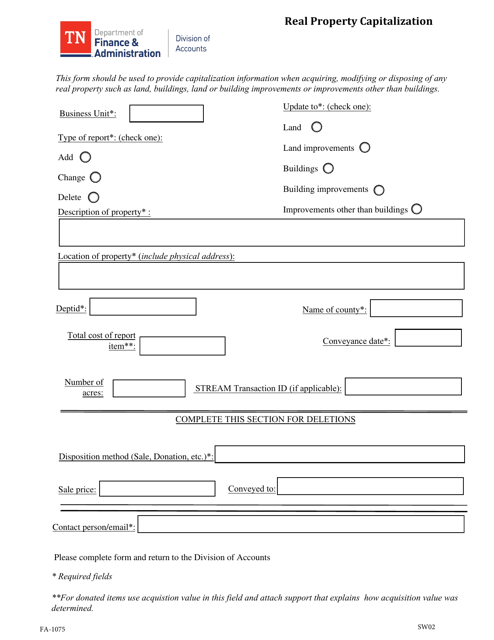

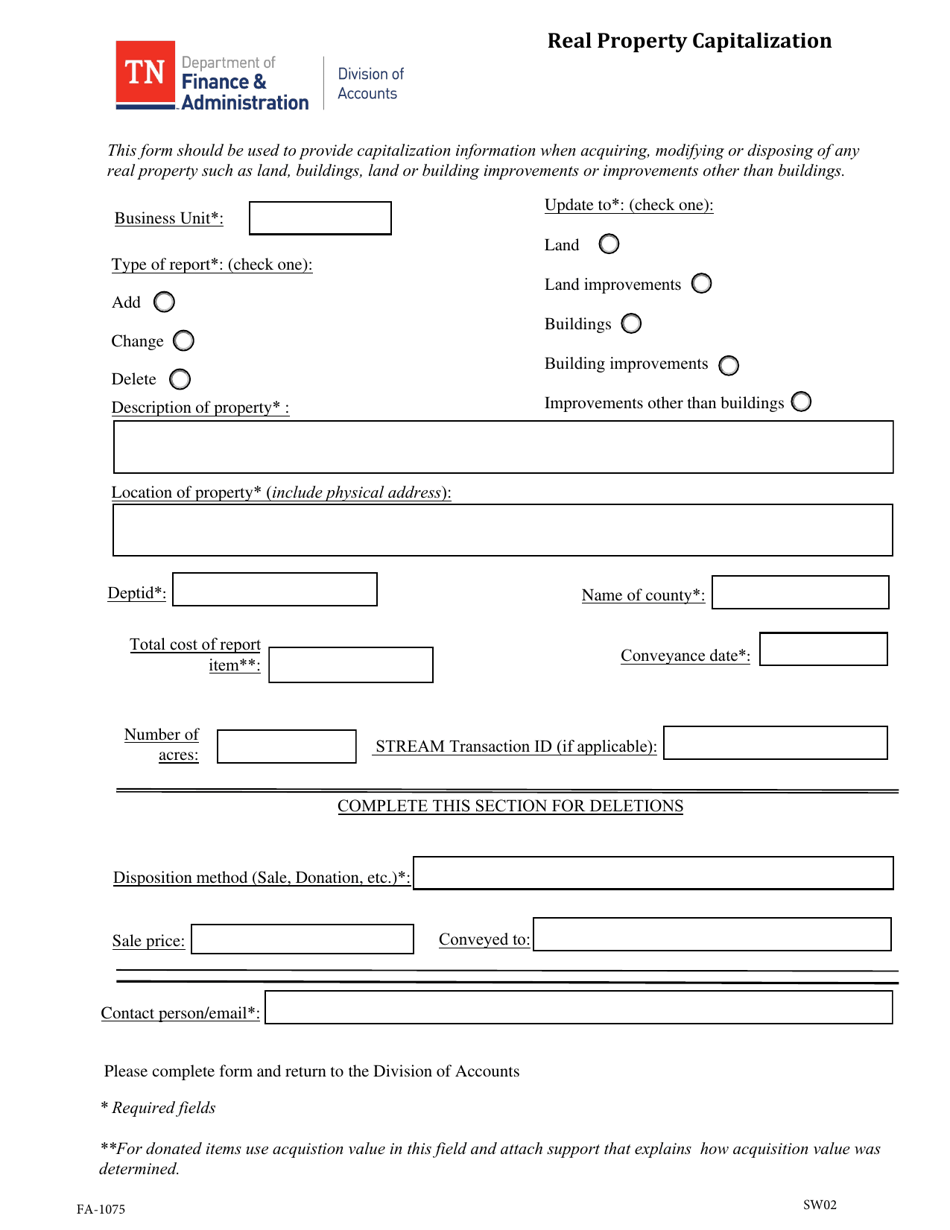

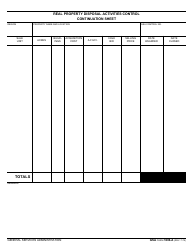

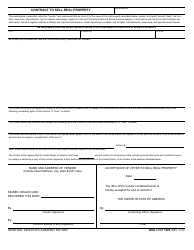

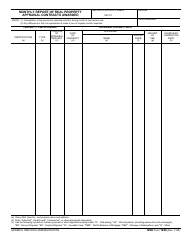

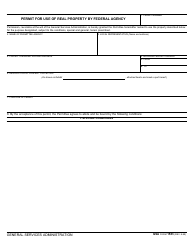

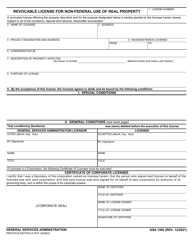

Form FA-1075 Real Property Capitalization - Tennessee

What Is Form FA-1075?

This is a legal form that was released by the Tennessee Department of Finance & Administration - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FA-1075?

A: Form FA-1075 is a document used in Tennessee for real property capitalization.

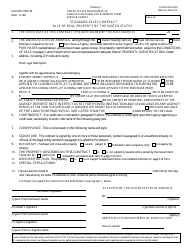

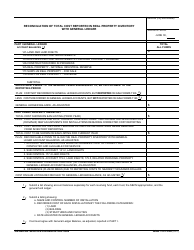

Q: What is real property capitalization?

A: Real property capitalization is the process of determining the assessed value of a property for tax purposes.

Q: Who uses Form FA-1075?

A: Form FA-1075 is used by assessors and local tax officials in Tennessee.

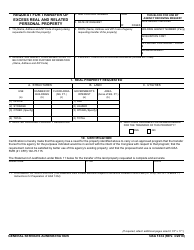

Q: What information is required on Form FA-1075?

A: Form FA-1075 requires information about the property, such as its location, size, and characteristics.

Q: How often is Form FA-1075 filed?

A: Form FA-1075 is typically filed annually or when there are significant changes to the property.

Form Details:

- The latest edition provided by the Tennessee Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FA-1075 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Finance & Administration.