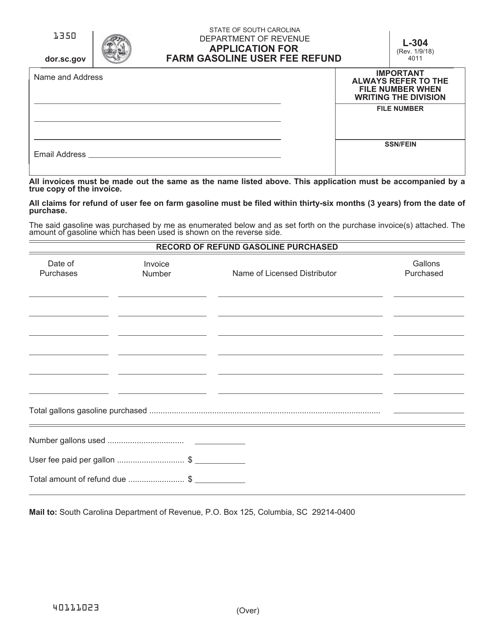

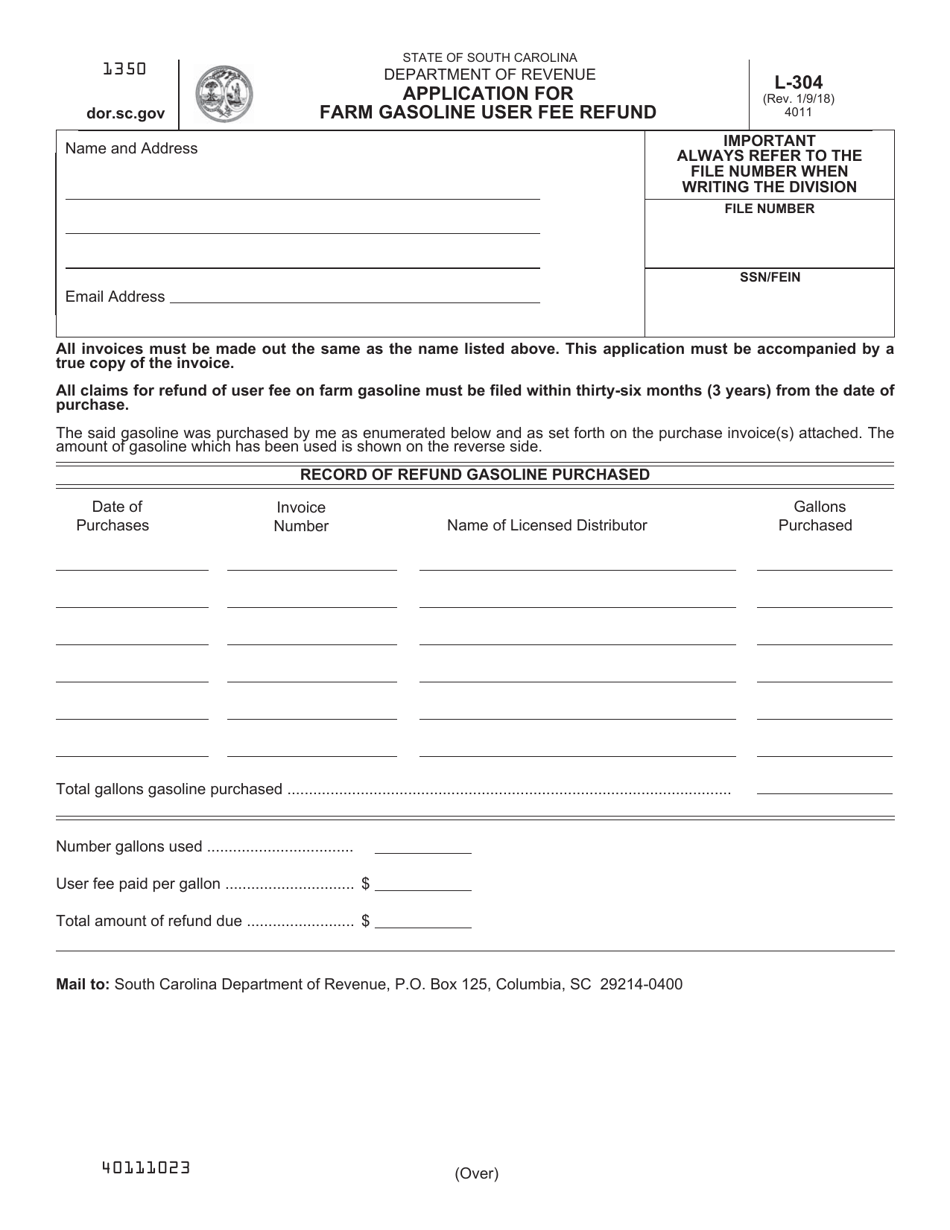

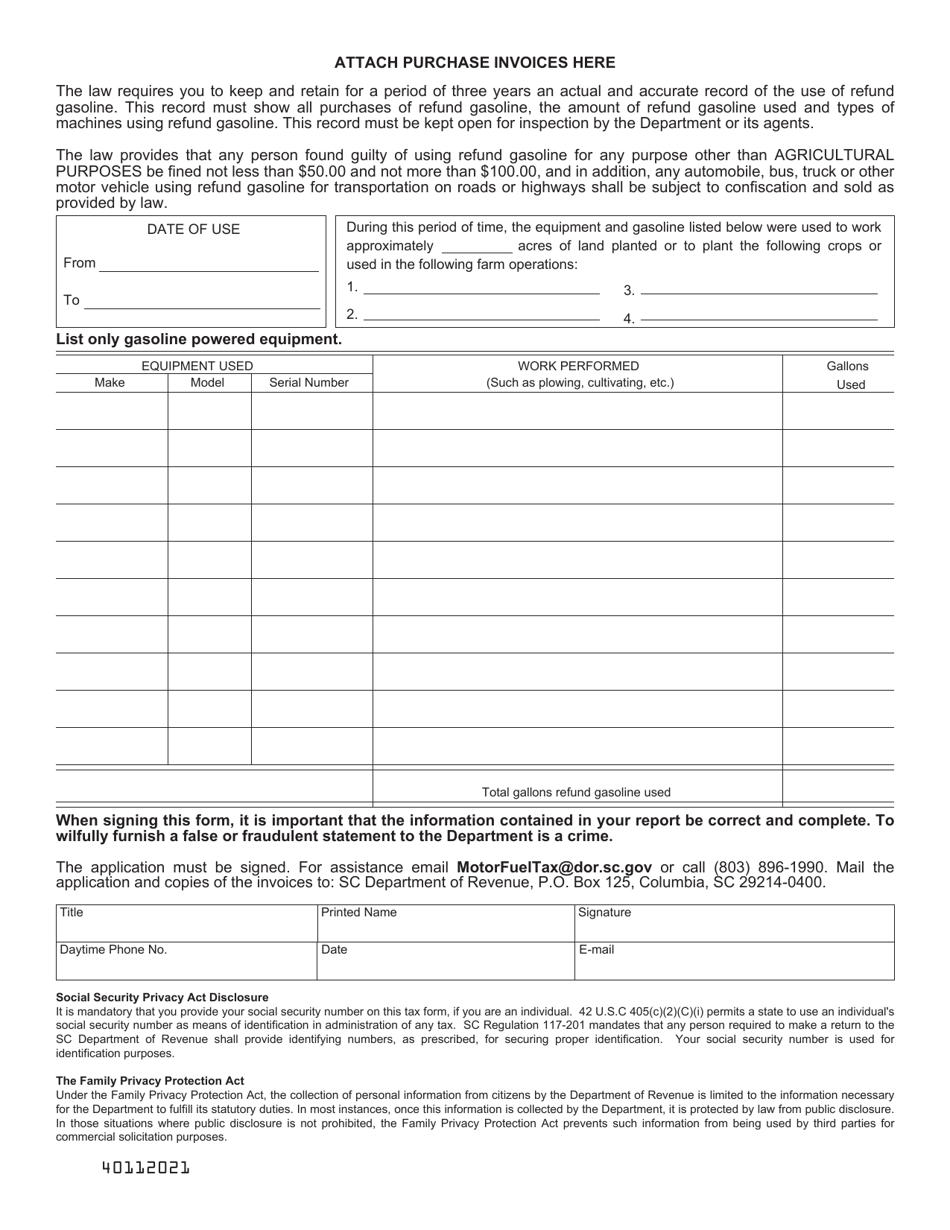

Form L-304 Application for Farm Gasoline User Fee Refund - South Carolina

What Is Form L-304?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form L-304?

A: Form L-304 is an application for Farm Gasoline User Fee Refund in South Carolina.

Q: Who can use Form L-304?

A: Farmers in South Carolina who use gasoline for certain farm purposes can use Form L-304.

Q: What is the purpose of Form L-304?

A: The purpose of Form L-304 is to apply for a refund of the gasoline user fee paid by farmers in South Carolina.

Q: What are the requirements to use Form L-304?

A: To use Form L-304, you must be a farmer in South Carolina and use gasoline for farm purposes that qualify for a refund.

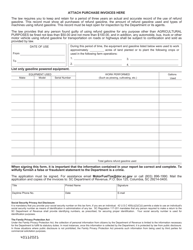

Q: How do I fill out Form L-304?

A: You need to provide your personal information, details about your farm and gasoline usage, and calculate the refund amount.

Q: Is there a deadline for submitting Form L-304?

A: Yes, Form L-304 must be submitted within three years from the date of the gasoline purchase.

Form Details:

- Released on January 9, 2018;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form L-304 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.