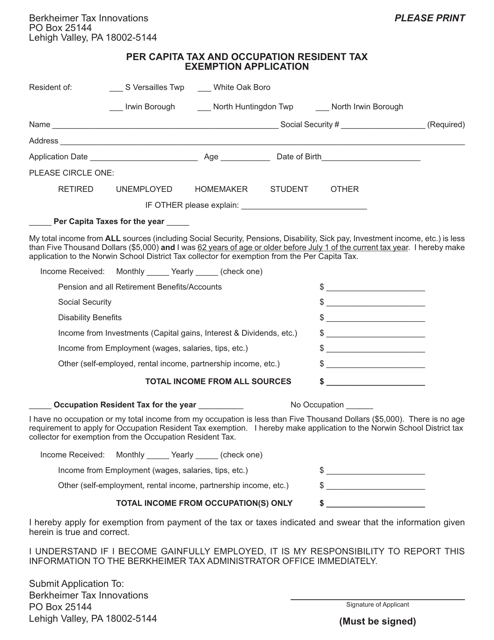

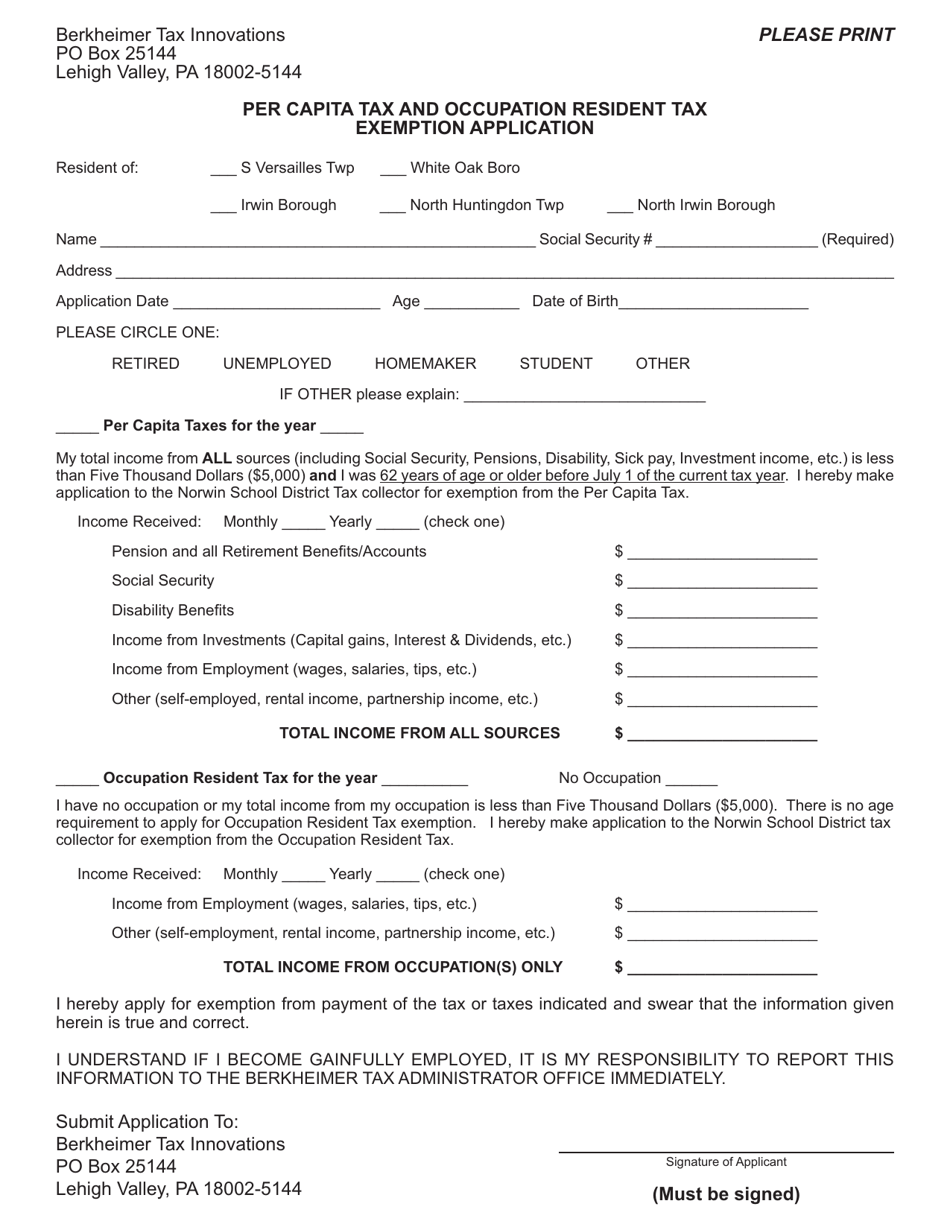

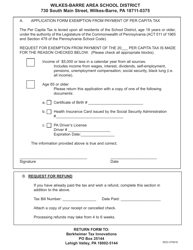

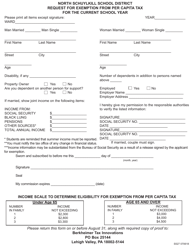

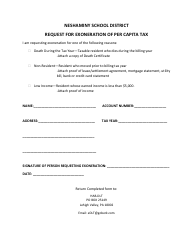

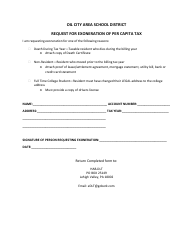

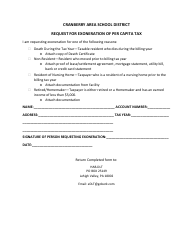

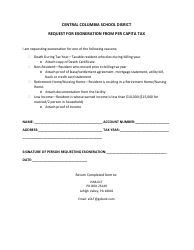

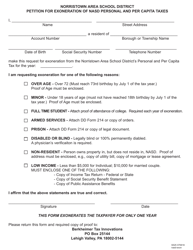

Per Capita Tax and Occupation Resident Tax Exemption Application - Norwin School District - Pennsylvania

Per Capita Tax and Occupation Resident Tax Exemption Application - Norwin School District is a legal document that was released by the Berkheimer Tax Administrator - a government authority operating within Pennsylvania.

FAQ

Q: What is the Per Capita Tax?

A: The Per Capita Tax is a tax imposed on each individual residing in the Norwin School District in Pennsylvania.

Q: Who is required to pay the Per Capita Tax?

A: Every individual living in the Norwin School District is required to pay the Per Capita Tax.

Q: How much is the Per Capita Tax?

A: The amount of the Per Capita Tax may vary and is set by the Norwin School District each year. You can contact the district for the current rate.

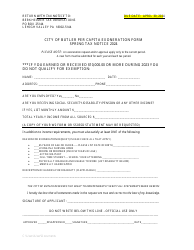

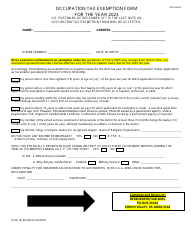

Q: What is the Occupation Resident Tax Exemption Application?

A: The Occupation Resident Tax Exemption Application is a form that residents can fill out to claim an exemption from paying the Per Capita Tax based on certain qualifications.

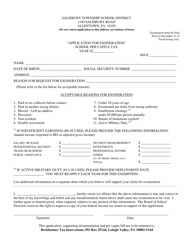

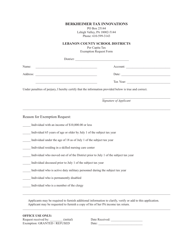

