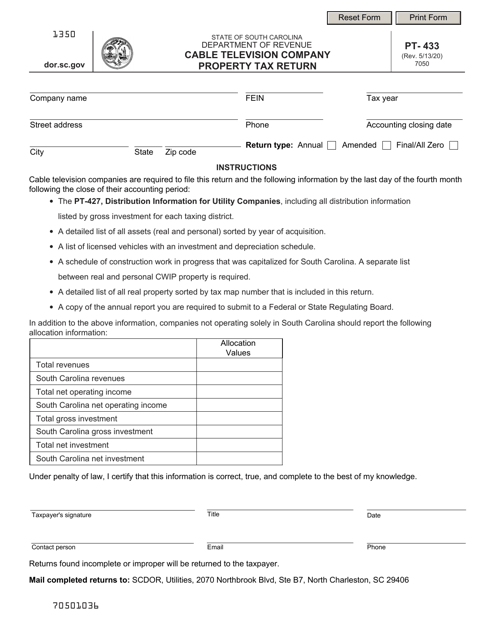

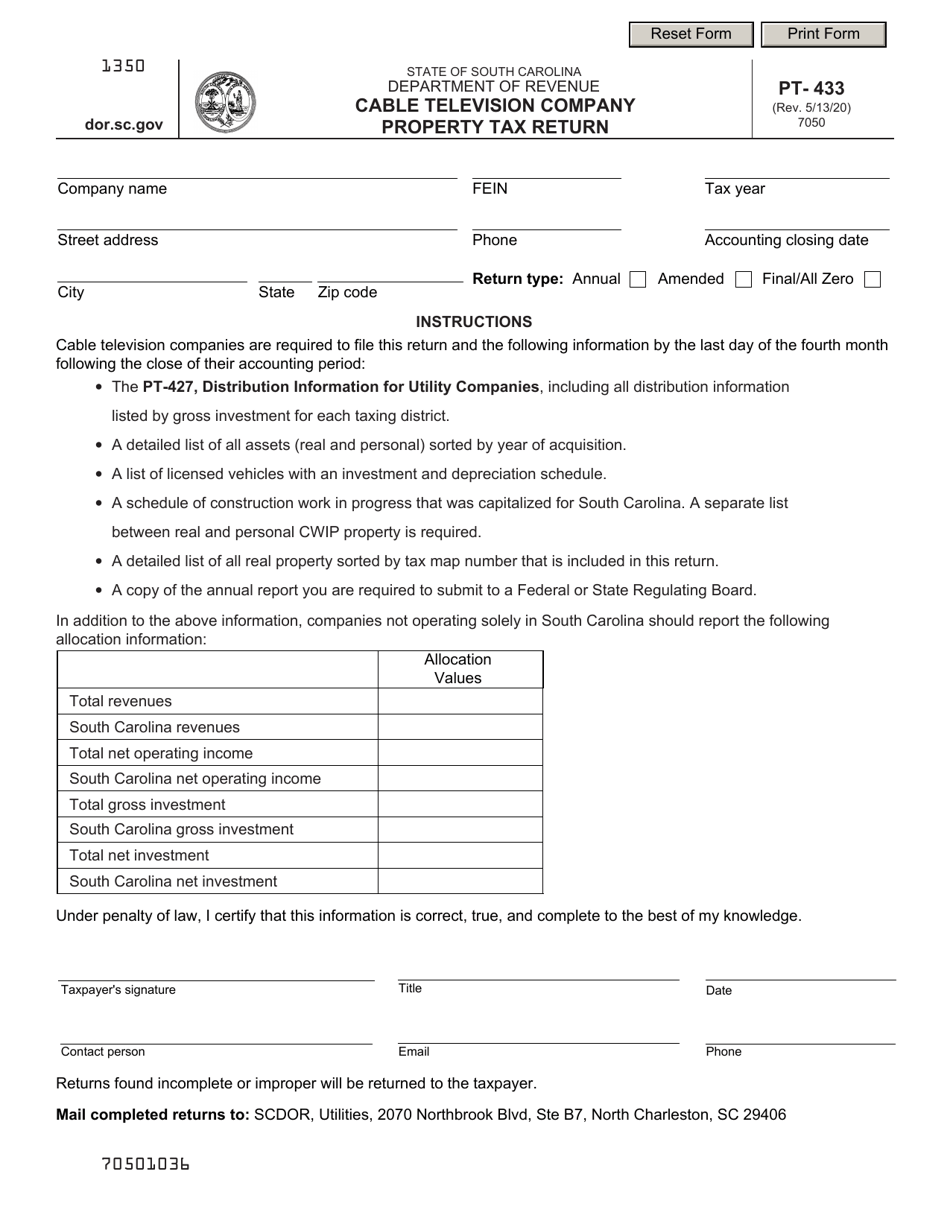

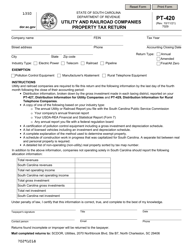

Form PT-433 Cable Television Company Property Tax Return - South Carolina

What Is Form PT-433?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT-433?

A: Form PT-433 is the Cable Television Company Property Tax Return specifically for South Carolina.

Q: Who needs to file Form PT-433?

A: Cable television companies in South Carolina need to file Form PT-433.

Q: What is the purpose of Form PT-433?

A: The purpose of Form PT-433 is to report property owned or leased by cable television companies in South Carolina for tax assessment purposes.

Q: How often do I need to file Form PT-433?

A: Form PT-433 needs to be filed annually.

Q: What information is required on Form PT-433?

A: Form PT-433 requires information about the cable television company as well as a detailed listing of the property owned or leased by the company.

Q: When is the deadline to file Form PT-433?

A: The deadline to file Form PT-433 is determined by the South Carolina Department of Revenue and can vary each year, so it is important to check for the current year's deadline.

Q: What happens if I don't file Form PT-433?

A: Failure to file Form PT-433 may result in penalties or fines imposed by the South Carolina Department of Revenue.

Q: Are there any exemptions for cable television company property tax in South Carolina?

A: Yes, there are certain exemptions available for cable television company property tax in South Carolina. It is recommended to consult the South Carolina Department of Revenue or a tax professional for more information.

Form Details:

- Released on May 13, 2020;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PT-433 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.