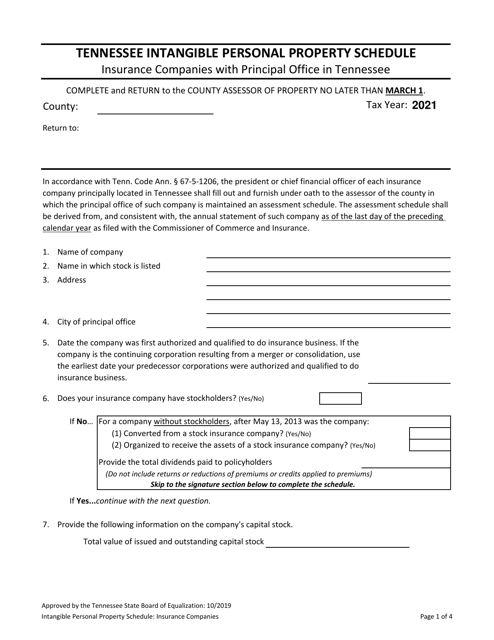

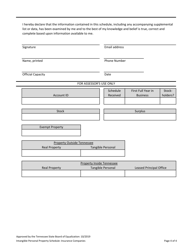

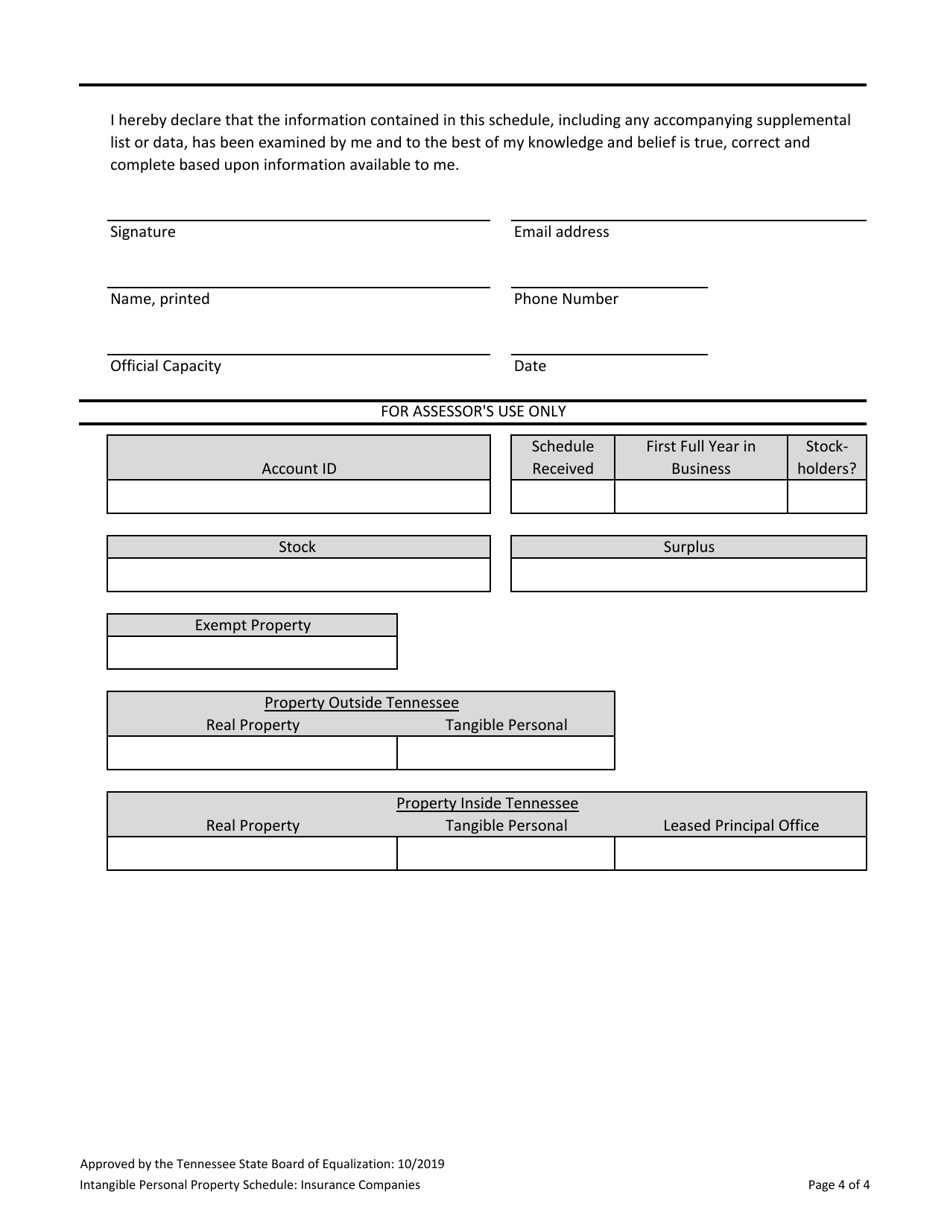

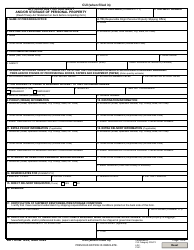

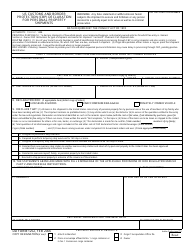

Tennessee Intangible Personal Property Schedule - Tennessee

