This version of the form is not currently in use and is provided for reference only. Download this version of

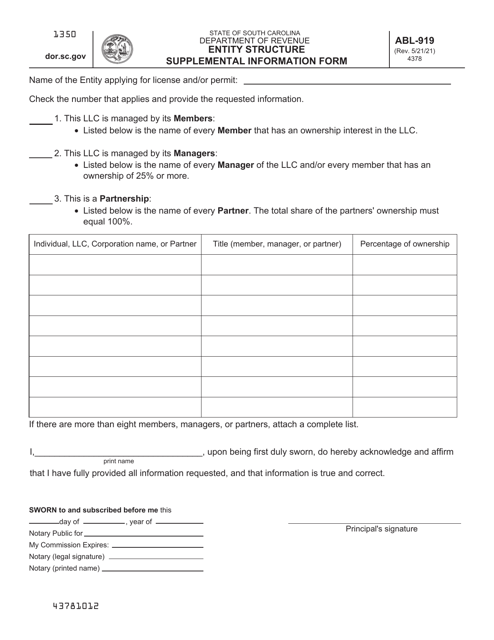

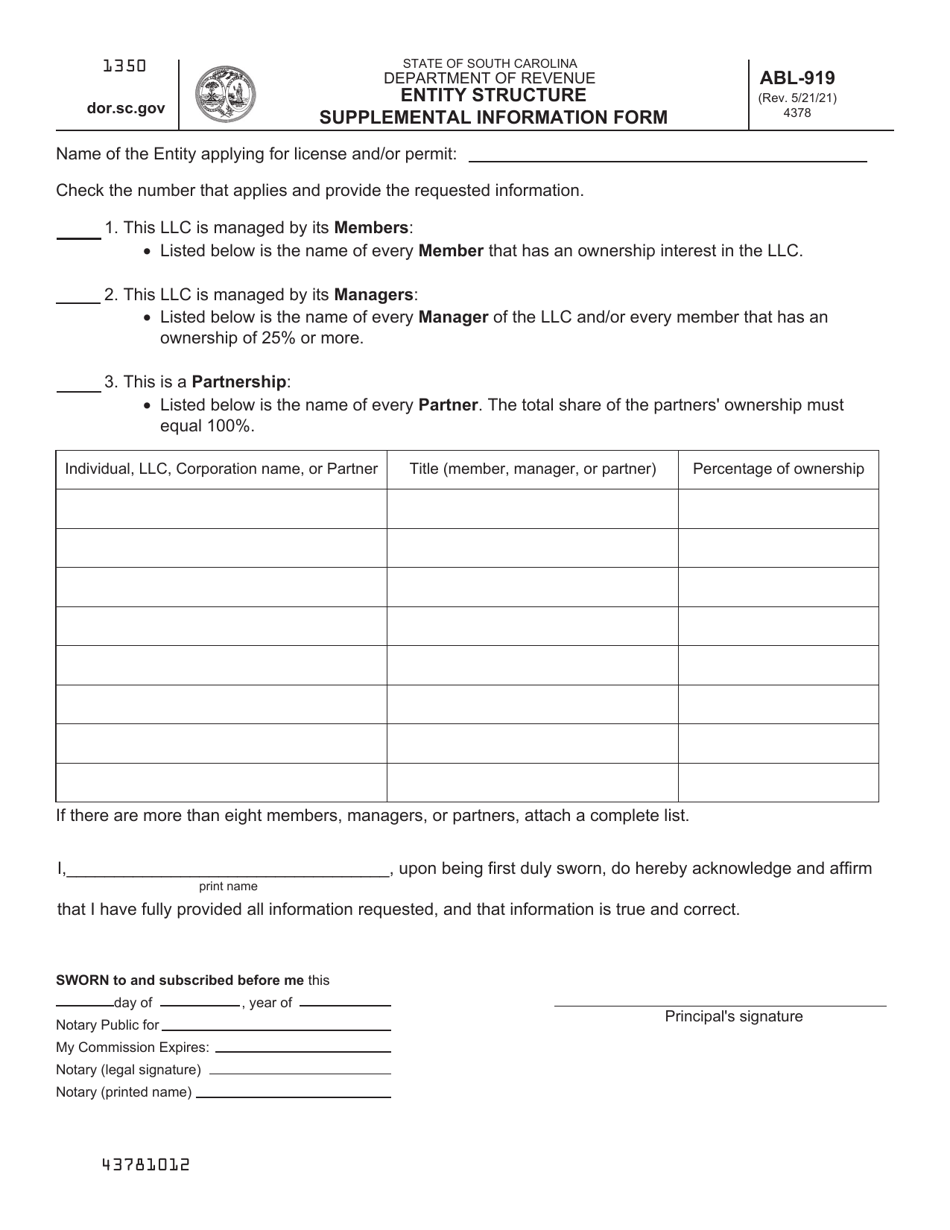

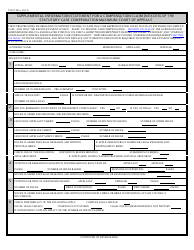

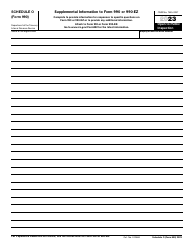

Form ABL-919

for the current year.

Form ABL-919 Entity Structure Supplemental Information Form - South Carolina

What Is Form ABL-919?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ABL-919?

A: Form ABL-919 is the Entity Structure Supplemental Information Form.

Q: What is the purpose of Form ABL-919?

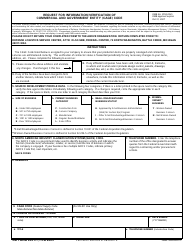

A: The purpose of Form ABL-919 is to provide supplemental information about the entity structure of a business in South Carolina.

Q: Who needs to fill out Form ABL-919?

A: Businesses operating in South Carolina need to fill out Form ABL-919.

Q: What information is required on Form ABL-919?

A: Form ABL-919 requires information about the entity structure of the business, including the legal name, type of entity, and ownership information.

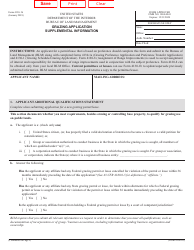

Q: Is there a deadline for submitting Form ABL-919?

A: Yes, businesses must submit Form ABL-919 by the due date specified by the South Carolina Department of Revenue.

Q: Are there any fees associated with Form ABL-919?

A: No, there are no fees associated with submitting Form ABL-919.

Q: What happens if I don't submit Form ABL-919?

A: Failure to submit Form ABL-919 may result in penalties or consequences from the South Carolina Department of Revenue.

Q: Can I make changes to Form ABL-919 after submitting it?

A: If you need to make changes to Form ABL-919 after submitting it, you should contact the South Carolina Department of Revenue for further instructions.

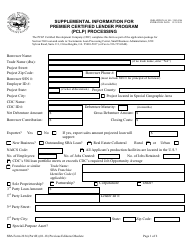

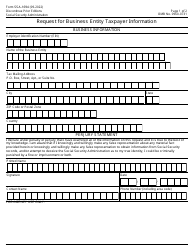

Form Details:

- Released on May 21, 2021;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ABL-919 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.