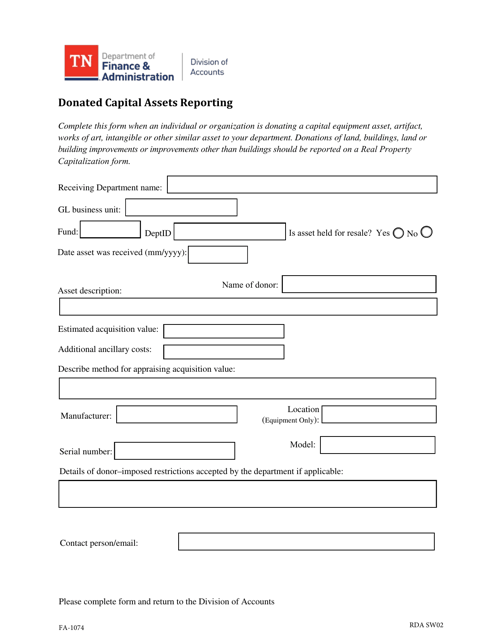

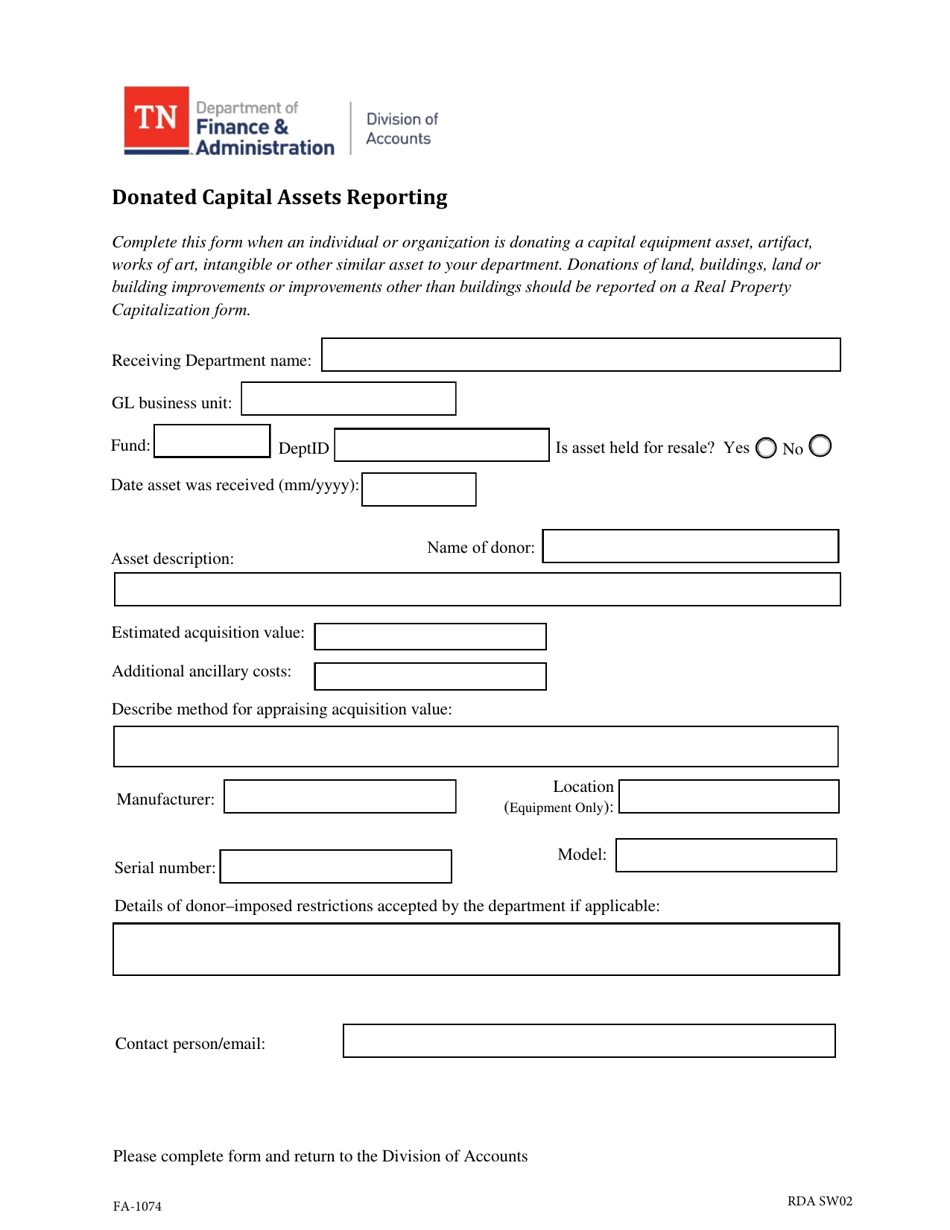

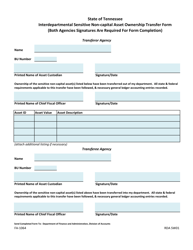

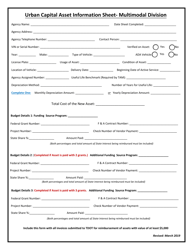

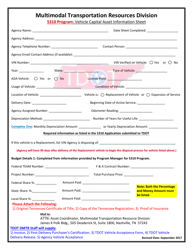

Form FA-1074 Donated Capital Assets Reporting - Tennessee

What Is Form FA-1074?

This is a legal form that was released by the Tennessee Department of Finance & Administration - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FA-1074?

A: Form FA-1074 is the Donated Capital Assets Reporting form in Tennessee.

Q: What is the purpose of Form FA-1074?

A: The purpose of Form FA-1074 is to report donated capital assets to the state of Tennessee.

Q: Who needs to file Form FA-1074?

A: Anyone who has donated capital assets in Tennessee needs to file Form FA-1074.

Q: What are capital assets?

A: Capital assets are valuable assets, such as land, buildings, and equipment.

Q: Is Form FA-1074 required for all types of donations?

A: Form FA-1074 is only required for donated capital assets, not for other types of donations.

Q: When is Form FA-1074 due?

A: Form FA-1074 is due by the 15th day of the 5th month after the end of the organization's fiscal year.

Q: Are there any penalties for not filing Form FA-1074?

A: Yes, there may be penalties for failing to file Form FA-1074 or for filing it late.

Form Details:

- The latest edition provided by the Tennessee Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FA-1074 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Finance & Administration.