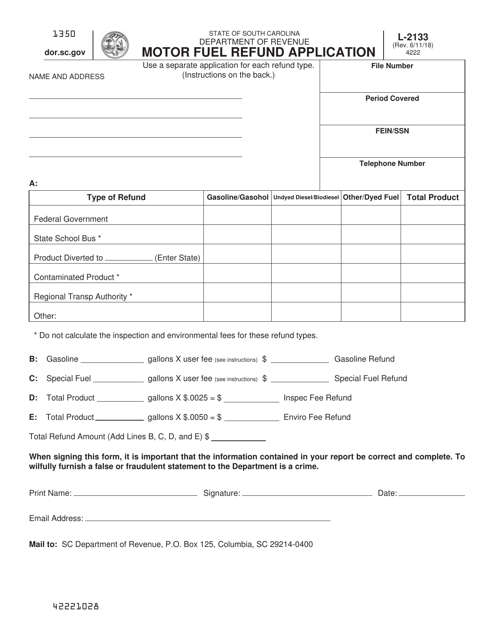

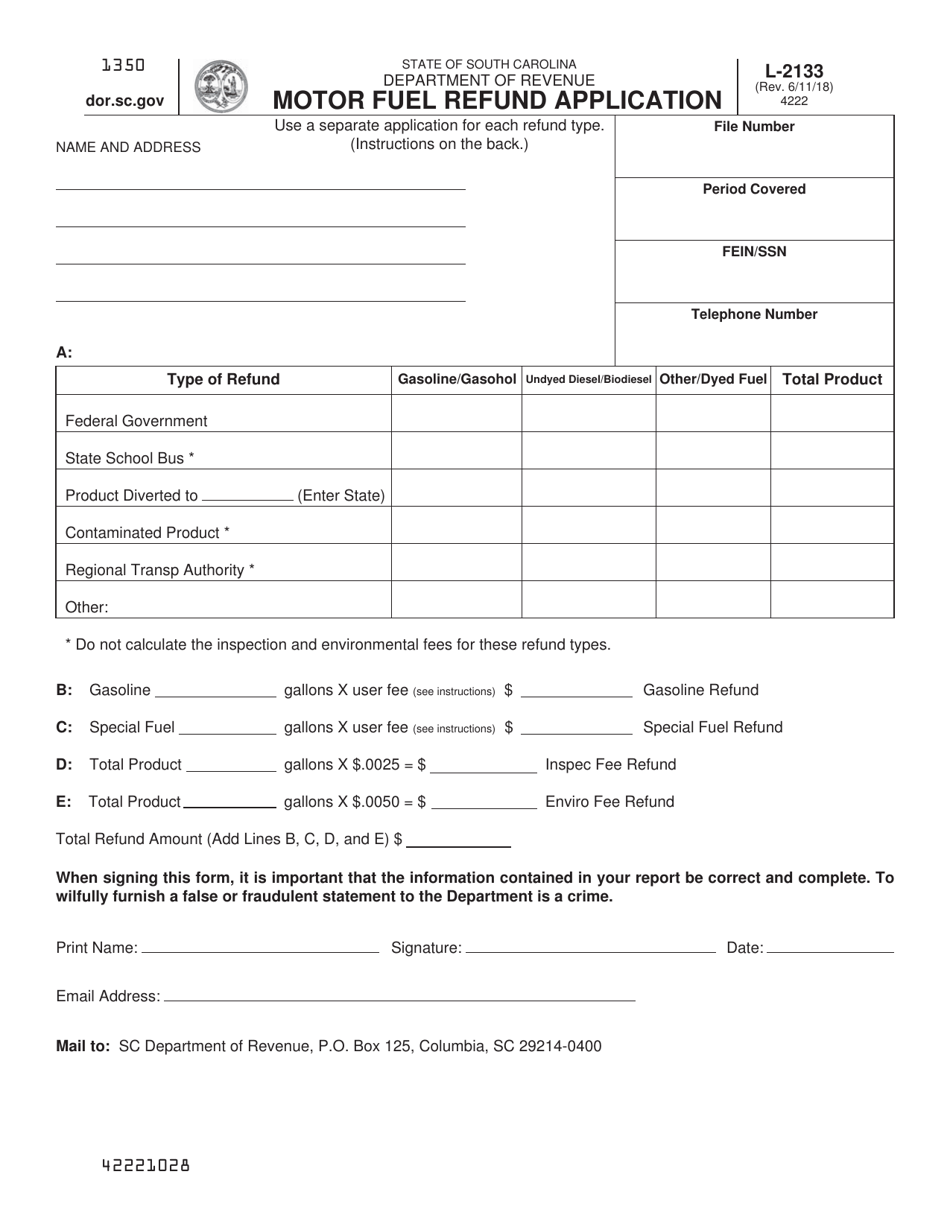

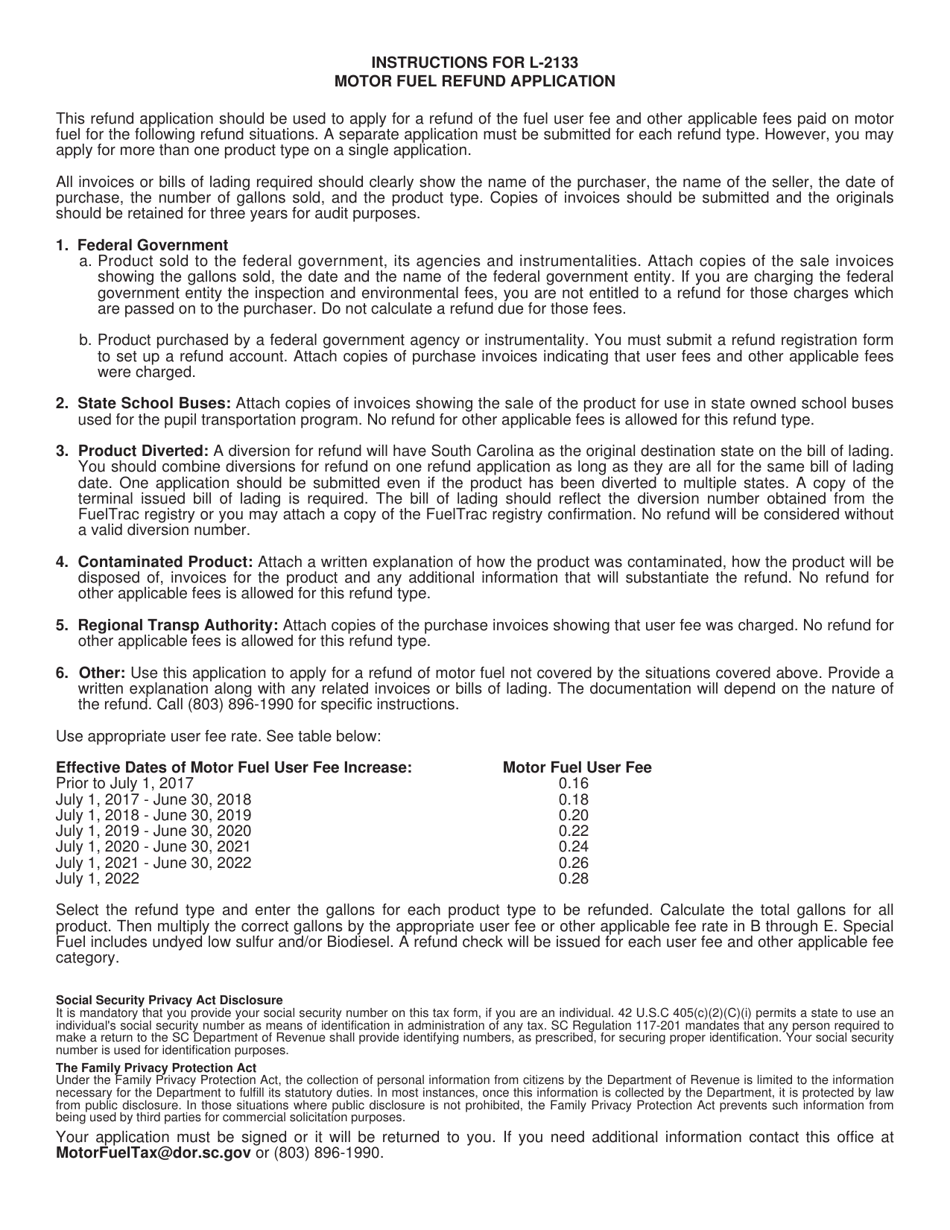

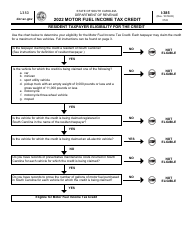

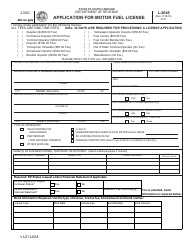

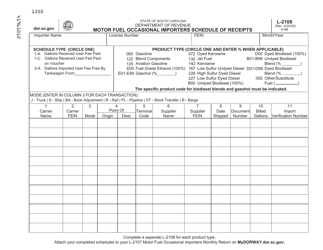

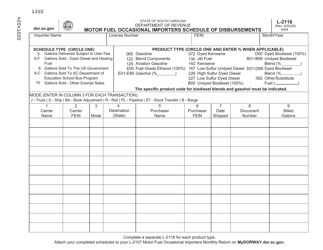

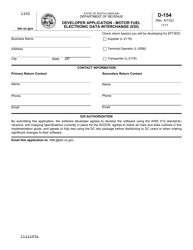

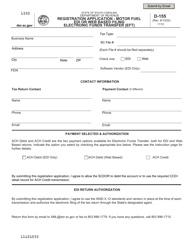

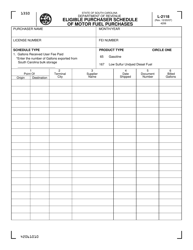

Form L-2133 Motor Fuel Refund Application - South Carolina

What Is Form L-2133?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form L-2133?

A: Form L-2133 is the Motor Fuel Refund Application specific to South Carolina.

Q: Who can use Form L-2133?

A: Individuals or businesses who have purchased motor fuel in South Carolina and meet the eligibility criteria can use Form L-2133 to apply for a refund.

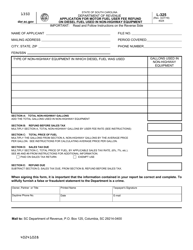

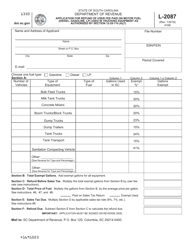

Q: What is the purpose of Form L-2133?

A: The purpose of Form L-2133 is to request a refund of the South Carolina motor fuel excise tax paid on fuel purchased for non-highway use.

Q: What information do I need to complete Form L-2133?

A: To complete Form L-2133, you will need to provide your personal or business information, details of the motor fuel purchases, and supporting documentation.

Q: What are the eligibility criteria for motor fuel refund in South Carolina?

A: The eligibility criteria for motor fuel refund in South Carolina include using the fuel exclusively for non-highway purposes and timely filing the refund application.

Q: Is there a deadline for submitting Form L-2133?

A: Yes, there is a deadline for submitting Form L-2133. Make sure to check the instructions or contact the Department of Revenue for the specific deadline.

Form Details:

- Released on June 11, 2018;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form L-2133 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.