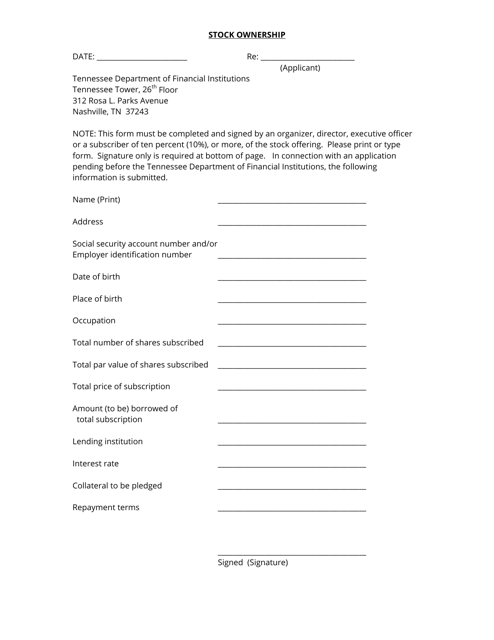

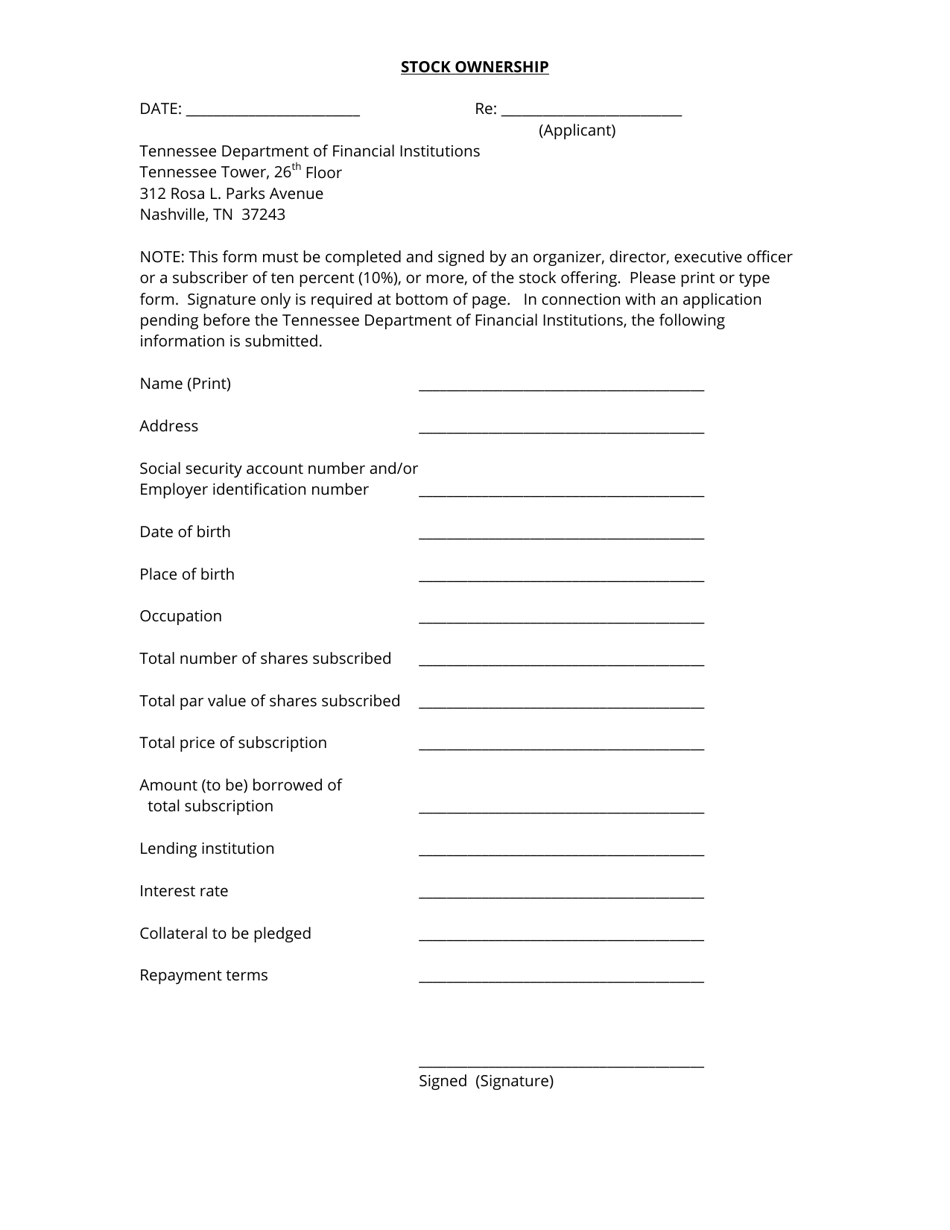

Stock Ownership - Tennessee

Stock Ownership is a legal document that was released by the Tennessee Department of Financial Institutions - a government authority operating within Tennessee.

FAQ

Q: Who owns stock in Tennessee?

A: Stock ownership in Tennessee is widespread among individuals and institutional investors.

Q: Can I own stock in Tennessee?

A: Yes, residents of Tennessee can own stock in various companies.

Q: Which companies are popular for stock ownership in Tennessee?

A: Popular companies for stock ownership in Tennessee include national corporations as well as local businesses.

Q: How can I buy stock in Tennessee?

A: You can buy stock in Tennessee by opening a brokerage account and purchasing shares of your desired company.

Q: Are there any restrictions on stock ownership in Tennessee?

A: There are no specific restrictions on stock ownership in Tennessee, but it is important to comply with applicable laws and regulations.

Q: What are the benefits of owning stock in Tennessee?

A: Owning stock in Tennessee can provide potential investment returns, dividend income, and a share in the company's ownership and success.

Q: Are there any risks associated with owning stock in Tennessee?

A: Yes, owning stock in Tennessee, as with any investment, carries the risk of potential loss if the value of the stock decreases.

Q: Can I sell my stock in Tennessee?

A: Yes, you can sell your stock in Tennessee by placing a sell order through your brokerage account.

Q: Is stock ownership in Tennessee taxable?

A: Yes, capital gains from selling stock in Tennessee may be subject to federal and state taxes.

Form Details:

- The latest edition currently provided by the Tennessee Department of Financial Institutions;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Tennessee Department of Financial Institutions.