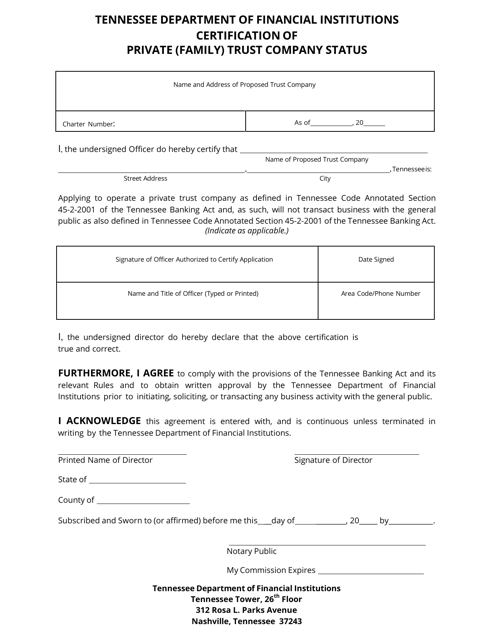

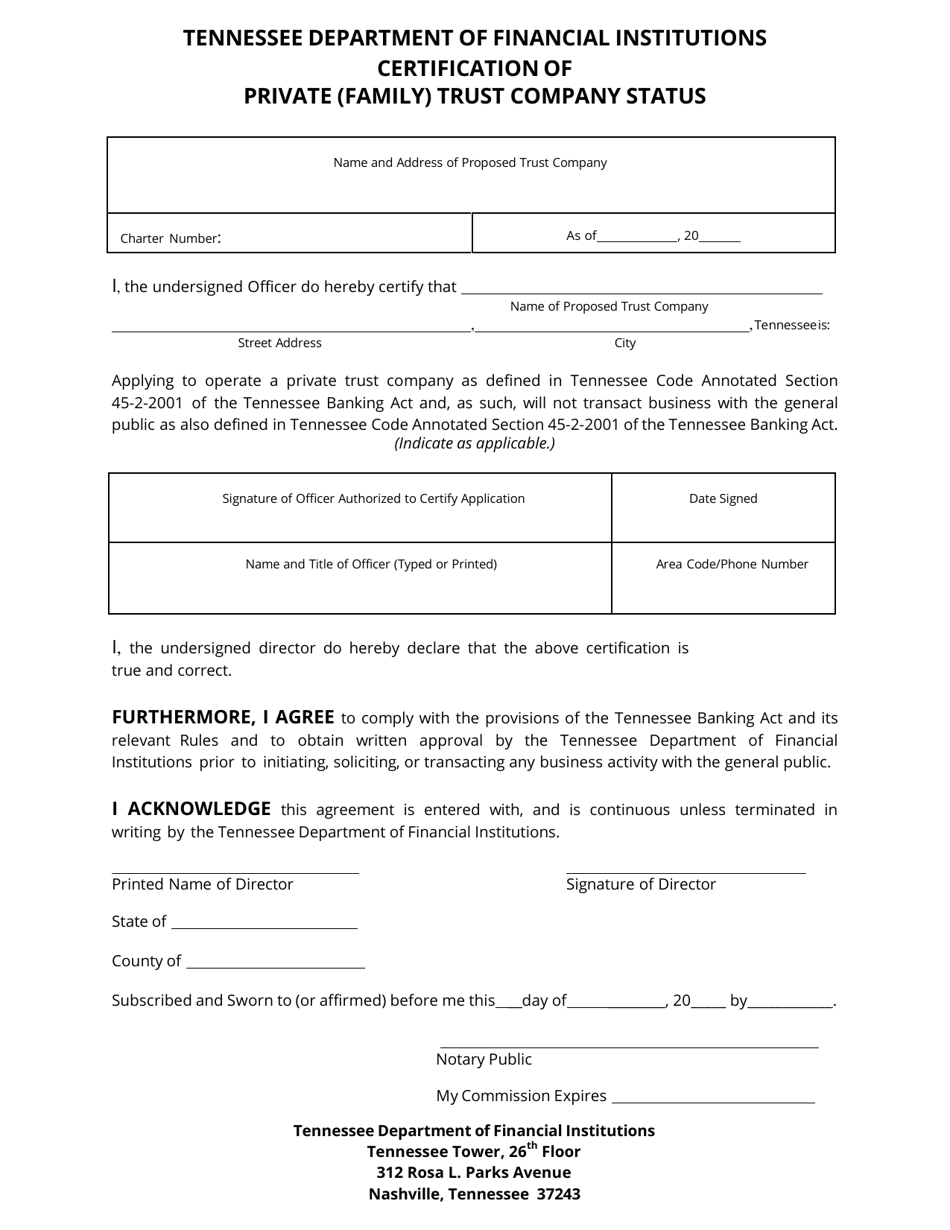

Certification of Private (Family) Trust Company Status - Tennessee

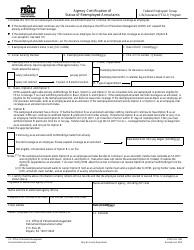

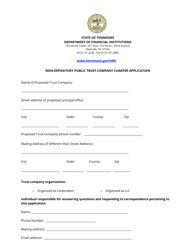

Certification of Private (Family) Trust Company Status is a legal document that was released by the Tennessee Department of Financial Institutions - a government authority operating within Tennessee.

FAQ

Q: What is a private (family) trust company?

A: A private (family) trust company (PTC) is a legal entity that is created to manage and administer the assets and affairs of a single family or multiple related families.

Q: What is the benefit of establishing a private trust company?

A: Establishing a private trust company can provide greater control and flexibility over the management of family wealth and assets.

Q: Is Tennessee a popular state for establishing private trust companies?

A: Yes, Tennessee is known for its favorable trust laws and is a popular state for establishing private trust companies.

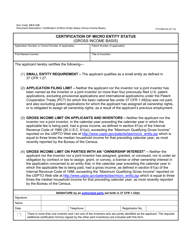

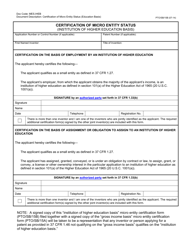

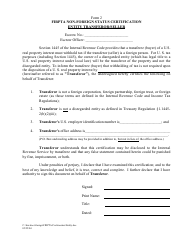

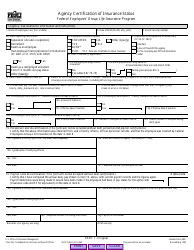

Q: How do I obtain certification of private (family) trust company status in Tennessee?

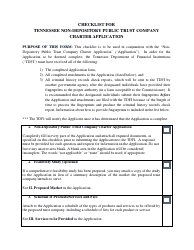

A: To obtain certification, you must file an application with the Tennessee Department of Financial Institutions and meet certain requirements and criteria.

Q: What are the requirements for obtaining certification in Tennessee?

A: The requirements may vary, but generally include having a minimum amount of assets under management, maintaining a Tennessee office and registered agent, and meeting certain financial and managerial qualifications.

Q: What are the advantages of becoming a certified private trust company in Tennessee?

A: Some advantages include limited regulation and oversight, potential tax benefits, and the ability to act as a fiduciary for family members without the need for external professional trustees.

Form Details:

- The latest edition currently provided by the Tennessee Department of Financial Institutions;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Tennessee Department of Financial Institutions.