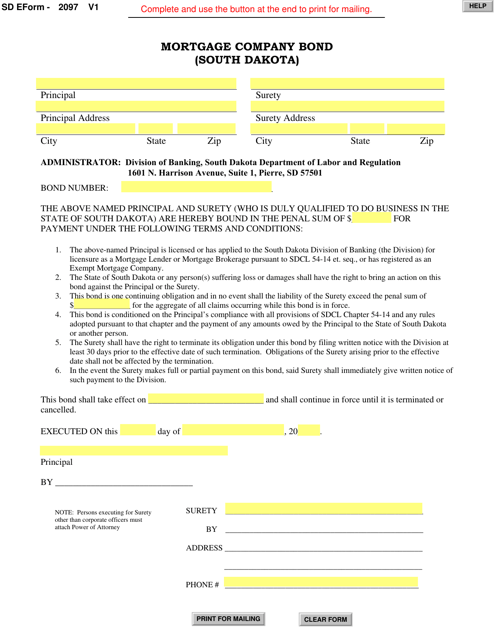

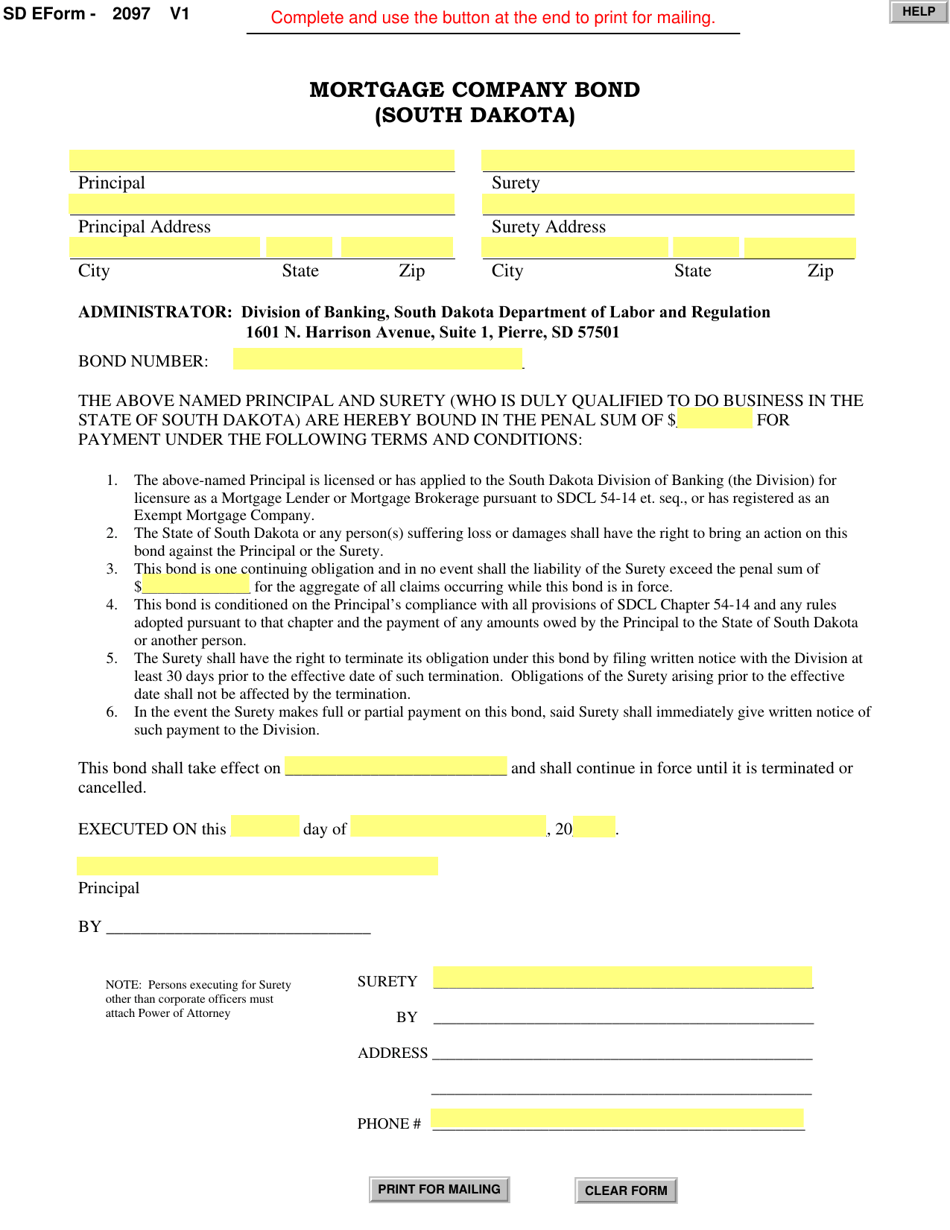

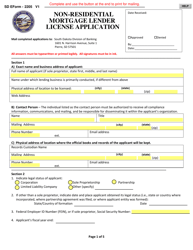

SD Form 2097 Mortgage Company Bond - South Dakota

What Is SD Form 2097?

This is a legal form that was released by the South Dakota Department of Labor & Regulation - a government authority operating within South Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SD Form 2097?

A: SD Form 2097 is the Mortgage Company Bond used in South Dakota.

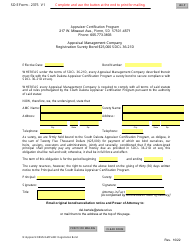

Q: What is a Mortgage Company Bond?

A: A Mortgage Company Bond is a type of surety bond required by mortgage companies to protect consumers.

Q: Who requires the SD Form 2097 Mortgage Company Bond?

A: The South Dakota Division of Banking requires mortgage companies to have the SD Form 2097 bond.

Q: What is the purpose of the SD Form 2097 Mortgage Company Bond?

A: The purpose of the bond is to provide financial protection to consumers in case a mortgage company engages in fraudulent or unethical activities.

Q: How much is the bond amount for the SD Form 2097 Mortgage Company Bond?

A: The bond amount is $50,000 for the SD Form 2097 Mortgage Company Bond.

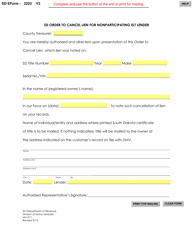

Q: How long does the SD Form 2097 Mortgage Company Bond need to be in effect?

A: The bond must be in effect for the entire duration of the mortgage company's licensing period.

Q: Are there any other requirements to obtain a Mortgage Company Bond in South Dakota?

A: Yes, aside from the bond, mortgage companies are also required to meet certain financial and licensing requirements set by the South Dakota Division of Banking.

Form Details:

- The latest edition provided by the South Dakota Department of Labor & Regulation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SD Form 2097 by clicking the link below or browse more documents and templates provided by the South Dakota Department of Labor & Regulation.