Tennessee Intangible Personal Property Schedule is a legal document that was released by the Tennessee Comptroller of the Treasury - a government authority operating within Tennessee.

FAQ

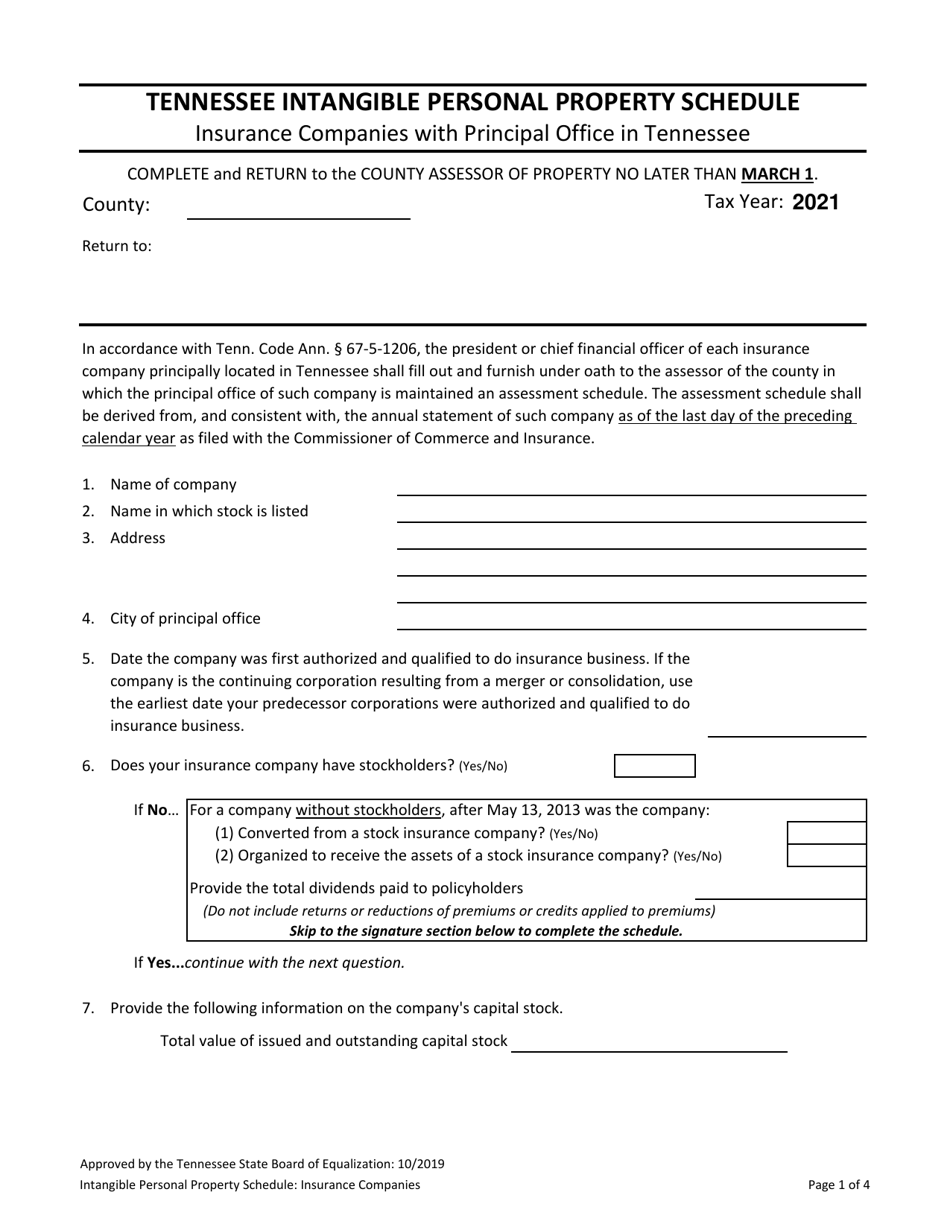

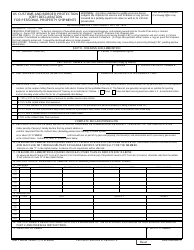

Q: What is the Tennessee Intangible Personal Property Schedule?

