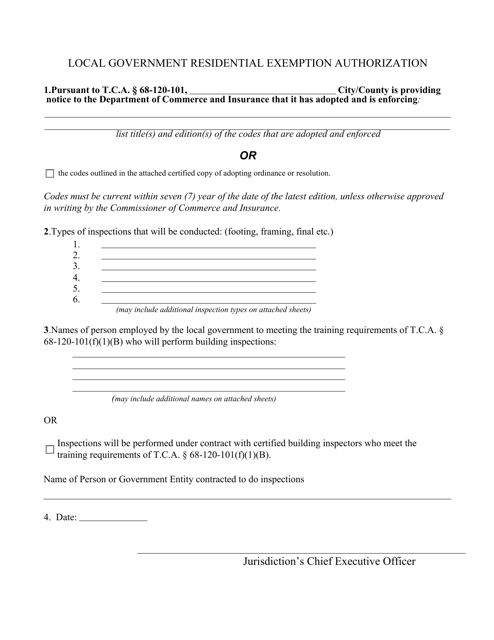

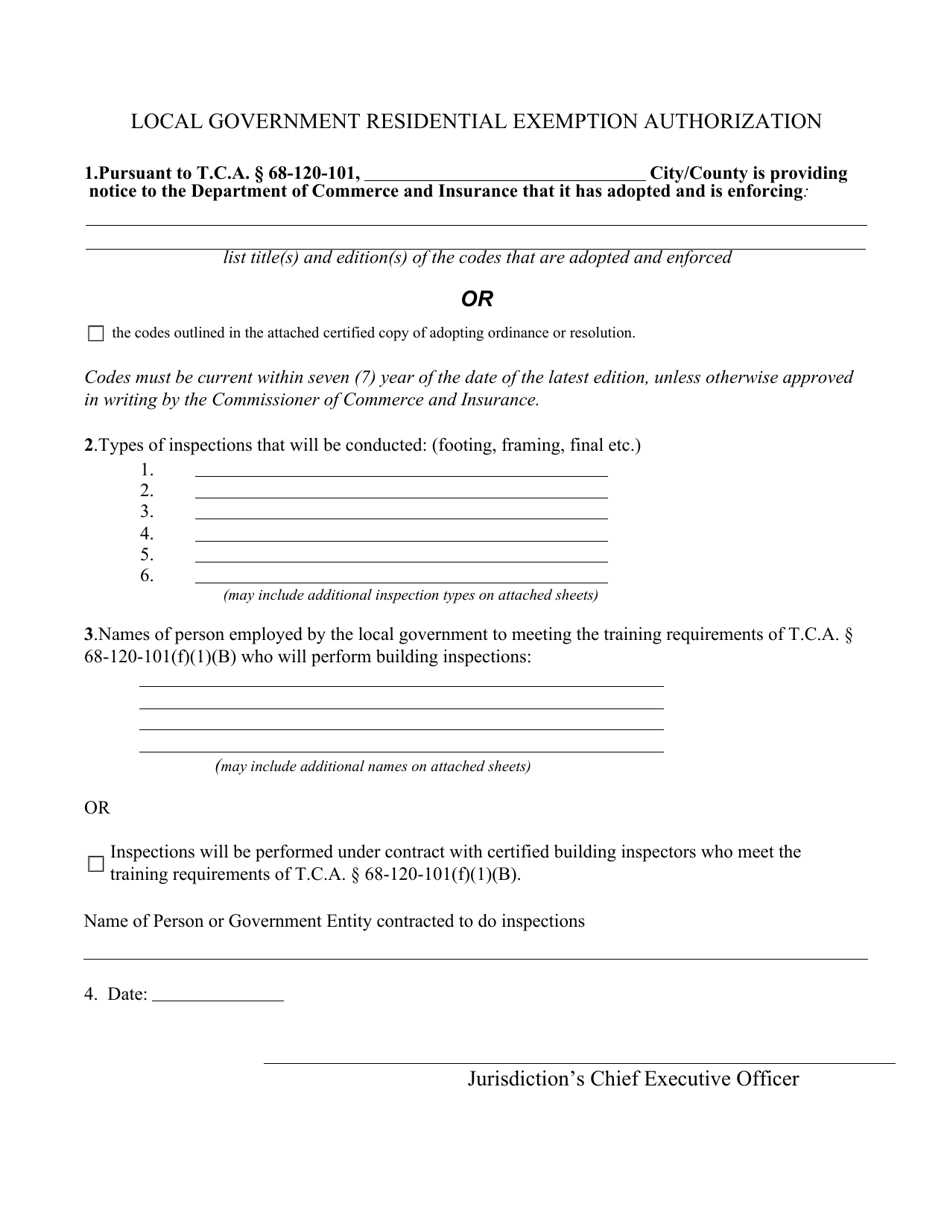

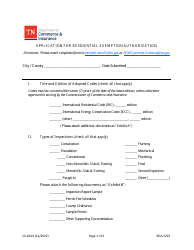

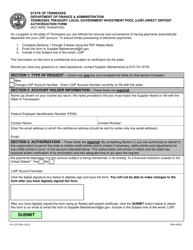

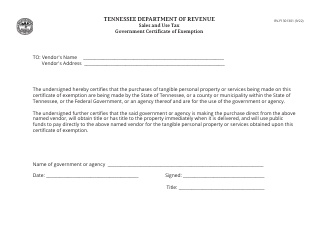

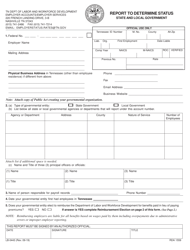

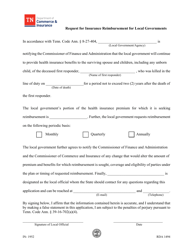

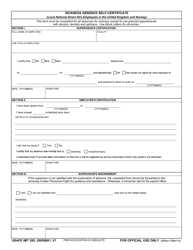

Local Government Residential Exemption Authorization - Tennessee

Local Government Residential Exemption Authorization is a legal document that was released by the Tennessee Department of Commerce and Insurance - a government authority operating within Tennessee.

FAQ

Q: What is the Local Government Residential Exemption Authorization?

A: The Local Government Residential Exemption Authorization is a program in Tennessee that provides property tax relief for eligible homeowners.

Q: Who is eligible for the Local Government Residential Exemption Authorization?

A: Homeowners in Tennessee who meet certain criteria, such as age, income, or disability, may be eligible for the program.

Q: How does the Local Government Residential Exemption Authorization provide tax relief?

A: The program exempts a portion of the assessed value of a homeowner's primary residence from property taxes, reducing the amount they have to pay.

Q: What are the criteria for eligibility?

A: The criteria for eligibility vary depending on the local government that offers the program, but they may include age, income level, disability status, or other factors.

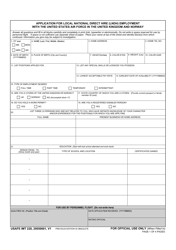

Q: How can I apply for the Local Government Residential Exemption Authorization?

