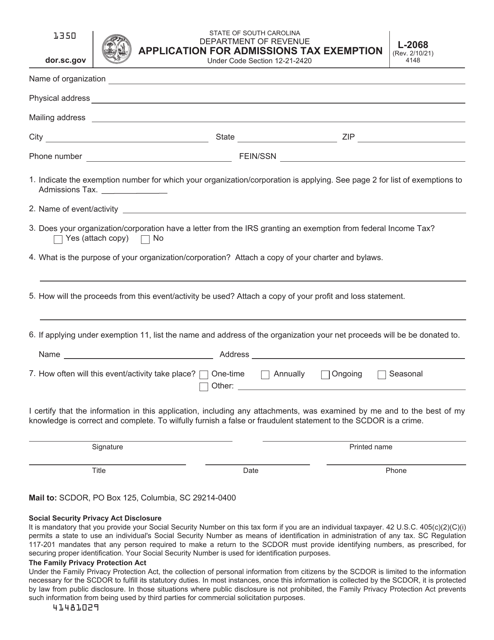

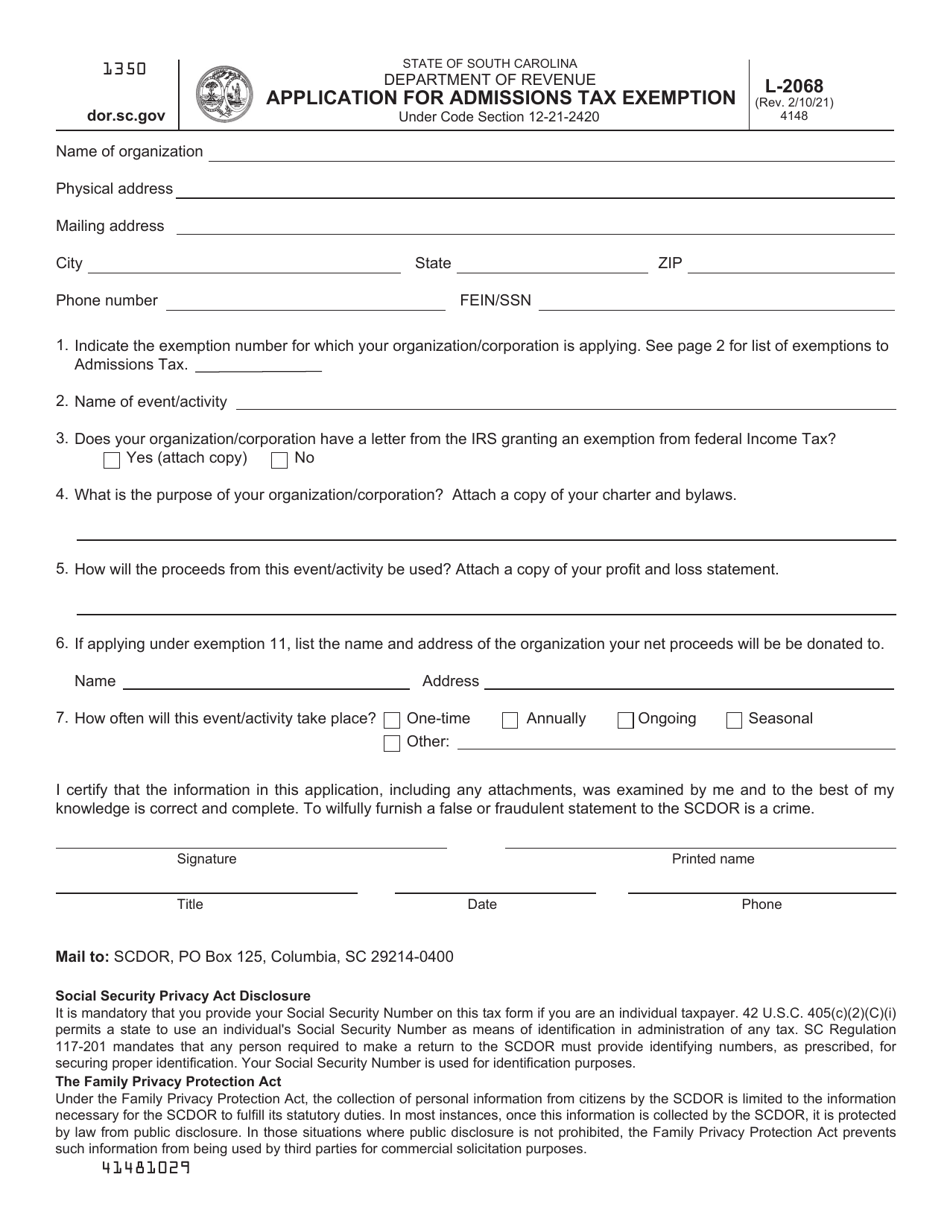

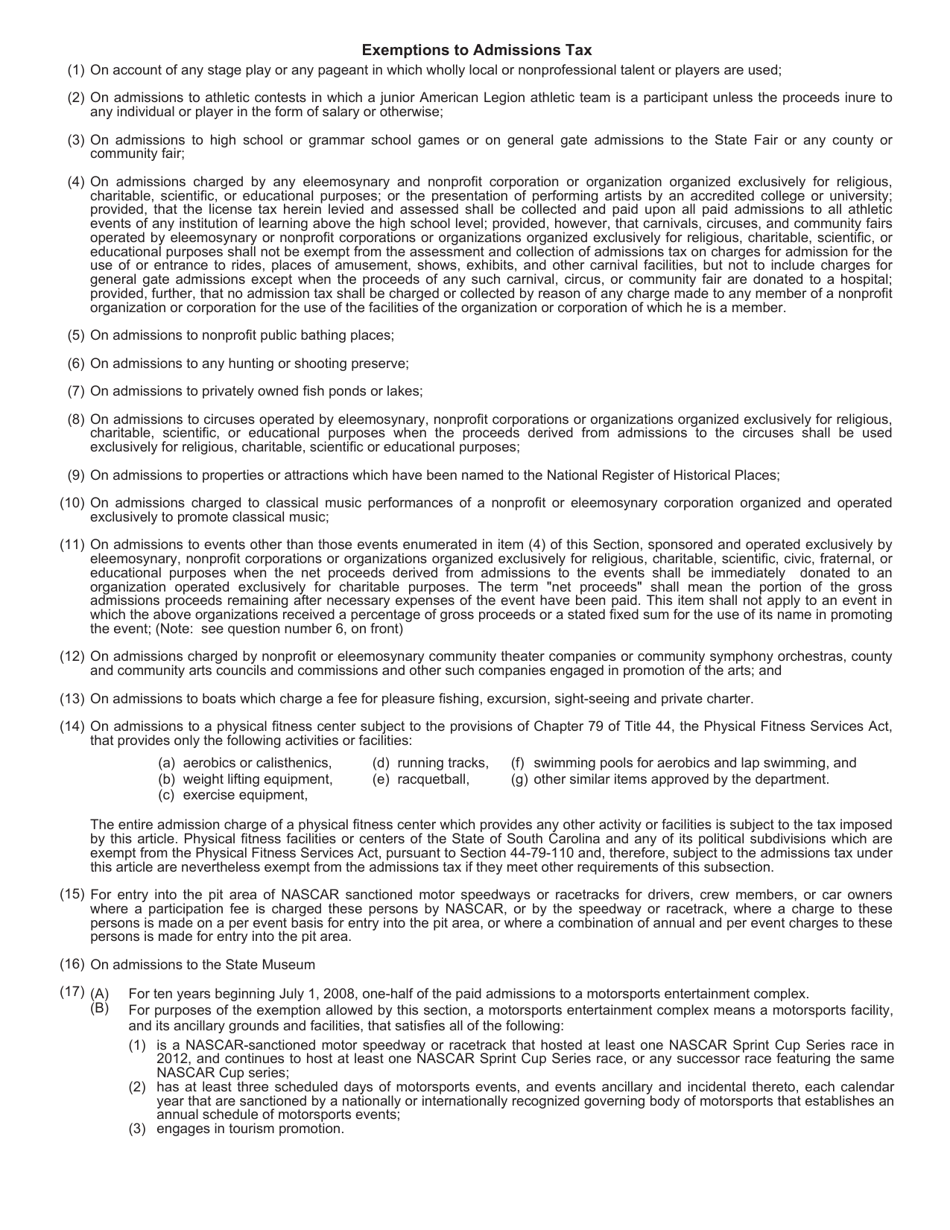

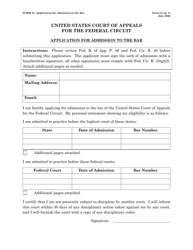

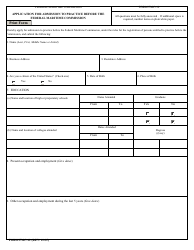

Form L-2068 Application for Admissions Tax Exemption - South Carolina

What Is Form L-2068?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

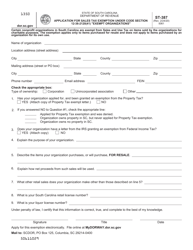

Q: What is Form L-2068?

A: Form L-2068 is the Application for Admissions Tax Exemption in South Carolina.

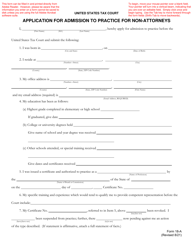

Q: Who needs to fill out Form L-2068?

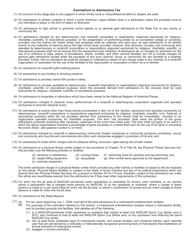

A: Organizations seeking tax exemption for admissions in South Carolina need to fill out Form L-2068.

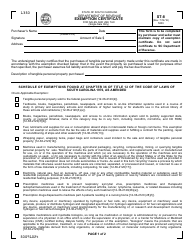

Q: What is the purpose of Form L-2068?

A: The purpose of Form L-2068 is to apply for tax exemption on admissions in South Carolina.

Q: Are there any fees associated with filing Form L-2068?

A: No, there are no fees associated with filing Form L-2068.

Q: What documents do I need to submit with Form L-2068?

A: You will need to submit supporting documents such as a copy of your organization's bylaws and financial statements with Form L-2068.

Q: How long does it take to process Form L-2068?

A: The processing time for Form L-2068 can vary, but typically takes several weeks.

Q: Can I apply for retroactive tax exemption using Form L-2068?

A: Yes, you can apply for retroactive tax exemption using Form L-2068, but it is subject to certain conditions and limitations.

Q: What should I do if my application for tax exemption is denied?

A: If your application for tax exemption is denied, you have the right to appeal the decision.

Q: Is Form L-2068 specific to South Carolina?

A: Yes, Form L-2068 is specific to South Carolina and is used to apply for admissions tax exemption in the state.

Form Details:

- Released on February 10, 2021;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form L-2068 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.