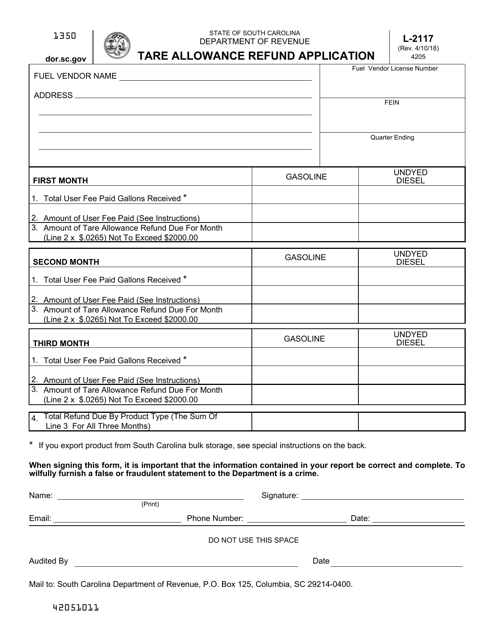

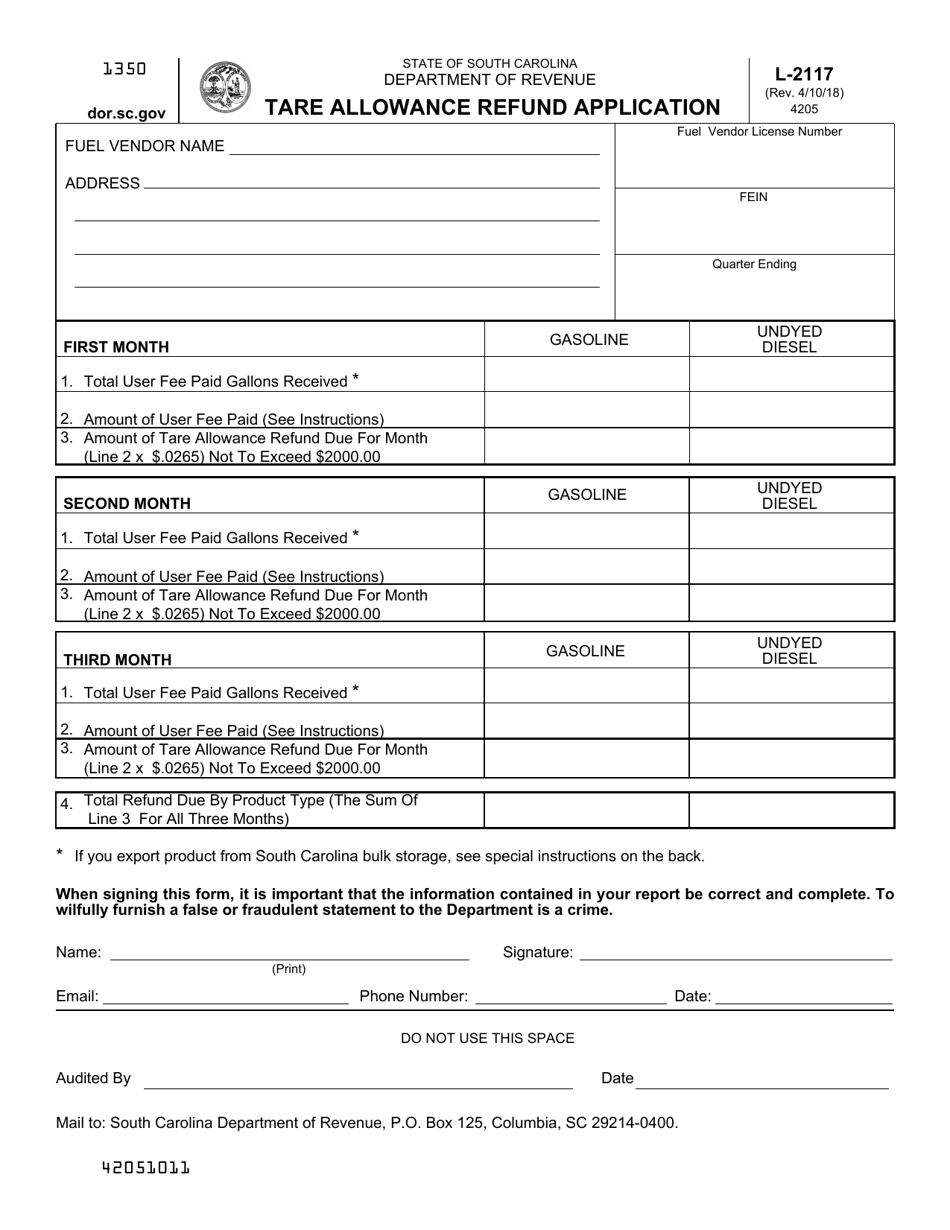

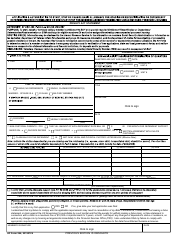

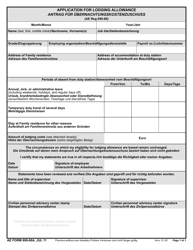

Form L-2117 Tare Allowance Refund Application - South Carolina

What Is Form L-2117?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

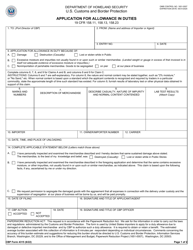

Q: What is Form L-2117?

