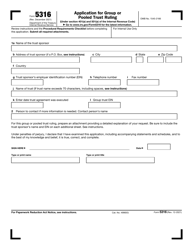

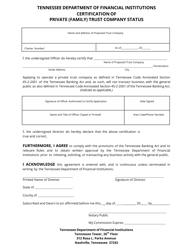

Non-depository Public Trust Company Charter Application - Tennessee

Non-depository Public Trust Company Charter Application is a legal document that was released by the Tennessee Department of Financial Institutions - a government authority operating within Tennessee.

FAQ

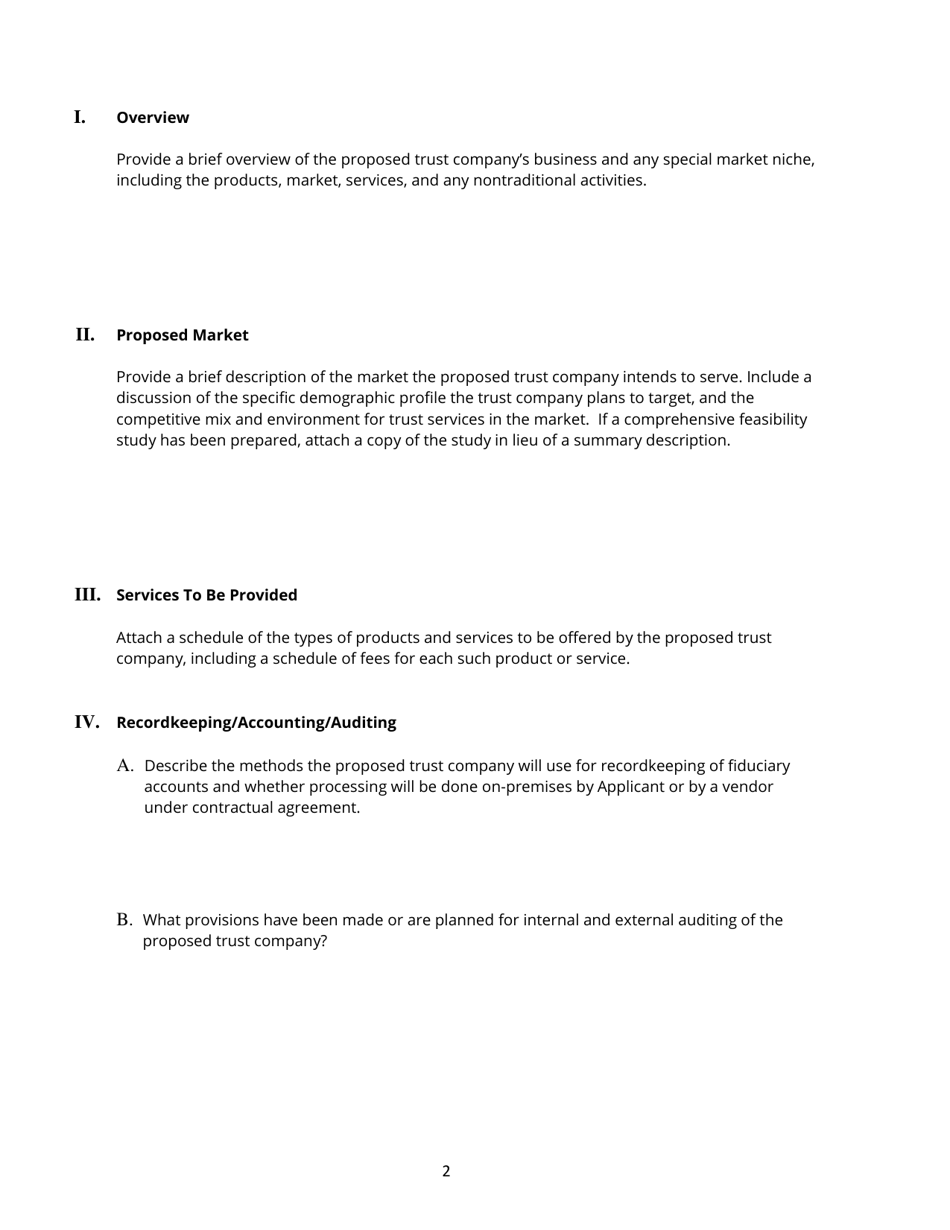

Q: What is a non-depository public trust company?

A: A non-depository public trust company is a type of financial institution that provides trust and fiduciary services, but does not accept deposits from customers.

Q: What is a charter application?

A: A charter application is a formal request made to the appropriate regulatory authority for the establishment of a new non-depository public trust company.

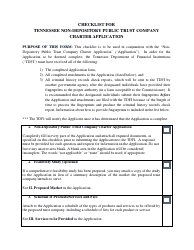

Q: What is the process for obtaining a charter for a non-depository public trust company in Tennessee?

A: The process for obtaining a charter for a non-depository public trust company in Tennessee involves submitting a completed application, paying the required fees, and meeting certain regulatory requirements.

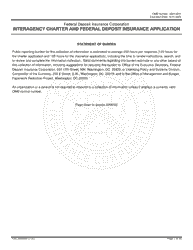

Q: What are the regulatory requirements for obtaining a charter for a non-depository public trust company in Tennessee?

A: The regulatory requirements for obtaining a charter for a non-depository public trust company in Tennessee may include meeting capital and liquidity requirements, demonstrating competence and fitness of management, and complying with applicable laws and regulations.

Q: Who should apply for a non-depository public trust company charter in Tennessee?

A: Individuals or entities looking to establish a financial institution that provides trust and fiduciary services but does not accept deposits should apply for a non-depository public trust company charter in Tennessee.

Q: What services can a non-depository public trust company provide?

A: A non-depository public trust company can provide a range of services, including acting as a trustee, executor, or administrator of estates, managing investment portfolios, and providing financial planning and advisory services.

Q: Are non-depository public trust companies regulated?

A: Yes, non-depository public trust companies are subject to regulation by the appropriate state regulatory authority, such as the Tennessee Department of Financial Institutions.

Q: Can a non-depository public trust company accept deposits from customers?

A: No, a non-depository public trust company cannot accept deposits from customers. They can only provide trust and fiduciary services.

Q: What are the fees associated with a non-depository public trust company charter application in Tennessee?

A: The fees associated with a non-depository public trust company charter application in Tennessee may vary and should be confirmed with the appropriate regulatory authority.

Q: Is a charter application guaranteed to be approved?

A: No, a charter application for a non-depository public trust company is not guaranteed to be approved. Approval is subject to meeting all regulatory requirements and satisfying the assessment of the regulatory authority.

Form Details:

- The latest edition currently provided by the Tennessee Department of Financial Institutions;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Tennessee Department of Financial Institutions.