This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

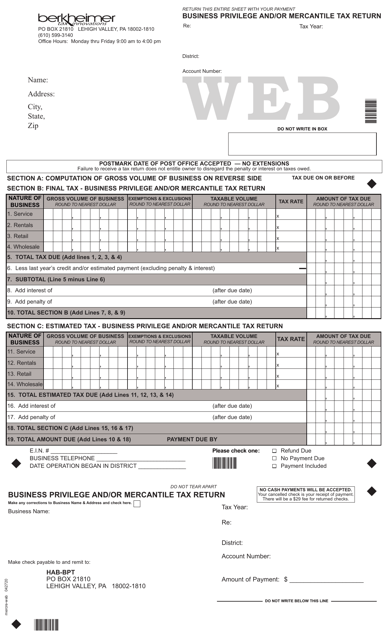

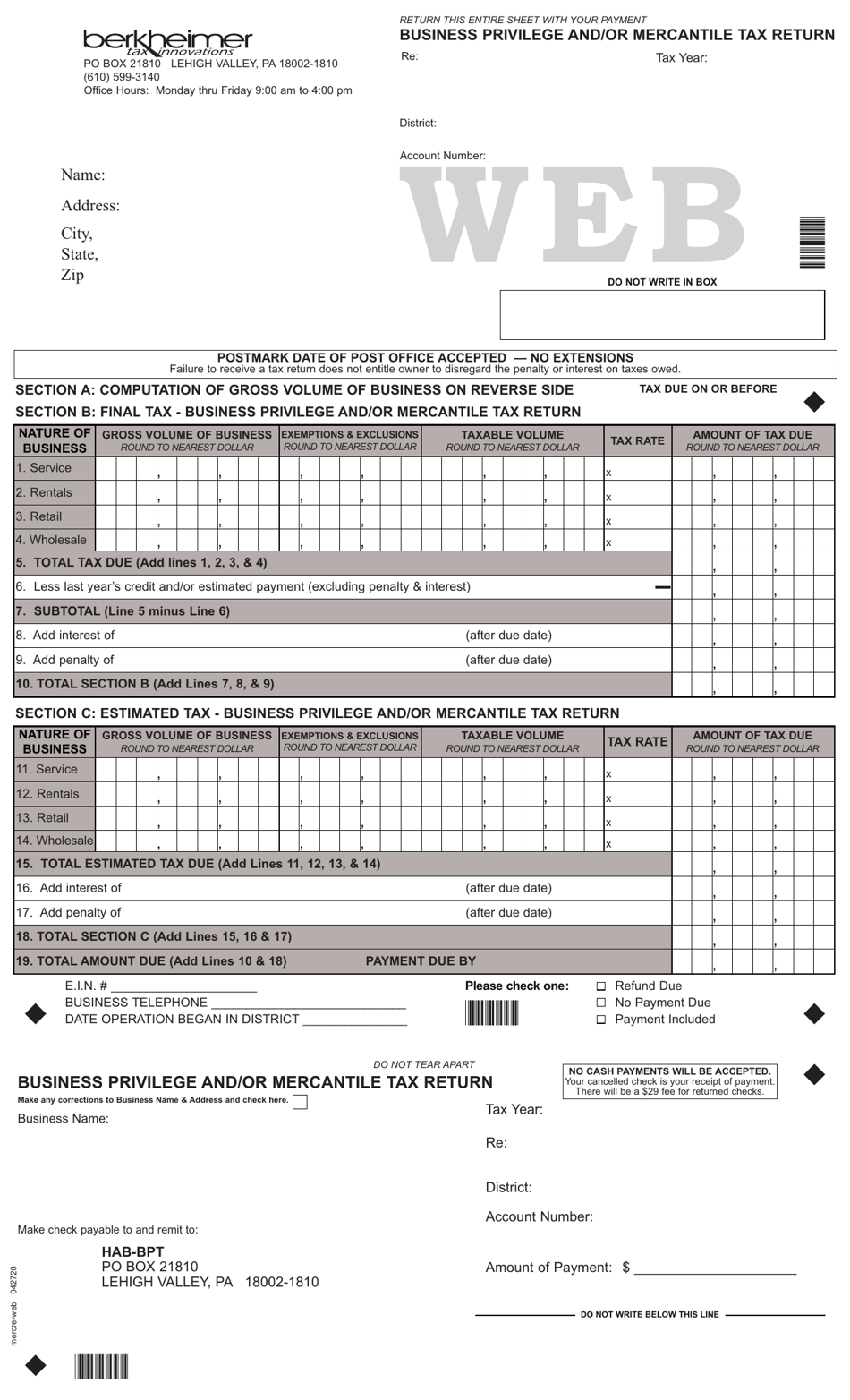

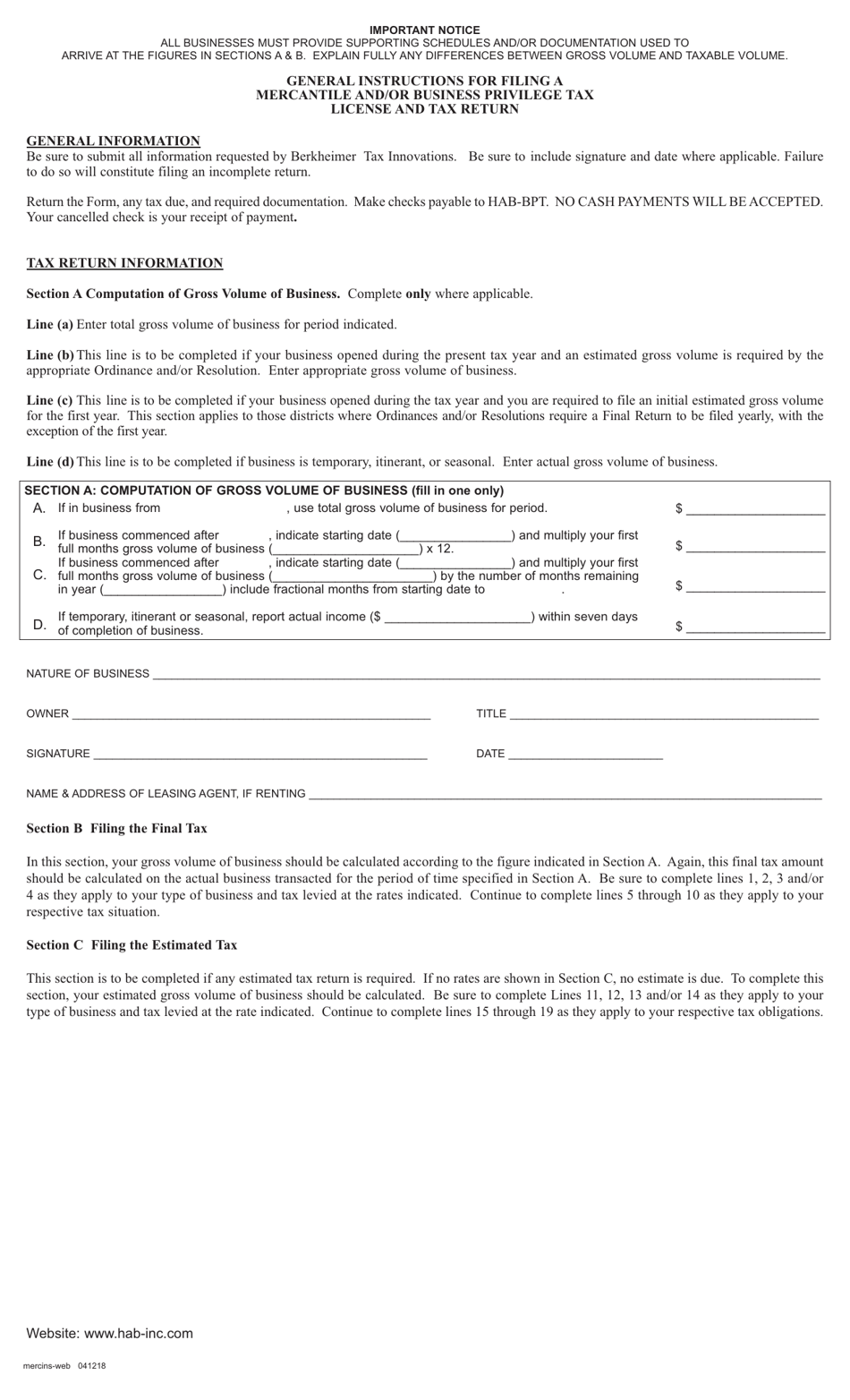

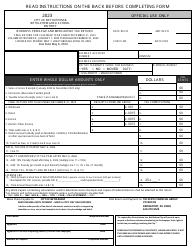

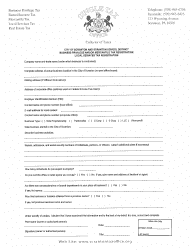

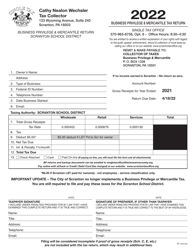

Business Privilege and / or Mercantile Tax Return - Pennsylvania

Business Privilege and/or Mercantile Tax Return is a legal document that was released by the Berkheimer Tax Administrator - a government authority operating within Pennsylvania.

FAQ

Q: What is a Business Privilege and/or Mercantile Tax Return?

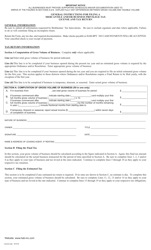

A: The Business Privilege and/or Mercantile Tax Return is a tax form that certain businesses in Pennsylvania are required to file in order to report their business activities and calculate the associated taxes.

Q: Who needs to file a Business Privilege and/or Mercantile Tax Return?

A: Most businesses that operate in Pennsylvania and have taxable gross receipts or gross purchases are required to file a Business Privilege and/or Mercantile Tax Return.

Q: How often do I need to file the Business Privilege and/or Mercantile Tax Return?

A: The filing frequency depends on the classification of your business. Most businesses are required to file on an annual basis, but some may have different filing periods such as quarterly or semi-annually.

Q: What taxes are associated with the Business Privilege and/or Mercantile Tax Return?

A: The Business Privilege Tax and the Mercantile and Business Privilege Tax are the main taxes associated with this return. The rates and calculations differ based on the classification of your business and the location of your operation.

Form Details:

- Released on April 27, 2020;

- The latest edition currently provided by the Berkheimer Tax Administrator;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Berkheimer Tax Administrator.