A: Form L-2117 is the Tare Allowance Refund Application.

Q: What is a tare allowance?

A: A tare allowance is a refund for excess weight on commercial motor vehicles.

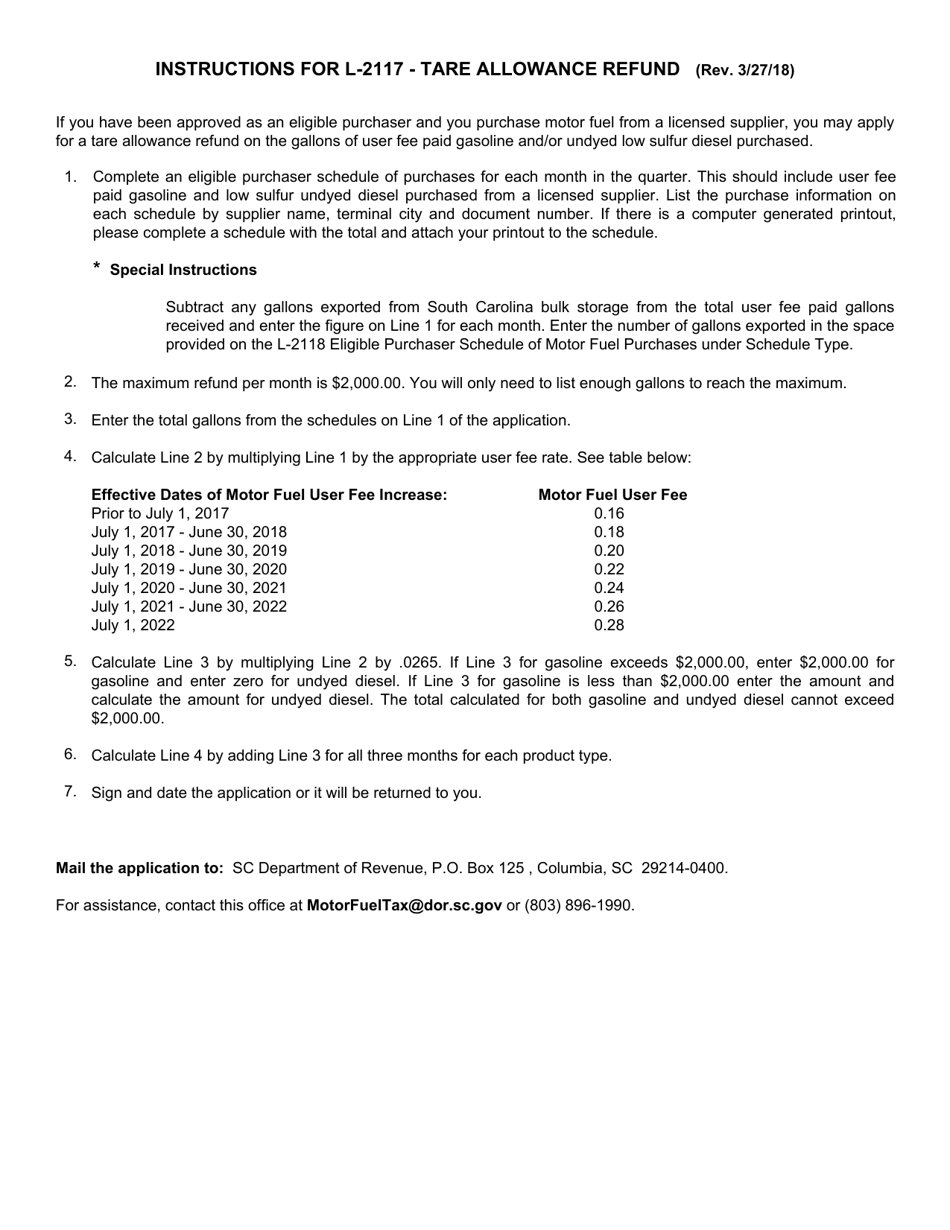

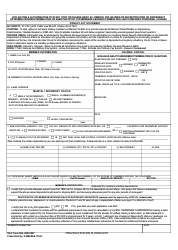

Q: Who can apply for a tare allowance refund?

A: Any person who operates a commercial motor vehicle in South Carolina and has paid a tare allowance fee can apply for a refund.

Q: What information is required on Form L-2117?

A: You need to provide the vehicle information, tare allowance fees paid, and supporting documentation.

Q: What is the deadline to submit Form L-2117?

A: The application must be submitted within one year from the date the tare allowance fee was paid.

Q: How long does it take to process the refund?

A: It may take up to eight weeks to process the refund once the completed application is received.

Q: What if my application for a tare allowance refund is denied?

A: If your application is denied, you can request a hearing to appeal the decision.

Q: Are there any fees associated with the tare allowance refund application?

A: No, there is no fee to submit the tare allowance refund application.

Form Details:

- Released on April 10, 2018;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form L-2117 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.