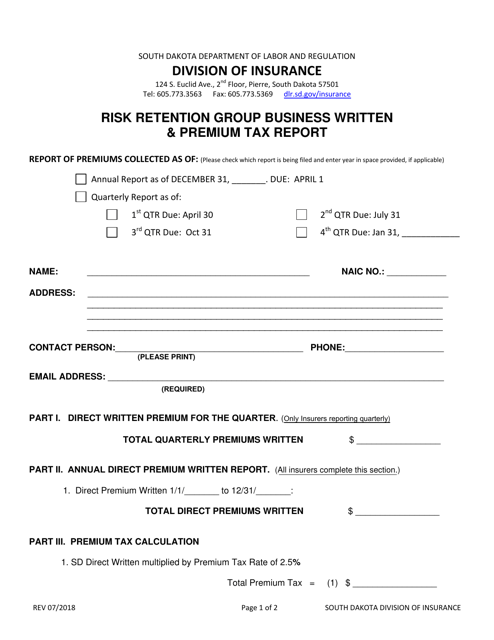

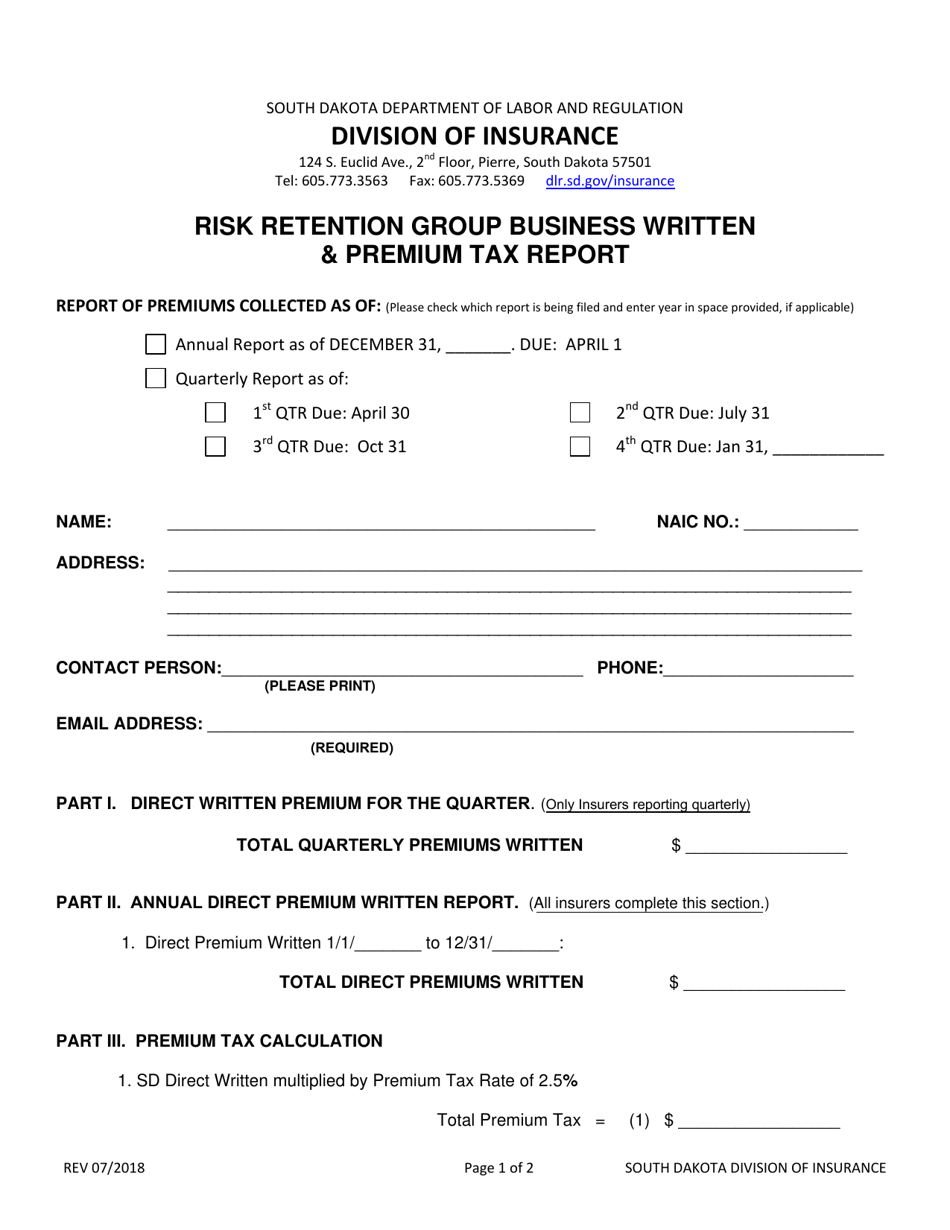

Risk Retention Group Business Written & Premium Tax Report - South Dakota

Risk Retention Group Business Written & Premium Tax Report is a legal document that was released by the South Dakota Department of Labor & Regulation - a government authority operating within South Dakota.

FAQ

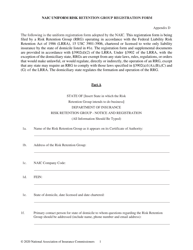

Q: What is a Risk Retention Group (RRG)?

A: A Risk Retention Group is an insurance company owned by its policyholders who share similar types of risks.

