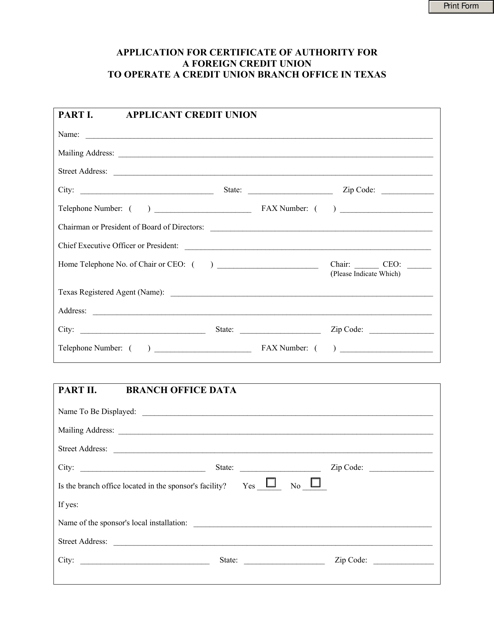

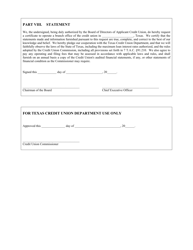

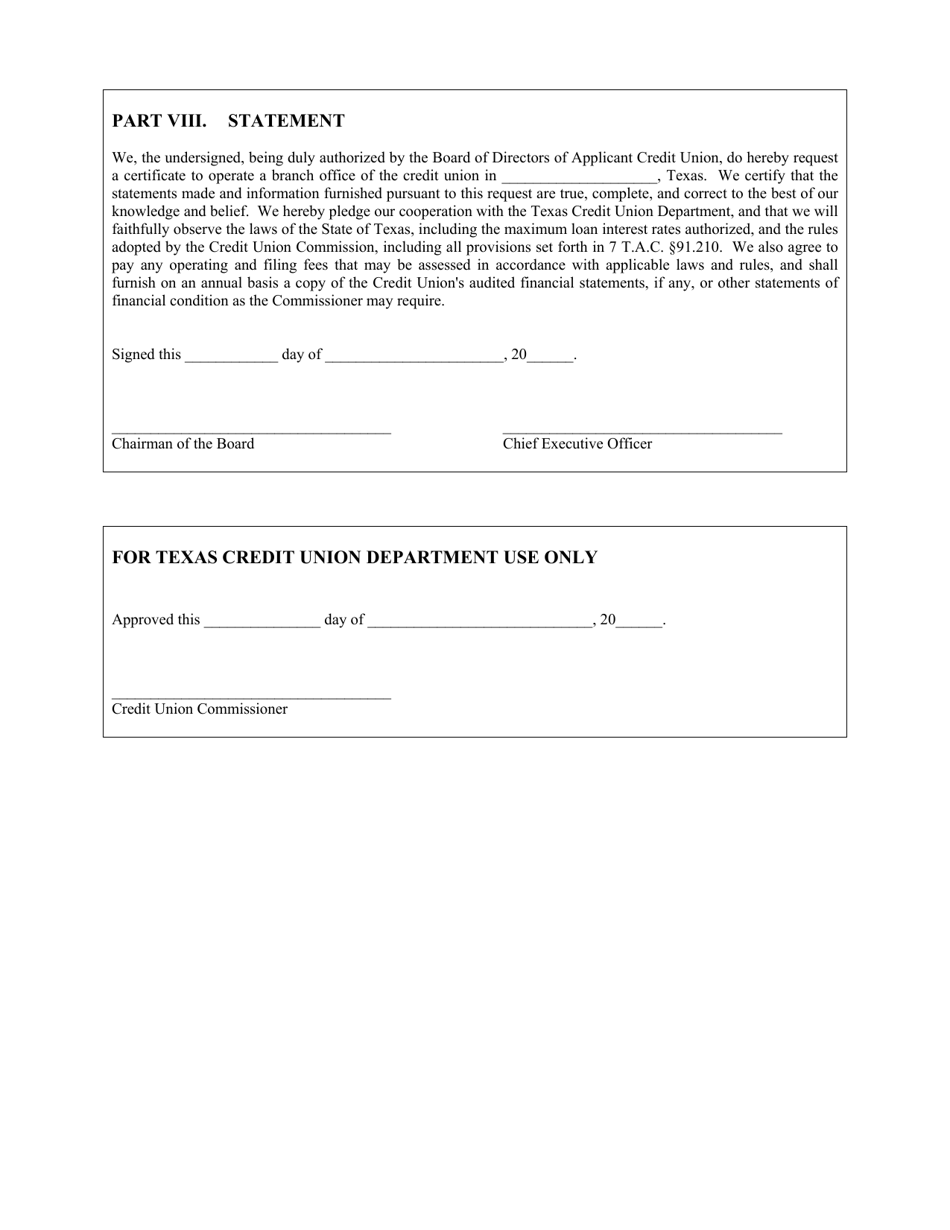

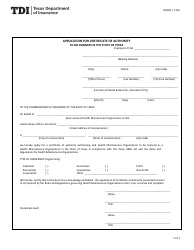

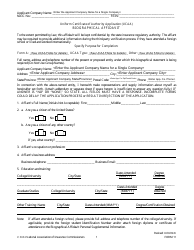

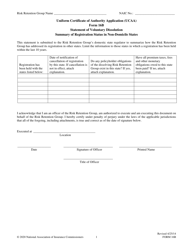

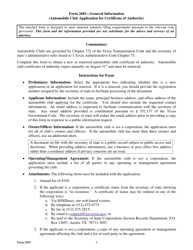

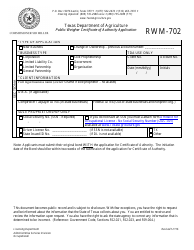

Application for Certificate of Authority for a Foreign Credit Union to Operate a Credit Union Branch Office in Texas - Texas

