This version of the form is not currently in use and is provided for reference only. Download this version of

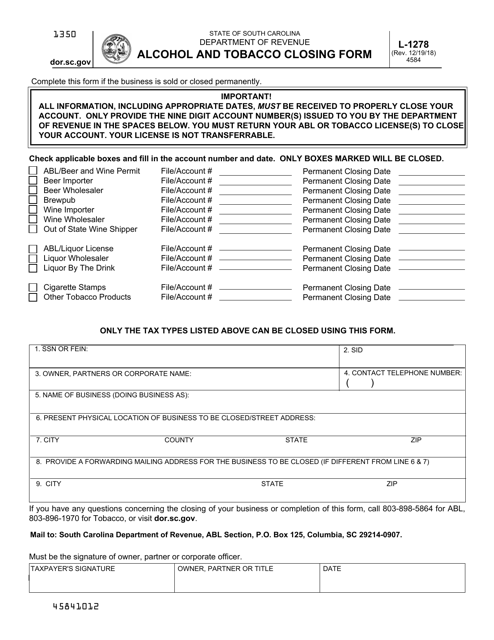

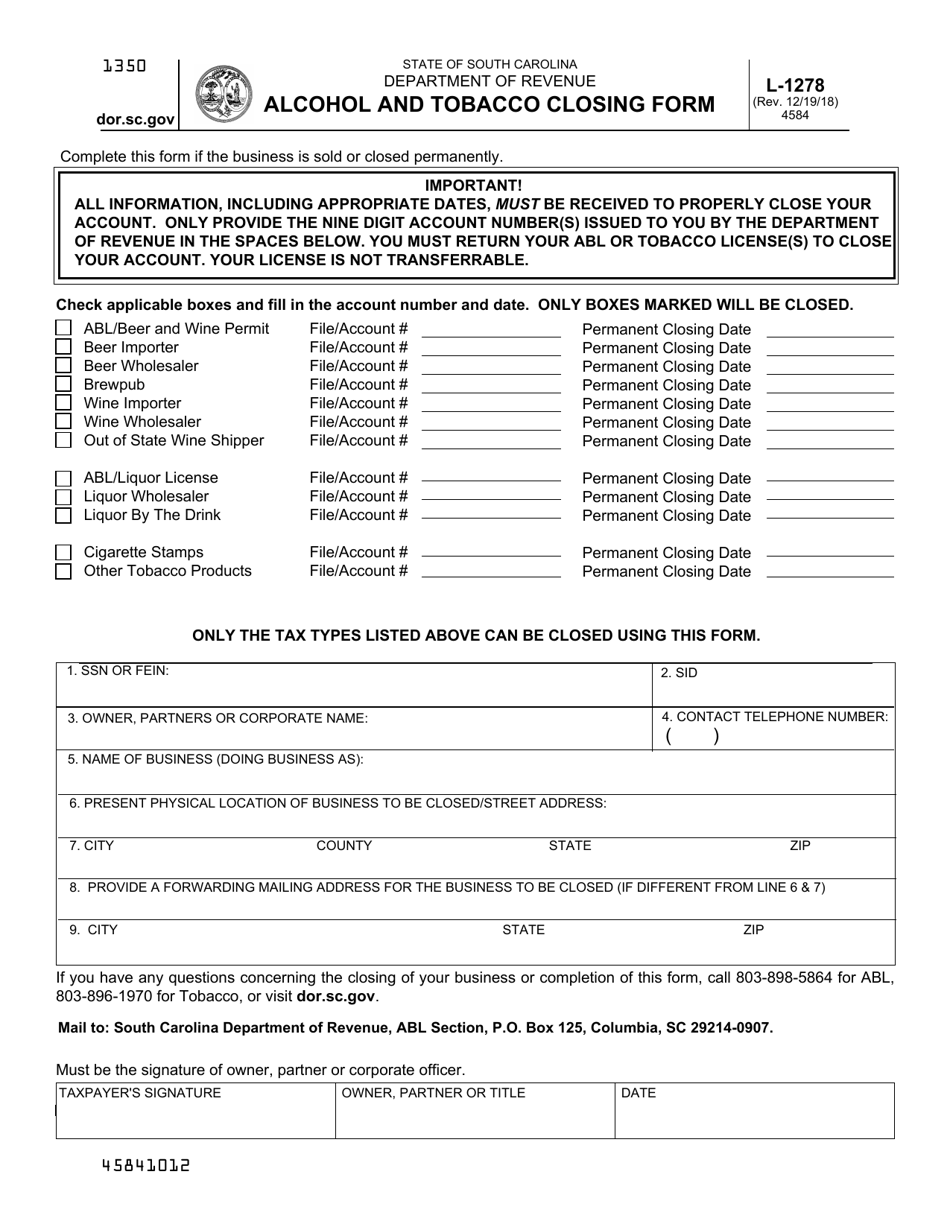

Form L-1278

for the current year.

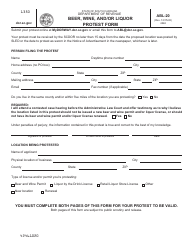

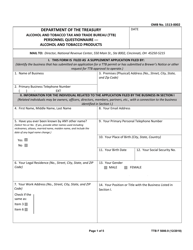

Form L-1278 Alcohol and Tobacco Closing Form - South Carolina

What Is Form L-1278?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form L-1278?

A: Form L-1278 is the Alcohol and Tobacco Closing Form used in South Carolina.

Q: Who needs to file Form L-1278?

A: Businesses that sell alcohol and tobacco products in South Carolina need to file Form L-1278.

