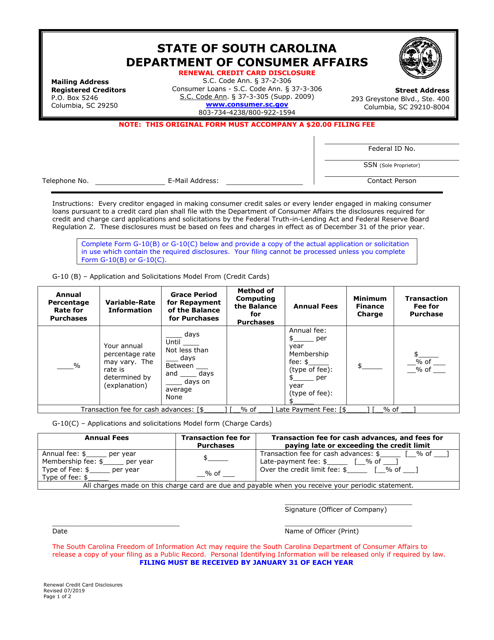

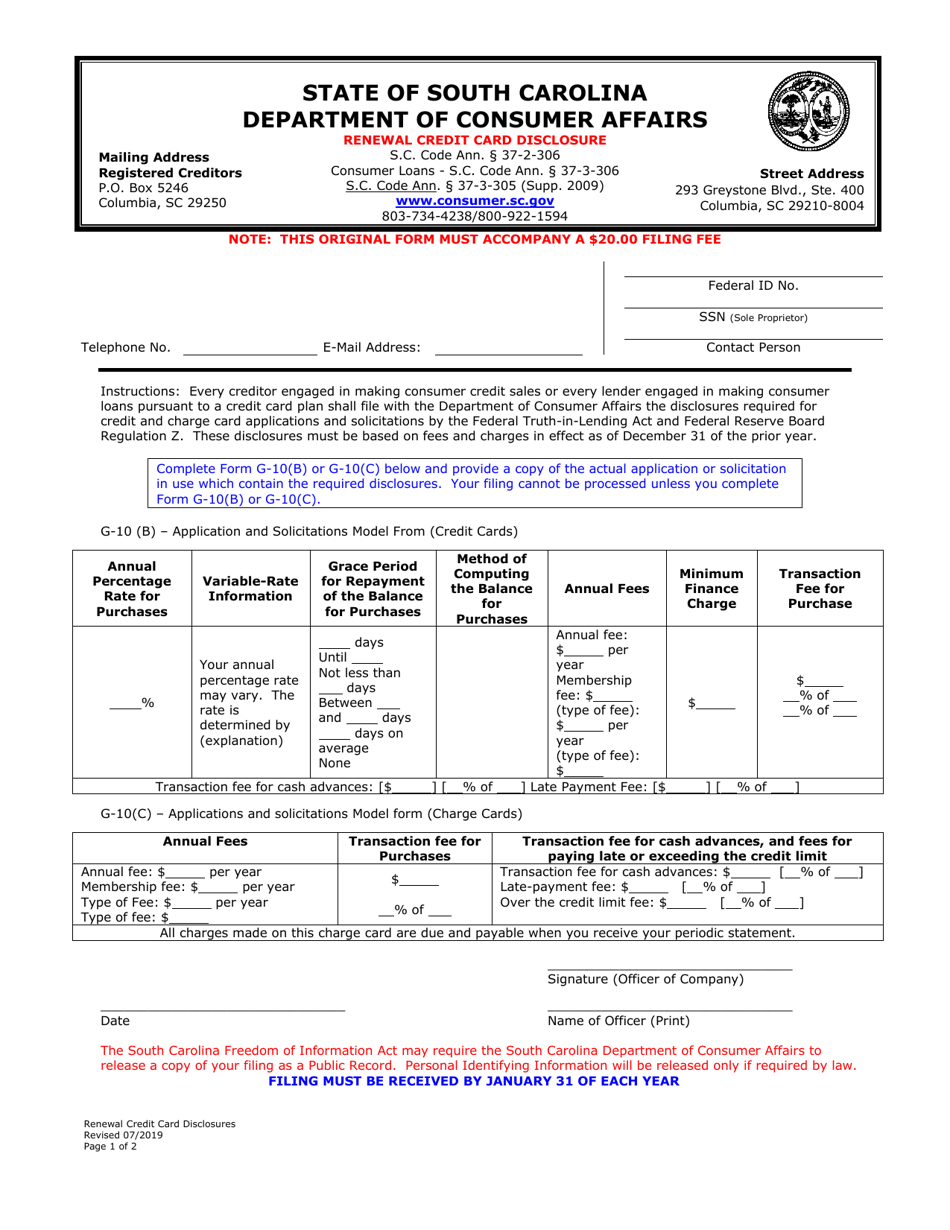

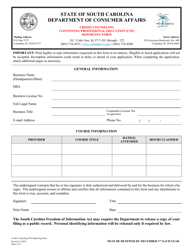

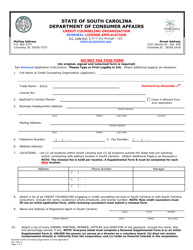

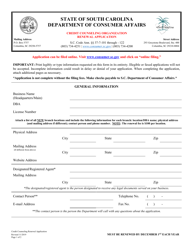

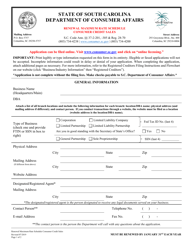

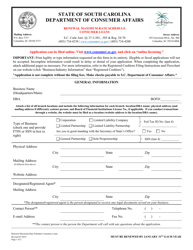

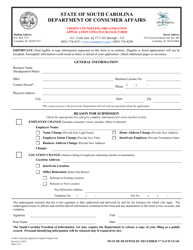

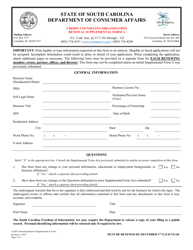

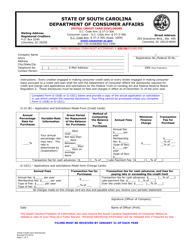

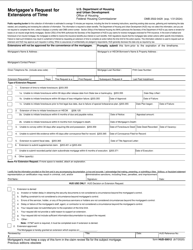

Renewal Credit Card Disclosure - South Carolina

Renewal Credit Card Disclosure is a legal document that was released by the South Carolina Department of Consumer Affairs - a government authority operating within South Carolina.

FAQ

Q: What is a Renewal Credit Card Disclosure?

A: A Renewal Credit Card Disclosure is a document that provides important information about the terms and conditions of your credit card account when it is being renewed.

Q: Why do I receive a Renewal Credit Card Disclosure?

A: You receive a Renewal Credit Card Disclosure to keep you informed about any changes to the terms and conditions of your credit card account.

Q: What information is included in a Renewal Credit Card Disclosure?

A: A Renewal Credit Card Disclosure includes information about the interest rates, fees, and any other changes to the terms and conditions of your credit card account.

Q: How often do I receive a Renewal Credit Card Disclosure?

A: You generally receive a Renewal Credit Card Disclosure when your credit card account is up for renewal, which is usually once a year.

Q: Do I need to read the Renewal Credit Card Disclosure?

A: Yes, it is important to read the Renewal Credit Card Disclosure to understand any changes to the terms and conditions of your credit card account.

Q: Can I opt out of a credit card renewal?

A: Yes, you can opt out of a credit card renewal by contacting your credit card issuer.

Q: What should I do if I have questions about the Renewal Credit Card Disclosure?

A: If you have questions about the Renewal Credit Card Disclosure, you should contact your credit card issuer for clarification.

Form Details:

- Released on July 1, 2019;

- The latest edition currently provided by the South Carolina Department of Consumer Affairs;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the South Carolina Department of Consumer Affairs.