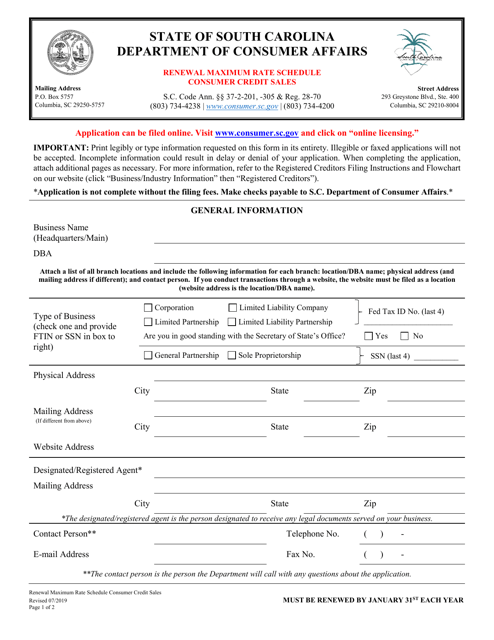

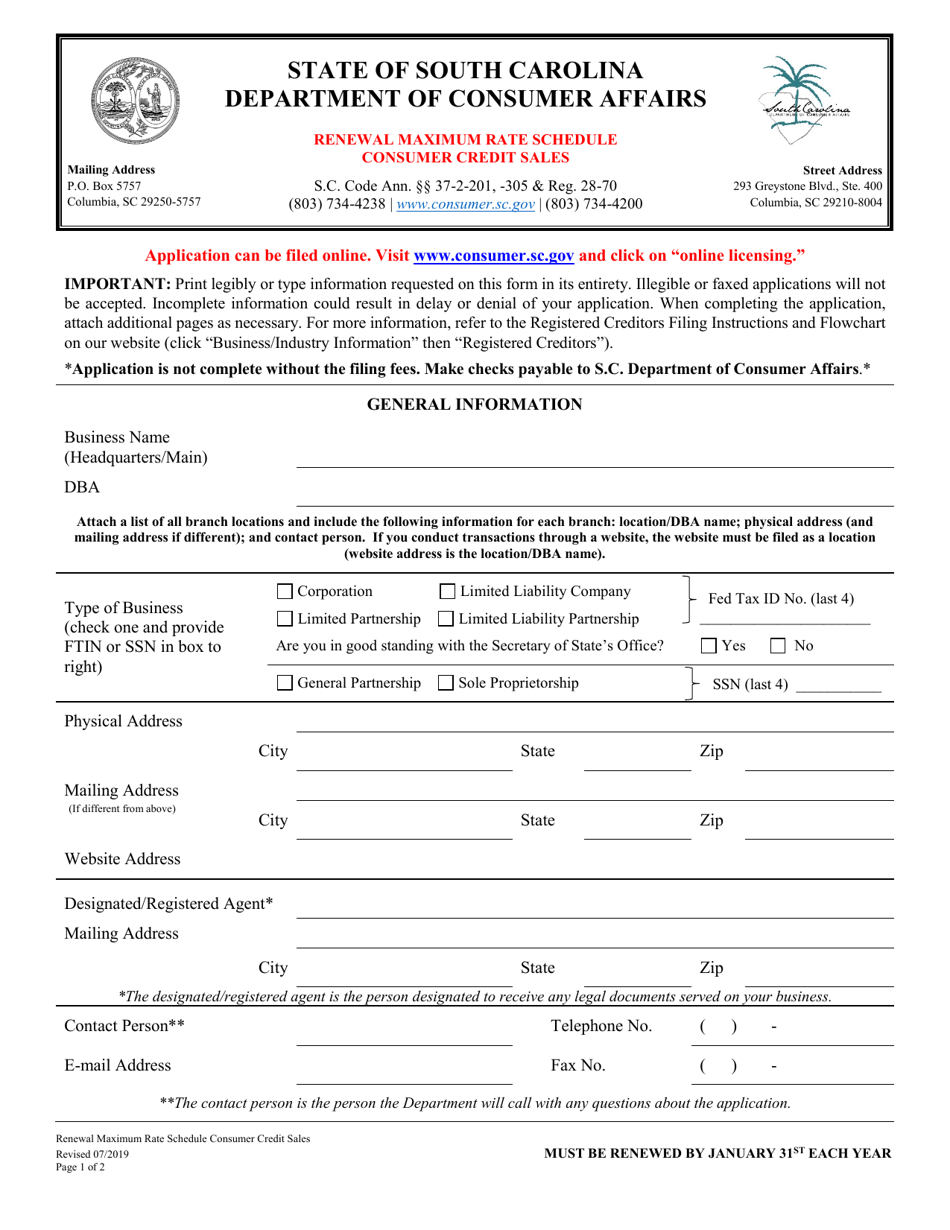

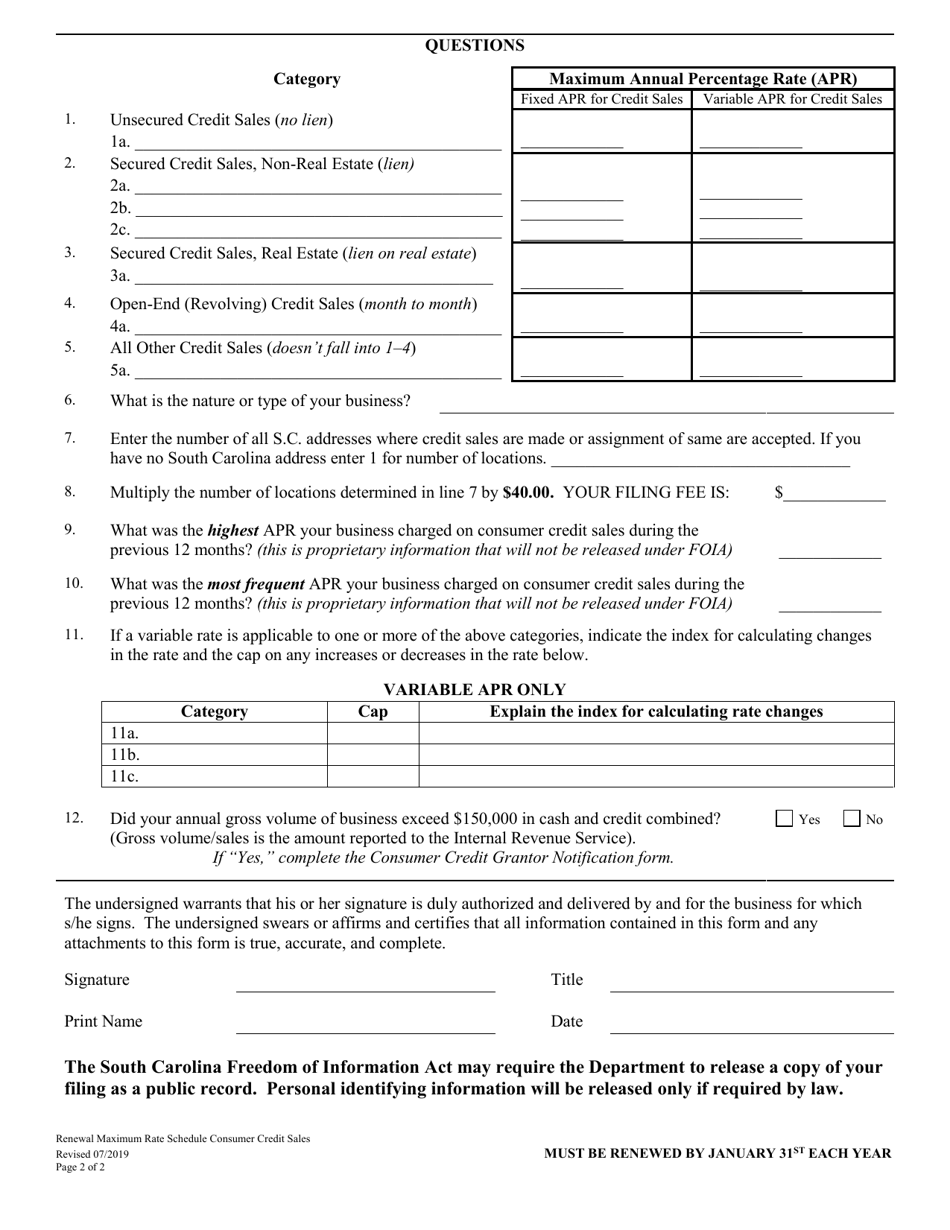

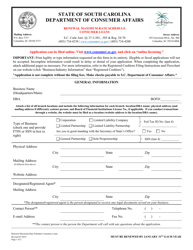

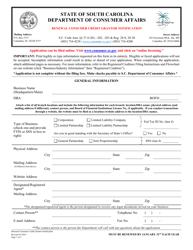

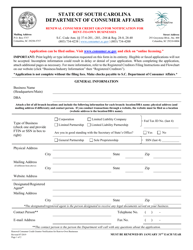

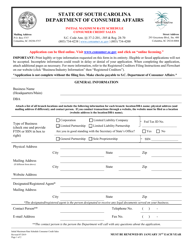

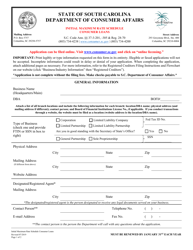

Renewal Maximum Rate Schedule - Consumer Credit Sales - South Carolina

Renewal Maximum Rate Schedule - Consumer Credit Sales is a legal document that was released by the South Carolina Department of Consumer Affairs - a government authority operating within South Carolina.

FAQ

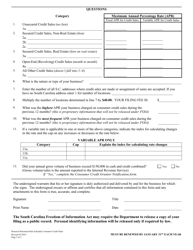

Q: What is the Renewal Maximum Rate Schedule for Consumer Credit Sales in South Carolina?

A: The Renewal Maximum Rate Schedule sets the maximum interest rates that can be charged for consumer credit sales in South Carolina.

Q: Who is affected by the Renewal Maximum Rate Schedule?

A: Lenders and borrowers involved in consumer credit sales in South Carolina are affected by the Renewal Maximum Rate Schedule.

Q: What does the Renewal Maximum Rate Schedule determine?

A: The Renewal Maximum Rate Schedule determines the maximum interest rates that lenders can charge on consumer credit sales.

Q: Why is the Renewal Maximum Rate Schedule important?

A: The Renewal Maximum Rate Schedule is important because it protects consumers from excessive interest rates and ensures fair lending practices in consumer credit sales.

Form Details:

- Released on July 1, 2019;

- The latest edition currently provided by the South Carolina Department of Consumer Affairs;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the South Carolina Department of Consumer Affairs.