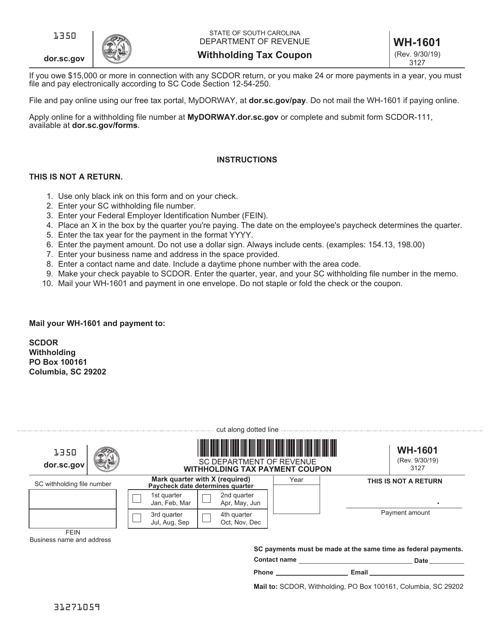

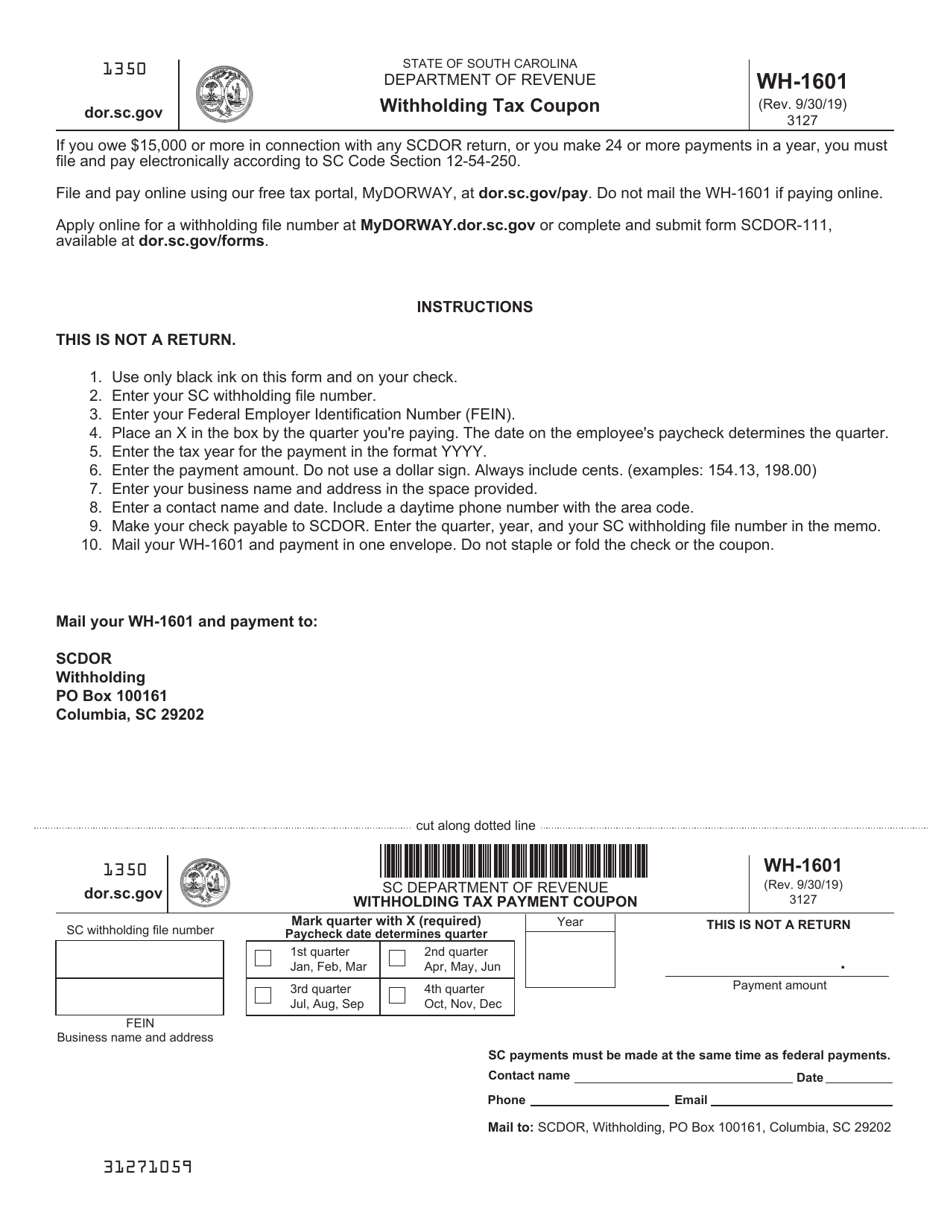

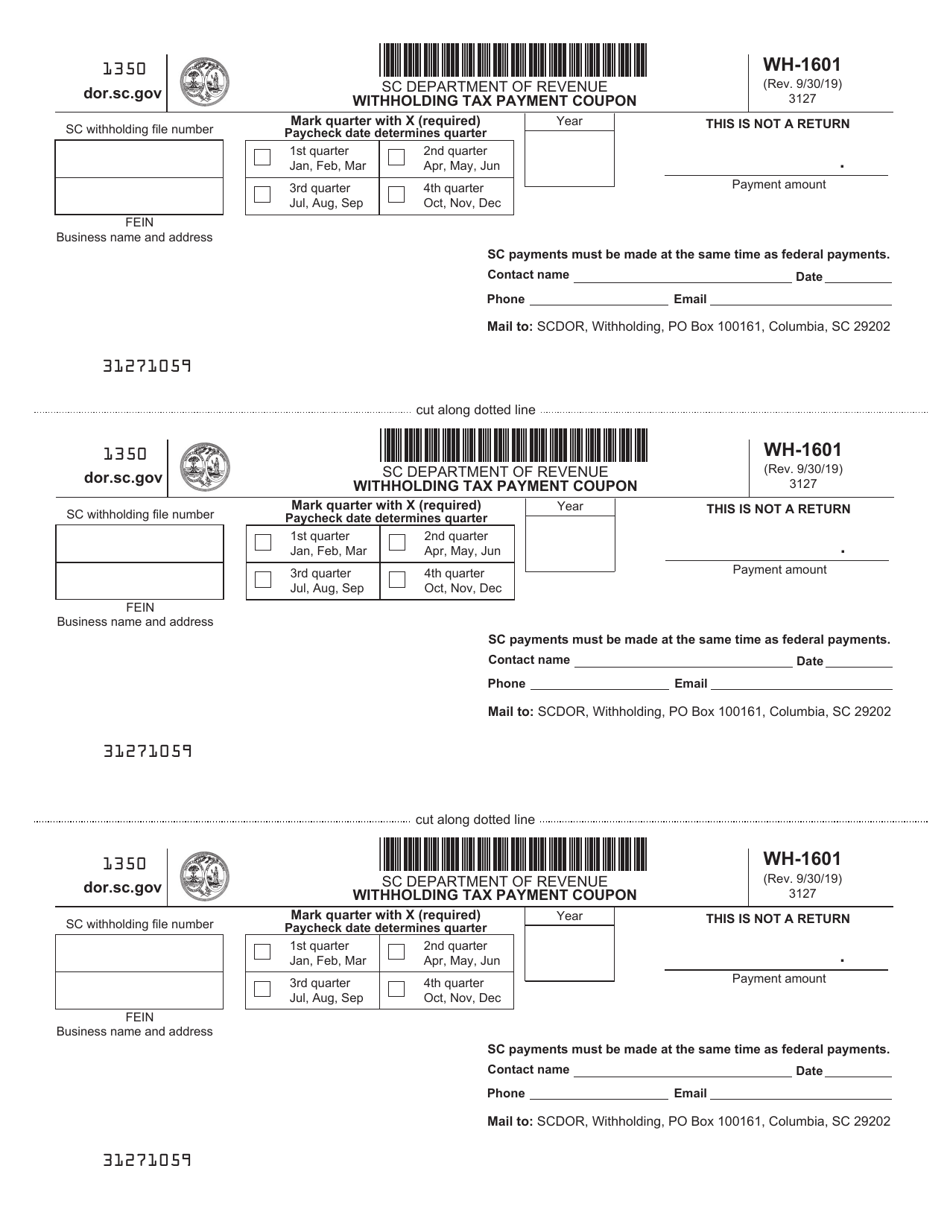

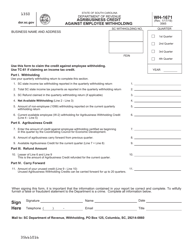

Form WH-1601 Withholding Tax Coupon - South Carolina

What Is Form WH-1601?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WH-1601?

A: Form WH-1601 is the Withholding Tax Coupon for South Carolina.

Q: What is the purpose of Form WH-1601?

A: Form WH-1601 is used to remit withholding tax payments to the South Carolina Department of Revenue.

Q: Who is required to file Form WH-1601?

A: Employers in South Carolina who are required to withhold state income taxes from their employees' wages must file Form WH-1601.

Q: How often is Form WH-1601 filed?

A: Form WH-1601 is filed monthly.

Q: Are there any penalties for not filing Form WH-1601?

A: Yes, failure to file Form WH-1601 or pay the withholding tax on time may result in penalties and interest being assessed by the South Carolina Department of Revenue.

Form Details:

- Released on September 30, 2019;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WH-1601 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.