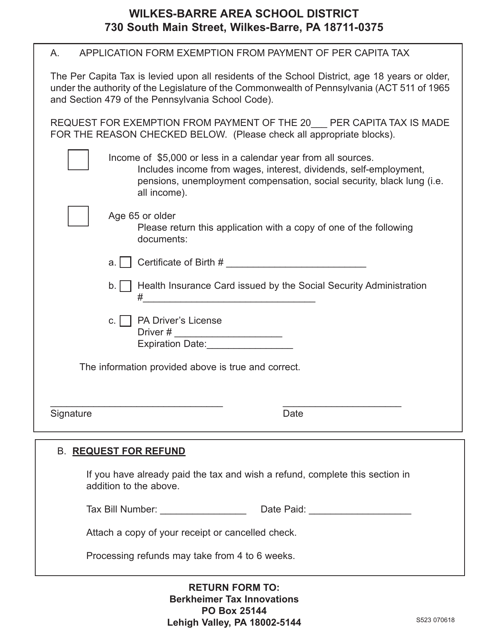

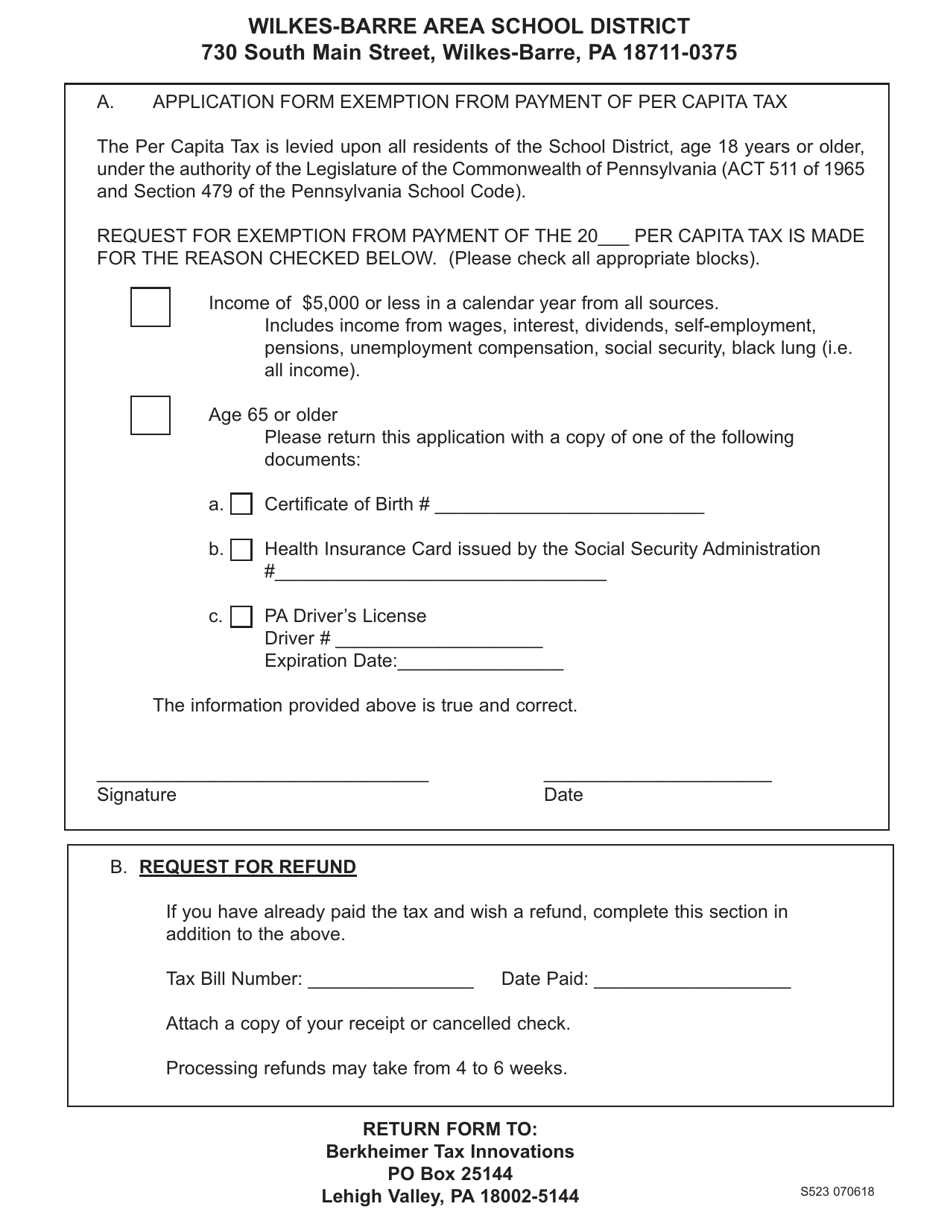

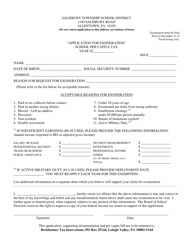

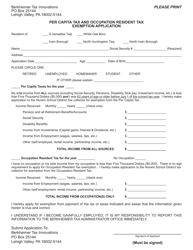

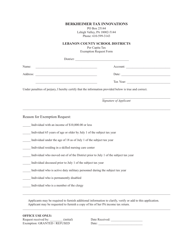

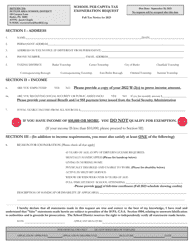

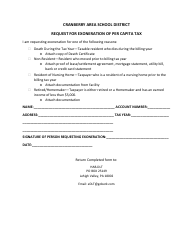

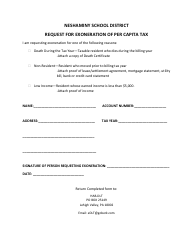

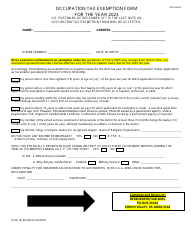

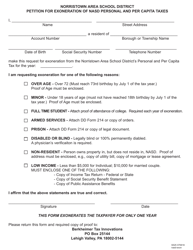

Form S523 Application Form Exemption From Payment of Per Capita Tax - Wilkes-Barre Area School District - Pennsylvania

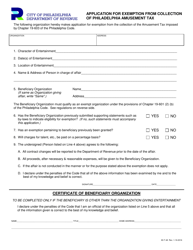

What Is Form S523?

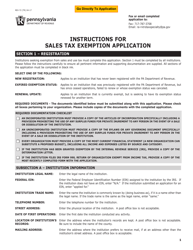

This is a legal form that was released by the Berkheimer Tax Administrator - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S523?

A: Form S523 is an application form for exemption from payment of per capita tax.

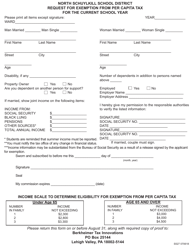

Q: Who is the form specifically for?

A: The form is for residents in the Wilkes-Barre Area School District in Pennsylvania.

Q: What is the purpose of the form?

A: The purpose of the form is to request exemption from paying per capita tax.

Q: What does 'per capita tax' refer to?

A: 'Per capita tax' refers to a tax imposed on individuals on a per-person basis.

Q: Why would someone seek exemption from per capita tax?

A: Individuals may seek exemption if they meet certain criteria, such as low income or disability.

Q: Are there any deadlines for submitting the form?

A: It is advisable to check with the Wilkes-Barre Area School District for any deadline information.

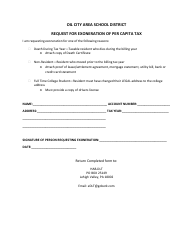

Q: Is there any fee for applying for exemption?

A: There is typically no fee for applying for exemption from per capita tax.

Q: Can I apply for exemption if I don't reside in the specified school district?

A: No, the form is specifically for residents of the Wilkes-Barre Area School District in Pennsylvania.

Q: What other forms of tax exemptions are available?

A: There may be other tax exemptions available at the local, state, and federal levels. It is advisable to consult with a tax professional or relevant authorities for more information.

Form Details:

- Released on July 6, 2018;

- The latest edition provided by the Berkheimer Tax Administrator;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form S523 by clicking the link below or browse more documents and templates provided by the Berkheimer Tax Administrator.