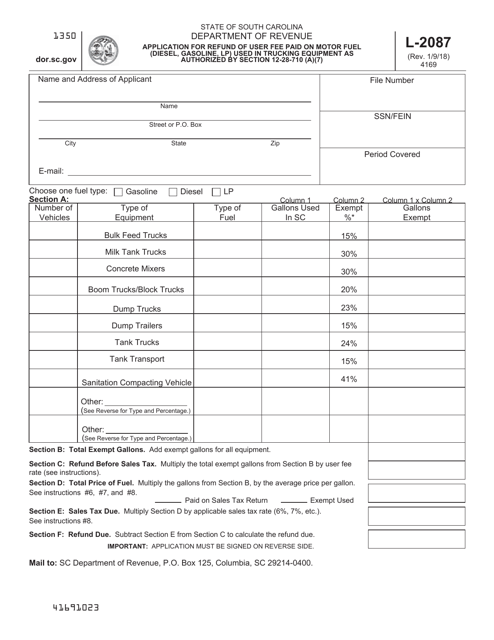

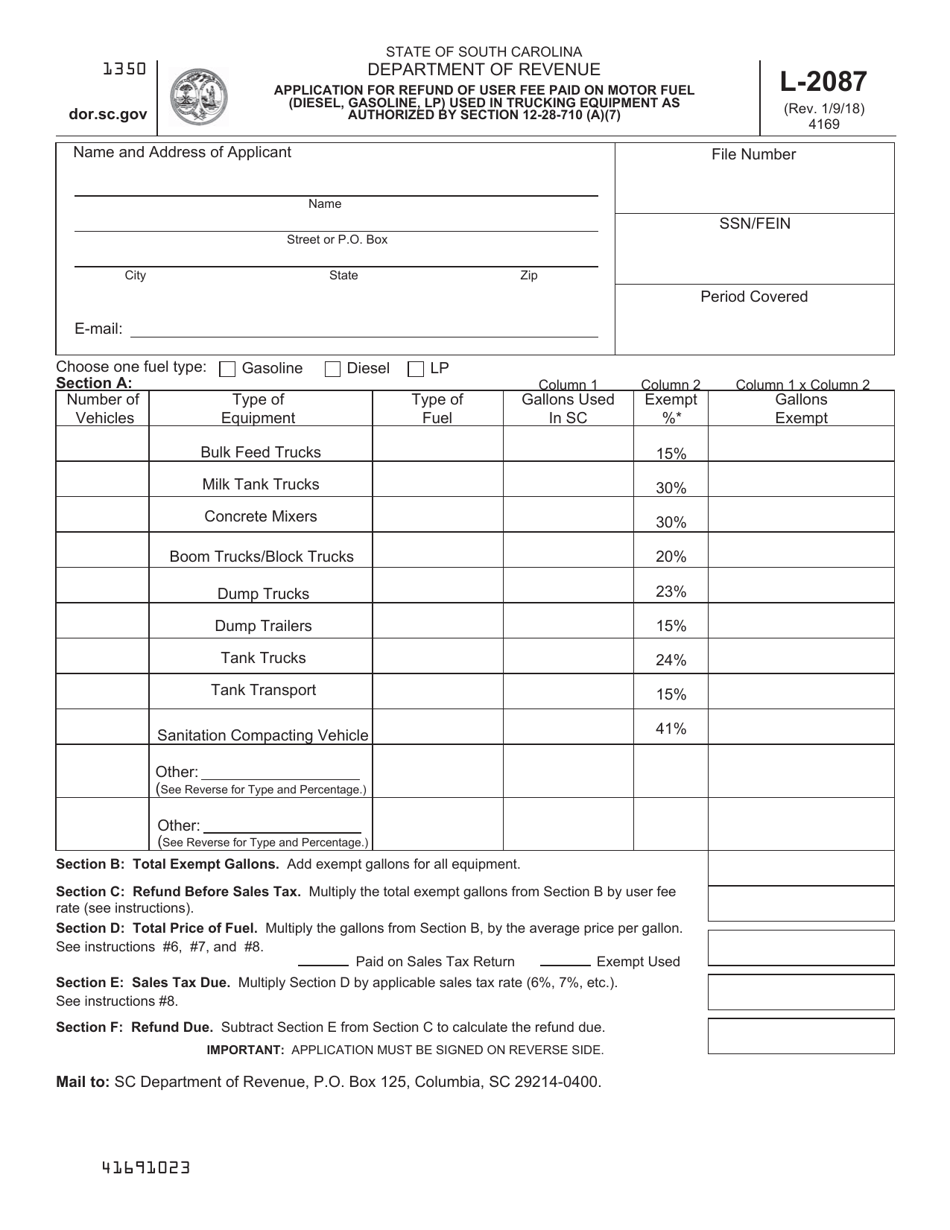

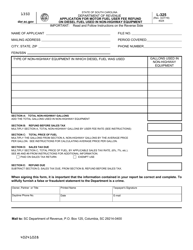

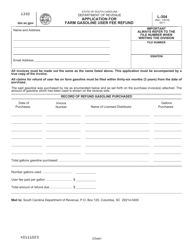

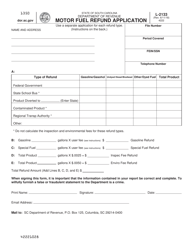

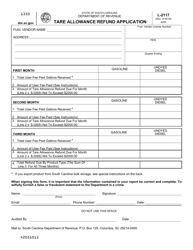

Form L-2087 Application for Refund of User Fee Paid on Motor Fuel (Diesel, Gasoline, Lp) Used in Trucking Equipment as Authorized by Section 12-28-710 (A)(7) - South Carolina

What Is Form L-2087?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form L-2087?