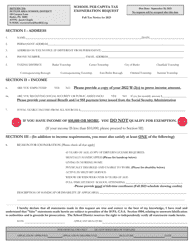

Q: Who can apply for the Occupation Resident Tax Exemption?

A: Residents who meet certain qualifications, such as being age 18 or older, being permanently disabled, or receiving certain public assistance benefits, can apply for the Occupation Resident Tax Exemption.

Q: How do I complete the Occupation Resident Tax Exemption Application?

A: The Occupation Resident Tax Exemption Application requires you to provide personal information, including your name, address, and qualifications for exemption. You must also sign and date the form.

Q: When is the deadline to submit the Occupation Resident Tax Exemption Application?

A: The deadline for submitting the Occupation Resident Tax Exemption Application is usually listed on the form. It is recommended to submit the form before the due date to ensure timely processing.

Q: What happens after I submit the Occupation Resident Tax Exemption Application?

A: After submitting the Occupation Resident Tax Exemption Application, the Norwin School District will review your application and notify you of the status of your exemption.

Q: What should I do if my Occupation Resident Tax Exemption Application is denied?

A: If your Occupation Resident Tax Exemption Application is denied, you may contact the Norwin School District for further information or clarification on the reason for denial.

Form Details:

- The latest edition currently provided by the Berkheimer Tax Administrator;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Berkheimer Tax Administrator.