Q: What is the purpose of Form L-1278?

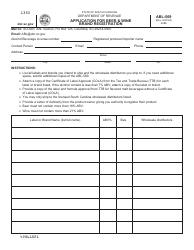

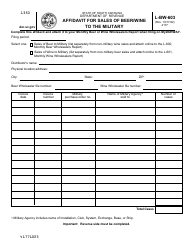

A: The purpose of Form L-1278 is to report the sales of alcohol and tobacco products for tax purposes.

Q: When is Form L-1278 due?

A: Form L-1278 is due on or before the 20th day of each month for the previous month's sales.

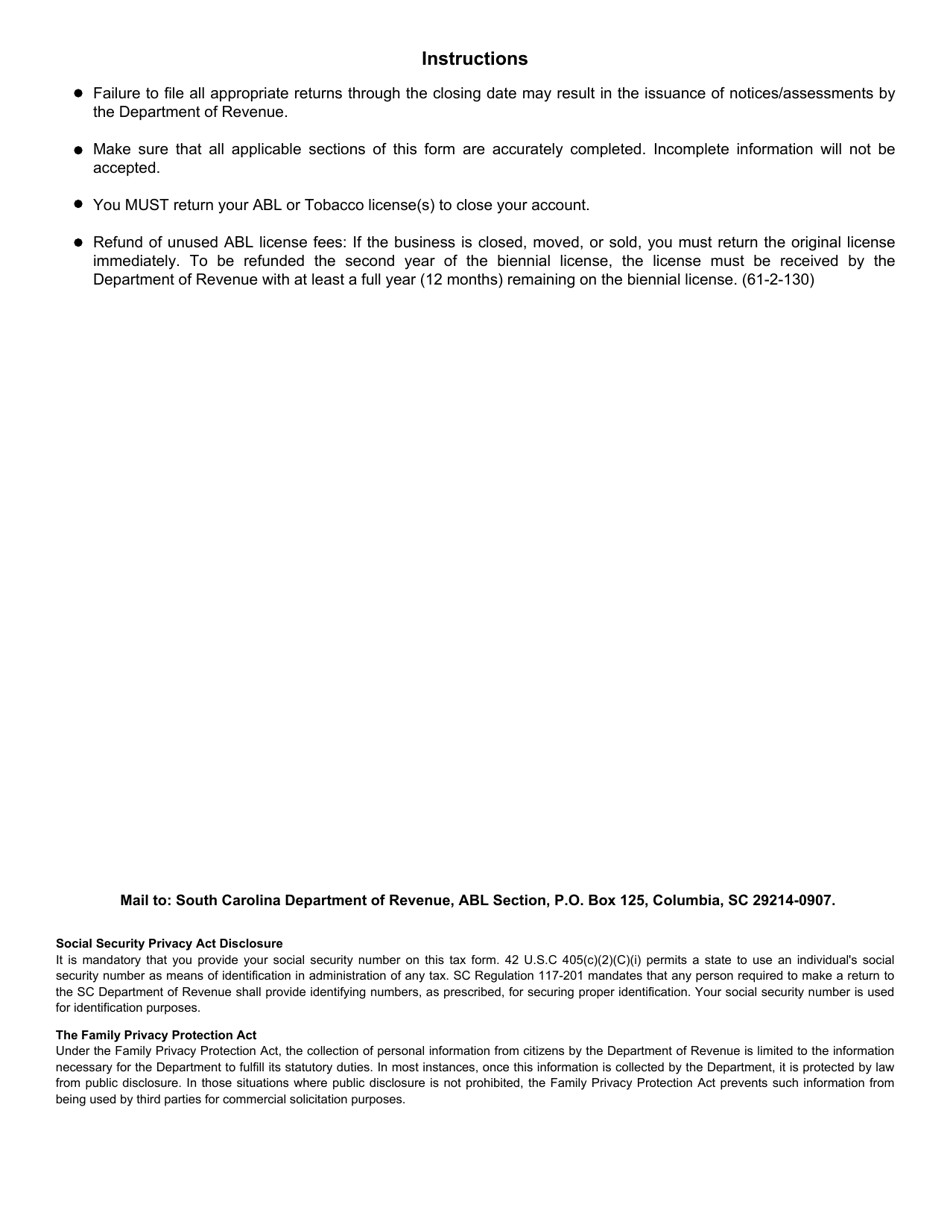

Q: Are there any penalties for not filing Form L-1278?

A: Yes, failure to file Form L-1278 or filing it late may result in penalties and interest.

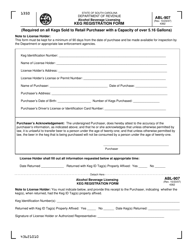

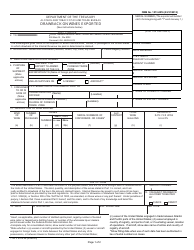

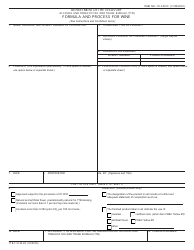

Q: What information do I need to complete Form L-1278?

A: You will need to provide information on the sales of alcohol and tobacco products, including quantities and prices.

Q: Are there any exemptions to filing Form L-1278?

A: Yes, certain small businesses may be exempt from filing Form L-1278. You should check with the South Carolina Department of Revenue for specific requirements.

Q: What should I do with Form L-1278 after filing?

A: After filing Form L-1278, you should keep a copy for your records and submit any required payments to the South Carolina Department of Revenue.

Form Details:

- Released on December 19, 2018;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form L-1278 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.