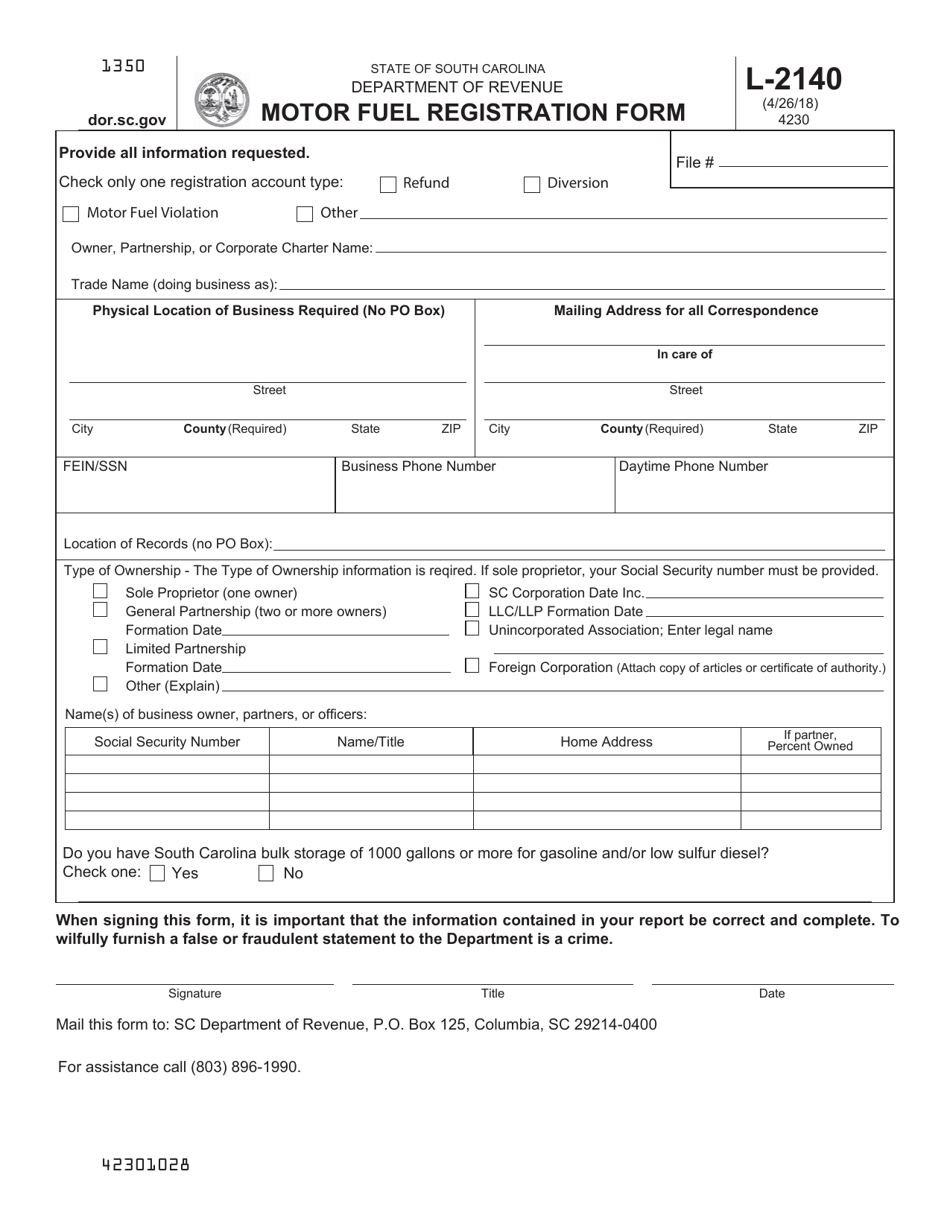

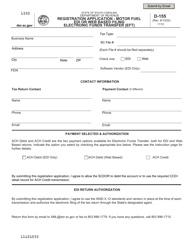

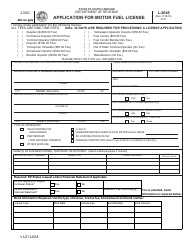

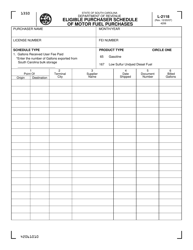

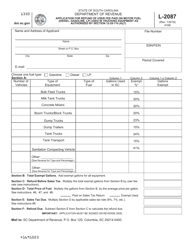

Form L-2140 Motor Fuel Registration Form - South Carolina

What Is Form L-2140?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form L-2140?

A: Form L-2140 is the Motor Fuel Registration Form.

Q: What is the purpose of Form L-2140?

A: The purpose of Form L-2140 is to register for motor fueltax purposes in South Carolina.

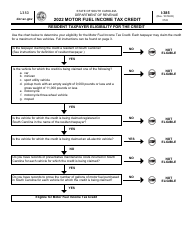

Q: Who needs to fill out Form L-2140?

A: Anyone who wants to engage in selling or distributing motor fuel in South Carolina needs to fill out Form L-2140.

Q: Are there any fees associated with Form L-2140?

A: Yes, there is a registration fee of $100 for each qualified fuel supplier location.

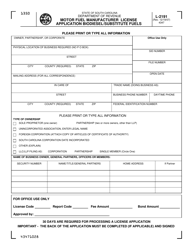

Q: What information is required on Form L-2140?

A: Form L-2140 requires information about the business, owners, types of fuel sold, and other related details.

Q: When is Form L-2140 due?

A: Form L-2140 should be submitted at least 10 days before engaging in selling or distributing motor fuel in South Carolina.

Q: Is there a penalty for late submission of Form L-2140?

A: Yes, there is a penalty for late submission, and it may result in the suspension or revocation of your registration.

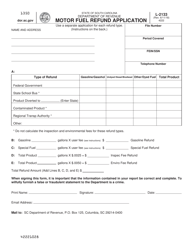

Q: Are there any exemptions to filing Form L-2140?

A: Yes, certain entities may be exempt from filing Form L-2140. Refer to the instructions or contact the Department of Revenue for more details.

Form Details:

- Released on April 26, 2018;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form L-2140 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.