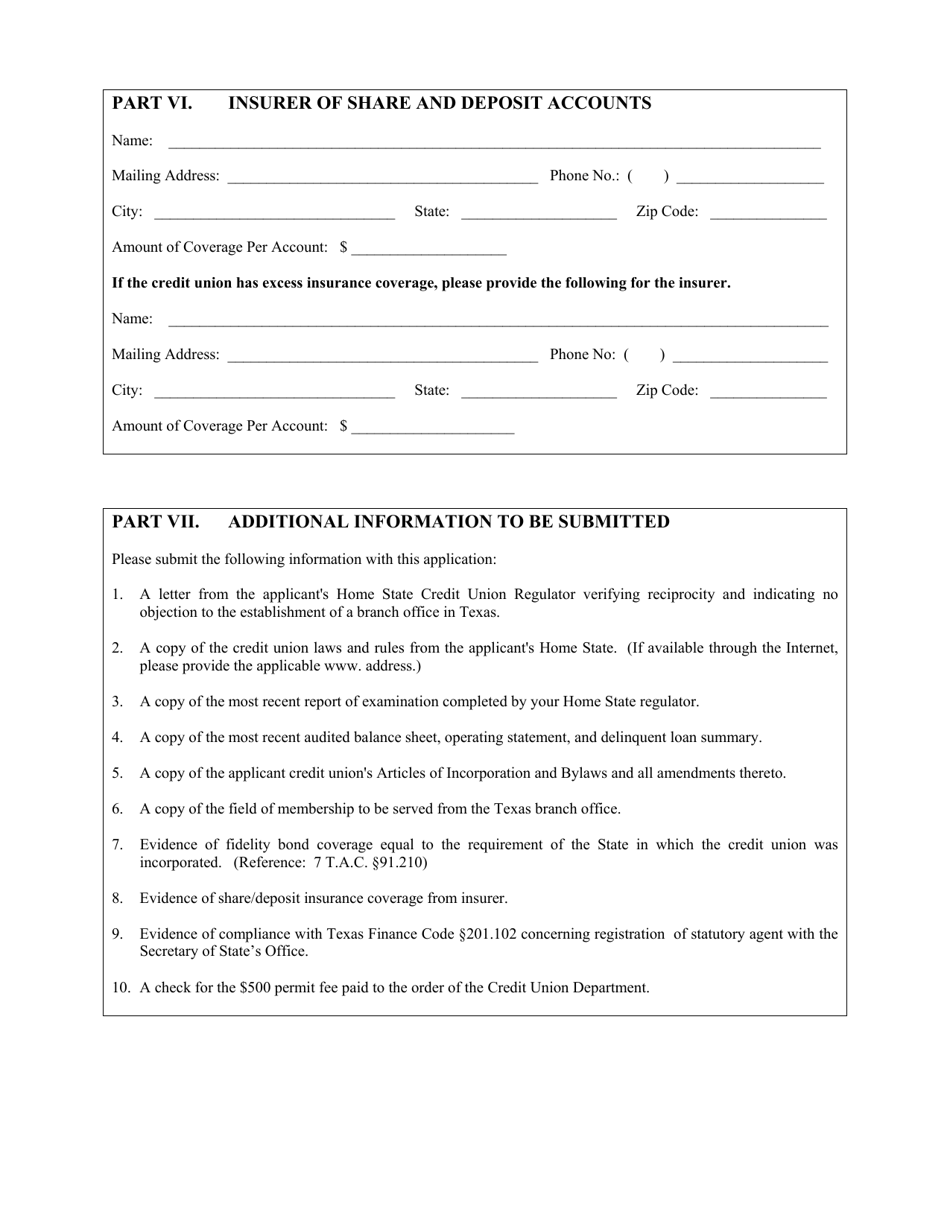

Application for Certificate of Authority for a Foreign Credit Union to Operate a Credit Union Branch Office in Texas is a legal document that was released by the Texas Credit Union Department - a government authority operating within Texas.

FAQ

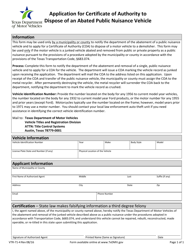

Q: What is a Certificate of Authority for a Foreign Credit Union?

A: A Certificate of Authority is a document granted to foreign credit unions allowing them to operate a branch office in Texas.

Q: What is a foreign credit union?

A: A foreign credit union is a credit union that is chartered and operates in a country other than the United States.

Q: What is a branch office?

A: A branch office is a location where a credit union conducts business activities.

Q: Who can apply for a Certificate of Authority for a Foreign Credit Union to operate a branch office in Texas?

A: Foreign credit unions can apply for this certificate.

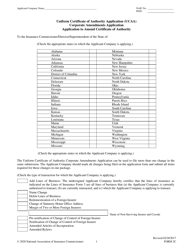

Q: What is the purpose of the Certificate of Authority?

A: The purpose of the Certificate of Authority is to allow foreign credit unions to establish and operate a branch office in Texas.

Q: How can a foreign credit union apply for a Certificate of Authority?

A: Foreign credit unions can apply for a Certificate of Authority by submitting an application to the Texas Credit Union Department.

Q: Are there any specific requirements for foreign credit unions to apply for a Certificate of Authority?

