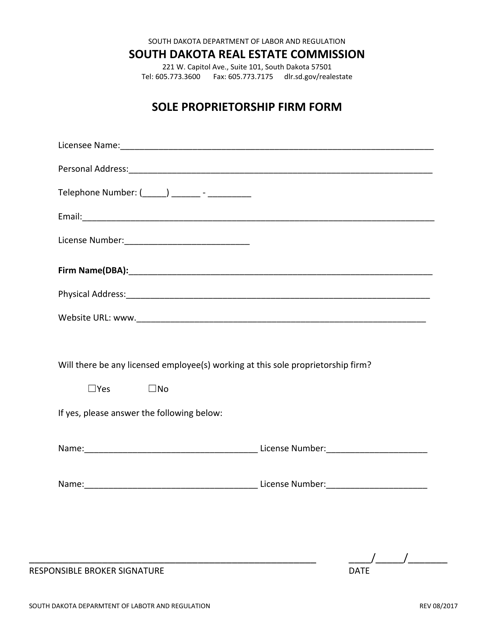

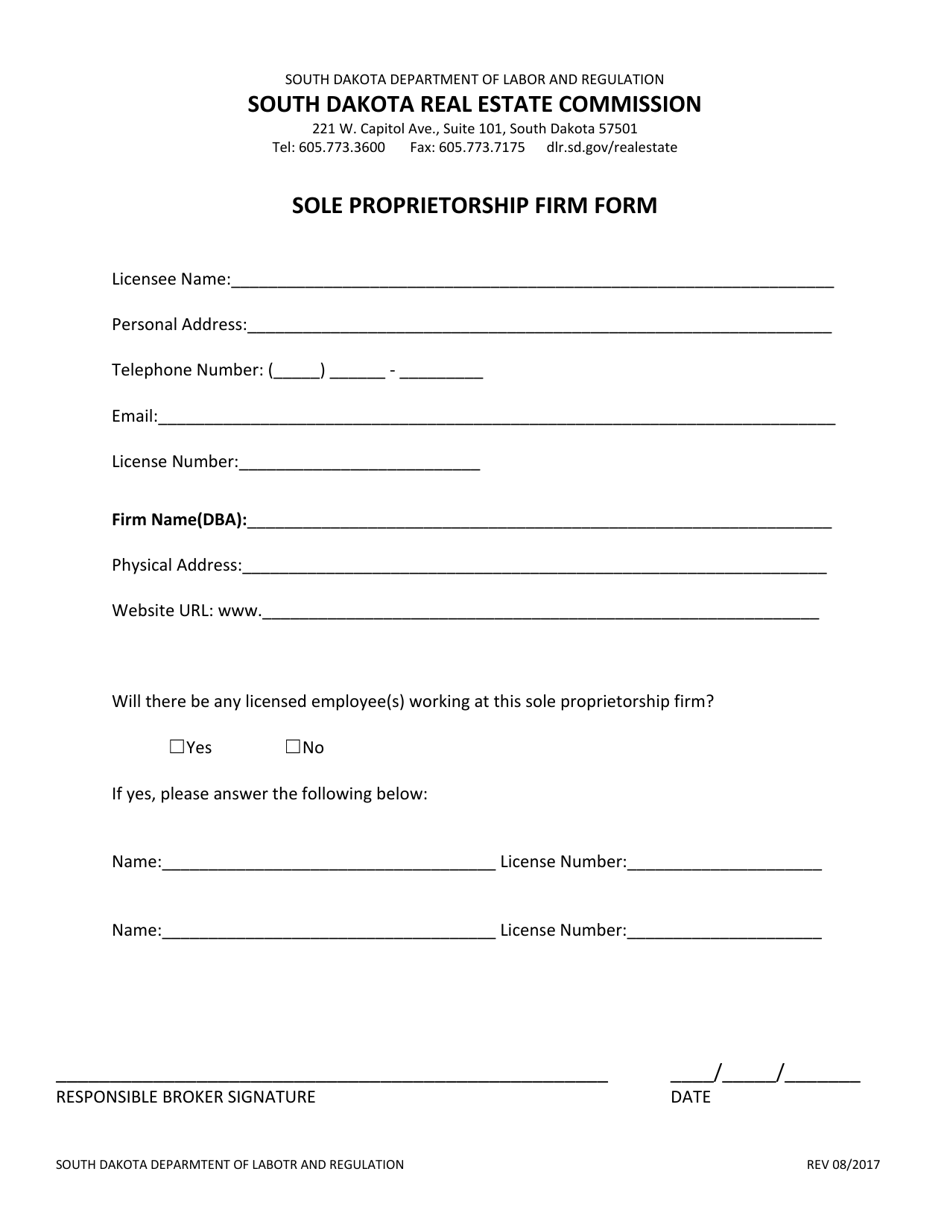

Sole Proprietorship Firm Form - South Dakota

Sole Proprietorship Firm Form is a legal document that was released by the South Dakota Department of Labor & Regulation - a government authority operating within South Dakota.

FAQ

Q: What is a sole proprietorship?

A: A sole proprietorship is a business owned and operated by a single individual.

Q: What are the advantages of a sole proprietorship?

A: Advantages of a sole proprietorship include simplicity, complete control, and direct profit.

Q: What are the disadvantages of a sole proprietorship?

A: Disadvantages of a sole proprietorship include unlimited liability and limited access to capital.

Q: How do I form a sole proprietorship in South Dakota?

A: To form a sole proprietorship in South Dakota, you don't need to file specific formation documents. You simply start operating your business under your own name or a fictitious name if desired.

Q: Do I need a business license for a sole proprietorship in South Dakota?

A: It depends on the type of business you operate. Some businesses may require a license or permit at the local or state level. Contact the South Dakota Department of Revenue for more information.

Q: How do I report taxes for a sole proprietorship?

A: As a sole proprietor, you report your business income and expenses on your personal tax return using Schedule C.

Q: Can I hire employees as a sole proprietorship?

A: Yes, you can hire employees as a sole proprietorship.

Q: What is the liability of a sole proprietor?

A: A sole proprietor has unlimited personal liability for the debts and legal obligations of the business.

Q: Can I convert my sole proprietorship to another business entity?

A: Yes, you can convert your sole proprietorship to another business entity, such as an LLC or corporation, if you decide to change the legal structure of your business.

Form Details:

- Released on August 1, 2017;

- The latest edition currently provided by the South Dakota Department of Labor & Regulation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the South Dakota Department of Labor & Regulation.