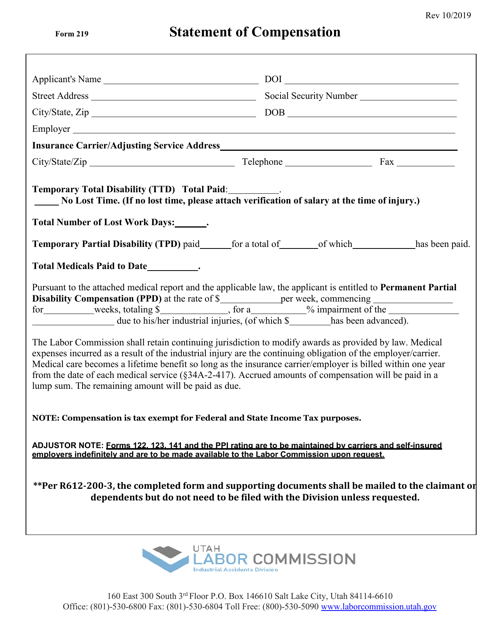

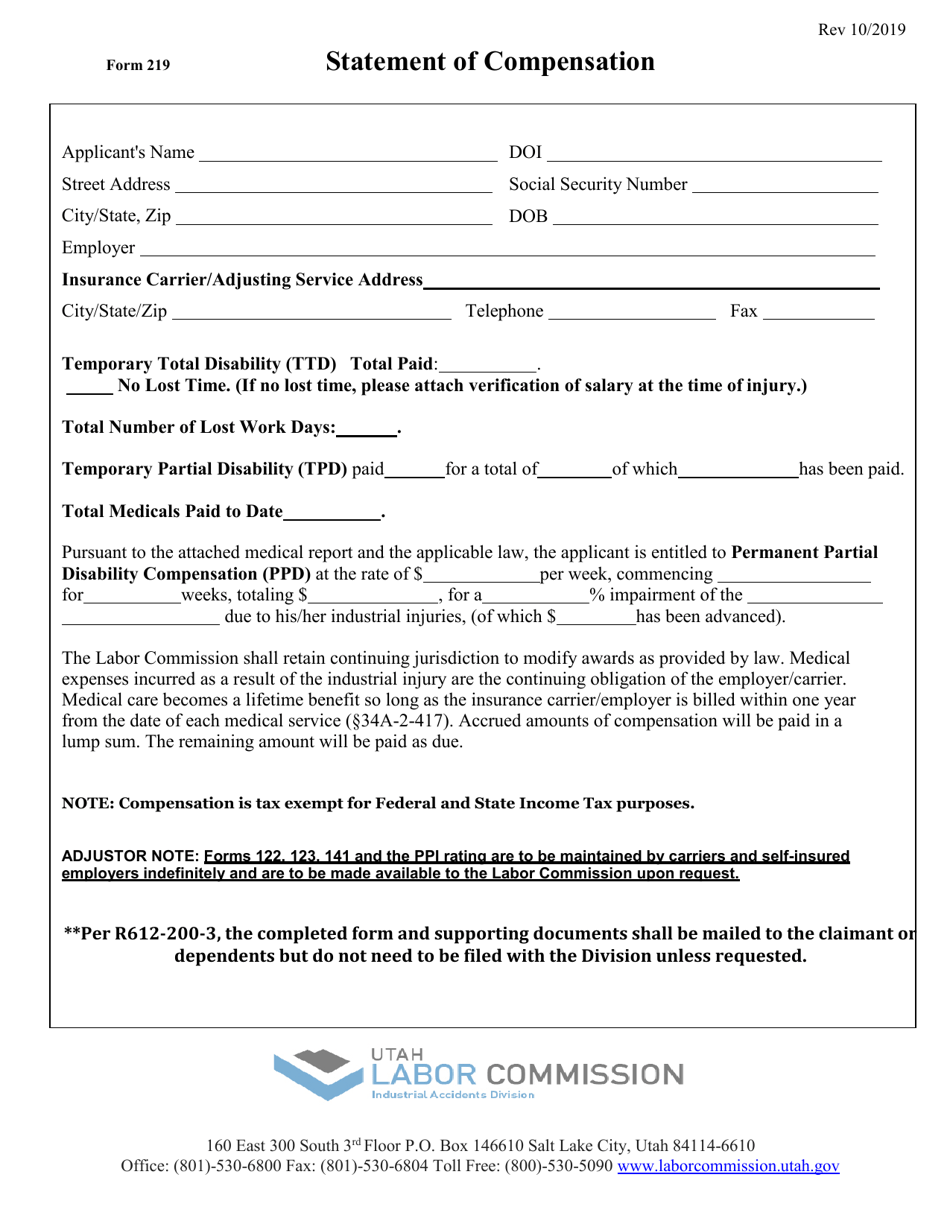

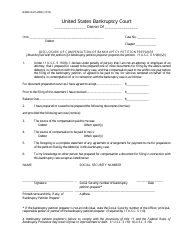

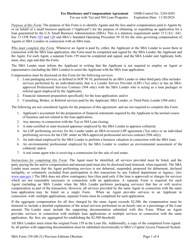

Form 219 Statement of Compensation - Utah

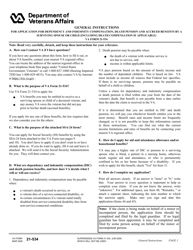

What Is Form 219?

This is a legal form that was released by the Utah Labor Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

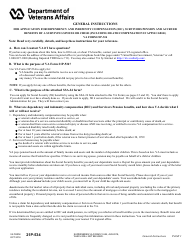

Q: What is Form 219?

A: Form 219 is the Statement of Compensation form used in Utah.

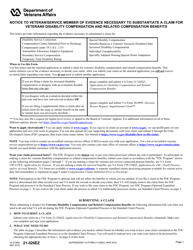

Q: What is the purpose of Form 219?

A: The purpose of Form 219 is to report compensation paid to employees in Utah.

Q: Who needs to file Form 219?

A: Employers in Utah who have paid compensation to employees during the tax year need to file Form 219.

Q: When is the deadline to file Form 219?

A: Form 219 must be filed by January 31st of the following year.

Q: Are there any penalties for not filing Form 219?

A: Yes, there may be penalties for not filing Form 219 or for filing it late. It is important to comply with the filing deadline to avoid these penalties.

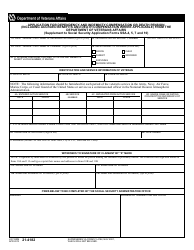

Q: What information is required on Form 219?

A: Form 219 requires information such as the employer's name, address, federal employer identification number (FEIN), and details of compensation paid to employees.

Q: Is Form 219 only for reporting wages and salaries?

A: No, Form 219 is used to report all types of compensation paid to employees, including wages, salaries, bonuses, commissions, and fringe benefits.

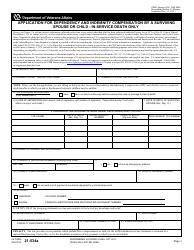

Q: Is Form 219 required for independent contractors?

A: No, Form 219 is not required for independent contractors. It is only used to report compensation paid to employees.

Q: How can I get help with filling out Form 219?

A: If you need assistance with filling out Form 219, you can contact the Utah State Tax Commission or consult a tax professional.

Q: Can I file Form 219 late if I missed the deadline?

A: It is best to file Form 219 by the deadline. However, if you missed the deadline, you should still file the form as soon as possible to avoid additional penalties.

Q: What other forms may need to be filed along with Form 219?

A: Depending on your business structure, you may also need to file other forms such as Form 200, Form 941, or Form W-2.

Q: Is a copy of Form 219 required to be sent to the employees?

A: No, there is no requirement to send a copy of Form 219 to employees. It is only filed with the Utah State Tax Commission.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Utah Labor Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 219 by clicking the link below or browse more documents and templates provided by the Utah Labor Commission.