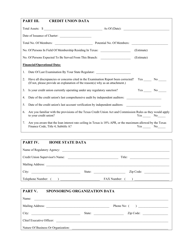

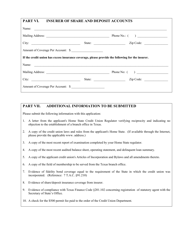

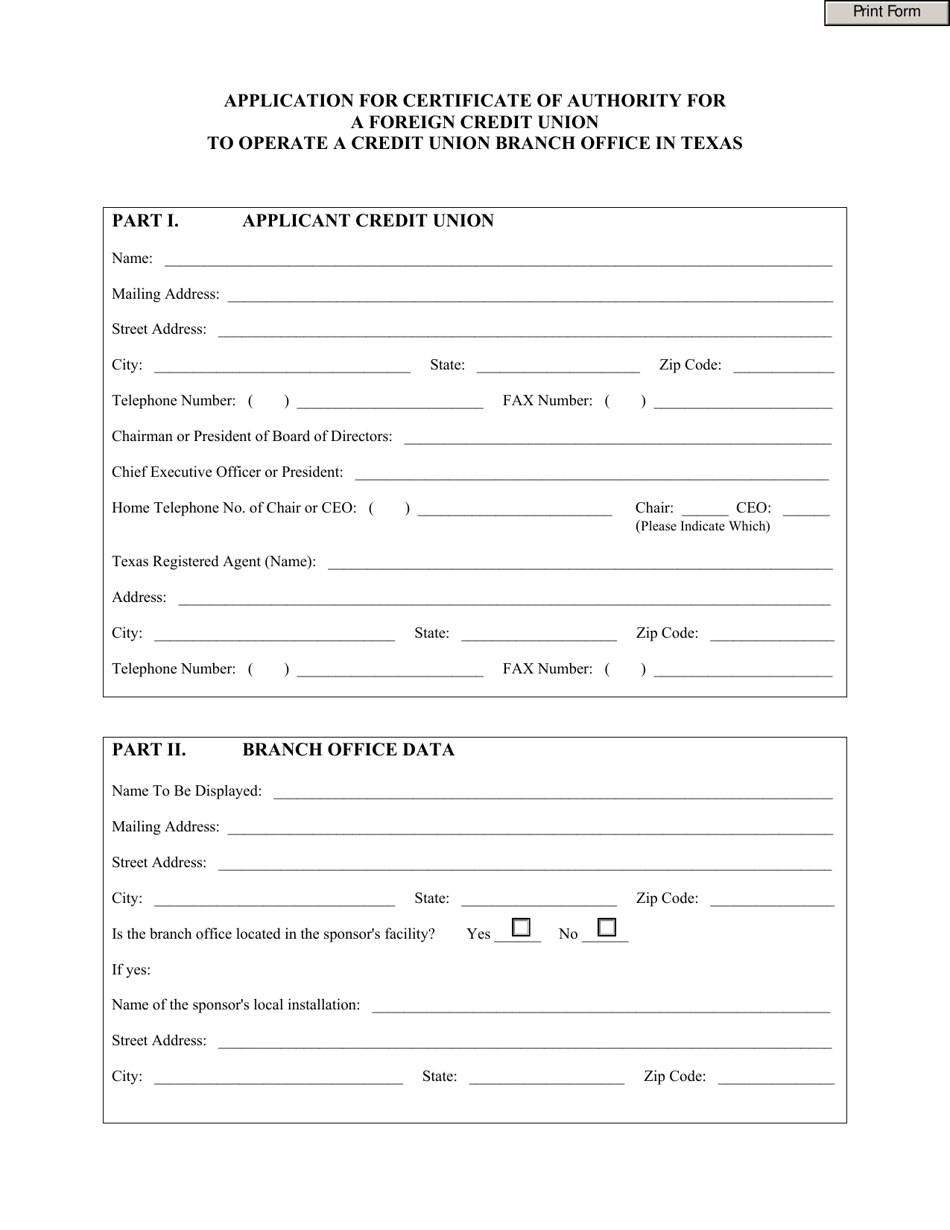

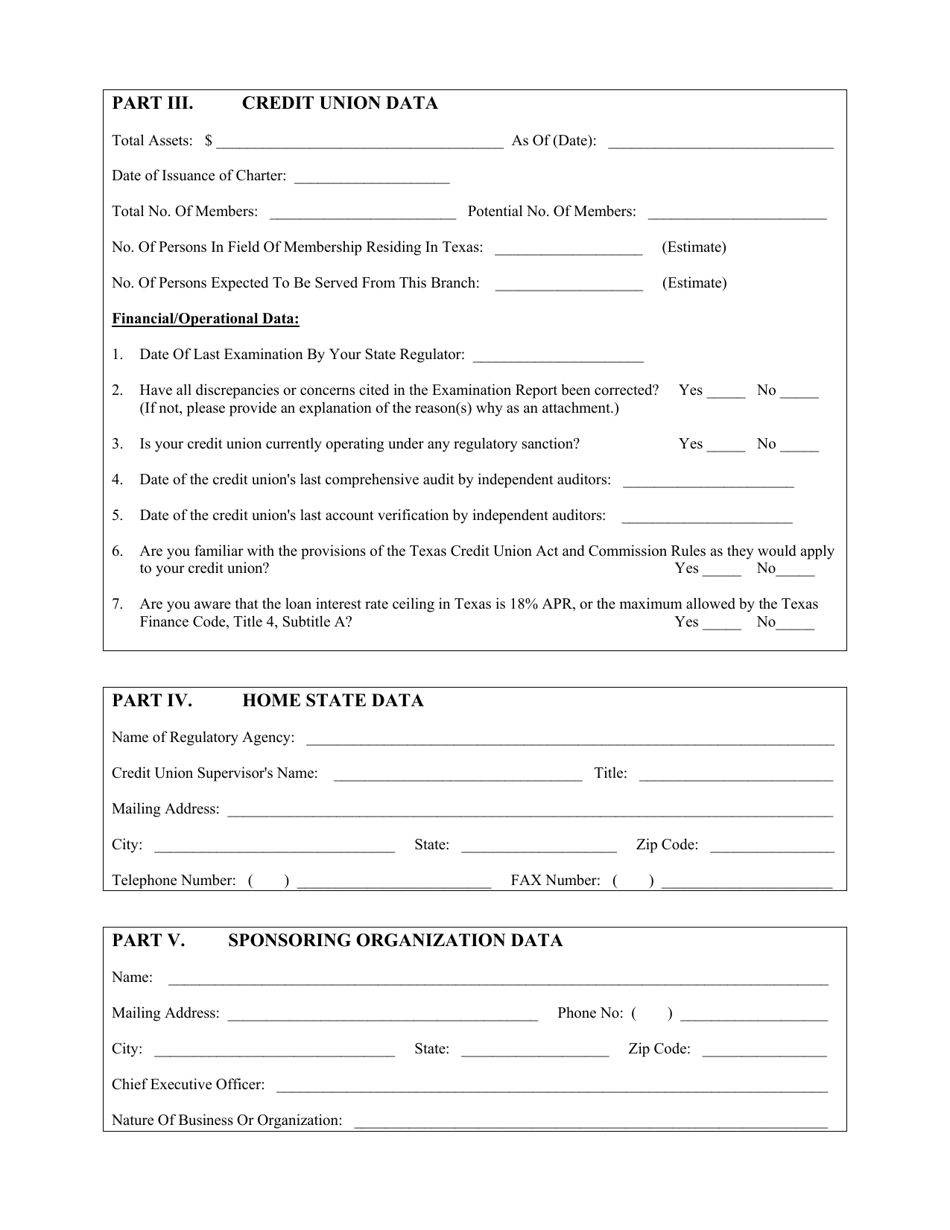

A: Yes, foreign credit unions must meet certain requirements, such as submitting financial statements, obtaining appropriate insurance coverage, and providing a business plan for the branch office.

Q: What is the fee for the application?

A: The fee for the application is $5000.

Q: Is the application fee refundable?

A: No, the application fee is non-refundable.

Q: How long does it take to process the application?

A: The processing time for the application can vary, but it typically takes several months.

Q: What happens after the application is approved?

A: Once the application is approved, the foreign credit union can start operating its branch office in Texas.

Q: Are there any ongoing requirements for foreign credit unions operating branch offices in Texas?

A: Yes, foreign credit unions must comply with the laws and regulations of Texas, maintain certain financial standards, and submit regular reports to the Texas Credit Union Department.

Form Details:

- The latest edition currently provided by the Texas Credit Union Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Texas Credit Union Department.