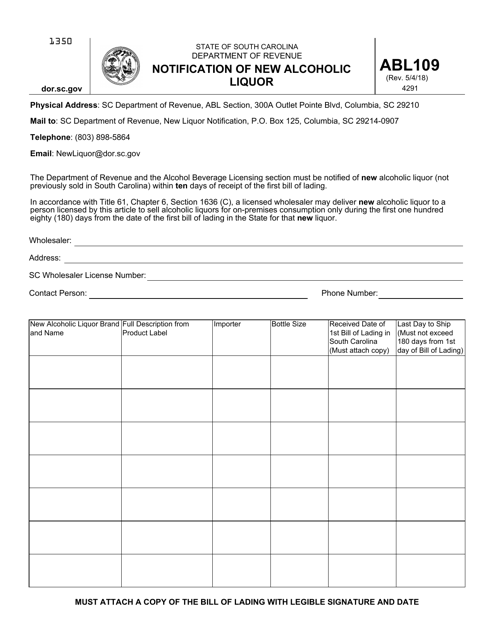

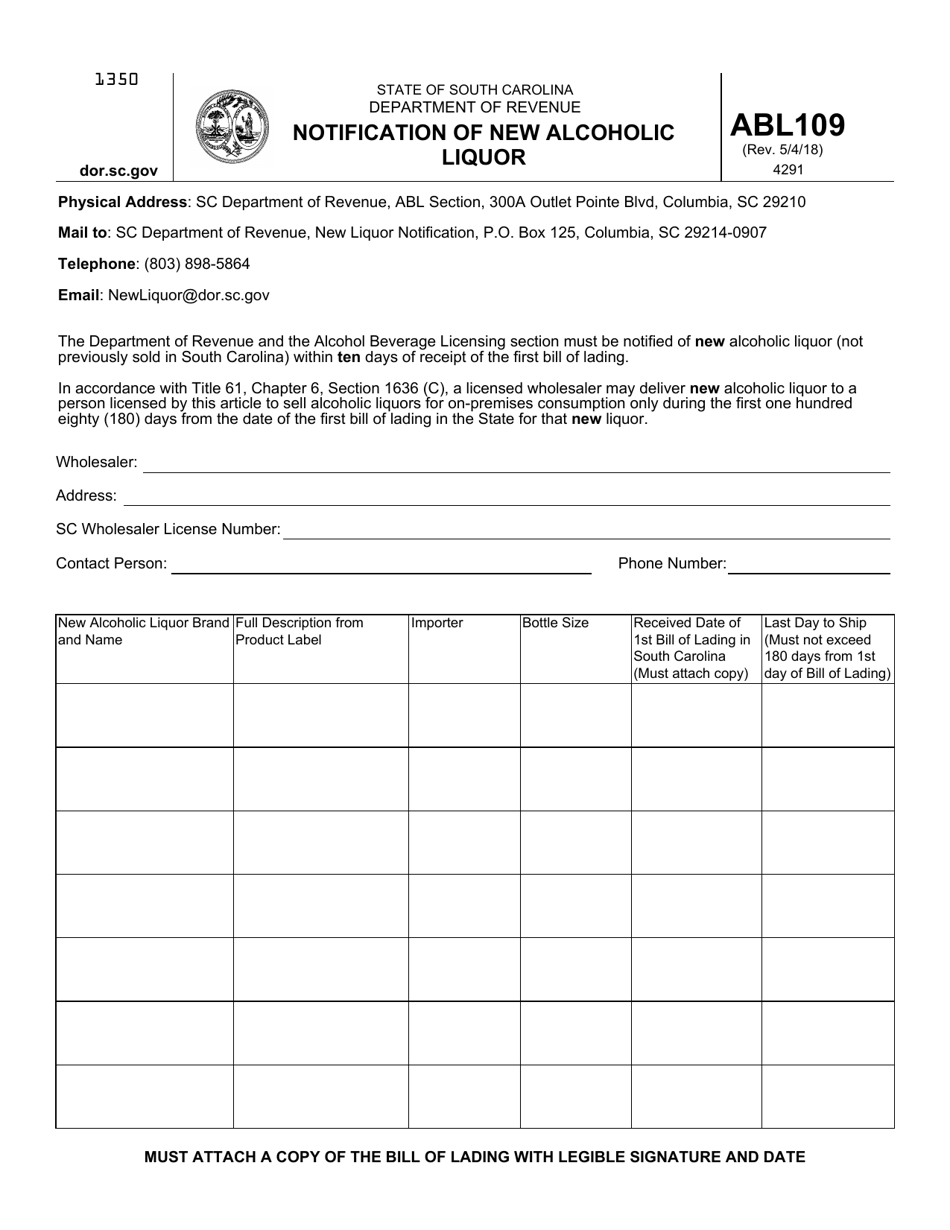

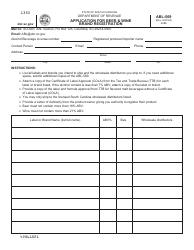

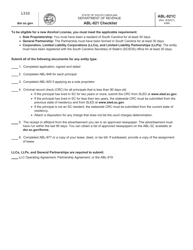

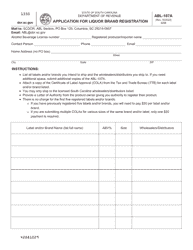

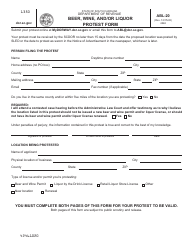

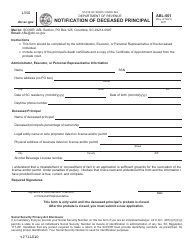

Form ABL-109 Notification of New Alcoholic Liquor - South Carolina

What Is Form ABL-109?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ABL-109?

A: Form ABL-109 is a notification form for new alcoholic liquor in South Carolina.

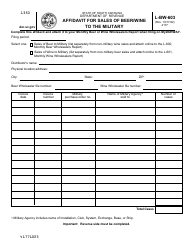

Q: Who needs to fill out Form ABL-109?

A: Any individual or business that wants to notify the State of South Carolina about new alcoholic liquor needs to fill out Form ABL-109.

Q: What information is required on Form ABL-109?

A: Form ABL-109 requires information such as the name and address of the business, the type of alcoholic liquor, and the anticipated opening date.

Q: Do I need to pay a fee to submit Form ABL-109?

A: No, there is no fee required to submit Form ABL-109.

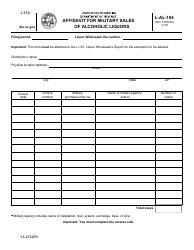

Q: When do I need to submit Form ABL-109?

A: Form ABL-109 should be submitted at least 20 days before the anticipated opening date of the business.

Q: What happens after I submit Form ABL-109?

A: After you submit Form ABL-109, the South Carolina Department of Revenue will review the information and notify you if any additional steps are required.

Q: Is Form ABL-109 only required for new businesses?

A: Yes, Form ABL-109 is specifically for notifying the state about new alcoholic liquor businesses in South Carolina.

Q: What should I do if I have more questions about Form ABL-109?

A: If you have more questions about Form ABL-109, you can contact the South Carolina Department of Revenue for assistance.

Form Details:

- Released on May 4, 2018;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ABL-109 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.