A: To apply for the program, you will need to contact your local government's tax assessor's office and inquire about the application process and required documentation.

Q: Does the program apply to all properties?

A: No, the program applies specifically to a homeowner's primary residence, not second homes or investment properties.

Q: Is the Local Government Residential Exemption Authorization available in all counties of Tennessee?

A: The availability of the program may vary by county, as it is implemented and administered by local governments. It is best to check with your specific county's tax assessor's office for more information.

Q: What is the benefit of participating in the program?

A: By participating in the program, eligible homeowners can potentially reduce their property tax burden and keep more money in their pocket.

Q: Are there any income limitations for eligibility?

A: Income limitations for eligibility may vary depending on the local government offering the program. It is best to check with your specific county's tax assessor's office for information on income requirements.

Q: Can I apply for the Local Government Residential Exemption Authorization if I rent a home?

A: No, the program is specifically for homeowners who own and reside in their primary residence.

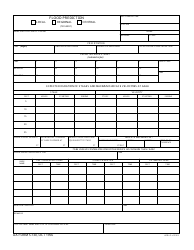

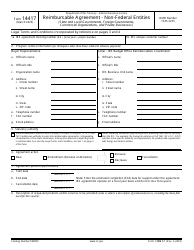

Form Details:

- The latest edition currently provided by the Tennessee Department of Commerce and Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Tennessee Department of Commerce and Insurance.