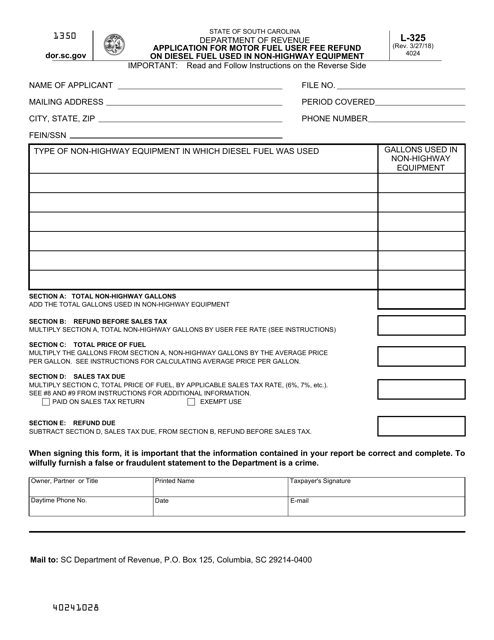

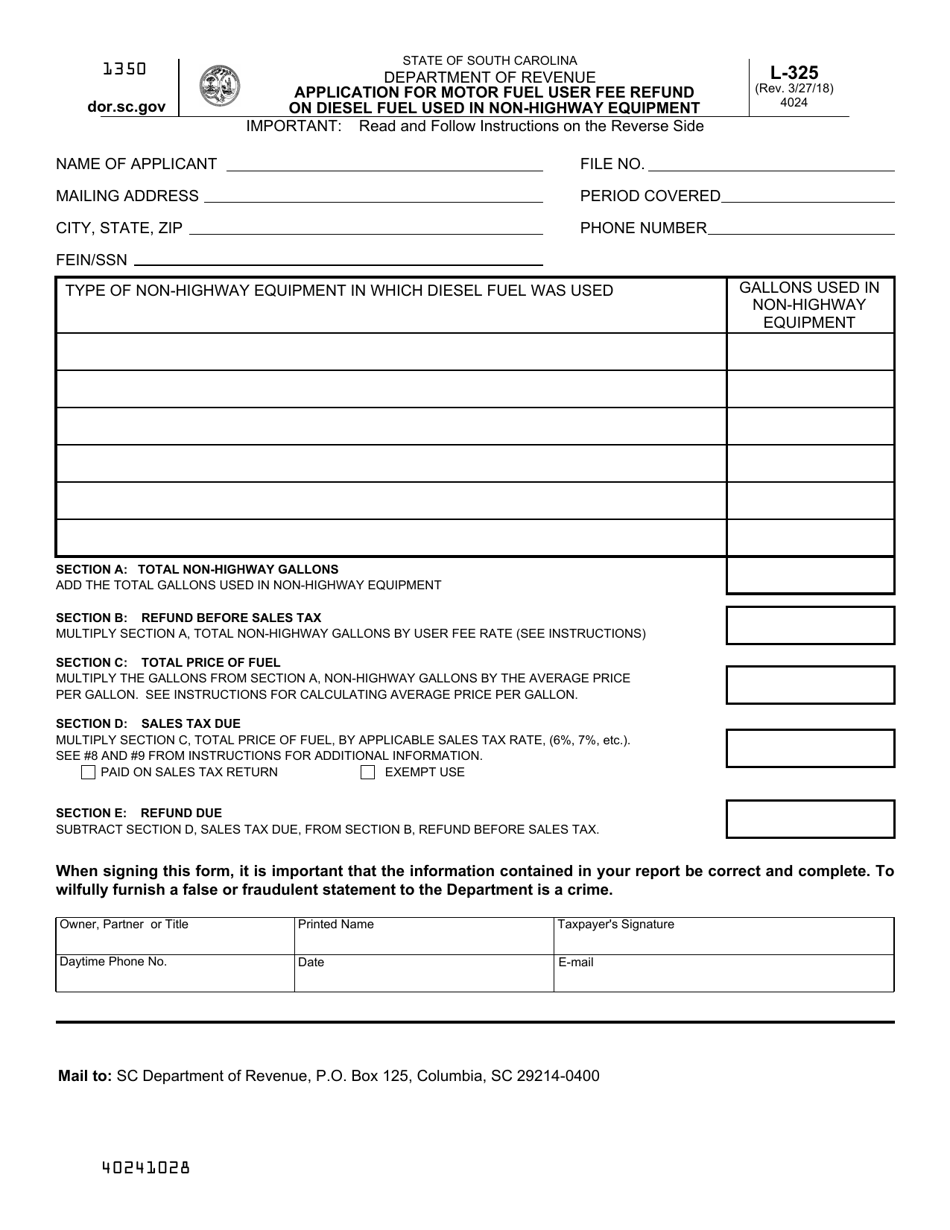

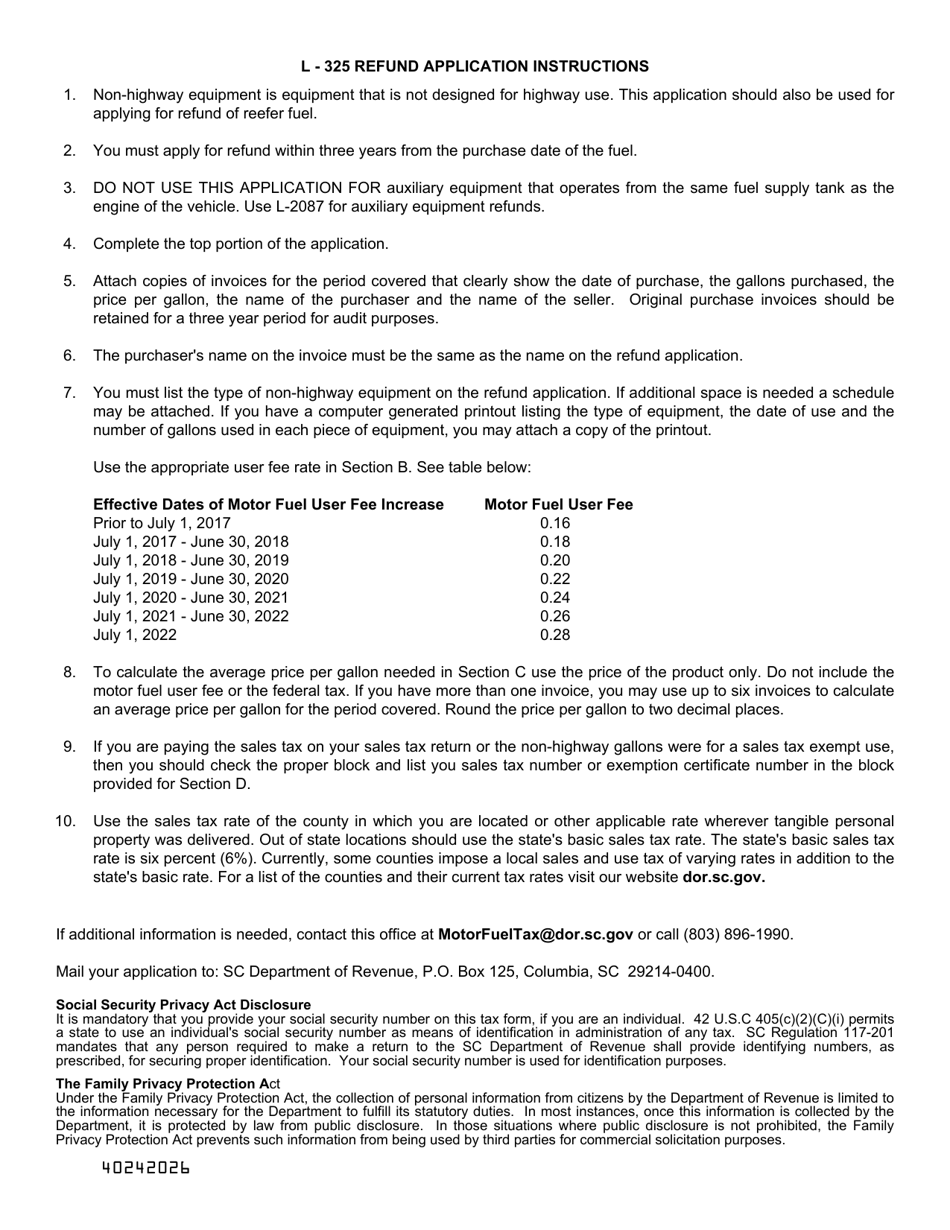

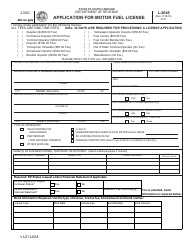

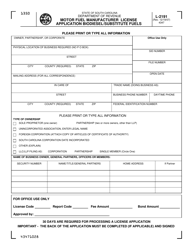

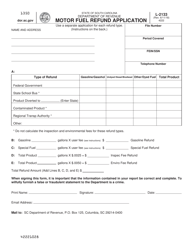

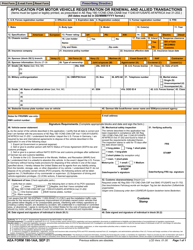

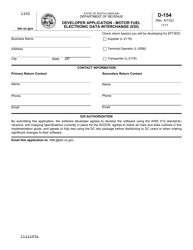

Form L-325 Application for Motor Fuel User Fee Refund on Diesel Fuel Used in Non-highway Equipment - South Carolina

What Is Form L-325?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form L-325?

A: Form L-325 is the application for Motor Fuel User Fee Refund on Diesel Fuel Used in Non-highway Equipment in South Carolina.

Q: What is the purpose of Form L-325?

A: The purpose of Form L-325 is to apply for a refund of motor fuel user fees paid on diesel fuel used in non-highway equipment.

Q: Who can use Form L-325?

A: Form L-325 can be used by individuals or businesses in South Carolina that have used diesel fuel in non-highway equipment.

Q: What is non-highway equipment?

A: Non-highway equipment refers to vehicles or machinery that are not driven or operated on public roads.

Q: How do I complete Form L-325?

A: To complete Form L-325, you will need to provide information such as your name, address, tax ID number, the amount of diesel fuel used in non-highway equipment, and proof of payment of motor fuel user fees.

Q: When is Form L-325 due?

A: Form L-325 must be filed with the South Carolina Department of Revenue by the 20th day of the month following the end of the quarter in which the diesel fuel was used in non-highway equipment.

Form Details:

- Released on March 27, 2018;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form L-325 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.