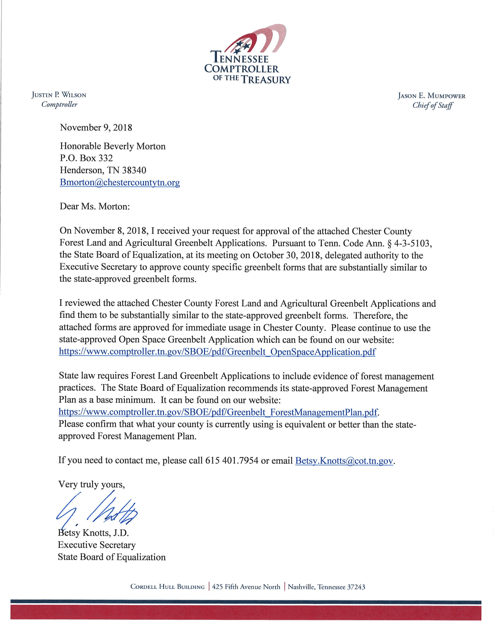

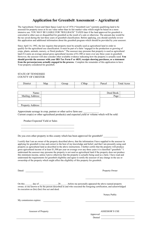

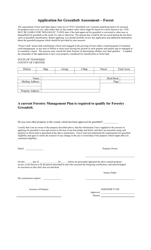

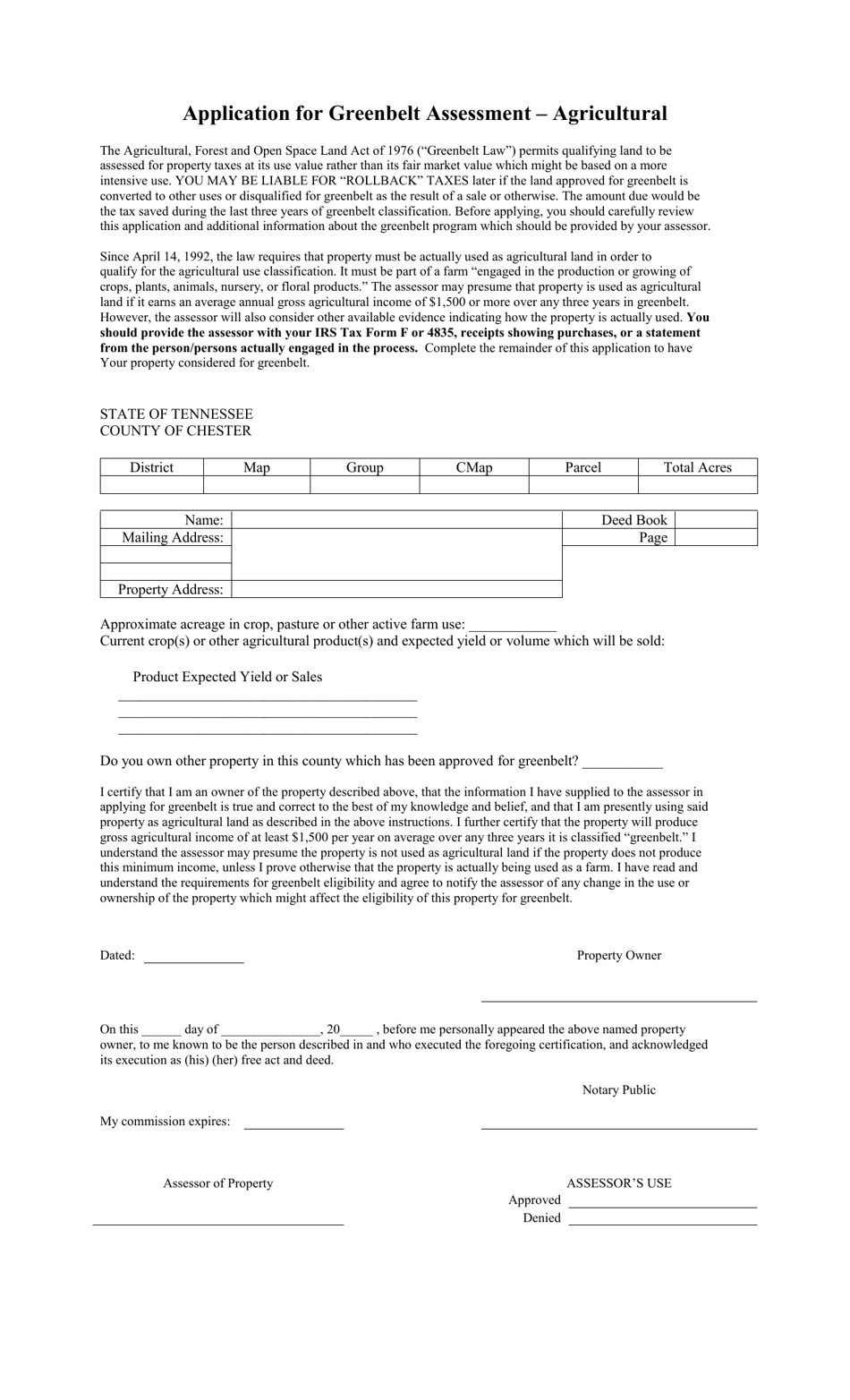

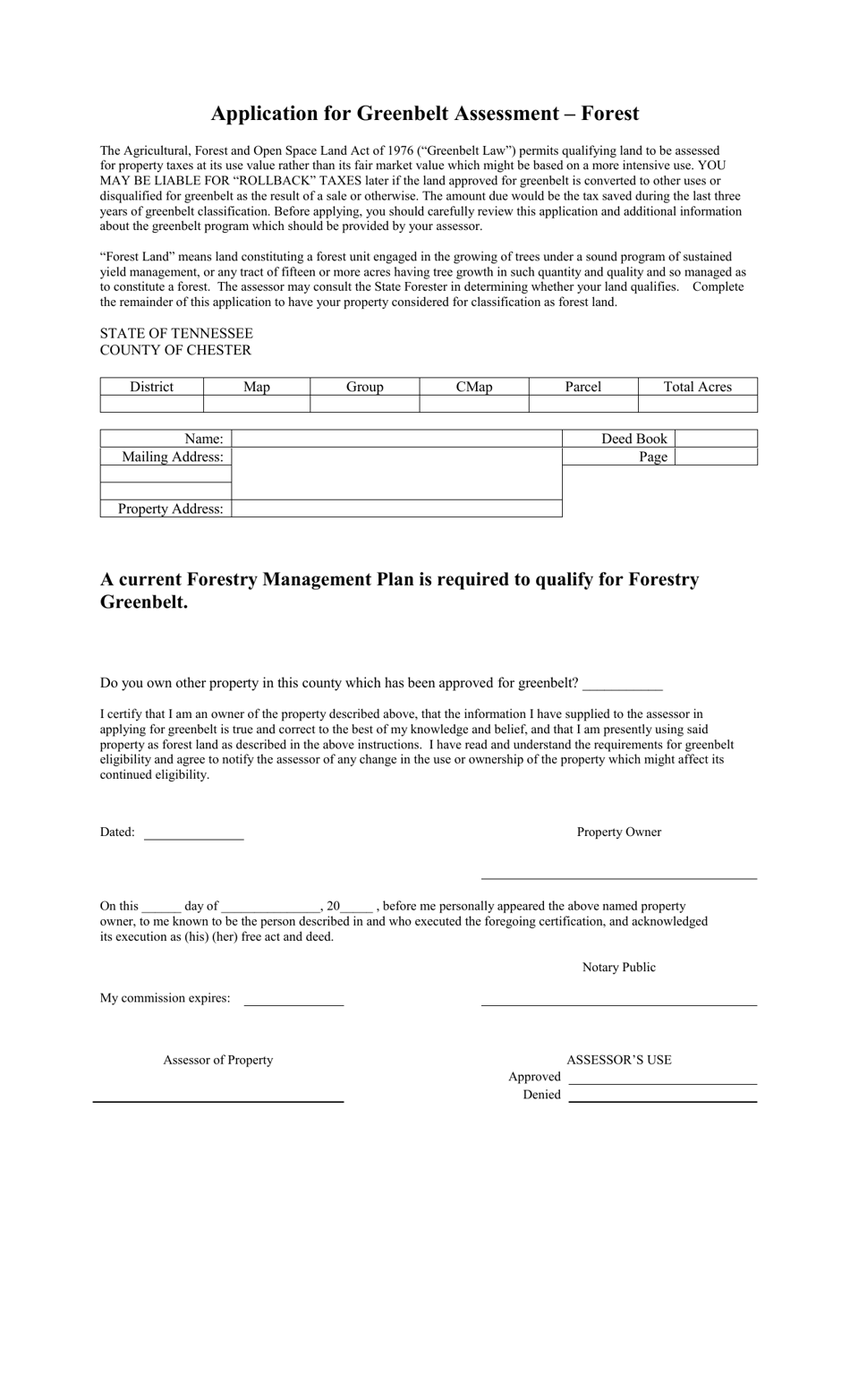

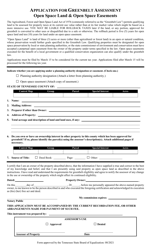

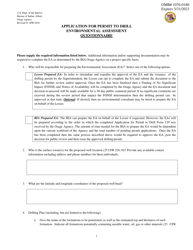

Application for Greenbelt Assessment - Chester County, Tennessee

Application for Greenbelt Assessment is a legal document that was released by the Tennessee Comptroller of the Treasury - a government authority operating within Tennessee. The form may be used strictly within Chester County.

FAQ

Q: What is a Greenbelt Assessment?

A: A Greenbelt Assessment is a program that provides property tax relief to agricultural and forest landowners.

Q: Who is eligible for a Greenbelt Assessment in Chester County, Tennessee?

A: Landowners who are engaged in agricultural or forest activities are eligible for a Greenbelt Assessment.

Q: How do I apply for a Greenbelt Assessment in Chester County, Tennessee?

A: You can apply for a Greenbelt Assessment by completing an application form and submitting it to the Chester County Assessor of Property.

Q: What are the benefits of a Greenbelt Assessment?

A: The benefits of a Greenbelt Assessment include lower property taxes and the preservation of agricultural and forest land.

Q: Are there any requirements to maintain a Greenbelt Assessment in Chester County, Tennessee?

A: Yes, there are requirements to maintain a Greenbelt Assessment, such as actively engaging in agricultural or forest activities and meeting certain income thresholds.

Q: Can I appeal the denial of a Greenbelt Assessment application?

A: Yes, you can appeal the denial of a Greenbelt Assessment application by filing an appeal with the Chester County Board of Equalization.

Form Details:

- Released on November 9, 2018;

- The latest edition currently provided by the Tennessee Comptroller of the Treasury;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Tennessee Comptroller of the Treasury.