A: Form L-2087 is the Application for Refund of User Fee Paid on Motor Fuel (Diesel, Gasoline, Lp) Used in Trucking Equipment as Authorized by Section 12-28-710 (A)(7) in South Carolina.

Q: What is the purpose of Form L-2087?

A: The purpose of Form L-2087 is to apply for a refund of the user fee paid on motor fuel used in trucking equipment in South Carolina.

Q: Who can use Form L-2087?

A: Trucking companies or individuals who have paid the user fee on motor fuel used in their trucking equipment can use Form L-2087 to apply for a refund.

Q: What is the user fee for motor fuel in South Carolina?

A: The user fee for motor fuel in South Carolina is authorized by Section 12-28-710 (A)(7).

Q: What types of motor fuel are eligible for a refund?

A: Diesel, gasoline, and LP (liquefied petroleum) used in trucking equipment are eligible for a refund.

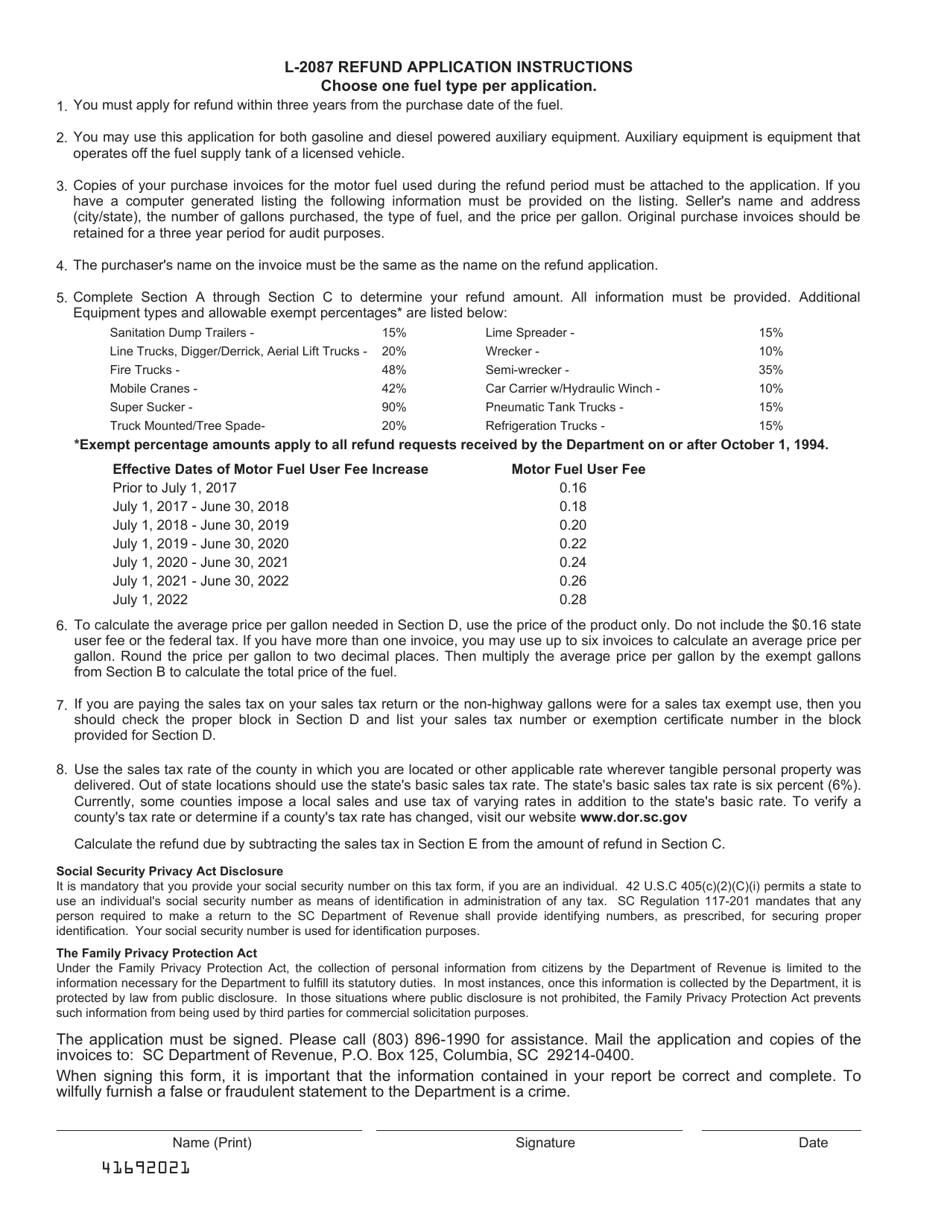

Q: What supporting documents do I need to submit with Form L-2087?

A: You will need to submit copies of fuel receipts or other documentation showing the amount of motor fuel used in your trucking equipment.

Q: How long does it take to process the refund?

A: The processing time for the refund may vary, but it typically takes several weeks to process.

Q: Can I claim a refund for motor fuel used in non-trucking equipment?

A: No, Form L-2087 is specifically for motor fuel used in trucking equipment as authorized by Section 12-28-710 (A)(7) in South Carolina.

Form Details:

- Released on January 9, 2018;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form L-2087 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.