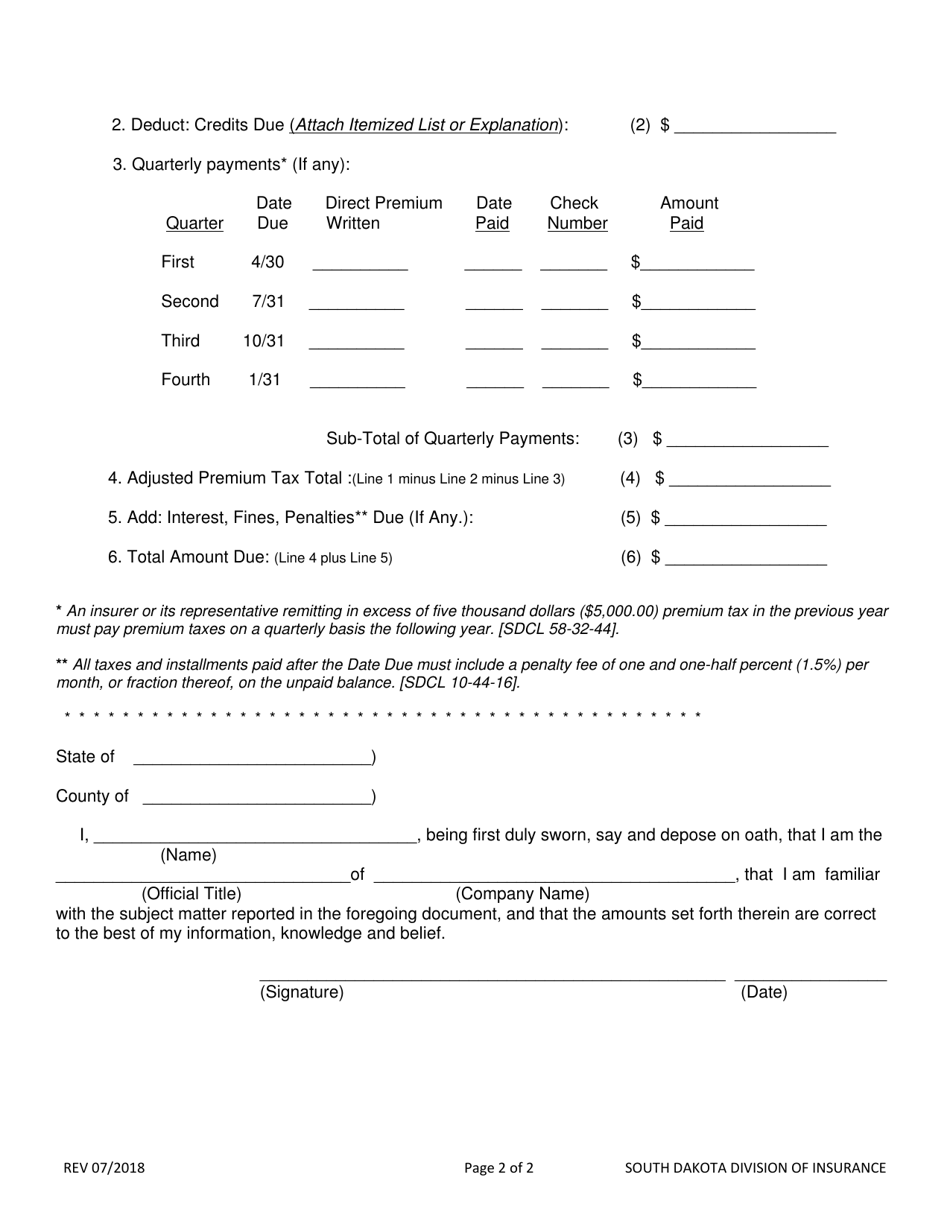

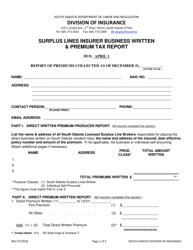

Q: What is the Risk Retention Group Business Written & Premium Tax Report?

A: The Risk Retention Group Business Written & Premium Tax Report is a report that RRGs in South Dakota are required to submit to the state detailing their written premiums and taxes.

Q: Who needs to file the Risk Retention Group Business Written & Premium Tax Report in South Dakota?

A: Risk Retention Groups operating in South Dakota are required to file this report.

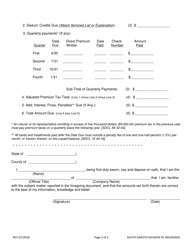

Q: What information is included in the report?

A: The report contains information about the RRG's written premiums, policyholders, taxes payable, and other related financial data.

Q: How often should the Risk Retention Group Business Written & Premium Tax Report be filed?

A: The report should be filed annually by March 1st.

Q: Are there any penalties for not filing the report or filing it late?

A: Yes, there may be penalties for failing to file the report or submitting it after the deadline. It is important to comply with the filing requirements to avoid penalties.

Q: Is there a specific form to use for the Risk Retention Group Business Written & Premium Tax Report?

A: Yes, South Dakota provides a specific form for this report, which should be used when submitting the required information.

Q: Can the report be filed electronically?

A: Yes, electronic filing is allowed and encouraged for the Risk Retention Group Business Written & Premium Tax Report in South Dakota.

Form Details:

- Released on July 1, 2018;

- The latest edition currently provided by the South Dakota Department of Labor & Regulation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the South Dakota Department of Labor & Regulation.