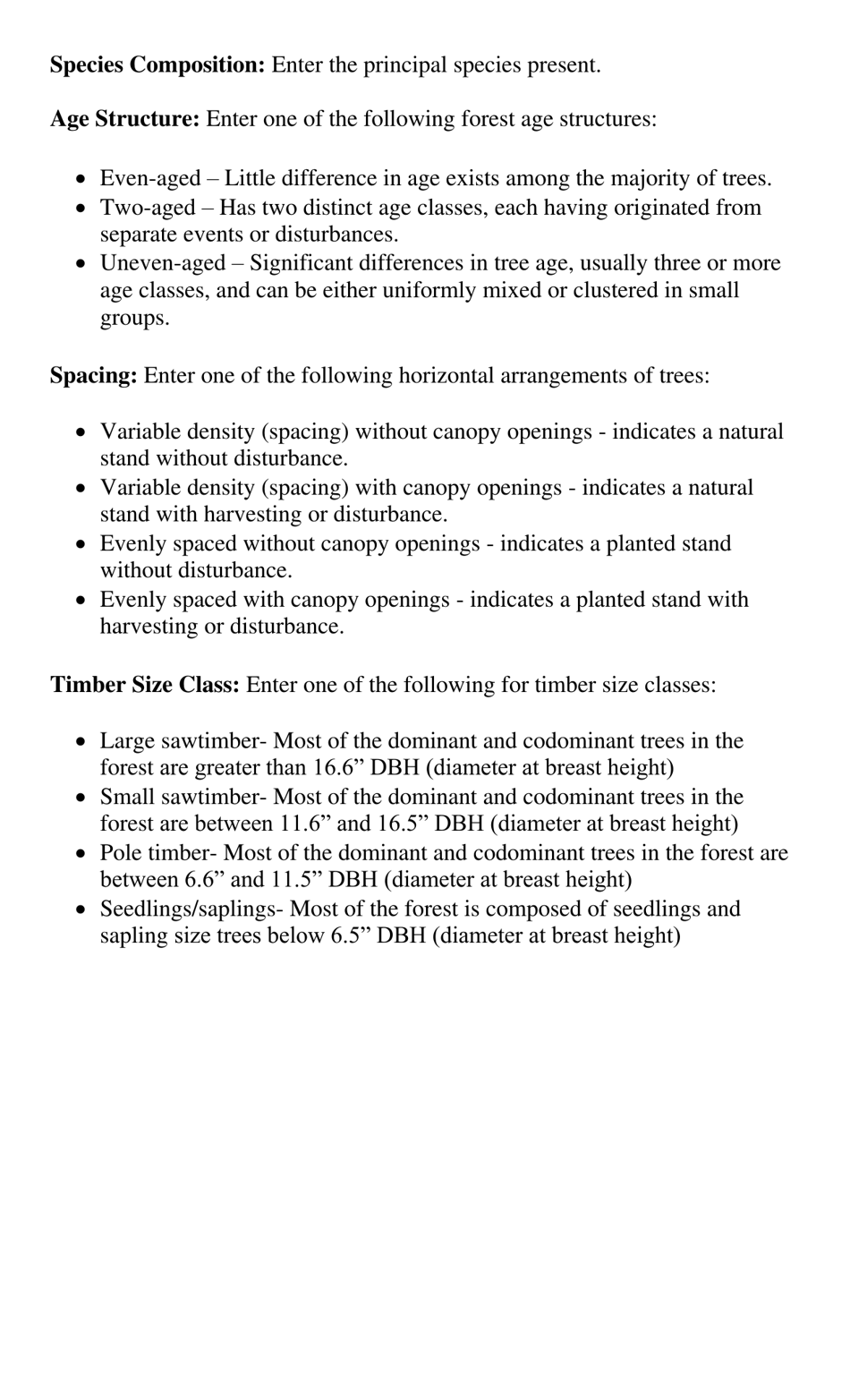

A: To apply for the Greenbelt Assessment, you must complete an application form, provide supporting documentation, and submit it to the appropriate county office.

Q: What is the deadline for applying for the Greenbelt Assessment?

A: The deadline to apply for the Greenbelt Assessment in Rutherford County, Tennessee is typically March 1st of each year.

Q: Can I transfer the Greenbelt Assessment to a new owner if I sell the land?

A: Yes, the Greenbelt Assessment can be transferred to a new owner if the property is sold, as long as the new owner meets the eligibility requirements.

Q: What happens if I no longer qualify for the Greenbelt Assessment?

A: If you no longer meet the eligibility requirements for the Greenbelt Assessment, you may be subject to additional taxes and penalties.

Q: Are there any restrictions on the use of land under the Greenbelt Assessment?

A: Yes, landowners must continue to use the land for qualifying purposes and may be subject to periodic inspections to ensure compliance with program requirements.

Form Details:

- Released on January 28, 2021;

- The latest edition currently provided by the Tennessee Comptroller of the Treasury;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Tennessee Comptroller of the Treasury.