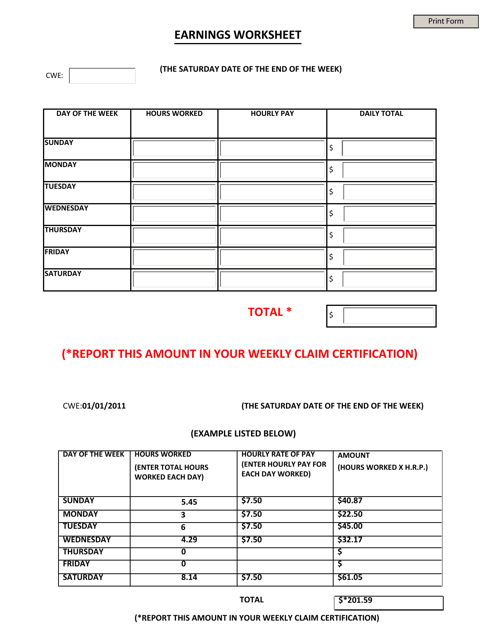

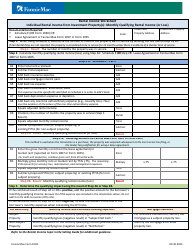

Earnings Worksheet - South Carolina

Earnings Worksheet is a legal document that was released by the South Carolina Department of Employment & Workforce - a government authority operating within South Carolina.

FAQ

Q: What is an earnings worksheet?

A: An earnings worksheet is a document used to calculate one's income and expenses.

Q: Why would I need an earnings worksheet?

A: You may need an earnings worksheet to get an overview of your income, track your expenses, or create a budget.

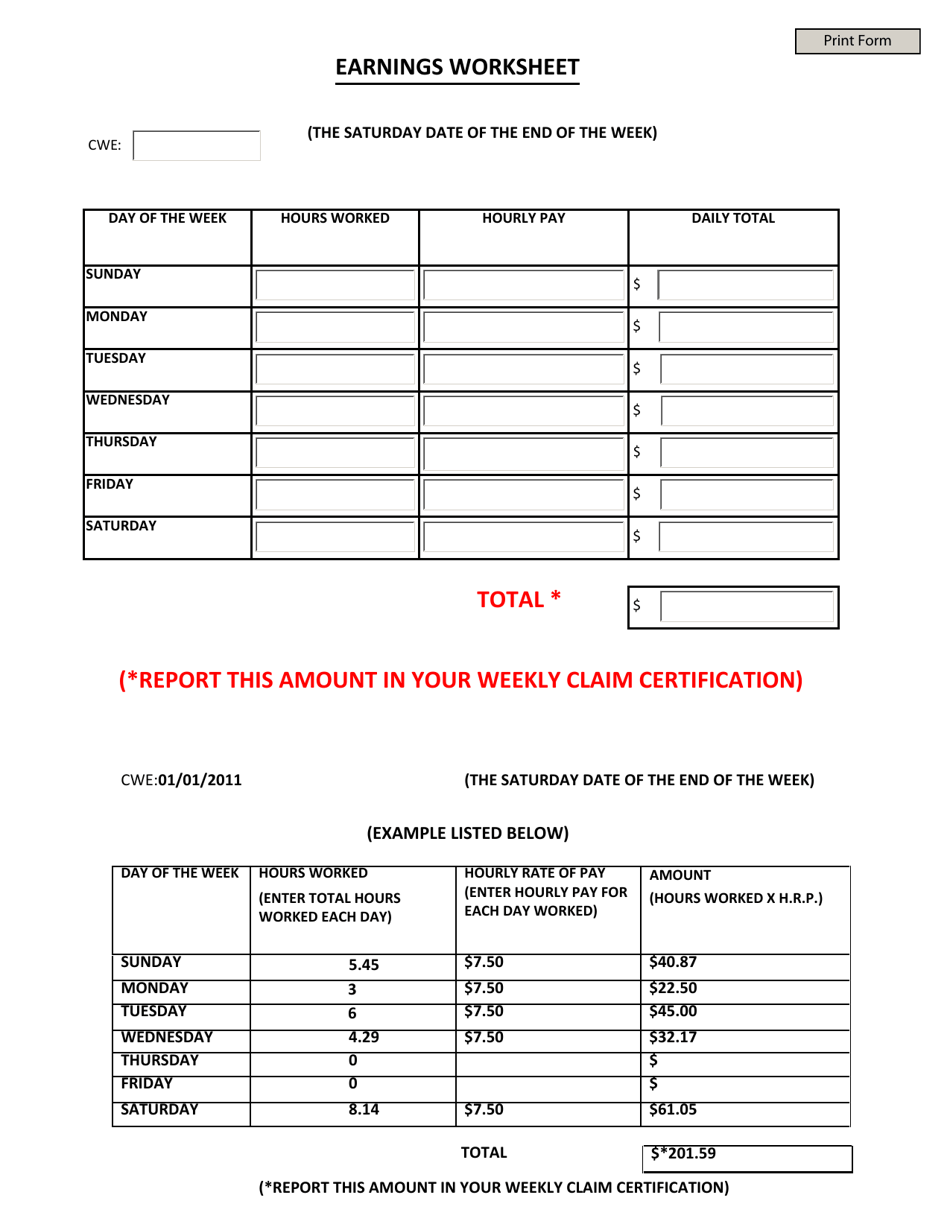

Q: How do I use an earnings worksheet?

A: To use an earnings worksheet, input your income sources and amounts, as well as your expenses. The worksheet will calculate your total income, total expenses, and the difference between the two.

Q: What should I include in my earnings worksheet?

A: In your earnings worksheet, include all sources of income, such as your salary, wages, tips, or rental income. Also include your expenses, such as rent, utilities, groceries, and transportation costs.

Q: Can an earnings worksheet help me save money?

A: Yes, an earnings worksheet can help you identify areas where you can cut expenses, increase your savings, or allocate funds towards specific financial goals.

Q: Is an earnings worksheet only for individuals?

A: No, an earnings worksheet can be used by individuals as well as households or families to track their income and expenses.

Q: How often should I update my earnings worksheet?

A: It is recommended to update your earnings worksheet on a regular basis, such as monthly or quarterly, to ensure accurate tracking of your income and expenses.

Q: Can I use an earnings worksheet for tax purposes?

A: An earnings worksheet can be a helpful tool when organizing your financial information for tax purposes, but you may need additional documentation when filing your taxes.

Form Details:

- Released on January 1, 2011;

- The latest edition currently provided by the South Carolina Department of Employment & Workforce;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the South Carolina Department of Employment & Workforce.