A: The Tennessee Intangible Personal Property Schedule is a form that individuals must complete to report and pay taxes on certain types of intangible personal property.

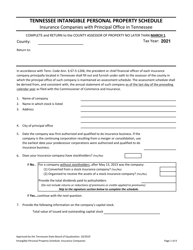

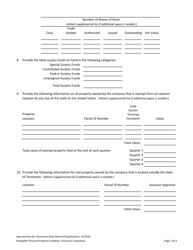

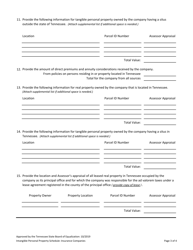

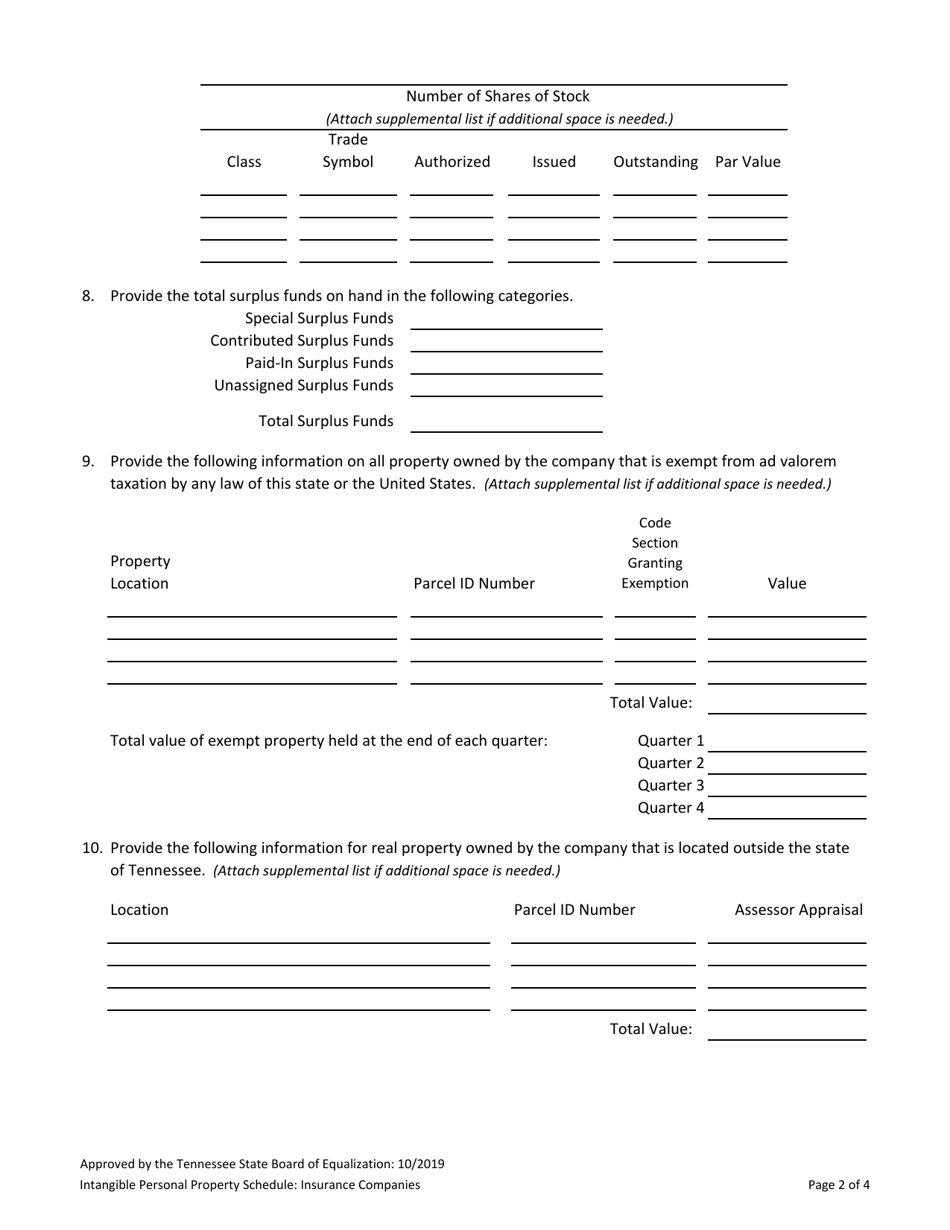

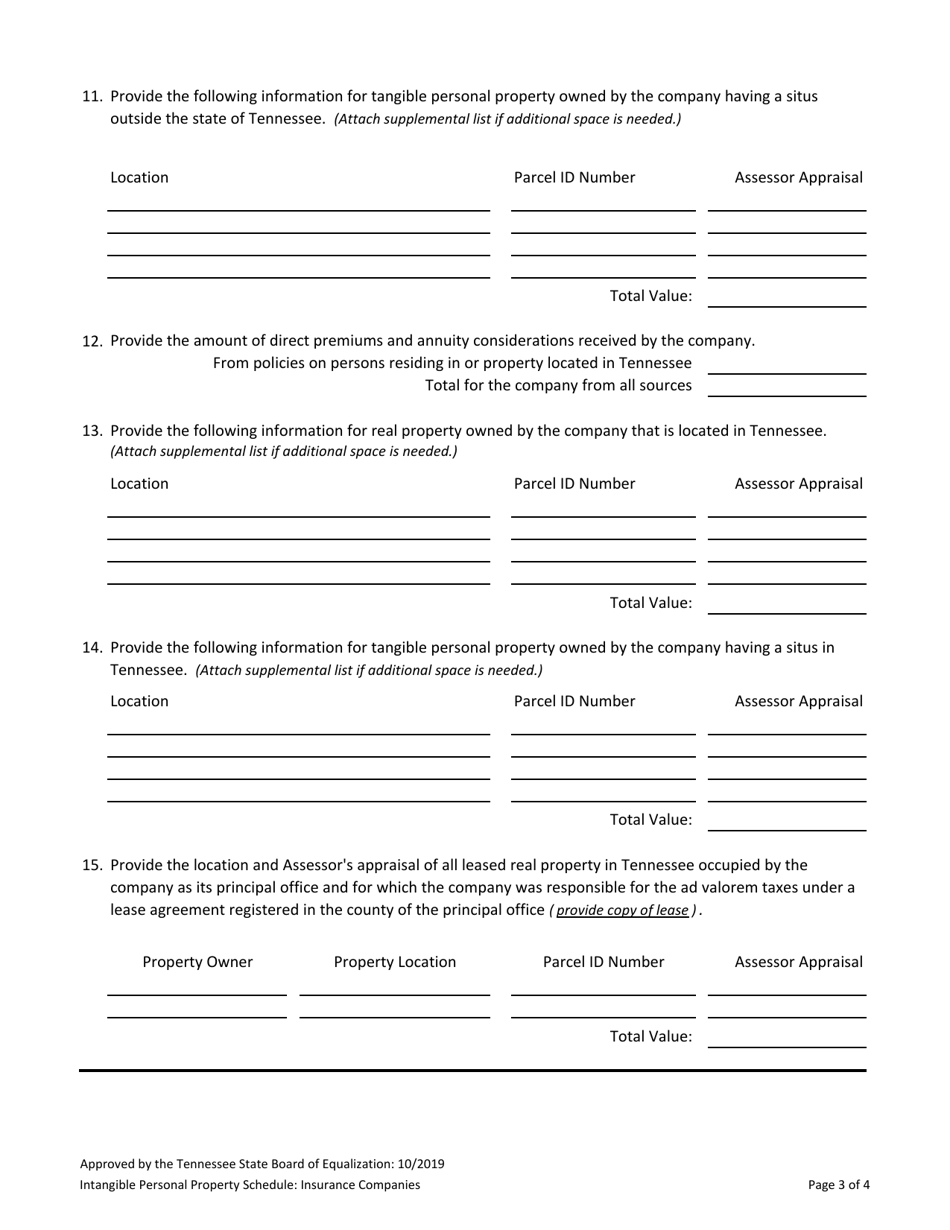

Q: What is considered intangible personal property in Tennessee?

A: Intangible personal property in Tennessee includes assets such as stocks, bonds, mutual funds, and other financial instruments.

Q: Who is required to file the Tennessee Intangible Personal Property Schedule?

A: Individuals who have qualifying intangible personal property with a value exceeding the exemption threshold are required to file the Tennessee Intangible Personal Property Schedule.

Q: What is the exemption threshold for the Tennessee Intangible Personal Property Schedule?

A: The exemption threshold for the Tennessee Intangible Personal Property Schedule is $1,000.

Q: When is the deadline for filing the Tennessee Intangible Personal Property Schedule?

A: The deadline for filing the Tennessee Intangible Personal Property Schedule is April 15th of each year.

Q: What are the penalties for failing to file the Tennessee Intangible Personal Property Schedule?

A: Penalties for failing to file the Tennessee Intangible Personal Property Schedule include a 5% penalty on the tax due for each month the form is late, up to a maximum of 25%.

Q: Is there any way to claim an exemption from the Tennessee Intangible Personal Property tax?

A: Yes, individuals who meet certain criteria may be eligible for an exemption from the Tennessee Intangible Personal Property tax. It is recommended to consult with a tax professional for more information on exemptions and eligibility.

Form Details:

- Released on October 1, 2019;

- The latest edition currently provided by the Tennessee Comptroller of the Treasury;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Tennessee Comptroller of the Treasury.